एनवीडिया का इतिहास: गेमिंग चिप्स से लेकर एआई हथियार डीलर तक, हुआंग का जबरदस्त उदय

On June 6, Nvidias stock price rose 5.2%, and its market value exceeded US$3 trillion, surpassing Apple to become the worlds second largest company by market value.

From $0.41 when it went public in 1999 to $1,224.40 today, Nvidia has created nearly 3,000 times returns in 24 years.

The most enviable thing about NVIDIA is that it is not restricted by cycles. It has always been the underlying infrastructure, continuously collecting taxes. No matter what you do, you cannot do without it.

As the creator of GPU, NVIDIA seized the opportunity of the PC wave and entered thousands of households along with the explosion of the gaming market;

Then, when the gaming business was weak, the crypto bull market arrived, and Nvidia graphics cards were widely used in Ethereum and other cryptocurrencies for “mining”, making a fortune in silence;

Subsequently, the smart car industry emerged, and its in-vehicle chip business also developed rapidly; finally, ChatGPT came out, and Nvidia transformed itself into an AI arms dealer…

But looking back at Nvidias growth history, it has repeatedly hovered on the brink of failure and bankruptcy. Huang (Huang Renxun) once shouted: My will to live is greater than almost everyones will to kill me.

NVIDIA, the creator of GPU

The birth of graphics cards (GPU) can be traced back to the 1990s.

At that time, some people in Silicon Valley came up with an idea: the workload of the central processing unit (CPU) could be reduced by using chips with specific functions, such as sound cards for processing sound and network cards for processing networks. By the same token, it was also natural to create a chip specifically responsible for computer image output, that is, a graphics card. For example, the PlayStation game console launched by Sony at the end of 1994 used a graphics card to process images.

However, there were many options for the technical path of graphics cards at that time. The breakthrough point found by NVIDIA was to achieve 3D graphics acceleration through parallel computing, especially in the field of games. The so-called parallel computing is to split a complex task into multiple small tasks, and then process them simultaneously to improve computing efficiency.

In 1999, NVIDIA launched a graphics card called GeForce. This graphics card is designed specifically for games, focusing on parallel computing and can significantly improve 3D graphics processing capabilities, thereby providing a smoother and more realistic gaming experience.

The success of GeForce has enabled NVIDIA to rise rapidly and become a leader in the graphics card field.

At that time, Nvidia was not the only one researching graphics processing units, but Nvidia successfully tied itself deeply to the label of GPU inventor.

Dan Vivoli, Nvidias head of marketing at the time, used the concept of graphics processing unit (GPU) to promote its own chips. He believed that Nvidia could become an industry leader by repeatedly emphasizing that it was the inventor of the GPU.

This was indeed the case later. NVIDIA became synonymous with GPU, and NVIDIA opened up a new path for itself by marketing GPU.

Nvidia, a beneficiary of the crypto bull market

Nvidias market value has increased from $14 billion in 2016 to a high of $175 billion in 2018. The more than 10-fold increase in two years may be inseparable from the cryptocurrency mining boom.

In 2017, cryptocurrency ushered in a bull market, attracting a large number of miners to scramble for GPUs. GPUs became money printing machines, global graphics card sales increased sharply, and prices also rose.

Taking the NVIDIA GTX 1060 graphics card used by miners as an example, the purchase price before May 2017 was about 1,650 yuan per card, and after June 2017, the price rose to around 2,900 yuan.

Nvidia has become the big winner behind the cryptocurrency bull market, and wealth has fallen from the sky.

Benefiting from the crypto mining boom, Nvidias full-year revenue in fiscal 2018 hit a record high of $9.7 billion. Huang Renxun said, Our GPU supports the worlds largest distributed supercomputing, which is why it is so popular in the cryptocurrency field. In addition, Nvidia also launched the GTX 1060 3 GB and P 106 and P 104 professional mining cards specially customized for mining.

In 2020, after two years of bear market, the crypto market took off again. Bitcoin more than doubled and Ethereum quadrupled. Nvidia once again became a beneficiary of the crypto boom.

NVIDIA heard the news and actively participated in the mining market, launching the CMP series of professional mining cards. These cards remove graphics processing functions and have lower core peak voltage and frequency to improve mining performance and efficiency.

At the end of 2020, NVIDIA released the RTX 30 series graphics cards. The entry-level RTX 3060 graphics card was priced at 2,499 yuan, and the RTX 3090 graphics card was priced at 11,999 yuan. However, with the rise of cryptocurrencies, the price of RTX 3060 was as high as 5,499 yuan, and the price of RTX 3090 soared to 20,000 yuan.

After the first quarter 2021 financial report was released, Nvidias Chief Financial Officer Colette Kress revealed that Nvidias encryption chip sales reached US$155 million, and graphics cards used for mining accounted for a quarter of the total sales in the first quarter.

In 2021, Nvidias full-year revenue hit a record of $26.91 billion, an increase of 61% from the previous fiscal year, and its market value once exceeded $800 billion.

However, the good times did not last long. In September 2022, the Ethereum execution layer and proof-of-stake consensus layer were merged, and the Ethereum blockchain network mechanism changed from PoW (proof-of-work mechanism) to PoS (proof-of-stake mechanism), and the era of graphics card mining gradually came to an end.

This has also affected Nvidias development to a certain extent. In the third quarter of 2022, Nvidias revenue and net profit both declined, with quarterly revenue of only US$5.931 billion, a year-on-year decrease of 17%, and net profit of only US$680 million, a year-on-year decrease of 72%. On November 23, 2022, Nvidias stock price was US$165 per share, nearly half of its highest point last year.

At that time, both overseas media such as Financial Failure and domestic technology media were pessimistic about Nvidia.

The situation was extremely difficult, but unexpectedly, the wind of AI and big models blew, and NVIDIA once again stood at the forefront.

Nvidia, the AI arms dealer

In March 2016, AlphaGO defeated Lee Sedol, shocking everyone and sparking a heated discussion about AI.

A month later, Huang Renxun officially announced at the GTC China conference that Nvidia is no longer a semiconductor company, but an artificial intelligence computing company.

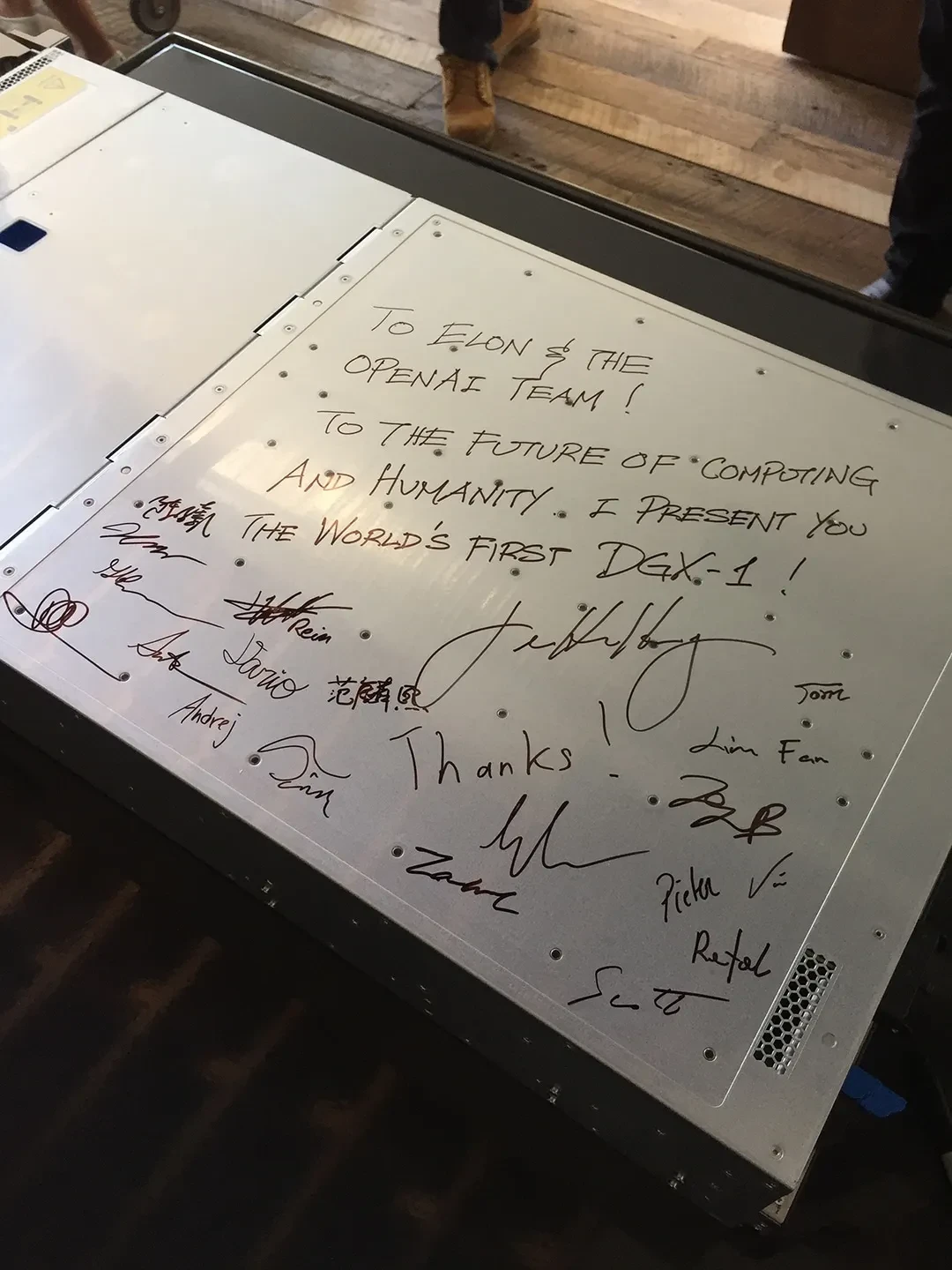

In August 2016, a historic moment occurred when NVIDIA donated its first AI supercomputer, DGX-1, to the newly established OpenAI. Huang Renxun personally delivered the computer to OpenAIs office , and the then chairman Elon Musk opened the package with a box opener.

Huang Renxun left a message: For the future of computing and humanity, I donate the worlds first DGX-1.

Later, OpenAI used NVIDIAs supercomputer to train the world-famous ChatGPT. NVIDIAs subsequent updated hardware product DGX H 100 was snapped up by the market and was in short supply.

Rome was not built in a day, and Nvidias dominance in the AI industry began with its accumulation in an earlier period.

Nvidias former chief scientist David Kirk has long dreamed of making the GPUs 3D graphics rendering computing power universal, not just limited to the gaming field.

Under the leadership of David Kirk and Jen-Hsun Huang, NVIDIA launched the revolutionary GPU unified computing platform CUDA in 2007, unleashing massive computing resources.

But at the time, CUDA did not impress investors at all. On the contrary, due to the huge investment in building a supercomputing system that was ahead of its time, Nvidias profits were greatly reduced, and Wall Street booed for it.

Ben Gilbert, host of Acquired, a popular Silicon Valley podcast, commented: They were not targeting a big market at the time, but an obscure corner of academic and scientific computing, but they spent billions of dollars on it .

The voices from outside did not affect Huang Renxun. He insisted on investing in CUDA for more than ten years, which has brought NVIDIA to its current position.

Huang Renxun regards computing power as the core. Whether it is AI, autonomous driving, the metaverse, robots or cryptocurrency, Nvidia uses huge computing power to find new opportunities.

Computing power is Nvidia’s eternal weapon.

Three failures

In 2023, Huang Renxun gave a speech at the graduation ceremony of National Taiwan University. He shared three stories of failure and taught college students the secret of Nvidias success.

The first time I failed, I survived the brink of bankruptcy.

In 1994, Nvidias first customer was the Japanese gaming company SEGA, which designed graphics cards for its game consoles.

But in the second year, Microsoft released the graphics interface Direct 3D for the Windows platform. This change made Nvidia very flustered because it conflicted with their design.

Eventually, Nvidia chose to terminate its contract with SEGA and switch to developing GPUs for the Windows platform. This was a risky decision because SEGA was their only customer, but they abandoned it. Nvidias funds could only support 6 months, and if they failed to launch new products during this period, they would face the risk of bankruptcy.

Fortunately, when funds were running out and only a month away from bankruptcy, Nvidia designed the Riva 128 chip, which was a success. By the end of 1997, Riva 128 shipments exceeded 1 million, and Nvidia survived.

The second failure, giving up short-term profits, leads to future greatness.

In 2007, NVIDIA released the CUDA GPU accelerated computing program with the vision of making CUDA a programming model that can enhance a variety of applications from scientific computing and physical simulation to image processing.

Creating a new computing model is difficult, and the CPU computing model has been the industry standard for 60 years, since the introduction of the IBM System 360.

CUDA requires developers to rewrite applications to demonstrate the benefits of GPUs; but to develop such programs, there must first be a large user base and a huge demand to drive developers to develop.

To solve the chicken and egg problem, Nvidia used their GForce gaming graphics cards, which already had a large number of gamers, to build a user base. However, the added cost of CUDA was very high, causing Nvidias profits to drop significantly over the years, and their market value has been fluctuating around the $1 billion level.

Nvidias years of sluggish performance also made shareholders skeptical of CUDA. Shareholders would rather the company focus on improving profitability, but Nvidia persisted, believing that the opportunity for accelerated computing would come.

Huang Renxun founded a conference called GTC and tirelessly promoted CUDA around the world. Eventually, hard work paid off, and applications really emerged, including CT reconstruction, molecular dynamics, particle physics, fluid dynamics, and image processing.

It was not until 2012 that AI researchers discovered the potential of CUDA. Alex Krizhevsky, a famous AI expert, trained AlexNet on GForce GTX 580, triggering an explosion in artificial intelligence.

After the third failure, Nvidia withdrew from the mobile phone chip market.

Do you still remember Lei Jun and Huang Renxun on the same stage?

In 2013, at the invitation of Lei Jun, Huang Renxun attended the Xiaomi Mi 3 launch conference.

Huang Renxun, who went to the United States when he was young, was asked by Lei Jun to speak Chinese. He spoke it not fluently, but he also confidently shouted in Chinese: Nvidias GPU is the best in the world .

At that time, the Xiaomi 3 flagship version was equipped with the mobile version of the Tegra 4 processor launched by Nvidia, which was also the swan song of the series.

At that time, the mobile phone market was emerging and Nvidia also entered the mobile chip market. Although the entire mobile phone market was very large and Nvidia could have fought for market share, they made a difficult decision: to give up this market.

Huang Renxun said that Nvidias mission is to build computers that can do what ordinary computers cannot, and they should be committed to realizing this vision and making unique contributions. Nvidias strategic retreat paid off.

Life advice: Experience hardship and lower your expectations

In 2024, Huang Renxun returned to his alma mater, Stanford University, and gave a speech at the business school, sharing some life experiences.

When the host asked Huang Renxun if he had any advice for Stanford students about success, he replied: I hope you have the opportunity to experience a lot of pain and suffering.

He mentioned that one of his greatest strengths is that “I have low expectations.”

Huang Renxun said that most Stanford graduates have high expectations for themselves, but they definitely deserve to have high expectations because they come from one of the best universities on the planet and are surrounded by equally incredible peers, so it is very natural to have high expectations.

People who have very high expectations of themselves tend to have low resilience, Huang said. Unfortunately, resilience is essential to success.

Huang Renxun emphasized, Success does not come from wisdom, but from character, and character is shaped by suffering.

This article is sourced from the internet: Nvidias history: From gaming chips to AI arms dealer, Huangs meteoric rise

Related: In-depth discussion of the new mechanism of friend.tech V2, is the model sustainable?

Original author: Francesco Original translation: TechFlow About friend.tech friend.tech (FT), one of the most successful Web3 dApps in SocialFi, achieved its highest revenue to net deposit ratio ever, with over $2 million in revenue and over $33 million in net deposits in its first month. This was supposed to be a big week for FT as they launched V2 of their product and the platform鈥檚 token $FRIEND, introduced major changes to enhance the sustainability and appeal of the protocol, and more, but it turned out to be (probably) the end of it. Previously, some were optimistic about these developments while others were pessimistic, but after today鈥檚 developments, everyone is in disbelief. In this article, we鈥檒l take a deep dive into FT V2鈥檚 new mechanism, $FRIEND, explore any vulnerabilities it has…