Original author: Route 2 Fi

Original translation: Ladyfinger, BlockBeats

Editors Note: In this article, we follow the perspective of a senior cryptocurrency market participant and KOL, and gain in-depth insights into his analysis of current market trends, reflections on his personal investment philosophy, and deep insights into the angel investment field. Through his writing, we not only gain insights into the dynamics of the cryptocurrency market, but also appreciate how an investor constantly learns, adapts, and seizes opportunities in a rapidly changing financial environment. In addition, the article also provides basic knowledge of venture capital structure, providing readers with a comprehensive perspective to understand this multidimensional and dynamic industry.

परिचय

I havent opened a document for a long time, and I always dont know where to start when facing a blank page. However, I do miss the feeling of being able to write freely. Unfortunately, there are not many such opportunities these days. So, I set myself a limit of one hour. During these sixty minutes, I let my thoughts flow, let my pen bloom, and finally turn my thoughts into words. There is no Internet disturbance, no external interference, only a blank piece of paper and the passage of time (in fact, the title you see now was decided by me at the last minute. At first, even I was not sure what I would write).

Current Market

The recent cryptocurrency market is quite depressed, with altcoins falling over the past three months and Bitcoin stagnating. I expect this downturn to continue throughout the summer until August, when the market may recover with the launch of the Ethereum ETF, preparations for the presidential election, and potential interest rate cuts. However, this is just my personal opinion and is for reference only.

My activity has been relatively limited lately. Aside from holding ETH, some yield farming via Pendle and Gearbox, and numerous angel deals, I havent been involved in much else, to be honest. Trading has become extremely difficult, with almost every airdropped project on the market selling off, with very few exceptions, such as ENA which is up about 50% since the TGE. We are in a completely new market environment. I have discussed the issue of low circulation, high FDV tokens in several previous briefings.

Compared to 2021 and 2022, tokens launched in the past year saw little price volatility after the TGE, which is no longer the case. As Cobie explains in his latest Substack article, the price volatility of these tokens actually occurred in the private phase. Therefore, unless you are a project founder, venture capitalist, angel investor, trader with inside connections, or KOL, you will find this bull run extremely difficult. Of course, there are some exceptions, such as October 2023 to March 2024, which was a good period overall, and if you participated in some emerging meme coins early, you can also make profits. But other than that, most people will probably agree that this is one of the toughest bull runs they have ever experienced.

Interestingly, even veteran OGs seem to fail to take advantage of their strengths. Take Hsaka, for example. Even though he is a key player in the market, we seem to only see him when the market is easy to operate. Ansem is in a similar situation and seems to be a bit lost. However, should we really blame him? At the end of the day, we are responsible for what we buy, when we sell, and what trades we make. Although KOLs can create FOMO, in the end, it is still us who decide how to manage our funds.

In 2023 and early 2024, I spent most of my time immersed in various trading interfaces, whether it was the PvP terminal, Tweetdeck/X Pro, or the alpha chat group on Telegram. Recently, however, I have taken a more relaxed attitude towards the market. This is mainly because other trading directions seem to be unsustainable except for short-term trading (the rumor about ETH ETF a few weeks ago is an exception). This situation reminds me of the post-Terra collapse in May 2022, when the market was silent and we had to return to real life. Although I see some similarities with that time, I still think that DeFi is ushering in a new renaissance.

While I look forward to the return of traditional DeFi, Farming points and airdrop hunting seem to have evolved into the new form of DeFi. For example, the Ethena project allows you to lock up USDe for three months in advance and then receive returns in subsequent airdrops. Few people at the time foresaw that Ethena would quickly become so popular. I wish I had better grasped such opportunities at the time, and there is a new stablecoin protocol called Usual that brings me similar expectations. They are currently operating in a private phase and also offer a high APR. The key is whether they can accurately grasp the market timing like Ethena (their airdrop is scheduled for October).

स्थिर सिक्के

I still believe that this is the most critical and practical use case in the cryptocurrency space. It provides the possibility of storing funds in personal wallets without being restricted by the network and sending funds to any corner of the world in an instant. At present, some stablecoins with yields have appeared on the market, such as Ethena, Open Eden, Usual, etc. Although the stability and reliability of the yields of these stablecoins are still to be discussed, we have clearly surpassed the UST period of Terra. Take Open Eden as an example, it is a stablecoin protocol backed by treasury bonds, which can bring an annualized net return of about 5%. Recall that at the peak of the last bull market, Terra UST had a market value of 20 billion US dollars, while Ethena’s current market value is only 3 billion US dollars. I am very much looking forward to seeing how large these stablecoins can grow, or whether there are other protocols that can challenge their position.

I have a dream that after this bull market ends (and maybe at the bottom of the next bear market), we will have a stablecoin that is as safe as USDT/USDC and can provide at least 5% sustainable returns. This market undoubtedly has huge potential, just think about Wall Street and the bonds held by those investors. The first step is to ensure the absolute security of this stablecoin, and hopefully we can get the support of financial giants like Larry Fink and Blackrock.

In this bull run, I am looking forward to EigenLayer, Pendle, Gearbox, Hivemapper, and sports betting and prediction market protocols. I miss the high-yield mining projects in the last bull run, such as TOMB on the Fantom chain, which is full of speculation and high risk. Although there are still some similar speculative projects in the market, their TVL is not high and their popularity is limited.

In general, I prefer to support innovative products, as I doubt the necessity of many forks of Pendle and EigenLayer. At the same time, I am also seriously considering starting my own project, although this is just a preliminary idea. If you are a developer and are interested in this, please feel free to contact me.

With the recent downturn in the market, I’ve been able to find more time to indulge in some reading. Let me share some of the books I’ve been reading lately.

Im reading a lot of philosophy, economics, life skills, and, since Ive been getting into venture capital over the past year and a half, Im also going to be reading a lot of that.

Some basic knowledge about venture capital

When making a pitch to investors, it’s critical to understand a few core terms related to venture fund structures.

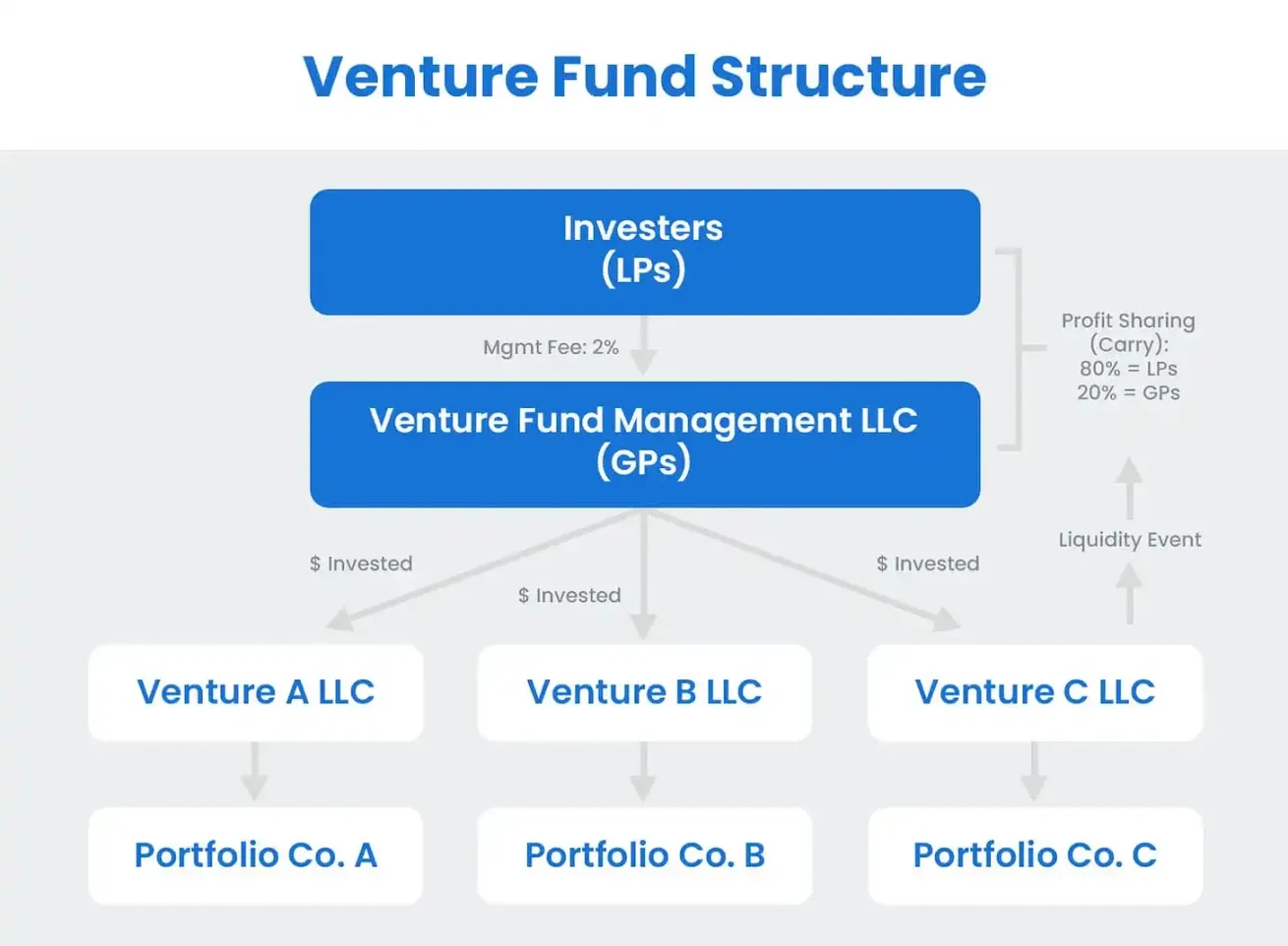

Please see the chart below and we will discuss these terms in detail in the text below.

Venture funds are funds used to invest in start-ups, commonly known as dry powder, which is the main investment tool. Each fund is managed as a limited partnership in accordance with the partnership agreement for a period of about 7 to 10 years.

The funds single objective during this period is to make a profit, which it achieves in two main ways:

-

A performance commission on fund returns, usually around 20%.

-

Management fee, usually around 2%.

This explains why youve heard of the 2/20 pattern.

The management company, also known as the venture capital company, is responsible for the day-to-day operations of the venture fund. It is different from the venture fund itself and is a business entity established by the companys partners.

The management company uses the management fees received to pay for the costs of company operations, including rent, employee salaries, etc. These management fees are used to support the deployment and growth of the fund.

Venture capital managers receive performance commissions only after limited partners receive returns.

GP, or general partner, is a core member of the management company, responsible for leading and overseeing the operation of the venture fund. GP may be a senior partner of a large venture capital firm or an independent individual investor.

GPs’ responsibilities include raising and operating venture funds, making investment decisions, evaluating potential investment opportunities, recruiting teams on behalf of the fund, assisting portfolio companies in achieving exits, and deciding how to effectively use the funds they manage. In general, the role of GPs can be summarized into two key tasks: investing in high-quality companies with potential, and raising more capital for the fund.

The GPs remuneration comes from the funds performance commission and management fees. For example, if the performance commission ratio is set at 20%, then 20% of the funds profit will be used as the GPs remuneration.

The actual source of funds for venture funds is limited partners (LPs), who are the financial pillars behind the fund. LPs usually include the following types of institutional investors:

-

University Endowment Fund

-

Pension funds

-

Sovereign Fund

-

Insurance companies

-

नींव

-

Family Office

-

High Net Worth Individuals

The core assets of a venture fund are its portfolio companies, which are start-ups that receive preferred shares in exchange for investments from venture funds. While specific requirements vary by fund, companies that receive venture capital generally need to meet the following conditions:

-

They should operate in markets with broad potential

-

Achieved product-market fit

-

Have excellent products that are loved by customers

-

Demonstrates strong economics and has the potential to deliver significant returns to investors

Here is a list of some of the largest crypto venture capital firms.

Angel Investment

Angel investing usually refers to investing at an earlier stage before venture capital, and angel investors tend to operate independently and write relatively small checks. This investment behavior mainly occurs in the pre-seed or seed round of a company, that is, when the product or service has not yet taken shape, or in its early stages of development. Although angel investing is riskier because most startups may not be able to develop sustainably, it also provides huge potential returns if the invested company can successfully grow.

I am passionate about the angel investment field because no matter where you come from, you can become an influencer in the field within 1 to 3 years by investing time, effort, and consistent action. This field is new and dynamic, and even without a background from a top university, you can become an expert through trial and error and curiosity.

So how did I get started in angel investing?

To explore this question, lets go back to the beginning of the story. Before getting involved in cryptocurrency, I was a member of the stock market, focusing on stock trading and improving the quality of life. In January 2019, I created a Twitter account to mainly share these contents. Before Twitter, I also ran a blog to discuss investment topics and wrote some press releases (these manuscripts have now been deleted). In 2021, I quit my 9-to-5 job and devoted myself to the cryptocurrency field full-time a few months later. At first, I just randomly invested in NFTs, DeFi projects, and some niche currencies on Binance. But as I continued to share my insights, I began to receive opportunities to participate in transactions. At first, I declined these opportunities due to my lack of experience, but I soon realized that many people who were more inexperienced than me were already involved.

This experience made me realize that although I knew very little about cryptocurrency at first, through learning and practice, I was able to gradually accumulate experience and find my place in this field.

As you all know, I’m a KOL, even though I don’t really like that title. With 300k followers on Twitter and 30k subscribers on Substack, I’m approached by many founders of projects asking if I’d like to invest in their projects, usually with no strings attached. There’s an unwritten rule though, that you should post something for the project, which makes total sense. Project gets exposure → people start paying attention → more people buy → price goes up.

Therefore, I think there are more KOL rounds this time because many founders feel that VCs dont contribute much. Yes, they do have network resources, but usually dont have a large audience. KOLs have a large audience and usually have solid network resources. Therefore, many VCs have also transformed into semi-KOLs to share more benefits. To be honest, I dont blame them.

Basically, I followed my curiosity and dabbled in multiple areas in the Crypto and Web3 space. I wouldnt call myself an expert in any field, but rather a well-rounded person who knows a little bit about a lot of topics. If I dont have an answer myself, I use my network resources in the field to find the answer. Many opportunities come from people contacting me after seeing what I wrote or posted. However, I do think I have certain advantages in some areas. In the DeFi field, I am personally most interested in trading DEXs, stablecoin protocols, and revenue narratives, such as EigenLayer, Pendle, Gearbox, Mellow, Symbiotic, etc. I am also fascinated by trading, whether it is on CEX or DEX. My dream is to have a competitor to Binance/Bybit one day, so I also like to work with teams that have this goal. I also have an advantage in marketing, and I know what methods work and what doesnt work as a KOL.

How should I obtain transaction flow?

In the crypto space, it is essential to either have specialized niche knowledge or build a strong personal brand. Ideally, it is best to have both.

Angel investors with significant personal brands or large audience bases perform well because companies value their support, which not only enhances credibility but also helps promote and distribute products. When reputable individuals stand with companies, the association itself sends a positive signal and helps spread the word about the companys products or services.

Additionally, seeing your name when founders mention their list of investors in pitch materials is a strong trust indicator in itself. For example, if you see that Cobie is also recommending this project, many people may choose to invest without a second thought, even without doing in-depth due diligence. After all, if a project can attract a well-known person like Cobie, it should be a good choice for you as well.

When deciding to make a transaction, the main factors to consider are

When I consider whether to enter a transaction, timing is definitely a key factor. I need to carefully evaluate the transaction conditions, including our current market conditions and market expectations for the next 3 months, 6 months, 12 months, and even 2-3 years. This is especially important given the potentially long vesting schedule.

I also think deeply about whether the team is building products with innovation and market fit, and whether those products are sustainable. I explore how they fit into the market narrative and which VCs might be involved. Next, I talk to people in my trusted network to get their perspective, including why some VC friends didn’t participate or why they didn’t invest at a larger scale.

I also consider the competition, assess the current TVL and future potential. In addition, I need to ask myself whether the protocol can be sustained independently after the incentive program ends, or will it be abandoned by the market. These questions are an integral part of the decision-making process.

I’ve already outlined the role of venture capital firms and a basic understanding of angel investing. Here’s a more in-depth look at angel investing from Ben Roy:

To wrap up on this topic, I want to share a quote I particularly like from @DCbuild3r’s recent article on angel investing:

“The cumulative effect of social capital is just as powerful as the growth of your financial capital, and perhaps even more impactful. I believe that social capital is a key driver of professional success in any career pursuit, whether it’s sales, technology development, academic research, or philanthropy. It’s critical to have a network of well-rounded friends who not only have extensive connections, capital, and new insights, but also have the wisdom and ability to spark change. If you make friends with this group of people, you will be able to work together to truly improve the world.”

That’s all for today.

This article is sourced from the internet: Can DeFi be revived?

संबंधित: आरडब्ल्यूए कथा स्पष्टीकरण: किन परियोजनाओं पर ध्यान देने योग्य है?

मूल लेखक: AYLO FLOW मूल अनुवाद: TechFlow हम क्रिप्टोकरेंसी के इतिहास में एक महत्वपूर्ण क्षण पर हैं। पिछले कुछ हफ़्तों में, हमने क्रिप्टोकरेंसी के प्रति अमेरिका के रवैये में 180 डिग्री का बदलाव देखा है। आश्चर्यजनक रूप से, सभी आठ एथेरियम ETF को SEC द्वारा अनुमोदित किया गया था। इसके अलावा, अमेरिकी प्रतिनिधि सभा ने न केवल क्रिप्टो FIT 21 बिल पारित किया, बल्कि केंद्रीय बैंक डिजिटल मुद्राओं के निर्माण को रोकने के लिए कानून भी पारित किया। लेकिन इससे भी अधिक चौंकाने वाली बात यह है कि क्रिप्टोकरेंसी आगामी अमेरिकी राष्ट्रपति चुनाव में भी एक महत्वपूर्ण मुद्दा बनने लगी है। इसलिए यदि आप एक बड़े वित्तीय संस्थान हैं, तो संदेश स्पष्ट है: क्रिप्टो खत्म नहीं होने वाला है, और आपको इससे परिचित होना चाहिए और इसके विभिन्न उपयोग मामलों की खोज शुरू करनी चाहिए, नहीं तो आप…