मूल लेखक: 1912212.eth, फ़ोरसाइट न्यूज़

At 9 oclock last night, BTC briefly broke through $70,000, and then was hit hard. The four-hour line fell by 2.12%, and finally stabilized around $67,000. After BTC consolidated for several hours, at around 6 oclock this morning, BTC ushered in another wave of decline, reaching a minimum of $65,862, and then hovered around $67,000 after stabilizing.

Affected by the performance of BTC, ETH also fell from above $3,500 to a minimum of $3,087, and has now rebounded to around $3,300. Altcoins generally fell. In the past 24 hours, the entire network had a liquidation of $168 million, and long orders had a liquidation of $144 million.

This month, after the negative news of Germany selling BTC was digested, the market began to rise dramatically due to Trumps assassination and the US election. From $58,000 in the middle of the month to around $68,000, the market fell back after Trump announced various types of Bitcoin for the election. But not long after, the interest rate market generally expected the Federal Reserve to cut interest rates for the first time this year in September, and BTC spot ETF data continued to have a net inflow. Under the influence of a series of positive news, BTC then began to surge upward again. Just when BTC broke through $70,000 and was close to the historical high of $73,777 set in March, the market was frustrated again and trended downward. Why is it so difficult for BTC prices to set new highs?

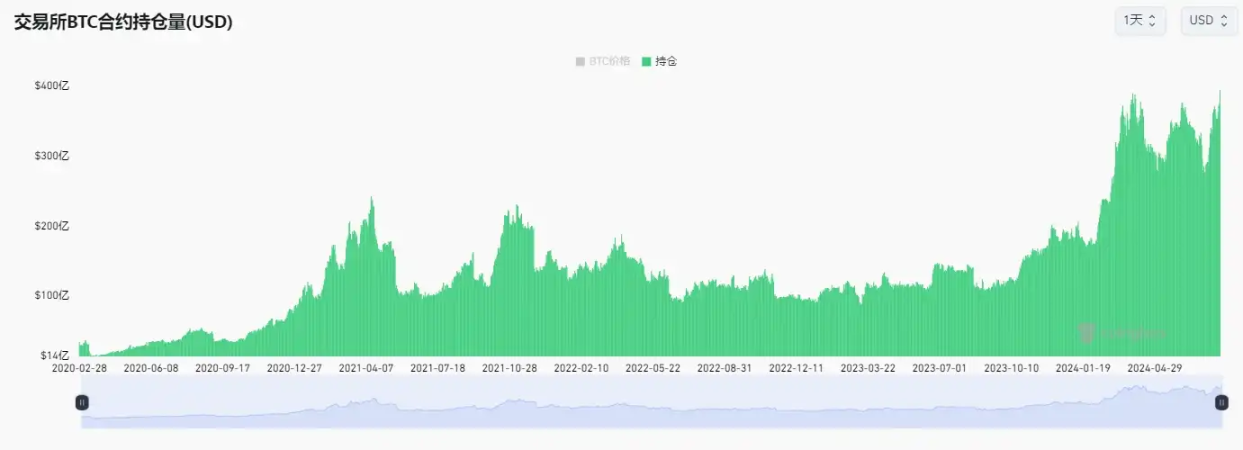

The BTC contract position data of the entire network hit a new high, which is often the short-term high point of BTC

At 6 pm on July 29, according to Coinglass data, the total Bitcoin contract holdings on the entire network reached $39.46 billion, setting a record high. Just three hours later, BTC broke through $70,000 and began to fall sharply.

Contract data, to a certain extent, represents the market funds’ views on future market trends. Contract data hit a record high, indicating that the market is too consistent in the short term and is extremely optimistic about BTC’s short-term trend, and is constantly increasing leverage. Therefore, it often ushers in a correction to clean up chips and move forward lightly.

On March 4, March 13, March 29, and June 7, 2024, the BTC contract data all hit data highs on the same day. If you compare it with the BTC price on the same day, you can clearly see that it was at the high price.

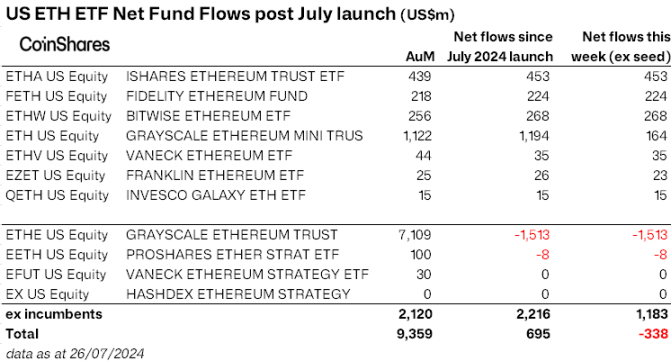

Ethereum spot ETF net inflows are less than Grayscale outflows

After the BTC spot ETF was approved, the BTC price also experienced a period of decline. History also happened on Ethereum. Just when the market thought that its inflow data would be bleak due to the lack of support for staking income, it attracted $1.183 billion in capital inflows in the first week of its launch.

However, Grayscale Ethereum Trust (ETHE) saw an outflow of $1.513 billion, which directly led to an overall net outflow of $338 million for its Ethereum ETF spot after this data was taken into account.

The price of ETH also rose from $2,800 to $3,562, and then fell slightly to around $3,300.

Mt.Gox compensation has started, huge selling pressure has caused market concerns

On July 24, Mt.Gox also transferred 61,558.9 BTC (about 3.894 billion USD) to the trading platform for compensation distribution. The 51,342.8 BTC (3.218 billion USD) that entered Bitbank, SBI VC Trade, and Kraken have already been distributed to creditors.

Later that day, Bitstamp also began distributing 10,200 BTC, or about $676 million, to Mt.Gox creditors. The next day, some users claimed to have received their compensation.

Although most users who passively locked their positions received less coins, due to the soaring BTC price over the past decade, after suddenly receiving such a huge compensation, it is highly likely that a considerable number of users will still choose to sell for profit.

This morning, the Mt.Gox address transferred 0.02 BTC to a newly created address, which may be a transfer test, and the compensation action will continue. It can be expected that before the compensation is completely completed, the market will still be negatively affected by its huge selling pressure.

Huge transfers from the U.S. Department of Justice address are either escrow or sell-offs

On July 28, Trump gave a speech at the Bitcoin 2024 Conference, saying that if elected president, the United States will not sell (100% retention) any Bitcoin and will use it as a strategic Bitcoin reserve. The BTC Trump referred to is the tens of thousands of BTC that the government confiscated from the Silk Road.

Recently, Arkham Intelligence’s blockchain data showed that a wallet marked as the US Government: Silk Road Justice Department transferred 29,800 BTC to a new address. Subsequently, the address forwarded 19,800 BTC and 10,000 BTC to two different addresses.

Arkham analysts predict that one of the transfers of 10,000 BTC worth $670 million was a deposit to an institutional custodian or service. James Seyffart, senior ETF analyst at Bloomberg, speculated that the transfer may be a wallet consolidation to hold custody of the seized Bitcoin.

So far, market participants have different opinions on whether these deposited BTC are being held in custody or sold, but the negative impact on the market is still in effect.

Future market trends

QCP Capital: The market needs a bigger catalyst for a major breakthrough

QCP Capital posted on its official channel that although the price of Bitcoin fluctuated during Trumps speech at the Bitcoin conference, the market did not fluctuate as much as expected. The price of Bitcoin remained between $67,000 and $70,000, and volatility dropped significantly.

Trumps speech echoed industry expectations, but the market may need a bigger catalyst for a major breakthrough. This catalyst may come when the US election is approaching and the promises and policies are clearer. Despite Trumps optimistic remarks, Bitcoin failed to break through its all-time high, so Bitcoin may continue to trade in a range.

GSR Co-CEO: Altcoins will come back and come back strong

Rich Rosenblum, co-CEO and co-founder of crypto market maker GSR, posted on social media that every time Bitcoin rises, the altcoin angel on my shoulder shouts: Altcoin season is coming. The altcoin devil responded sarcastically: Not this time… Altcoins cant rise in this regulatory environment. The angel said: The team and technology are much better now, and altcoins will find a way to break through. This is the first time that the altcoin devil has remained silent.

Bitcoin’s market dominance has been rising throughout the month, and BTC may continue to lead the next phase of the bull cycle (or rather, SOL, the fastest horse). But this is the time I am most confident that altcoins will come back, and come back strong.

Real Vision founder: Bitcoin is about to break through the huge cup-handle pattern and enter the banana range

Raoul Pal, a former Goldman Sachs executive and founder of macro research firm Real Vision, posted on social media that Bitcoin is about to break through the huge cup-handle pattern and enter the banana range.

Raoul Pal previously stated that the banana range is a concept that Arthur Hayes and others often talk about. This is a highly cyclical stage when liquidity enters the market and the central bank needs to refinance all debts, using candy to please the people. At this time, cryptocurrencies usually rise vertically. This is a debt refinancing cycle driven by macroeconomic forces that affects all asset prices, but cryptocurrencies are particularly outstanding. So the easiest way is not to screw it up. Keep a core portfolio with most of the assets allocated in major cryptocurrencies. If you can do it right in other assets, you can make a lot of money in that 10-20% of the portfolio, which has higher risks but greater returns.

BRN Chief Analyst: Bitcoin will usher in a strong rise and reach a new high

Valentin Fournier, chief analyst at digital asset research firm BRN, said that in addition to accumulating mining rewards, mining companies appear to be buying Bitcoin directly from the market to increase their reserves. They triggered the Hash Ribbon signal, a long-term bullish indicator that shows the end of miner capitulation and an increase in processing power used to mine Bitcoin.

Fournier said the recent behavior of miners shows that they are confident in the long-term value of Bitcoin. Given this accumulation behavior, Fournier added that traders will be inclined to continue to invest in the top cryptocurrency, citing a series of strong catalysts. The lower PCE data released on Friday, Trumps speech at the Bitcoin 2024 conference, and the reduction of selling pressure from Mt. Gox and Grayscale ETFs all indicate that Bitcoin will usher in a strong rise to new highs.

10x Research: The Fed rate decision on August 1 and the CPI report on August 14 will be crucial

10x Research posted on social media that according to historical data analysis, Bitcoins return rate flattened in August and fell in September. However, positive factors in US interest rate policy, falling interest rates and the election calendar may buffer any downward pressure on the unlocking of $1 billion in tokens in August. Bitcoins dominance is creating new highs in this cycle and has a significant impact.

It believes that Bitcoin is expected to eventually break new highs, but Bitcoin may need macro help. The Federal Reserves interest rate decision on August 1 and the CPI report on August 14 will be crucial.

This article is sourced from the internet: Why has Bitcoin been unable to reach new highs?

Original source: Coinbase Original translation: BitpushNews Mary Liu Summary: According to Arkham data, the German government’s Federal Criminal Police Office (BKA) may have completed its sell-off, reducing its holdings from approximately 50,000 BTC ($3.55 billion) in mid-June to 0 BTC as of July 12 (data as of 14:38 EST on that day). There is concern that a rate cut could be bad for markets if the economic slowdown is deeper amid fears that the U.S. could fall into recession later this year or early 2025. Panel discussions and speeches at the seventh Ethereum Community Conference (EthCC), including a keynote by Ethereum co-founder Vitalik Buterin, reiterated Ethereum’s roadmap to provide the most decentralized and secure settlement layer 1 (L1) for various L2s. Market View The third quarter started off badly with…