सिग्नलप्लस वोलैटिलिटी कॉलम (20240814): सीपीआई ईव

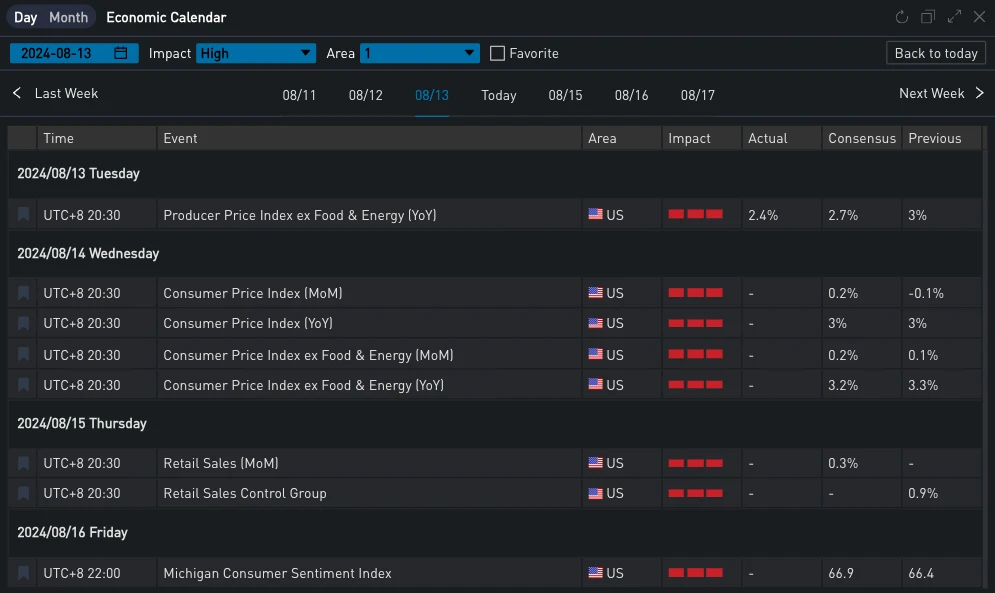

Yesterday (13 August), the US PPI rose 2.2% year-on-year in July, lower than expected, and also fell sharply compared with the previous value. Before the release of CPI today, traders increased their bets on the Feds easing policy. The 10-year Treasury yield is now at 3.838%, a recent low, and the two-year yield fell below 4% to 3.941%. Boosted by this, US stocks collectively closed higher (Dow +1.04%, SP +1.68%, Nasdaq +2.43%), helping BTC break through 6 w (closed at $60874, +2.75%), and ETH stood above $2700 (closed at $2725, 2.75%).

स्रोत: सिग्नलप्लस, आर्थिक कैलेंडर

Source: Invensting

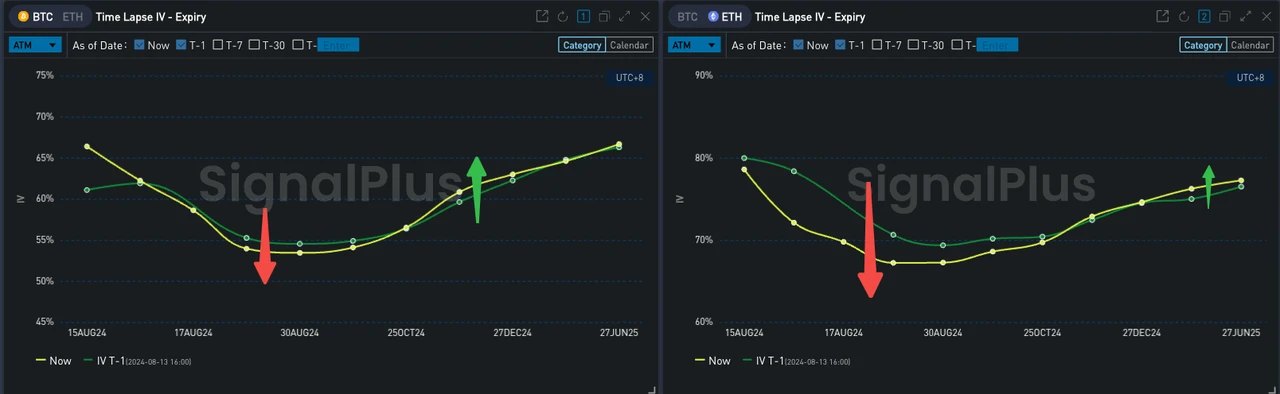

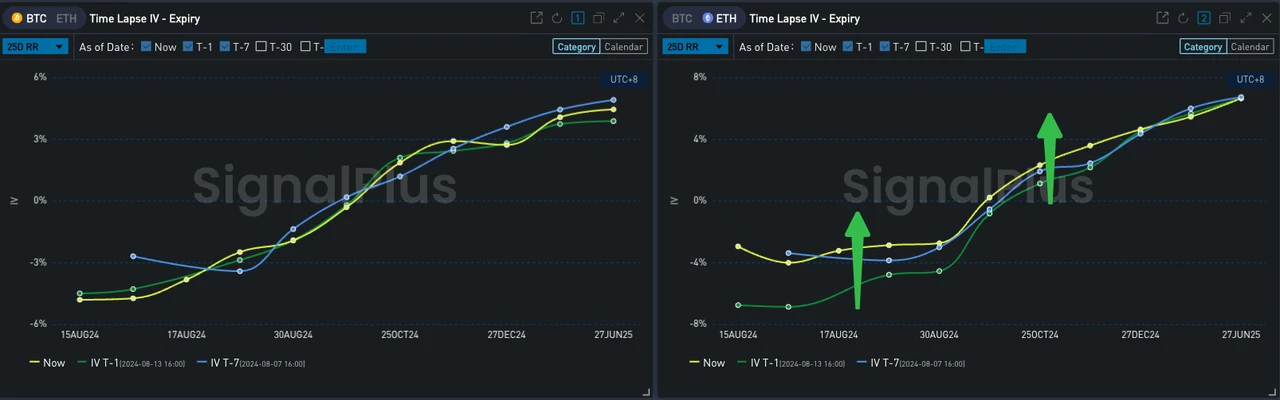

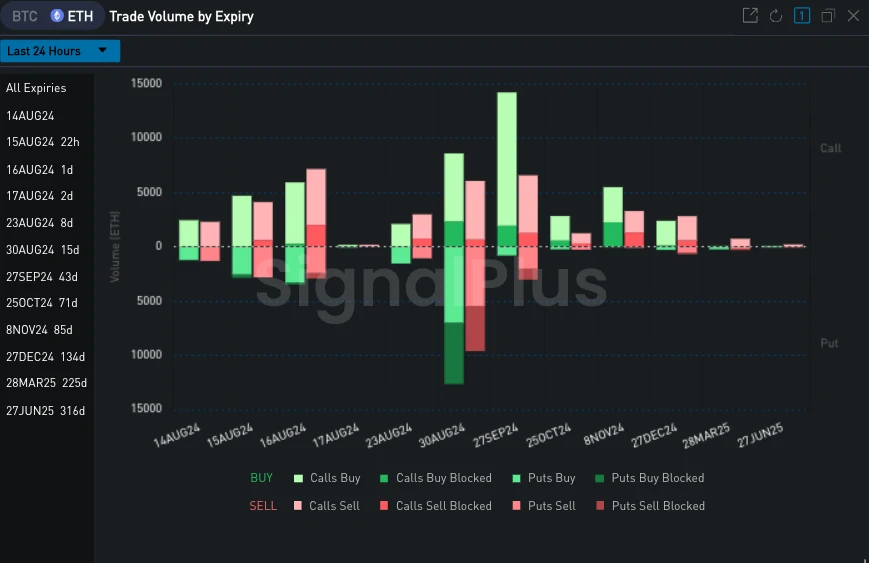

As the price of the currency rises, the volatility curve has steepened again. Specifically, the release of PPI data has eliminated some uncertainties. The IV of the middle and front ends (especially ETH) has dropped significantly, but the IV of the end of the day still enjoys a higher Vol Premium due to tonights CPI data. The far-end IV has risen slightly, and some Top Side buying can be seen from the transaction. From the perspective of Vol Skew, ETHs RR continues to rise overall. The day before yesterday (August 12), Grayscales ETHE ended the outflow of funds for the first time, becoming an important turning point. The overall ETF has also received positive inflows for two consecutive days, providing support and confidence for ETHs currency price, allowing it to break through the two lines of defense of 2600 and 2700 in succession, and challenge 3000 again.

Source: Deribit (as of 14 AUG 16: 00 UTC+ 8)

Source: SignalPlus, ATM

Source: SignalPlus, Vol Skew

Data Source: SignalPlus, Deribit ETH transaction overall distribution

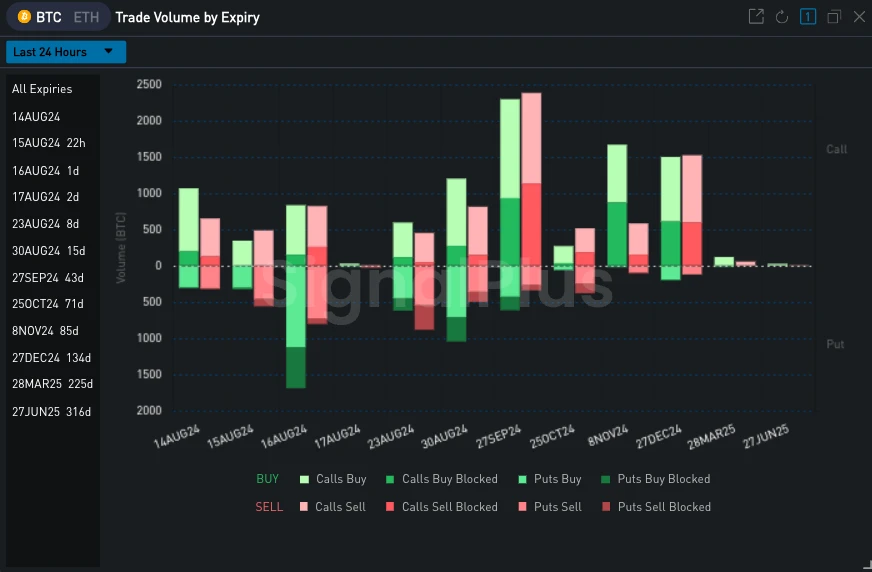

Data Source: SignalPlus, Deribit BTC transaction overall distribution

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240814): CPI Eve

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Odaily Planet Daily took stock of the airdrop projects that can be claimed from July 15 to July 21, and added 3 TON ecosystem free project airdrops (as shown below). At the same time, it sorted out and introduced the interactive projects/tasks and important airdrop information added last week. For detailed information, see the text. Sanctum Project and air investment qualification introduction Sanctum is the LST liquidity aggregation protocol on the Solana ecosystem. The project announced the opening of airdrop applications on July 18, with over 100,000 addresses eligible for airdrops. The Sanctum airdrop adopts a dynamic amount mechanism. Depending on the time of application, the amount of tokens that users can obtain will also vary. Immediate…