4अल्फा रिसर्च: फेड संतुलन और बाहरी स्थिरता की ओर मुड़ रहा है, लेकिन क्रिप्टो के प्रति उसका रवैया रूढ़िवादी बना हुआ है

With the upcoming FOMC meeting on July 30, Fed officials have entered a silent period, and the market, which has fully priced in the expectation of a rate cut, has begun to look forward to the new interest rate decision and the Feds policy statement. Taking this opportunity, this article reviews the composition of the current FOMC voting committee, the evolution of the FOMC composition in recent years, and the Feds policy attitude towards the cryptocurrency industry.

Opinions in a nutshell

-

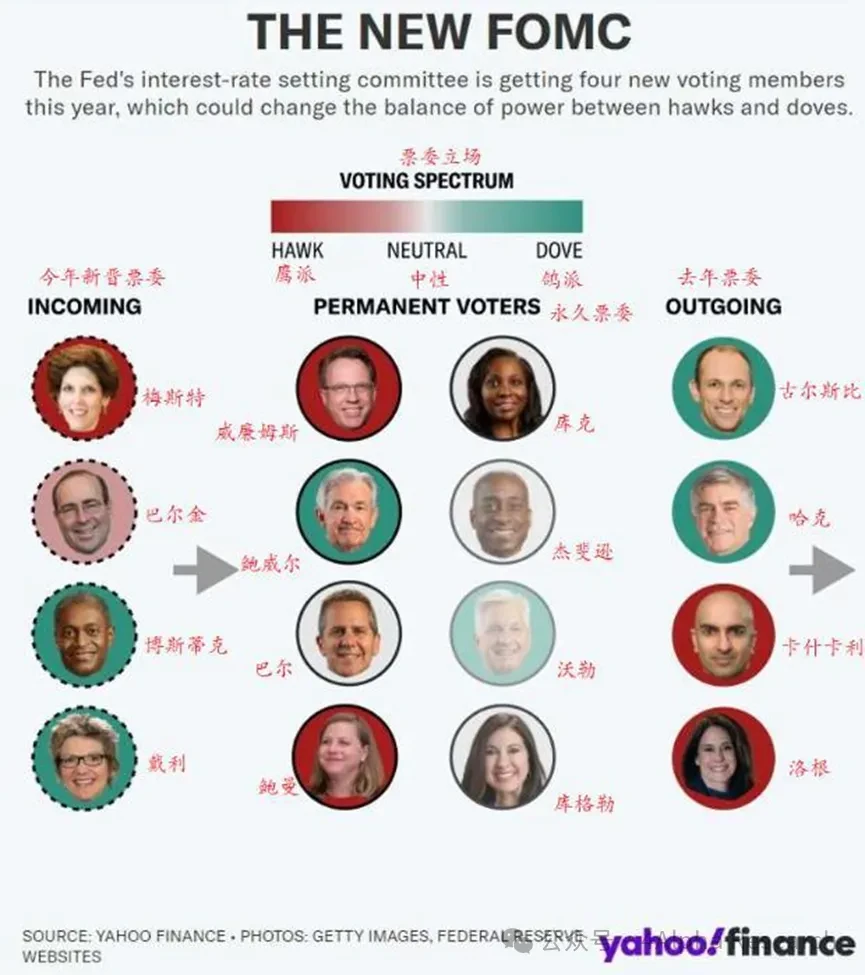

The composition of FOMC voting members tends to be balanced and neutral, with 7 permanent members having permanent voting rights, and the remaining seats being held by regional Fed chairmen on a rotating basis. Most of the current FOMC voting members are considered neutral. Among the rotating members, two doves and two hawks were replaced this year, and the new members include two hawks, one neutral, and one member with a volatile view. Overall, the trend of neutral composition of FOMC voting members continues.

-

The neutralization trend of the FOMC makes the Feds policy attitude more balanced and neutral, which helps the Fed to independently implement monetary policy and better balance the relationship between inflation and economic growth. The Feds neutral and cautious attitude helps to restore its professional, independent and authoritative image, but the reduced internal debate may also increase the risk of policy mistakes.

-

In terms of their attitude towards cryptocurrencies, Fed officials generally hold a negative attitude. Although cryptocurrencies are gradually moving towards compliance in the US financial market, Fed officials emphasize that due to the sharp price fluctuations and lack of stability of cryptocurrencies, their basic requirements as a currency have not yet been met. In addition, the lack of global acceptance and regulatory maturity of cryptocurrencies makes it difficult for them to become a universal means of payment. Fed officials also pointed out that innovation in stablecoins should be carried out under a strict regulatory framework, which reflects the Feds cautious attitude towards the cryptocurrency industry. The Fed does not want to introduce new exogenous uncertain variables in the monetary policy decision-making process.

1. The composition of the FOMC voting committee in 2024 will be balanced and neutral

Seven of the 12 FOMC voting members of the Federal Reserve are permanent governors, who have permanent voting rights during their term of office. Currently, these seven people include Federal Reserve Chairman Powell, Vice Chairman Philip Jefferson, Vice Chairman Michael Barr, Governor Christopher Waller, Governor Lisa Cook, Governor Adriana Kugler, Governor Michelle Bowman and New York Fed President John Williams.

Among the regional Federal Reserve banks, only the president of the New York Fed is a permanent voting member. The remaining four seats are rotated by other regional Federal Reserve banks. This time, they are Cleveland Fed President Loretta Mester, Richmond Fed President Thomas Barkin, Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly. Chicago Fed President Austan Goolsbee, Philadelphia Fed President Patrick Harker, Minneapolis Fed President Neel Kashkari and Dallas Fed President Lorie Logan will be rotated out.

Among the current (January 2024) permanent voting members of the Federal Reserve FOMC, Bowman is generally considered to be a hawk, while Cook and Kugler are doves, and the others are neutral; among the rotating members, two doves and two hawks were rotated out this year (Goolsbee and Harker are respectively a dove representative and a moderate dove, while Minneapolis Fed President Kashkari and Dallas Fed President Logan are the two new hawk kings), and the new members are two hawks (Mester, Barkin), one neutral (Daly), and one member whose opinions change frequently and whose position has long been controversial (Bostic).

Overall, this years incomers and outgoers are slightly hawkish overall, while maintaining the balance of the Feds voting committee, as shown in the figure below. The slight hawkish tendency is also in line with the Feds current need to wrap up the year-long anti-inflation action and prevent inflation from rebounding.

The relative balance of the above factions is also reflected in the current monetary policy of the Federal Reserve. In recent years, the Federal Reserves FOMC interest rate decisions, dot plots and future outlooks have changed from the radicalism of the epidemic era (for example, on March 3, 2020, the Federal Reserve made an extremely unconventional 50 bp interest rate cut at non-FOMC time), showing an increasingly smooth and cautious trend. At the same time, the public statements of Federal Reserve officials have also weakened a lot compared with previous years.

Take Federal Reserve Chairman Powell as an example. After 2020, he has always emphasized that inflation is short-lived and has been repeatedly slapped in the face and ridiculed. At present, there are very few such judgmental statements in his speeches, and more ambiguous statements. This has also given media such as the New Federal Reserve News Agency ample room for interpretation.

The Feds tendency to balance and neutrality will generally help the Fed to be more independent, better play the role of a monetary policy balancer, and better realize the function of trade-off between inflation and economic growth. The Feds past radical monetary policy and balance sheet decisions (such as the large-scale QE expansion in 2020) and some overly arbitrary and imprecise statements have seriously damaged the Feds professional, independent, and authoritative image, which will seriously weaken the forward guidance role of the Feds statements and resolutions, resulting in the partial failure of monetary policy. After all, monetary policy is to some extent the management of market expectations. The Feds neutral and cautious attitude since mid-2023 has played a certain role in recovery, and the Feds neutral and more balanced process mainly starts with personnel balancing and de-extremeization.

2. Is the disappearance of dissenting votes from Federal Reserve committee members a completely good thing?

Dissenting votes by FOMC members have been steadily decreasing since the Powell era. During Powells nearly six years as Fed chairman, dissenting votes accounted for only 2.6% of the total votes, the lowest level since the Volcker era. Since the start of the pandemic in March 2020, FOMC dissenting votes have become even rarer, accounting for only 1.4% of the total votes.

Andrew Levin, an economics professor at Dartmouth University and a former Fed official, said: Dissent within the FOMC is fading, and the FOMC looks more like a corporate board than a public policymaking body. Former St. Louis Fed President Bullard is one of the officials who has dissented several times during his tenure as a FOMC member. According to the Feds data, Bullard voted against the resolution in June 2013, September and June 2019, and March 2022.

There is also a view that Powell is easy-going and smooth, and is good at maintaining complex interpersonal relationships, which may be a factor in the low rate of dissent within the Fed after he took charge of the Fed. FOMC voting members may also worry that with many parties in Washington and the increasingly torn political situation in the United States, public opinion may be very tolerant of the internally discordant Fed. The concerns of FOMC members about their personal future are understandable, but as Brad said, the herd mentality within the Fed and excessive external solidarity may cause the FOMC decision-making mechanism to fail and make mistakes. Similar to the consensus in the crypto world that centralization will harm economic operations, the centralization of the FOMC is likely to damage its monetary policy sensitivity and the timeliness of adjustments, and undermine the effectiveness of its voting-based decision-making mechanism, but the harm of centralization is obviously rarely paid attention to in the world of traditional finance.

3. Federal Reserve officials are generally negative about cryptocurrencies

Although cryptocurrencies are moving towards full compliance at an unprecedented pace in the U.S. financial market with the launch of the BTC spot ETF in early 2024 and the recent launch of the ETH spot ETF, Federal Reserve officials’ public statements on cryptocurrencies in recent months have remained mainly negative.

On November 17, 2023, Fed Vice Chairman and Permanent Voter Barr said that the U.S. banking system has not been seriously affected by cryptocurrency risks because most banks have adopted a cautious attitude, but regulators must still be very careful with stablecoins. Historically, private currencies can have explosive influence if they are not properly regulated. Stablecoin innovation can be allowed, but it must be clearly regulated under a very clear regulatory framework, which is equivalent to denying one of the most important motivations for blockchain stablecoins on the वेब3 chain.

On February 27, 2024, Jefferson, vice chairman and permanent voting member of the Federal Reserve, further stated that it is a mistake to regard cryptocurrencies as currencies. He emphasized that although cryptocurrencies have shown circulation and trading capabilities in specific scenarios, their sharp price fluctuations and lack of stability make it difficult for them to meet the basic requirements of being a currency, that is, as a value storage and accounting unit. In addition, he mentioned that the global acceptance and regulatory maturity of cryptocurrencies have not yet reached the level that makes them a universal means of payment, and the tendency of crypto stablecoins to anchor to the US dollar also represents the lack of other solid valuation foundations.

Bowman, a member of the Federal Reserve Board and a permanent voter, has also repeatedly stated that the construction of the US dollar stablecoin must involve the Federal Reserve and the federal government at all levels, and that Congress still does not recognize stablecoins. These views reflect the Federal Reserves cautious attitude towards cryptocurrencies and may affect the formulation of future policies. The Federal Reserve still chooses a very conservative attitude today when cryptocurrencies are fully turning to compliance, probably because of its need to maintain short-term market stability. As a monetary policy maker, the Federal Reserve already faces too many uncertain factors (external supply shocks, difficult-to-measure employment elasticity, an uncertain interest rate transmission chain, and a long-standing debate on the multiplier effect). The resumes of the Federal Reserves voter members have no intersection with the crypto world without exception. In the already very headache-inducing decision-making process, they obviously do not like the newly added uncertain variables of cryptocurrencies and US dollar stablecoins.

अंत

The content of this article is only for information sharing, and does not promote or endorse any business or investment behavior. Readers are requested to strictly abide by the laws and regulations of their region and not participate in any illegal financial behavior. It does not provide transaction entry, guidance, distribution channel guidance, etc. for the issuance, trading and financing of any virtual currency or digital collections.

4 Alpha Research content is not allowed to be reproduced or copied without permission. Violators will be held accountable for legal liability.

This article is sourced from the internet: 4Alpha Research: The Fed is turning to balance and external consistency, but its attitude towards Crypto remains conservative

Related: In-depth analysis: How much impact does mining cost have on the lower limit of BTC price?

Original author: Murphy, on-chain data analyst (X: @Murphychen 888) How much impact does mining cost have on the lower limit of BTC price? Some people have misunderstandings about whether mining costs affect BTC prices. They believe that in the current capital era, the proportion of BTC in the hands of miners in the entire circulation market is very small, so whether miners sell or not does not affect the price trend of BTC. Here I can talk about my personal opinion. First of all, the mining cost has no effect on the upper limit of BTCs price, which is beyond doubt; but it will greatly affect the lower limit of BTCs price . The logic behind this is not that miners will sell or not sell their chips when the…