सोलाना ने PYUSD बाजार हिस्सेदारी का 64% हिस्सा अपने कब्जे में ले लिया है, और कामिनो पसंदीदा स्टेकिंग प्रोटोकॉल बन गया है

Original author: Lila

On August 27, official data showed that the market value of PayPals stablecoin PYUSD has exceeded the $1 billion mark, and its supply has more than doubled since June. According to Visas stablecoin dashboard, PYUSDs user activity has soared, with monthly active wallet addresses jumping to more than 25,000 in July, compared with 9,400 in May.

This is also the explosive growth of PYUSD after it expanded to the Solana network in May. It grew from zero to $650 million in just three months, exceeding the supply on the Ethereum chain. According to DefiLlama data, the supply of PYUSD on the Solana chain has increased by 171% in the past month.

Why did PayPal choose to build on Solana, and what drove the adoption of PYUSD? In response, the Solana official account released a long push and tried to answer this question for us. BlockBeats compiled it as follows:

For more than two decades, PayPal has been committed to providing people with fast, low-cost and global payment services. This philosophy has led the company to pioneer online payments. Now, PayPal is exploring what is considered the next generation of digital payments: on-chain payments.

On-chain payments have many advantages over traditional payment systems, including faster settlement, lower costs, and programmability.

In August 2023, PayPal launched PYUSD on Ethereum. The stablecoin is issued by @Paxos and regulated by the New York Department of Financial Services (NYDFS). The stablecoin is 100% backed by high-quality liquid assets and is redeemable 1:1 with the US dollar.

PayPal believes that the mass adoption of PYUSD will go through these three stages: awareness, practicality, and popularity.

By deploying on Ethereum, PYUSD has taken the first step in increasing awareness. However, in order for PYUSD to better provide practical value to consumers and merchants, PayPal recognizes the need for a more efficient blockchain.

PayPal chose to expand PYUSD to Solana because of its nearly instant settlement and finality, median transaction fee rate of less than one cent, and an ecosystem of more than 2,500 developers. (Source: https://pyusd.mirror.xyz/ TpEwPNybrwzPSSQenLtO 4 kggy 98 KH 4 oQRc 06 ggVnA 0 k ) But just as importantly, Solana鈥檚 unique token expansion capabilities also became a key factor in making this decision.

PYUSD uses multiple token extensions, including confidential transfers, transfer pegs, and memo fields. PayPal said: These features are not optional. If you want PYUSD to play a role in the wider commercial field, you must provide it to merchants.

Currently, Solana has become the main platform used by PYUSD, with a market share of 64%, compared to Ethereums 36%.

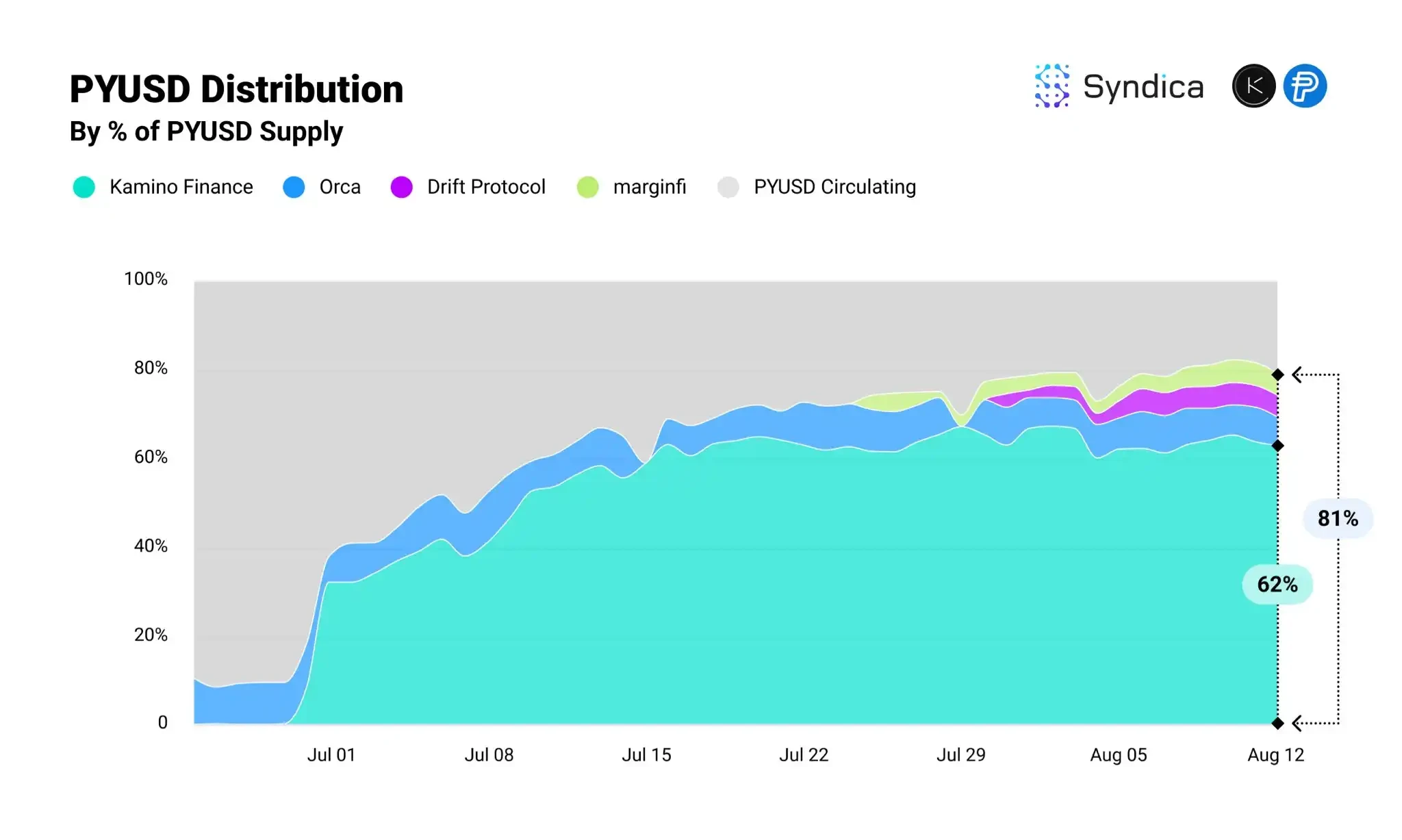

To drive adoption of PYUSD in DeFi protocols, PayPal also launched token incentives, such as use in @KaminoFinance . This helped drive growth. According to @Syndica_io, 81% of PYUSD on Solana is used in DeFi protocols.

According to BlockBeats, Kamino Finance is the current leader project of Solana TVL. As of August 27, more than 45% of the circulating PYUSD supply has been deployed to Kamino, totaling $460 million. So what is Kamino Finance, and why has it become the preferred staking protocol for PYUSD?

About Kamino Finance

Founded in 2022, Kamino Finance is a decentralized finance (DeFi) protocol that integrates lending, liquidity provision, and leverage. Users can use a one-click, automatically compounding liquidity strategy, use centralized liquidity positions as collateral, and build automated liquidity strategies. Kamino issued KMNO tokens on April 30 this year, with a total of 10 billion, and an estimated initial circulation supply of 1 billion.

The Kamino Finance project was incubated by Hubble Protocol. Hubble Protocol is a stablecoin lending platform based on Solana. It completed financing of US$3.6 million और US$15 million in 2021 and 2022 respectively. Investors include Three Arrows Capital, Multicoin Capital, Jump Capital, DeFiance Capital, Digital Currency Group, Crypto.com Capital, etc.

The founder of Hubble Protocol, Marius Ciubotariu (@y 2 kappa), was previously a senior software engineer at Bloomberg and graduated from the University of Exeter. His profile has now been changed to co-founder of KaminoFinance, and he is fully committed to developing the product. In March this year, Kamino Finance received $10 million in financing from Early Stage VC, and more financing information has not yet been disclosed.

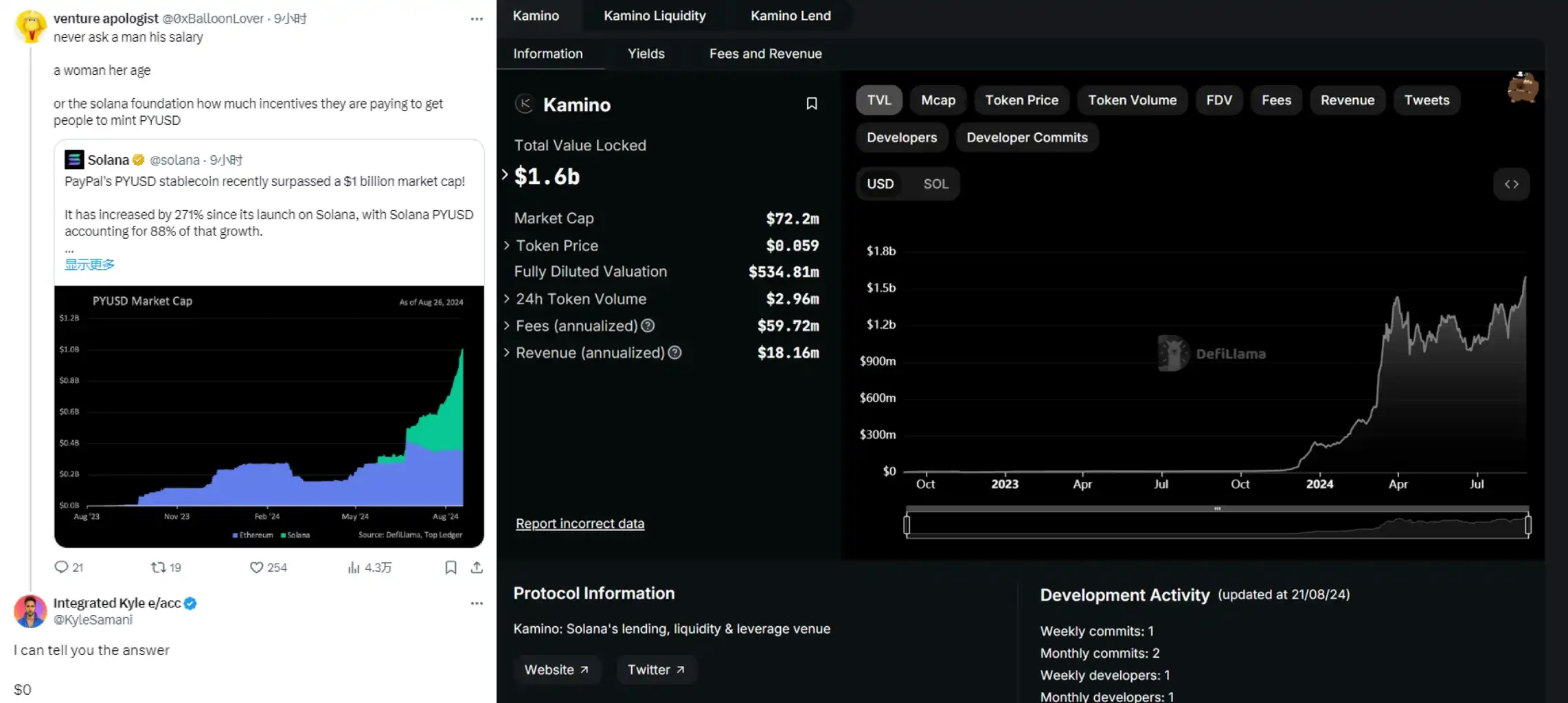

Today, Kamino has become Solanas largest lending platform, with a TVL of over $1.6 billion. On Kamino, 470 million PYUSD enjoy an annualized return of 13.24%, which means that depositors will receive an additional reward of over 1.2 million PYUSD per week. At the same time, large amounts of PYUSD are circulating on Solana at very low costs. According to @artemis__xyz, the median transaction fee for peer-to-peer PYUSD transfers is about one hundredth of a cent.

Additionally, on Kamino, PYUSD borrowers pay an interest rate of 3.28% and a utilization rate of 5.31%, while on Kamino鈥檚 rival lending protocol MarginFi, the interest rate is 1.54% and the utilization rate is 4%.

Where does the interest come from for such a high annualized stablecoin? It also makes people question whether PYUSD can continue to grow without the incentives currently provided. In this regard, KOL @0x BalloonLover questioned, You will never know how many rewards the Solana Foundation paid to encourage people to mint PYUSD. Unexpectedly, perhaps these rewards did not come from the Solana Foundation. Under the KOLs tweet, Kyle Samani, managing partner of Multicoin Capital, and Mert, a core member of the Solana community and founder of Helius, both stated that the Solana Foundation did not actually pay a penny.

On August 20, Alpha Pls, a well-known Web3 analyst, estimated that Kamino鈥檚 annualized revenue was $17.4 million. This suggests that it may not be able to maintain the current reward increase in the long run. But if it weren鈥檛 for the income support given by the Solana Foundation, who would have such a large amount of funds to maintain high financial incentives? After all, these subsidies are PYUSD, a real dollar stablecoin, not the project鈥檚 own tokens that we have seen in DeFi mining before.

From this, we can also boldly speculate that if the beneficiary Solana Foundation does not bear this part of the subsidy to users, then the only other beneficiary willing to give reward subsidies may be PayPal, the issuer of PYUSD?

In any case, Web2 giants have already set their sights on the crypto market. Previously, Solana Foundation President Lily also pointed out at the Asian Blockchain Summit that PayFi will be the biggest theme in this round of crypto cycle , and Solana is the best fertile ground for the concept to be implemented and widely used.

संदर्भ:

https://x.com/solana/status/1828175011590664412

https://thedefiant.io/news/tokens/paypal-usd-surpasses-usd1b-market-cap

This article is sourced from the internet: Solana occupies 64% of PYUSD market share, and Kamino becomes the preferred staking protocol

Original | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser2010 ) In May, the decentralized social protocol Farcaster announced the completion of a $150 million financing led by Paradigm, with participation from a16z crypto, Haun, USV, Variant, Standard Crypto, etc., with a valuation of up to $1 billion, entering the unicorn ranks; on July 2, the total revenue of the protocol exceeded $2 million, and the total number of users exceeded 570,000. It can be said that Farcaster is now the hottest social protocol in the crypto industry, and according to sources , Like most protocols, Farcaster is expected to launch tokens, and investors will be eager to capture its fully diluted value. Previously, in the article Analyzing Spectral: An on-chain AI agent that raised $30 million and…