रणनीति परीक्षण 01|OKX और AICoin अनुसंधान संस्थान: निश्चित निवेश रणनीति

OKX has teamed up with high-quality data platform AICoin to launch a series of classic strategy research, aiming to help users better understand and learn different strategies and avoid blind use through analysis of core dimensions such as data measurements and strategy characteristics.

Fixed investment strategy is one of the most classic strategies in strategic trading. In laymans terms, strategic trading is a tool that helps users conduct automatic trading, which has advantages over manual trading such as reducing risks and simplifying operations. Fixed investment strategy is a method of regular fixed-amount trading, which disperses the risk of one-time investment in the market and smoothes transaction costs. By adhering to fixed-amount trading for a long time, the effect of time compounding can be used to achieve the purpose of profit.

Issue 01 introduces the fixed investment strategy, and uses 2 big data models to test the BTC fixed investment strategy:

1) Analyze the returns that can be generated by fixed investment in different halving cycles since the birth of Bitcoin

2) Analyze the income generated by annual fixed investment in the past 4 years

This data test will use a time-based fixed investment strategy model. The fixed investment standard is: fixed investment at 0:00 (UTC+ 8) every Monday, and the fixed investment amount is 0.1 BTC. Before each fixed investment, the profit of the previous fixed investment will be settled once, leaving the total principal invested before.

To summarize the fixed investment strategy in one sentence: For long-term BTC holders, the market will reflect long-term value.

Compare the pros and cons

In general, the fixed investment strategy is a long-term trading strategy suitable for ordinary traders. It can effectively smooth market fluctuations and cultivate disciplined trading habits, but it also requires traders to have a certain degree of patience and long-term vision.

Model 1

Analyze the returns that can be generated by fixed investment in different halving cycles since the birth of Bitcoin

Note: Due to the settings of the backtesting system, the transaction amount includes the total cost of buying BTC and selling BTC. For example, if you buy 0.1 BTC on the first fixed investment day, you sell 0.1 BTC and buy 0.2 BTC on the second fixed investment day, and so on.

Model 2

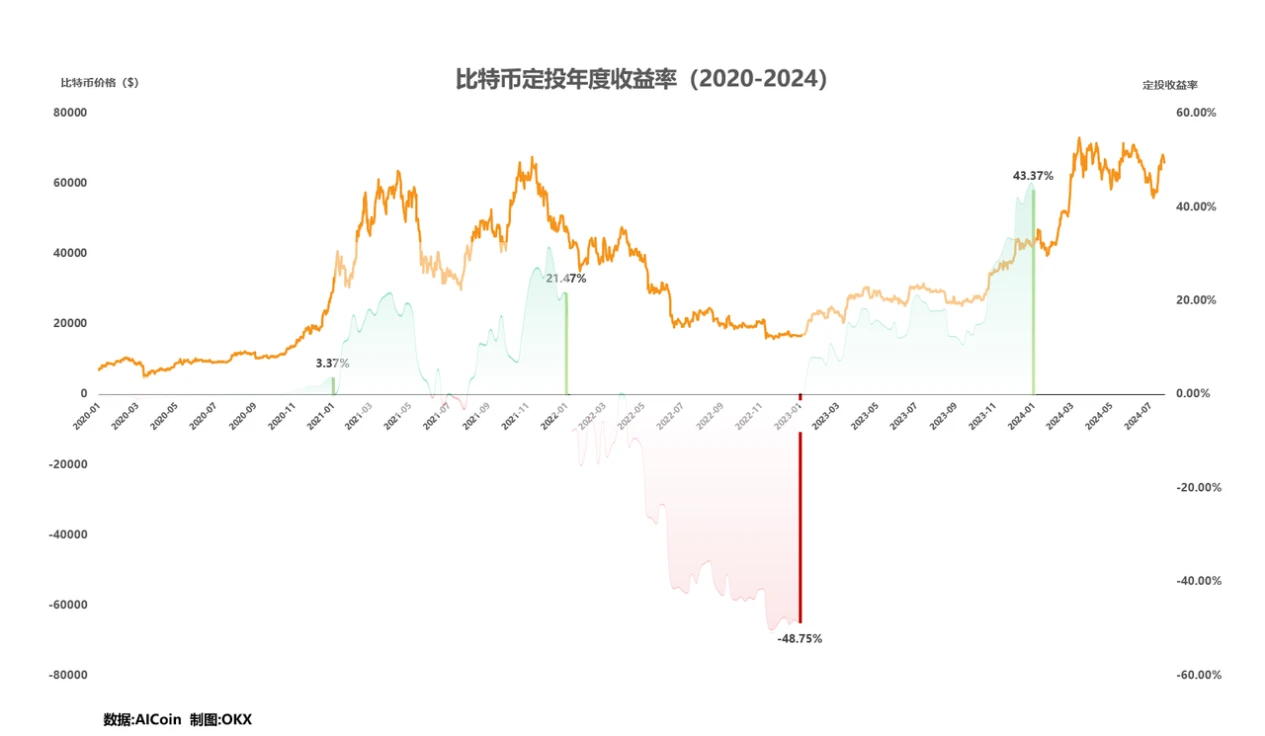

Analyze the income generated by annual fixed investment in the past four years

Note: Due to the settings of the backtesting system, the transaction amount includes the total cost of buying BTC and selling BTC. For example, if you buy 0.1 BTC on the first fixed investment day, you sell 0.1 BTC and buy 0.2 BTC on the second fixed investment day, and so on.

Analysis and summary

The fixed investment strategy of Model 1 is based on the Bitcoin industry cycle, spanning four industry cycles from the initial reward of Bitcoins birth to the third halving. The number of fixed investments, transaction amounts and yields in each cycle are different. Model 1 shows that with the passage of time and the rise in Bitcoin prices, the fixed investment returns have increased significantly, and it is impossible to capture the maximum returns. For example, the yield in the second cycle was 9.74%, while the yield in the third cycle jumped to 170.03%. Model 1 is suitable for long-term traders. Through fixed investments over a longer time span, Bitcoin is gradually accumulated, market fluctuations are smoothed, and significant long-term returns are ultimately obtained. Although the winning rate fluctuates in each cycle, it generally remains above 50%, showing high stability and risk resistance. Although the yield is high, it is mainly due to the large fluctuations in the price of Bitcoin itself, and the robustness is insufficient, so it is necessary to pay attention to the impact of market fluctuations on returns.

The fixed investment strategy of Model 2 is based on the year, and analyzes the annual fixed investment income of Bitcoin from 2020 to 2023. The number of fixed investments per year is fixed at 52 times, and the total amount of coins held remains at around 5.2 BTC. The annual fixed investment yield fluctuates greatly. For example, the yield in 2021 was 21.47%, while in 2022 there was a negative yield of -48.75%. This shows that the annual fixed investment strategy is significantly affected by short-term market fluctuations. Model 2 highlights that even in the short term (such as one year), the fixed investment strategy will face the risk of negative returns. It is suitable for traders who observe market performance in the short term. Through annual fixed investment, they can quickly assess market conditions and adjust trading strategies. Although the returns fluctuate greatly, the winning rate is still 50%. Overall, although there have been positive returns in recent years, the yield level is lower than that of Model 1, and the short-term winning rate and yield are not as stable as the long-term strategy.

From the perspective of return and risk, although Model 1 has extremely high returns in some cycles, it needs to bear the risk of large fluctuations in Bitcoin, that is, high returns are accompanied by high risks. Model 2 shows that the annual fixed investment strategy has high volatility in the short term and is not suitable for conservative traders who pursue stable returns, that is, short-term strategies are full of uncertainty. In short, the fixed investment strategy is more suitable for long-term trading and can withstand market fluctuations. For traders with a long-term trading vision, among the two models, the long-term fixed investment strategy shown in Model 1 is more suitable because it shows a higher winning rate and return rate in multiple cycles. In short, although the fixed investment strategy is relatively stable, the fixed investment strategies of different models will also produce large differences, both in terms of risk and return. Users need to further distinguish when using the fixed investment strategy.

OKXAICoin Fixed Investment Strategy

The fixed investment strategy is one of the most direct trading strategies for the cost averaging method. OKXs fixed investment strategy makes the implementation of the cost averaging (DCA) strategy simpler, supporting the purchase of more than 20 different crypto assets. Users can use their USDT balance to invest in a single crypto asset at selected time intervals, or invest in multiple crypto assets at the same time in different proportions according to their preferred trading portfolio, thereby averaging their purchase price.

Currently, the OKX fixed investment strategy has added more new features such as pause and restart, switching of trading currencies, setting the price range of fixed investment currencies (that is, allowing users to set the price range of each fixed investment coin pair, and fixed investment operations will only be performed within the price range), editing parameters, viewing history, etc., to help users conduct fixed investment strategy transactions more conveniently and efficiently.

How to access OKXs strategy trading? Users can go to the Strategy Trading in the trading section through the OKX APP or official website, and then click on the Strategy Square or Create Strategy to start the experience. In addition to creating strategies by yourself, the Strategy Square currently also provides Quality Strategies and Quality Strategies with Strategy Leaders. Users can copy strategies or follow strategies.

OKX strategy trading has multiple core advantages such as easy operation, low fees and security.

In terms of operation, OKX provides intelligent parameters to help users set trading parameters more scientifically; and provides graphic and video tutorials to help users quickly get started and master them. In terms of fees, OKX has comprehensively upgraded the fee rate system to significantly reduce user transaction fees. In terms of security, OKX has a security team composed of top global experts who can provide you with bank-level security protection.

Currently, OKX Strategy Trading provides convenient and diverse strategy products, which mainly include:

• Grid strategies: spot grid, contract grid, infinite grid

• Cost Averaging: Contract Martingale (Contract DCA), Spot Martingale (Spot DCA), Fixed Investment Strategy

• Combination arbitrage: Coin Treasure, Dip Buying, Top Escape, Arbitrage Order

• Large order splitting: Iceberg strategy, time-weighted strategy

• Signal Trading: Signal Strategies

Among them, the grid type and the regularly purchased Tunbibao type are the simplest and easiest to use strategies. At the same time, arbitrage orders, iceberg strategies, and time-weighted strategies are more suitable for high-net-worth users, because using these strategies requires facing more complex risk conditions.

In addition, AICoin also provides users with a variety of strategic transactions, allowing users to understand the current market more quickly and intuitively. Users can find the Custom Indicator/Backtest/Real Trading option in the Market option on the left sidebar of the AICoin product. Click here and search for Fixed Investment in Community Indicators to find the code for the fixed investment strategy.

अस्वीकरण

यह लेख केवल संदर्भ के लिए है और केवल लेखक के विचारों का प्रतिनिधित्व करता है, OKX की स्थिति का नहीं। इस लेख का उद्देश्य (i) ट्रेडिंग सलाह या ट्रेडिंग अनुशंसाएँ प्रदान करना नहीं है; (ii) डिजिटल संपत्ति खरीदने, बेचने या रखने का प्रस्ताव या आग्रह; (iii) वित्तीय, लेखा, कानूनी या कर सलाह। हम ऐसी जानकारी की सटीकता, पूर्णता या उपयोगिता की गारंटी नहीं देते हैं। डिजिटल संपत्ति (स्टेबलकॉइन और NFT सहित) रखने में उच्च जोखिम शामिल हैं और इसमें काफी उतार-चढ़ाव हो सकता है। आपको सावधानीपूर्वक विचार करना चाहिए कि आपकी वित्तीय स्थिति के आधार पर डिजिटल संपत्ति का व्यापार करना या रखना आपके लिए उपयुक्त है या नहीं। कृपया अपनी विशिष्ट स्थिति के लिए अपने कानूनी/कर/ट्रेडिंग पेशेवरों से परामर्श लें। कृपया स्थानीय लागू कानूनों और विनियमों को समझने और उनका पालन करने के लिए जिम्मेदार बनें।

This article is sourced from the internet: Strategy Testing 01|OKX and AICoin Research Institute: Fixed Investment Strategy

Related: Risk aversion heats up, market awaits guidance from the Fed on rate cuts

Original title: The market continues to consolidate, waiting for the Feds interest rate cut guidance Original author: Mary Liu, BitpushNews Crypto markets opened the week lower as investors await the Federal Reserve and its upcoming interest rate decision and the Consumer Price Index (CPI) for May. According to Bitpush data, Bitcoin once broke through the $70,000 mark in the early trading, reaching a high of $70,195, but turned down in the afternoon and returned to the support level near $69,600. Altcoins fell more than they rose. Among the top 200 tokens by market value, Polymesh (POLYX) led the gains, up 9.7%, followed by Gnosis (GNO), up 8.6%, and Livepeer (LPT), up 5.5%. Wormhole (W) fell the most, up 18%, Biconomy (BICO) fell 17.1%, and Echelon Prime (PRIME) fell 10%. The…