क्रिप्टो मार्केट सेंटीमेंट रिसर्च रिपोर्ट (2024.07.12-07.19): ट्रम्प की हत्या से बिटकॉइन में उछाल

Trump assassination drives Bitcoin surge

The rising probability of Trumps victory has made risky assets such as Bitcoin popular. In particular, the Republican Party mentioned in its latest campaign platform that if Trump takes office, it will end the suppression of cryptocurrencies, which has greatly boosted confidence in the cryptocurrency market.

The “Trump deal” is a hit.

After Trump was attacked over the weekend, a series of Trump-related assets such as U.S. Treasury yields and Bitcoin soared. This is all thanks to the fact that he survived the assassination attempt, and the American peoples support for Trump has soared.

Among them, Bitcoin rose for six consecutive days, with a total increase of 11.59% this week, reaching a high of US$66,000.

There are about 11 days until the next Fed meeting (August 1, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

बाजार तकनीकी और भावना पर्यावरण विश्लेषण

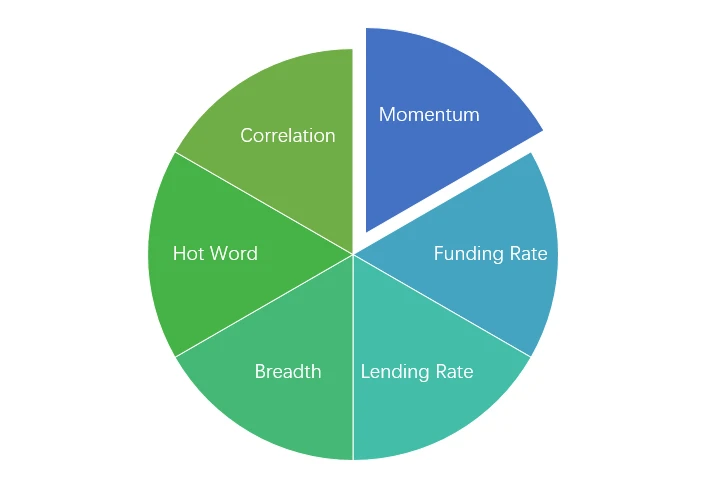

भावना विश्लेषण घटक

तकनीकी संकेतक

मूल्य प्रवृत्ति

In the past week, BTC prices rose 11.59% and ETH prices rose 10.55%.

उपरोक्त चित्र पिछले सप्ताह का BTC का मूल्य चार्ट है।

उपरोक्त चित्र पिछले सप्ताह का ETH का मूल्य चार्ट है।

तालिका पिछले सप्ताह के मूल्य परिवर्तन दर को दर्शाती है।

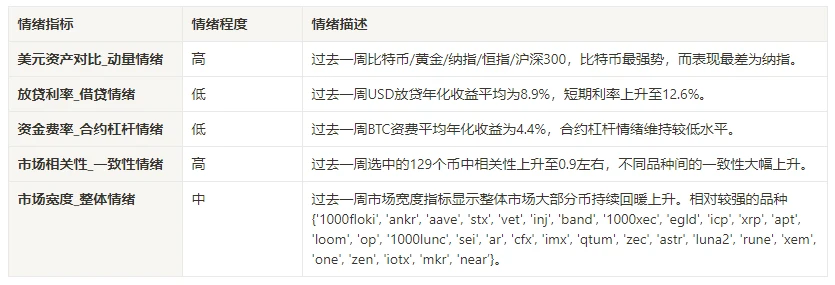

मूल्य मात्रा वितरण चार्ट (समर्थन और प्रतिरोध)

In the past week, BTC and ETH formed a new intensive trading area as they rose to high levels and increased in volume.

उपरोक्त चित्र पिछले सप्ताह में बीटीसी के घने व्यापार क्षेत्रों के वितरण को दर्शाता है।

उपरोक्त चित्र पिछले सप्ताह में ETH के सघन व्यापारिक क्षेत्रों के वितरण को दर्शाता है।

तालिका पिछले सप्ताह BTC और ETH की साप्ताहिक गहन ट्रेडिंग रेंज को दर्शाती है।

वॉल्यूम और ओपन इंटरेस्ट

In the past week, BTC and ETH had the largest trading volume when they rose from July 15 to 16; the open interest of BTC and ETH both fell slightly.

ऊपर की तस्वीर के शीर्ष पर बीटीसी की कीमत प्रवृत्ति दिखाई गई है, बीच में ट्रेडिंग वॉल्यूम दिखाया गया है, नीचे ओपन इंटरेस्ट दिखाया गया है, हल्का नीला 1-दिवसीय औसत है, और नारंगी 7-दिवसीय औसत है। के-लाइन का रंग वर्तमान स्थिति को दर्शाता है, हरे रंग का मतलब है कि मूल्य वृद्धि ट्रेडिंग वॉल्यूम द्वारा समर्थित है, लाल का मतलब है समापन स्थिति, पीला का मतलब है धीरे-धीरे जमा होने वाली स्थिति, और काला का मतलब है भीड़भाड़ वाली स्थिति।

ऊपर की तस्वीर में सबसे ऊपर ETH की कीमत का रुझान दिखाया गया है, बीच में ट्रेडिंग वॉल्यूम है, नीचे ओपन इंटरेस्ट है, हल्का नीला 1-दिन का औसत है, और नारंगी 7-दिन का औसत है। K-लाइन का रंग वर्तमान स्थिति को दर्शाता है, हरा रंग दर्शाता है कि मूल्य वृद्धि ट्रेडिंग वॉल्यूम द्वारा समर्थित है, लाल रंग समापन स्थिति है, पीला रंग धीरे-धीरे जमा होने वाली स्थिति है, और काला रंग भीड़ है।

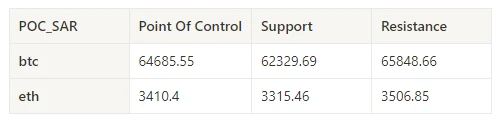

ऐतिहासिक अस्थिरता बनाम निहित अस्थिरता

In the past week, the historical volatility of BTC and ETH was the highest when it rose to 7.16; the implied volatility of BTC and ETH rose synchronously.

पीली रेखा ऐतिहासिक अस्थिरता को दर्शाती है, नीली रेखा निहित अस्थिरता को दर्शाती है, तथा लाल बिंदु इसका 7-दिवसीय औसत है।

घटना संचालित की गई

There were no major data releases in the past week.

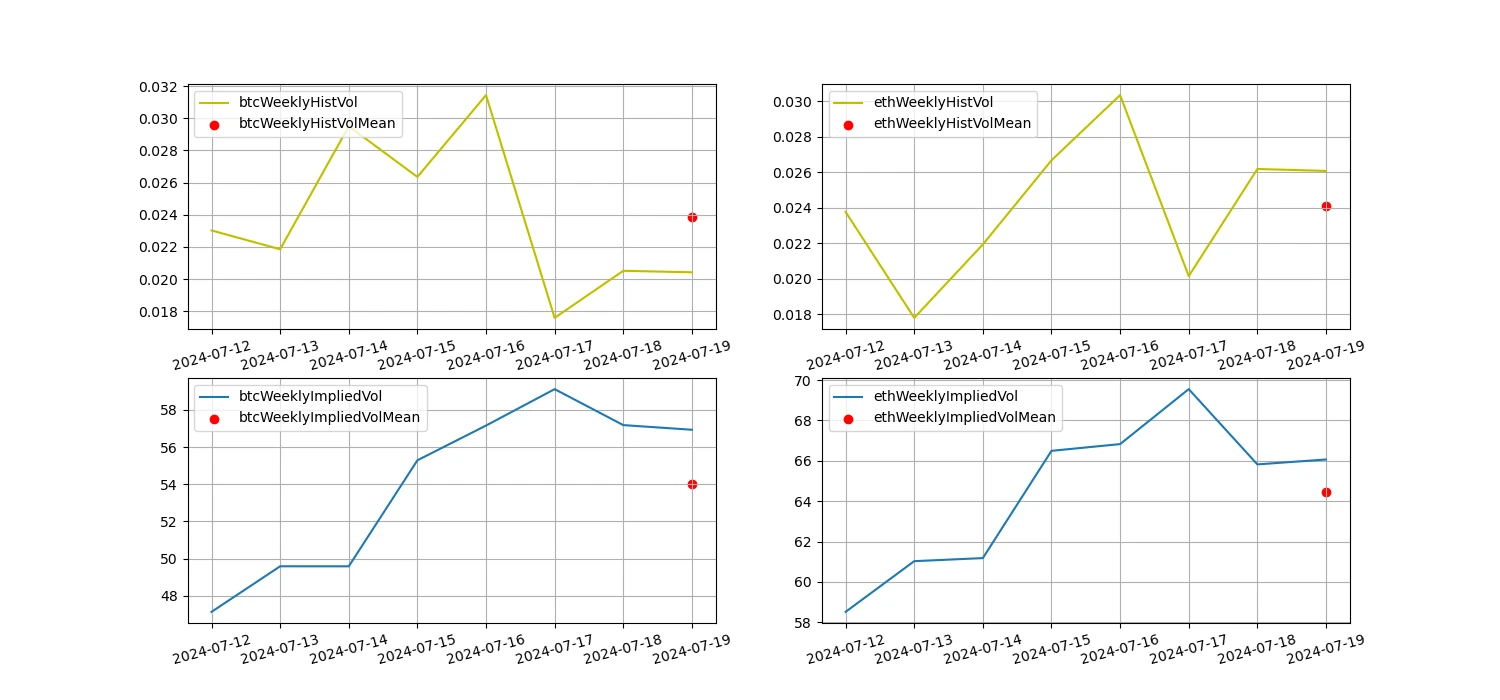

भावना सूचक

गति भावना

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Bitcoin was the strongest, while Nasdaq performed the worst.

उपरोक्त चित्र पिछले सप्ताह में विभिन्न परिसंपत्तियों की प्रवृत्ति को दर्शाता है।

उधार दर_उधार भावना

The average annualized return on USD lending over the past week was 8.9%, and short-term interest rates rose to 12.6%.

पीली रेखा USD ब्याज दर का उच्चतम मूल्य है, नीली रेखा उच्चतम मूल्य का 75% है, और लाल रेखा उच्चतम मूल्य का 7-दिवसीय औसत 75% है।

तालिका पिछले कुछ समय में विभिन्न होल्डिंग दिनों पर USD ब्याज दरों के औसत रिटर्न को दर्शाती है

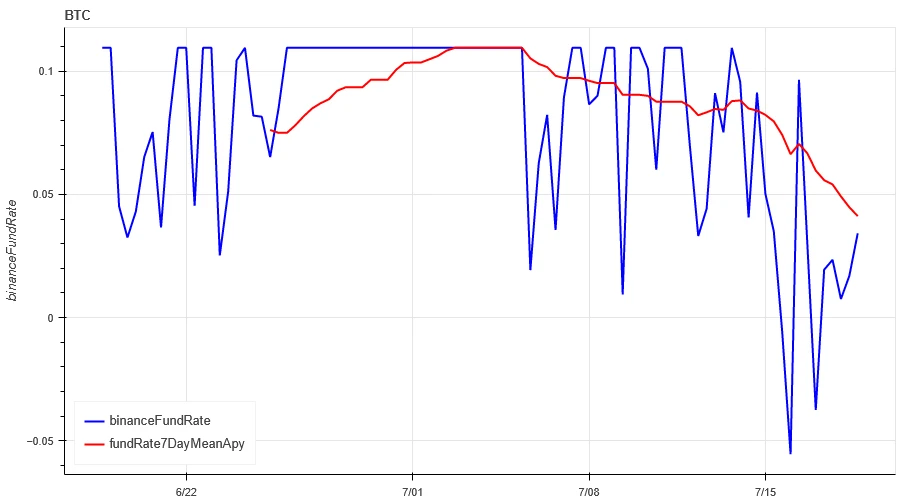

फंडिंग दर_अनुबंध उत्तोलन भावना

The average annualized return on BTC fees in the past week was 4.4%, and contract leverage sentiment remained at a low level.

नीली रेखा Binance पर BTC की फंडिंग दर है, और लाल रेखा इसका 7-दिवसीय औसत है

The table shows the average return of BTC fees for different holding days in the past.

बाजार सहसंबंध_आम सहमति भावना

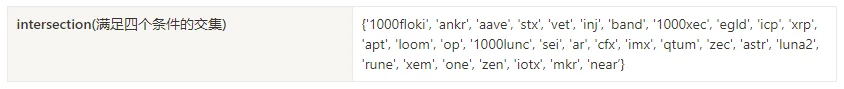

The correlation among the 129 coins selected in the past week remained at around 0.9, and the consistency between different varieties increased significantly.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

बाजार विस्तार_समग्र भावना

Among the 129 coins selected in the past week, 78% of the prices were above the 30-day moving average, 37% of the prices were above the 30-day moving average relative to BTC, 33% of the prices were more than 20% away from the lowest price in the past 30 days, and 67.7% of the prices were less than 10% away from the highest price in the past 30 days. The market breadth indicators in the past week showed that most of the coins in the overall market rebounded and rose.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

संक्षेप

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) rose for 6 consecutive days, while the volatility and trading volume of these two cryptocurrencies reached the highest level when they rose on July 16. The open interest of Bitcoin and Ethereum is declining. In addition, the implied volatility of Bitcoin and Ethereum has also risen in tandem. Bitcoins funding rate remains at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. Market breadth indicators show that most cryptocurrencies have rebounded and risen, indicating that the overall market has rebounded from lows in the past week.

ट्विटर: @ https://x.com/CTA_ChannelCmt

वेबसाइट: चैनलसीएमटी.कॉम

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.12-07.19): Trumps assassination drives Bitcoin up

Related: Decoding Dar Open Network: The infrastructure layer for the next generation of Web3 games

At Dar Open Network, we firmly believe in the transformative power of blockchain games. Games are not only entertainment, but also empower players, revolutionize the digital economy, and push the boundaries of technological innovation. As the crypto industry grows, we believe that blockchain games will become the cornerstone of a new paradigm in driving adoption, creativity, and digital interaction. Our team is committed to building a gaming platform that serves game developers and players. We are not creating a new chain, but building an ecosystem. Guided by this vision, we developed Dar Open Network as the infrastructure layer for future games. The creation of Dar Open Network has been going on for six months. Starting from the mission of providing a one-stop solution, we have made progress in many aspects…