गहन चर्चा: क्या अभी भी गवर्नेंस टोकन की आवश्यकता है?

Original author: Outerlands Capital

मूल अनुवाद: टेकफ्लो

Governance tokens are a complex and controversial topic, with opinions ranging from “novel innovation” to “largely unnecessary” among crypto investors. We tend to lean toward the former, and believe that well-structured governance tokens can add significant value to a project.

चाबी छीनना

-

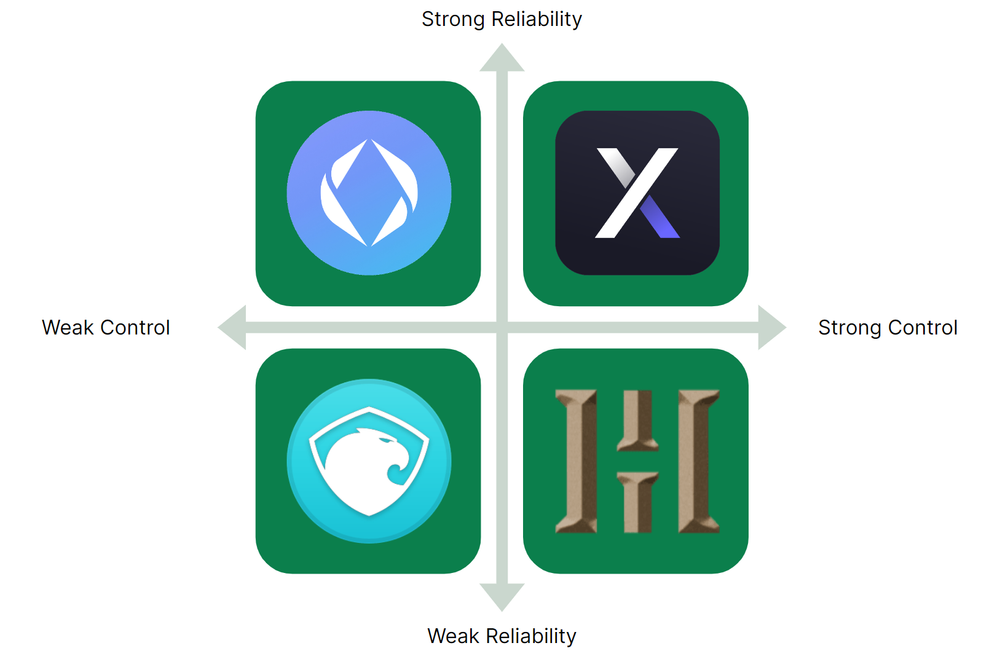

In this paper, we propose a four-quadrant framework for evaluating governance tokens based on the reliability of token holder rights and control over economic value.

-

After proposing the framework, we examine tokens in each quadrant through example cases and conclude with recommendations for builders and investors on how to build and evaluate governance tokens.

परिचय

Governance tokens are generally defined as tokens that grant holders voting rights on certain project parameters, which may include implementing product updates, fee/revenue capture, and business development decisions. While market participants often describe governance tokens as a distinct category, it is more accurate to say that governance tokens are a feature or attribute that any token may have. From Layer 1, DeFi, infrastructure, to gaming, there are examples of governance tokens in every crypto market segment.

In this article, we explore the utility of governance tokens and the circumstances under which they succeed or fail to unlock the value of their underlying projects. We begin by introducing the role that governance tokens play in cryptocurrencies, responding to common criticisms, and making the case for their existence. This initial analysis reveals two key characteristics required of governance tokens: control over economic value and accountability for that control.

We derive a framework from key characteristics and apply it to case studies to illustrate the difference between projects that do and do not meet our criteria. Finally, we conclude with how projects and their potential investors should think about the design and valuation of governance tokens.

Should governance tokens exist?

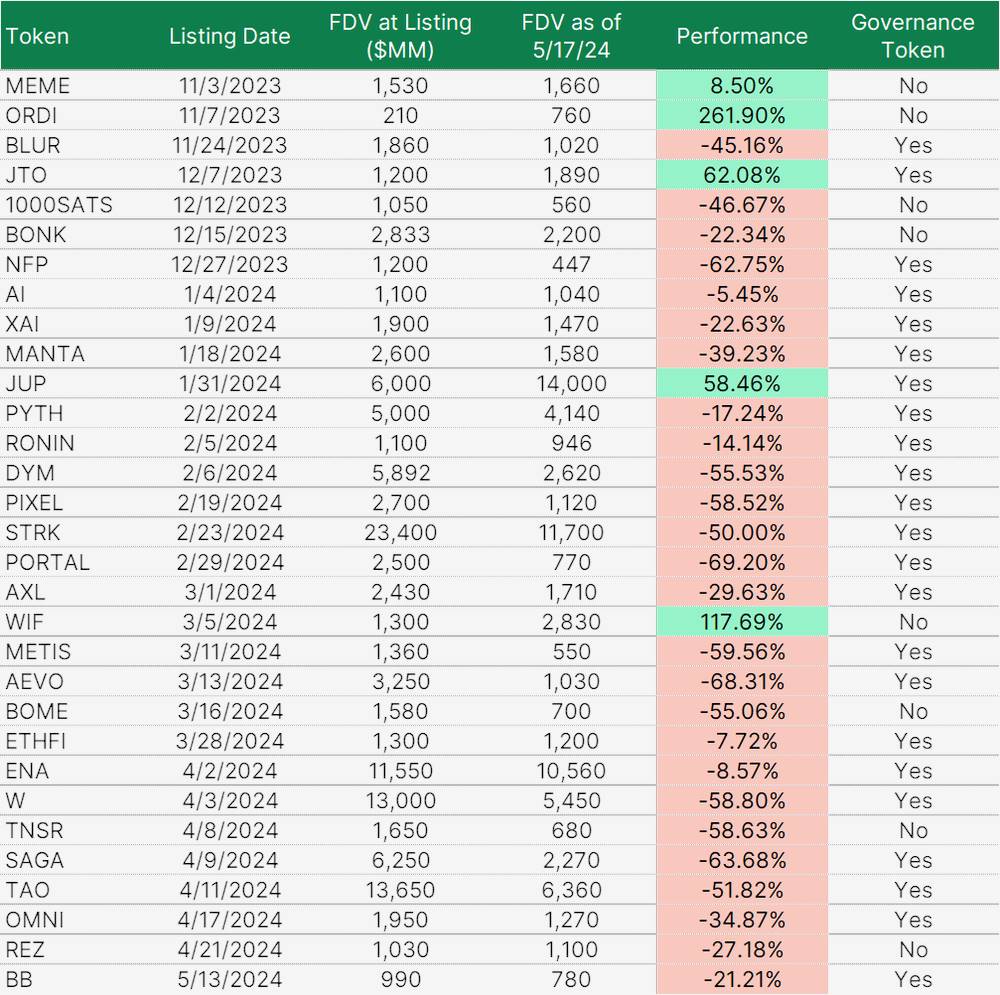

Chart 1: Performance of newly listed Binance tokens since November 2023. Source: @tradetheflow_, Outerlands Capital Research

Some market participants and builders believe that governance tokens have no reason to exist, or at least should exist in far fewer numbers than they do today. This view is exacerbated by the relatively poor performance of newly launched venture-backed tokens, which are struggling to compete with large-cap and meme coins at high valuations.

Common criticisms include:

-

The protocol works just as well or better without decentralized governance (or even a token), and the presence of a token only slows it down.

-

Many teams launch tokens simply to profit early, with no real reason to create utility.

-

The utility provided by governance tokens is often of little consequence to smaller investors, who lack sufficient influence to truly sway the strategic direction of a project.

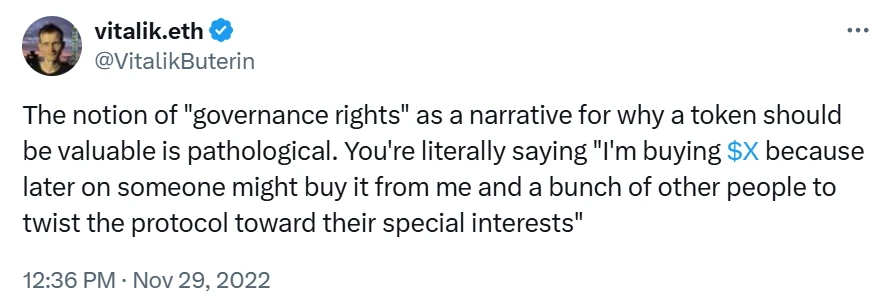

It’s worth noting that it’s not always influential people who are making widespread criticisms of governance tokens. Respected figures such as Ethereum co-founder Vitalik Buterin and Flashbots’ head of strategy Hasu have expressed skepticism about the benefits of governance tokens.

Figure 2: Vitalik Buterin’s comments on governance tokens

While the above statements are true in some cases, we believe that all of them are incorrect. If structured properly, projects using governance tokens can retain aspects of centralization that typically benefit startups while unlocking the additional value of decentralized governance. For example, a team can retain control over the strategic direction of the project and product development while providing governance token holders with control over other important parameters such as protocol revenue distribution or approval of new upgrades. Projects can also strategically utilize airdrops and other community distribution programs to give tokens to those who are aligned with the long-term interests of the protocol. We believe that governance tokens can achieve value-added through two main avenues:

We believe that governance tokens can increase in value in two main ways:

-

Governance tokens can help applications manage the risks inherent in their business models. Importantly, they can do this better than tokenless governance systems because they provide an incentive to do so. For example, governance tokens can help mitigate vulnerabilities from centralized attack vectors within protocols. While layer-2 networks like Optimism and Arbitrum are continually developing their own technology, they already collectively house billions of dollars in TVL on-chain. If a centralized party like Offchain Labs (Arbitrum’s developer) was able to upgrade contracts or modify system parameters at will, it would pose a huge risk to the network. That is, if certain contracts suddenly received a malicious code upgrade, funds could be stolen. However, the technology is still under development and needs to be upgraded to remain competitive. By delegating these decisions to a decentralized governance process, projects become more resilient because no single entity can be targeted by malicious actors.

-

Governance tokens can provide utility to their holders in the form of tangible economic value. One use case is GMX, a crypto derivatives platform that pays a percentage of the platform’s trading fees to those who purchase and hold its tokens. Many centralized exchanges also offer trading fee discounts to their token holders. Tokens can provide similar utility to other projects, too, providing economic benefits in exchange for development funding or aligning incentives.

There are many governance tokens that meet at least one of the above criteria, and we are optimistic that there will be more of them in the future.

Outerlands Capital’s Governance Token Valuation Framework

We look at governance tokens from four quadrants. Among them,

-

The Y-axis represents reliability, or the strength of rights granted to token holders. Tokens with strong reliability provide holders with clear rights that are not easily changed, giving holders greater certainty of their control over given parameters. At the same time, tokens with weak reliability only nominally grant holders voting rights, and there is great uncertainty as to whether the holders rights will be respected by the team or the protocol. Chris Dixon makes a similar point in Read Write Own, emphasizing the importance of the protocols ability to make strong commitments.

-

The x-axis represents control, defined as the economic value or other utility that token holders possess. Tokens with strong control give ecosystem participants (users, investors, etc.) many reasons to own the token, while tokens with weak control give little incentive to do so.

Figure 3: The four quadrants of token governance. Source: Outerlands Capital Research

Token attributes with strong reliability

Here are the attributes Outerlands Capital looks for in a token with strong reliability:

-

A strong charter that is consistent with the core spirit of the project model.

-

The threshold for amending the bylaws should be higher than other governance votes (e.g., 2/3 supermajority and 10% quorum).

-

A comprehensive governance process that includes:

-

Day-to-day business functions (such as grants, payroll, etc.) should be controlled directly by the team or handled by specific subcommittees to allow for faster decisions than standard governance allows. Token holders should still have visibility into these functions and the option to object if needed.

-

Key decisions (such as major technology deployments, financial investments exceeding a certain amount, or risk management functions) should undergo multi-stage discussions over a longer period of time (more than 1 week).

-

Provide multiple tracks for proposals that balance efficiency and democracy, based on urgency and importance:

-

A dedicated forum and voting platform for token holders to easily access and interact.

-

Token holders can delegate their governance power to knowledgeable/interest-aligned parties.

-

A democratically elected emergency DAO/security committee to respond in the event of a critical incident such as a hack, which the DAO should be able to modify or remove.

-

On-chain execution/enforcement of important decisions (so token holders don’t have to trust the team to honor votes). This must be heavily audited and properly constructed to avoid governance attacks, and on-chain execution should include reasonable time locks.

-

A foundation or other legal entity that represents the DAO in the real world (this may not be appropriate for a completely anonymous team). This limits the legal liability of governance participants and makes it easier for others to do business with the DAO (as they can interact with a more traditional corporate structure).

-

Implement strong controls over any specific utility promised to token holders (such as revenue distributions or periodic buybacks). Ideally, this can be done directly at the protocol level or through smart contracts (the strongest promise), but legal protection is also an option.

Token attributes with strong control capabilities

Broadly speaking, tokens with strong control give holders control over important economic parameters. The most obvious mechanisms that investors look for are those that are similar to traditional equity. A project that distributes revenue to holders (who have management rights over how it is distributed) or repurchases tokens on the open market is easy to evaluate based on its cash flows. As the underlying business grows, the tokens will also share in its success, which means investing in tokens is an easy way to bet on the business. Investors can use traditional metrics such as discounted cash flow analysis or relative valuation based on revenue/earnings multiples.

However, in addition to equity-like value capture, there are several important control factors that may incentivize holding tokens. These include:

-

Other forms of economic utility include discounts on protocol fees or priority product access for users who hold a certain number of tokens.

-

Control over technology upgrades and deployment of new protocol versions, which may affect the economic interests of stakeholders.

-

Control changes related to token economics, including inflation/deflation and distribution, which may affect the voting power of existing token holders.

-

Influence business development decisions that may impact the financial success of the protocol, such as team salaries, partnerships, incentive plans, fees paid to third parties such as exchanges and market makers, etc.

Assessment Framework Case Study

The following case studies showcase tokens in four quadrants where governance can enhance and/or diminish the fundamental value of a project.

Strong control, strong reliability: dYdX

The decentralized derivatives exchange dYdX (token: DYDX) is an example of a strong control, strong reliability quadrant. Founded in 2017, dYdX offers perpetual contract trading in 66 trading pairs (as of June 2024). In November 2023, dYdX upgraded to v4 of its trading software, including migrating to its own Cosmos application chain, and significantly improved the token economics model through changes to the governance process, token utility, and revenue collection methods.

Today, the DYDX token provides the following control mechanisms:

-

DYDX is the staking token for Lisk, meaning stakers earn income through transaction fees in compensation for the security they provide to the network. As with most PoS blockchains, DYDX stakers receive fees in proportion to the number of tokens they stake, creating a linear relationship between earnings and token purchases. Token holders who do not wish to stake can delegate their DYDX to others in exchange for a small portion of the earnings earned. At current activity levels, the chain generates over $43 million in annualized fees for validators⁹.

-

DYDX holders have the power to propose and vote on proposals that directly influence the direction of the dYdX chain. Recent proposals include the introduction of new perpetual contract markets, a trading incentive program, funding for the dYdX Foundation, and technology upgrades.

With the above upgrades, the DYDX token provides stakeholders with a number of benefits, including access and control over protocol revenue through governance, and significant influence over future project development.

In terms of reliability, the new token is also critical to the project in multiple ways. Beyond the technology, one of the core reasons the dYdX team migrated from Ethereum-based rollups to Cosmos was its superior decentralization, enabled by a distributed set of PoS validators. Not only does this reduce the regulatory risk of running a centralized sorter, it also makes it possible to distribute revenue directly to token holders through the protocol (in the form of staking returns), a strong commitment that will be difficult to reverse and more solid than a revenue sharing system run by the team. The same applies to the other proposals in the third point above, all of which are executed on-chain after a successful vote.

Weak control, strong reliability: Ethereum Name Service (ENS)

Ethereum Name Service (ENS), a decentralized naming service for crypto wallets, websites, and operations, is an example of the weak control, strong reliability quadrant.

On paper, ENS is one of the more successful projects in the crypto space, with revenues of $16.57 million over the past year (as of May 2024), placing it in the top 25 projects by revenue (as tracked by Token Terminal). Despite this, the ENS token is ranked well outside the top 100 by market cap (despite only ~31.5% of supply being in circulation 12). This result can be largely attributed to the DAO’s mission as set out in its charter, which includes:

-

Fees are an incentive to prevent mass domain squatting and to fund DAO operations. Excessive profits are not a priority. The average ENS domain renews for $5 per year, well under half of what the most popular Web2 providers charge. ENS could double its fees and the loss in demand would be minimal.

-

The revenue accumulated by the ENS pool should be used to grow the ENS ecosystem and ensure its long-term viability. Any excess revenue should fund other public goods in the Web3 ecosystem.

This is not an explicit criticism of ENS Labs (the nonprofit responsible for core software development) for codifying its charter before handing it off to the DAO. They have several qualities needed for strong accountability, including voting delegation, on-chain execution, and different proposal tracks. The Cayman Islands Foundation represents a DAO in the real world, providing limited liability for participants (addressing the legitimate legal issues raised in the OokiDAO case). ENS is a good model for other projects looking to run as a nonprofit.

However, its public interest-oriented philosophy limits the potential control that token holders have over the project. Due to the low probability of ENS increasing fees or distributing revenue in the future, the token is not broadly attractive to investors and lacks an attractive upside story. Even if domain sales increase significantly, token holders should not expect to receive a portion of these fees. The structure of the ENS constitution makes it difficult for activist investors to target. Because of this, only a small group of people are interested in purchasing governance tokens, including:

-

Individuals who have a strong interest in the DAO and are willing to contribute to its development and success. These individuals are also more likely to become delegates rather than accumulating a large number of tokens for themselves.

-

Projects that wish to work with ENS must earn or be delegated at least 100,000 (about $2 million at current prices) tokens in order to make a proposal.

-

Projects that have integrated with ENS wish to keep the protocol as free public infrastructure.

While these groups are not completely without demand, they alone cannot form an economic flywheel as powerful as dYdX.

Strong control, weak reliability: Hector Network

Hector Network is a project in the strong control, weak reliability quadrant. It is one of the many forks of Olympus DAO that emerged in 2021 and claims to be the future reserve currency of DeFi.

Initially a clone of Olympus DAO on the Fantom blockchain, Hector evolved over time into an on-chain asset manager. New investors can deposit funds into its pool and receive new tokens through a rebase mechanism, while existing stakers keep their current claim value. Teams can then use funds from the pool to develop new projects and invest in assets for returns. At the same time, token holders are granted control over important protocol parameters, including pool investment decisions, which helps their tokens rank highly in the control section of our framework.

The Hector Network team attempted to bring value to the pool by building multiple DeFi-focused products. However, these products failed to succeed due to poor execution and the market decline in 2022. Community members grew increasingly dissatisfied with the team, which paid itself a generous salary (reportedly $52 million in 18 months) despite the failed roadmap.

When token holders called for exercising their governance rights over the remaining pool, the Hector Network team began censoring individuals and implementing governance restrictions in the project Discord due to the lack of legal or smart contract protections for HEC holders. When the team was finally convinced to propose a pool liquidation, only about $16 million remained, and the value of the HEC token had fallen 99% from its all-time high.

Providing stronger management protections for HEC holders could push the project in another direction. Implementing protections inspired by traditional equity investment tools would have been a good start. Specific redemption periods (i.e. contracts open for one week every quarter), regular return distributions, and/or smart contract-based investment locks would have allowed HEC token holders to exit their investments at par before the decline. Many people had already sounded the alarm about the DAO months before it was finally dissolved, but they were powerless to do anything about it due to the poor reliability of its governance capabilities.

Weak control, weak reliability: Aragon

In some cases, governance tokens fail to provide control over the underlying project and are unreliable in protecting the rights they confer. A relevant example is Aragon: a project that provides legal, technical, and financial infrastructure for DAOs to run their operations. Several major crypto projects, including Lido, Decentraland, and API 3, have used its services.

While the team explored multiple use cases for ANT early on, the team pivoted to using ANT as a general governance token after previous ideas failed to gain traction. Unfortunately, the vague governance powers described did not provide holders with much control, as evidenced by its lack of meaningful proposals and sparse community activity 24.

In June 2022, this changed, and the Aragon Association and its community passed a proposal to move the pool to a DAO governed by token holders, with a planned date of November 2022, but this process was repeatedly delayed, with the first transfer not taking place until May 2023. At this point, the total value of the pool was approximately $200 million 26, and ANT was trading at a discount due to delays and holder frustration.

The decline in confidence in the team attracted the interest of activist investors, including Arca (a cryptocurrency hedge fund), who began buying tokens at a discount to the funding pool to push for a faster transition of DAO control, increase transparency, and use funds from the funding pool to buy back tokens and restore ANT to book value.

However, instead of allowing token holders to exercise their alleged governance rights over the pool, the Aragon Association has suspended the transfer of remaining funds, banned members from the project Discord, and accused activist investors of coordinating a 51% attack, claiming that holders only have governance rights over on-chain products and protocols built by Aragon.

Six months of turmoil followed, with Aragon’s status hanging in the balance until November 2, 2023, when the Aragon Association internally decided to dissolve and distribute the funds in the pool to token holders. The team did not allow ANT holders to vote on the plan for alleged legal reasons, despite their previous participation in the transfer of the pool. Predictably, many of the terms were considered unfair by holders and biased in favor of the team, which led to an ongoing legal battle.

A governance structure that gives holders greater control and accountability from the outset could help alleviate a lot of the pain, perhaps by giving holders the power to unwind their tokens before they get to this point, or by properly designing it in a way similar to ENS. In the next section, we’ll offer suggestions to help project founders and investors avoid negative control and accountability situations in governance.

Considerations for builders and investors

Our governance token framework and accompanying case studies outline what we believe are the general characteristics of strong governance tokens. However, each token is unique, which means the specific functions and parameters of governance should vary from project to project.

However, it is generally important for builders to create a roadmap that steadily moves toward a defined end state. This means that if a project team decides to integrate decentralized governance, they should work to make token holders’ rights solid and clear, preferably protected by strong commitments such as legal or smart contract mechanisms. Providing vague governance rights and then withdrawing them is worse than waiting for the right time to decentralized decision-making.

Builders should also determine whether a governance token is necessary before issuing one. Recalling from the previous section, governance tokens can add value by managing risk and as a form of equity. In terms of risk management, projects must decide whether certain decisions are better made by a decentralized group of token holders rather than a smaller centralized team. They can then design a governance token that gives holders control over those parameters.

If the governance token is not in the interest of the team, it can still provide utility if there are other forms of risk that need to be managed. For example, Chainlink’s LINK token does not confer governance rights, but has a staking function designed to increase network security. LINK is also an important resource for launching the Chainlink oracle ecosystem and paying for services.

If there are no risks that need to be managed by token holders, the crypto equity route may still be an option, depending on the jurisdiction and the regulatory challenges the team is willing to address. However, if investors choose to invest in new governance tokens, they should clearly understand what they will gain (control over some of the fees, ability to initiate buybacks, etc.).

Regarding control, not all projects want to design tokens for profit-driven investors. This may be due to an uncertain regulatory environment, a desire for public goods alignment (also seen in nonprofits and public benefit corporations), or other reasons. While these reasons diminish the investment value of the token, many of these reasons are legitimate. Projects that go down this path should set expectations accordingly so that investors understand what they are investing in.

निष्कर्ष के तौर पर

The problem of designing and implementing cryptocurrency governance is far from solved, but many tokens with governance features today provide clear added value to the projects they represent. Encouragingly, there are also signs that markets are beginning to price governance tokens more effectively, with many of the worst offenders (including several highlighted in the article) being forced to shut down or remediate their failures.

Our governance token valuation framework aims to advance this trend, providing builders and investors with a lens on how to design and invest in tokens, ultimately allowing more value to flow to projects that establish clear token holder rights (control) and actively protect those rights (reliability).

Finally, we want to emphasize that whether the cryptocurrency project is brand new or mature, it is not too late to identify deficiencies and make changes. The industry is still young and can achieve a transformation from weak to strong in a short period of time, especially with the help of the framework described in this article.

This article is sourced from the internet: In-depth discussion: Is there still a need for governance tokens?

संबंधित: विकेन्द्रीकृत डिज्नी लोकप्रिय क्यों नहीं हो पाया?

मूल लेखक: cc0 स्टूडियो मूल अनुवाद: ब्लॉक यूनिकॉर्न पिछले चक्र में, खुदरा निवेशकों और VC ने समान रूप से इस विचार को अपनाया कि क्रिप्टोकरेंसी एक "विकेंद्रीकृत डिज्नी" को जन्म दे सकती है। बहुत सारे बीज वित्त पोषण और उच्च उम्मीदों के बावजूद, यह दृष्टि साकार नहीं हुई है। क्यों? बेशक, खराब उपयोगकर्ता अनुभव, उच्च लेनदेन शुल्क, धीमी गति और अपर्याप्त बुनियादी ढाँचे ने सभी ने एक भूमिका निभाई। लेकिन विफलता का मुख्य बिंदु यह महसूस करने में विफलता थी कि विकेंद्रीकृत डिज्नी की नींव पहले से ही मौजूद थी और एक मेम के रूप में पनप रही थी जो इंटरनेट के माध्यम से तेज़ी से फैल गई। जेन जेड को एक ऐसे शो की सख्त जरूरत है जो उनकी भाषा, इंटरनेट संस्कृति की भाषा बोलता हो। बड़े शहर में कड़ी मेहनत करने वाले लड़के और लड़की की पुरानी कहानी, अपने सपनों का पीछा करते हुए, और एक खुशहाल जीवन जी रहे हैं…