मूल | ओडेली प्लैनेट डेली ( @ओडेलीचाइना )

लेखक: अज़ुमा ( @अज़ुमा_एथ )

As the crypto market fell sharply yesterday, the risk discussion about Ethena and its stablecoin USDe was once again put on the table.

ड्यून data shows that as of the time of writing, the supply of USDe has shrunk from more than 3.6 billion at its peak to about 3.1 billion, of which the supply reduction yesterday alone reached about 95 million. The reason for the reduction in USDe circulation is essentially that the arbitrage space for funding rates is shrinking under the downward trend, and may even turn negative in stages. Investors have chosen to reduce their positions for reasons such as risk aversion and adjustment of arbitrage strategies.

In the panic-stricken market sentiment, some users are worried that USDe will not be able to bear the large-scale redemption pressure. Some users even began to compare USDe with UST, worrying that the former will experience a death spiral similar to the latter.

In our opinion, USDe has its own risks, but it is not fair to compare it with UST. The difference in their design mechanisms determines that they are two completely different systems, and their response logic when under pressure is also completely different. Even in the most extreme environment, USDe may only suffer irreversible systemic trauma after several monitorable extreme conditions occur (which will be explained in detail below).

Ethena: Funding Rate Arbitrage Protocol

For users who are not familiar with Ethena, you can read A Brief Analysis of Ethena Labs: Valuation of US$300 Million, the Stablecoin Disruptor in the Eyes of Arthur Hayes इस लेख को पढ़ने से पहले.

संक्षेप में, Ethena is essentially a funding rate arbitrage agreement. USDe is a new type of stablecoin collateralized by equal amounts of spot longs (currently only supporting ETH and BTC) and futures shorts.

USDes biggest label is Delta neutral. The so-called Delta is an indicator in finance to measure the impact of changes in the price of underlying assets on changes in investment portfolios. Combined with the nature of USDes products, since the collateral assets of this stablecoin are composed of equal amounts of spot longs and futures shorts, the Delta value of spot positions is 1, and the Delta value of futures short exposure is -1. After the two are hedged, the Delta value is 0, which means Delta neutrality is achieved.

Compared with traditional stablecoin projects, the biggest feature of USDe is its more imaginative yield space.

-

The first is the stable income from spot long staking. Ethena supports staking spot ETH through liquidity staking derivative protocols such as Lido, thereby earning an annualized return of 3% – 5%.

-

The second is the unstable income from the short futures funding rate. Users familiar with the contract understand the concept of funding rate. Although funding rate is an unstable factor, for short positions, the funding rate is positive most of the time in the long run, which also means that the overall income will be positive.

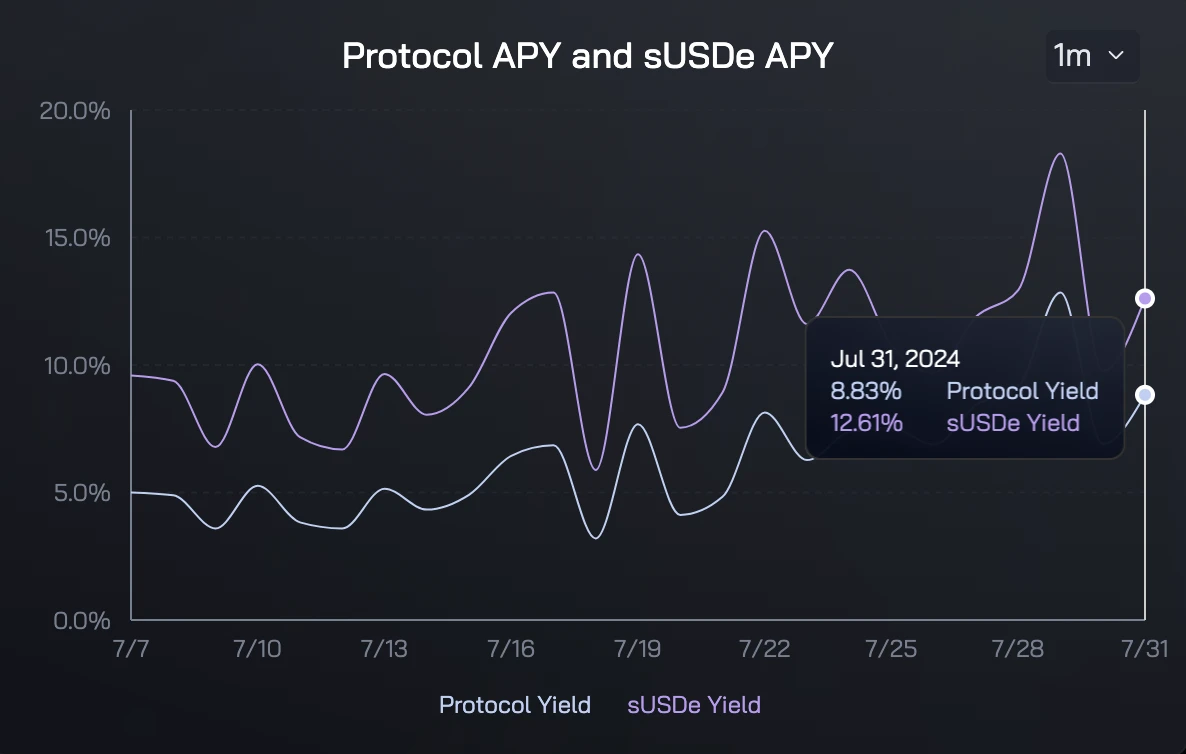

The combination of the two benefits has achieved considerable returns for Ethena (the latest agreement yield announced on Ethena鈥檚 official website is 8.83%, and the sUSDe yield is 12.61%). Under normal circumstances, it can sustainably exceed the treasury bond yield products based on sDAI, which also makes USDe the most attractive stablecoin product in the current market.

-

Odaily Note: The yield data given on the Ethena official website is often delayed by several days, and the latest data has not yet been updated.

The essential difference between USDe and UST

The story of UST has ended for so long that old players may have forgotten its design model.

In Terras economic model, UST price stability is regulated through an arbitrage system and a protocol mechanism. Market participants can mint UST by destroying LUNA of equal value, and vice versa.

For example, if the demand for UST exceeds the supply (assuming the price is $1.01), arbitrageurs have the opportunity to destroy LUNA and mint UST on the chain, and then take the difference as profit on the open market; conversely, if the supply of UST is greater than the demand (assuming the price is $0.98), arbitrageurs will be able to buy 1 UST for less than $1, and then destroy and mint $1 of LUNA for a profit.

There are two fundamental problems with UST鈥檚 design model. First, UST itself does not have sufficient value support and is completely based on algorithmic maintenance. Second, in extreme market conditions where both UST and LUNA fall, its built-in balance mechanism will lose its regulatory capabilities and may even become a double-edged sword that backfires on the system. The arbitrage program will accelerate the decline of LUNA, thereby exacerbating panic.

This is also the essential difference between USDe and UST.

-

USDe essentially still has sufficient spot + futures position support. Ethena founder Guy Young also mentioned yesterday that USDes collateral rate has always remained above 101%, while UST made an empty commitment to anchor at $1 without sufficient collateral.

-

In addition, the operation of UST must rely on LUNA, the latters volatile currency price will have an impact on the system itself; while the operation of USDe is not bound to ENA, and even if ENA returns to zero, it will not directly cause the system to collapse.

With such essential differences, the response plans of USDe and UST when facing large-scale redemptions are also different. When UST faced the failure of the balancing mechanism, it could only seek external funds such as Jump for assistance, while USDe only needed to ensure the smooth redemption of mortgage assets – which involves the liquidation of futures positions and the redemption of spot (including pledged spot), which also has independent risks, which will be discussed in detail in the next section.

USDe鈥檚 four layers of risk

Regarding the potential risks of USDe, Austin Campbell, professor at Columbia Business School, founder and managing partner of Zero Knowledge Consulting, once published an article to analyze the risks. We believe this is the best USDe risk analysis on the market today.

In the article, Austin analyzes the four layers of potential risks of USDe.

-

The first is the security risk at the pledge level, that is, whether the security and sustainability of the pledge can be guaranteed. As mentioned earlier, Ethena will pledge spot ETH to earn pledge income, but if the pledge protocol itself is attacked, it may cause holes in the pledged assets of the Ethena protocol itself.

-

The second is the security risk of opening a futures contract platform. Like the pledge agreement, both DEX and CEX are subject to the risk of hacker attacks, which may also lead to the loss of pledged assets.

-

The third is the risk of contract availability. As Ethena expands in size, the liquidity it requires is also increasing. Sometimes there may not be enough liquidity in the trading platform to short sell. In extreme cases, there may not be enough liquidity to close positions, and the platform may even unplug the network cable… This may cause Ethenas arbitrage mechanism to fail, and the protocol will face losses.

-

The fourth is the funding rate risk, which is also the situation that USDe is facing now. Although the funding rate of short positions is positive most of the time, there is also the possibility of turning negative. If the comprehensive rate of return after weighted staking income is negative, it will inevitably cause outflow of the agreement.

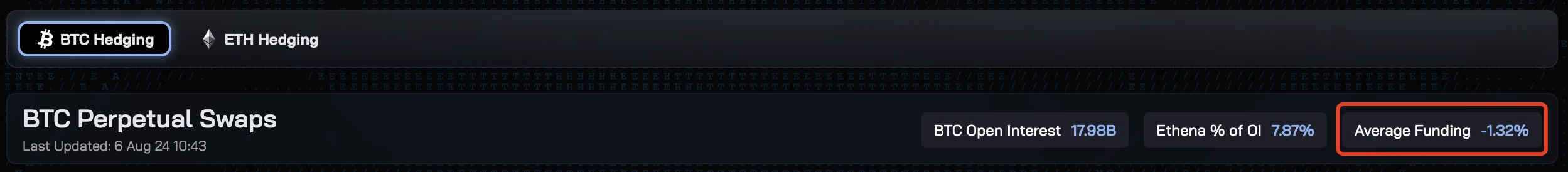

Since the market fell, the funding rates of BTC and ETH have turned negative at various times, which has caused the Ethena protocol to face losses during these periods. As of the time of writing, the funding rates of BTC and ETH are still negative, so the protocol is still losing money.

Market outlook

In summary, it is expected that in the next period of time, the funding rate may continue to remain at a low level (including negative values) due to market panic, which also means that USDe is likely to continue to face outflows – in a sense, outflows are also self-healing of the protocol.

However, from the design model of Ethena, the trading period with negative fees is predictable. In other words, the current situation is an uncommon but inevitable state in the normal operation of Ethena. In terms of past historical rules, the duration of positive fee periods tends to be longer, which also makes Ethenas overall profit expectations still objective, but at the turn of the bear market, no one knows whether the historical rules still work.

We tend to believe that even if the downward trend continues, as long as the market does not appear too extreme, Ethena will have enough time to handle redemptions. The most pessimistic result here is that the circulation of USDe will be greatly reduced, but the operation of the protocol itself will still work.

Relatively speaking, the more dangerous situation is still the extreme market conditions – mainly the third risk mentioned above, because the probability of the first two risks is relatively low – that is, there will be problems with the contract liquidity of the trading platform itself, which will cause Ethenas operating logic to fail, and thus cause irreversible damage to the protocol.

This article is sourced from the internet: USDe will not be the next UST, but it has these unique risks

According to incomplete statistics from Odaily Planet Daily, there were 26 blockchain financing events announced at home and abroad from July 1 to July 7, an increase from last weeks data (20). The total amount of disclosed financing was approximately US$122 million, a significant decrease from last weeks data (US$288 million). Last week, the project that received the most investment was the Bitcoin restaking protocol Lombard ($16 million); followed by the distributed GPU network Prodia ($15 million). The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain): Bitcoin re-staking protocol Lombard completes $16 million seed round of financing, led by Polychain Capital On July 2, Bitcoin re-staking protocol…