वर्ल्डकॉइन ने टोकन अनलॉकिंग समय को काफी हद तक बढ़ा दिया है, क्या यह भारी बिक्री दबाव को उलट सकता है?

मूल | ओडेली प्लैनेट डेली ( @ओडेलीचाइना )

लेखक锝淣an Zhi ( @हत्यारा_मालवो )

Since March, WLD (Worldcoin) has been on a downward trend, with the unit price falling from a peak of nearly 12 USDT to a low of 1.72 USDT. The fundamental reason for this is not only the overall market downturn, but also the massive and continuous token unlocking and selling pressure of WLD.

However, in recent days, Worldcoin has made two consecutive changes to the token release rules, causing the token to rise by 8% and 13% within an hour respectively. Odaily will explain in this article how much WLDs original selling pressure was and what impact the two changes had on the continued unlocking.

WLD Token Unlock Data

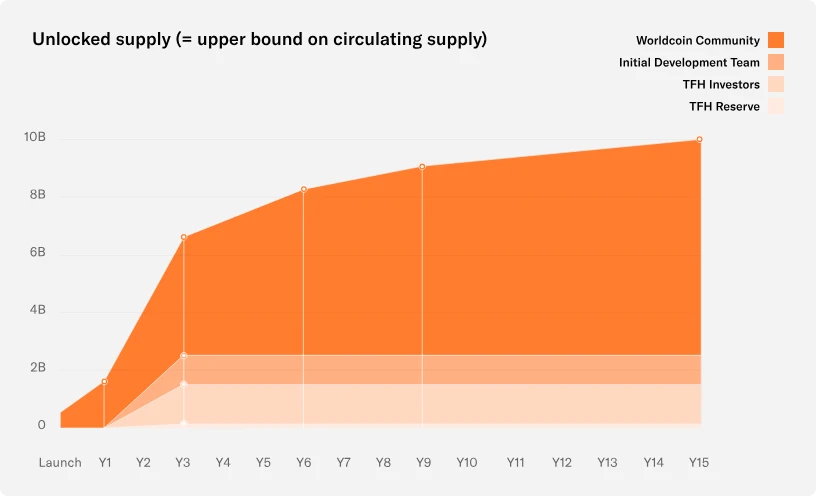

The WLD token will be launched on July 14, 2023 , with an initial circulation of 143 million tokens, including 100 million loans from market makers, and a total of 10 billion tokens. Excluding the loan portion, the actual initial circulation is 43 million tokens .

The release of WLD tokens is most rapid in the first three years. In the first year, all community tokens will be unlocked. From the second year, institutional unlocking will begin and last for two years.

One year after the token was issued, the actual circulation of WLD has risen to 276 million , with an inflation rate of 541%. Please note that the actual circulation is based on the data returned by the Orb API (click to call). टोकन Unlocks uses the upper limit of the theoretical circulation , with an initial circulation of 500 million and a current circulation of 1.65 billion. However, in fact, the amount of these tokens that need to be transferred from governance control to real circulation depends on the rate at which these tokens enter circulating supply is controlled by governance.

Three days ago, WLD was launched for the first year and started to unlock TFH (Tools for Humanity). The theoretical circulation will increase from the current 1.65 billion to 6.5 billion. This corresponds to 6.62 million unlocked per day. Based on the current unit price of 2.8 USDT, there will be a daily selling pressure of 15.42 million USD .

If calculated based on the current ratio of actual circulation to the upper limit, the daily selling pressure is approximately 2.76/16.5 脳 1542 = 2.58 million US dollars , but it is impossible to predict how long this ratio will last and how it will change.

(Odaily Note: Tools for Humanity is the actual technology development entity and the operator of World App. TFH unlocks multiple objects including investors, employees, consultants, etc.)

What are the impacts of changing the unlocking rules?

Worldcoin has modified the token release rules twice. The first modification occurred on July 10, when Worldcoin announced that the claim period for unclaimed WLD reserve tokens would be extended by one year . This proposal actually increased the selling pressure of WLD. The background of this part of the token is that shortly after the launch of Worldcoin in July 2023, the Worldcoin Foundation introduced the WLD token reservation mechanism, allowing users who have not yet passed the Orb verification to reserve WLD tokens and redeem them at a certain point in the future. To enable as many people as possible to participate in Worldcoin, regardless of whether the Orb device is available.

This modification allows WLD that was previously unclaimed to re-enter the market, increasing the amount of WLD that can be sold in the next year . There is no public data on the specific number of WLD tokens affected, but according to a tweet from Worldcoin, this change affects 6 million users .

TFH unlock extension

Yesterday, Worldcoin announced again that the token lock-up period for early Worldcoin contributors to Tools for Humanity will be extended, and the token unlocking period for 80% of TFH investors and team members will be adjusted from two years to four years .

According to the original release plan, the TFH team and investors will unlock 3.19 million tokens per day, currently worth approximately US$7.44 million. The revised daily unlocking is reduced to (319 脳 80% 梅 2 + 319 脳 20%) = 1.914 million tokens, while the data given in the Worldcoin announcement is that approximately 2 million tokens will be unlocked per day .

सारांश, the amount of token unlocking has dropped from 6.62 million per day to approximately 5.4 million , with no change in magnitude.

निष्कर्ष के तौर पर

Although this token release modification has not substantially reversed the continuous selling pressure of WLD, WLD has risen by 29% since the announcement. Worldcoin has also demonstrated its news trading ability many times in the past year. In theory, it should be long short and short long. However, if the specific rules of World Chain give WLD actual use cases, the fundamentals will reverse again, which deserves readers attention in the future.

This article is sourced from the internet: Worldcoin significantly extends token unlocking time, can it reverse the massive selling pressure?

Related: Full record of Odaily editorial department investment operations (July 8)

This new column is a sharing of real investment experiences by members of the Odaily editorial department. It does not accept any commercial advertisements and does not constitute investment advice (because our colleagues are very good at losing money) . It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain. Recommender: Nan Zhi (X: @Assassin_Malvo ) Introduction : On-chain player, data analyst, plays everything except NFT Share : Solanas on-chain market is gradually recovering, and the relatively stable JLP spot (JLP contains 10% stablecoins) is gradually being exchanged for the more flexible SOL. At the same time, the exchange uses SOL to hang long orders…