ऑन-चेन लिक्विडिटी गेम: डेवलपर्स, स्नाइपर्स और ट्रेडर्स की तलाश

मूल लेखक: post-goa

मूल अनुवाद: टेकफ्लो

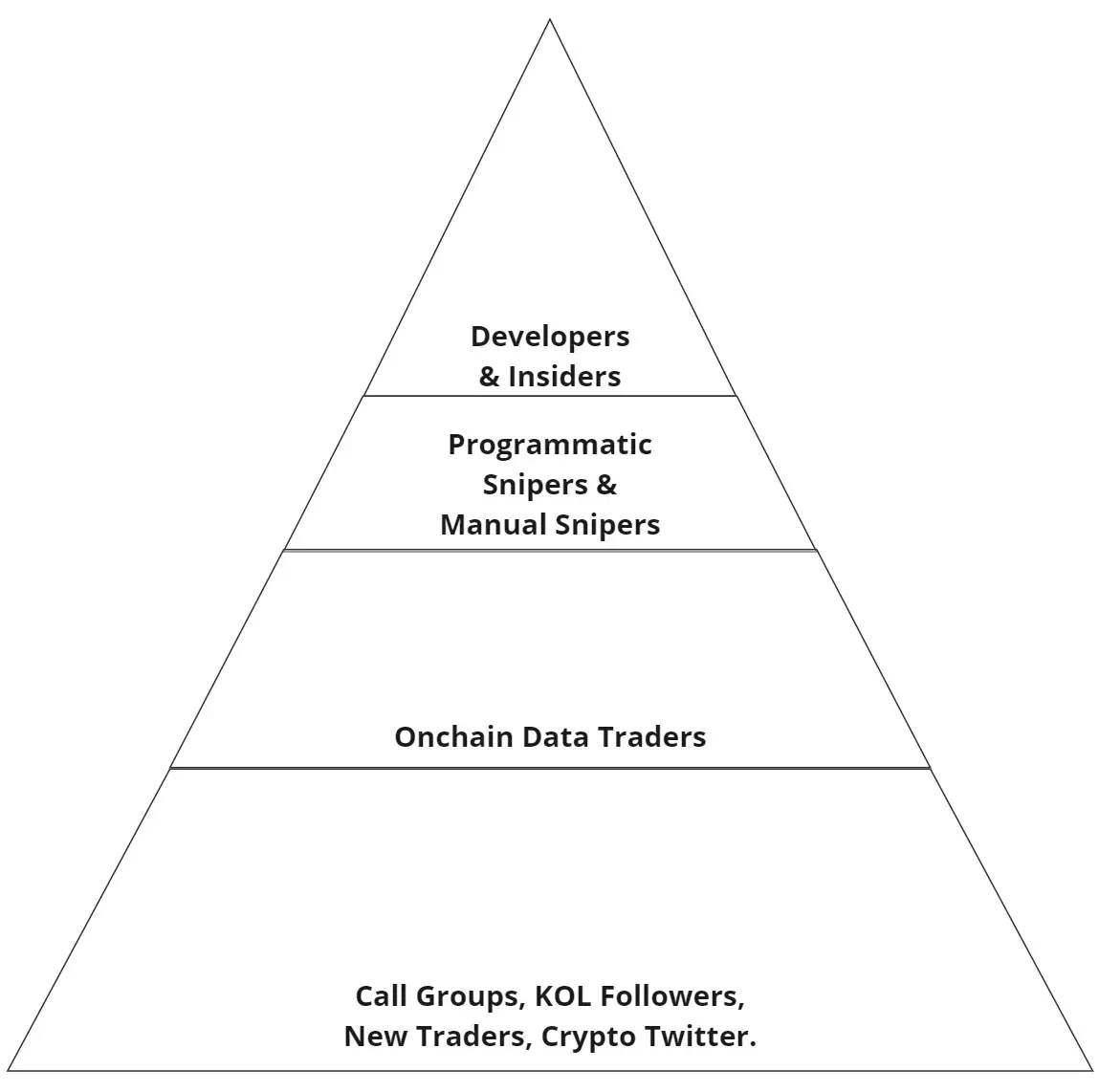

Based on my research, here is a brief summary of the roles that play the on-chain liquidity game.

Developers and Insiders

False utility slowly pulls up or is “exploited”:

-

These were very popular in the early AI craze because no one really understood AI at the time, but everyone wanted early exposure.

-

They never complete more than 1% of their roadmap, usually hyped up by opinion leaders (KOLs).

-

The team often allocates a large amount of supply to themselves when the contract is launched, and then distributes it before anyone else. These tokens are then hidden in multiple wallets and then sold.

-

Slowly pull up after the initial rally or hit a hole after a few weeks of pumping, and quickly run away after accumulating a large market cap (20-100 million).

-

Involving groups that repeatedly release fake projects that follow the current popular narrative. These projects are often spin-offs of more successful large venture-backed projects.

Programmatic Sniper

Custom Robots:

-

A custom bot that systematically targets multiple ETH projects.

-

The bot follows specific parameters based on the smart contract and transaction volume.

-

The goal is to achieve 10-100x returns on a handful of projects from many that fail or run away, almost like a form of income.

Manual Sniper (ETH)

One of the most profitable on-chain traders:

-

Search and discover new contract addresses, or obtain contract addresses through internal messages.

-

Simulate contracts to check their security and other indicators of potential, or to understand the background of the team.

-

Outbid other snipers when promising contracts launch.

-

Grab large amounts of supply when promising on-chain or stealth projects launch without anti-sniping defenses or using pre-launch platforms like Fjord.

-

Use multiple wallets to snipe to hold a large amount of supply, more than 1%.

-

In many cases, projects are subject to snipers who can smash the project to zero at an early stage.

-

Many snipers enter the project and play against each other, hoping that dumb money will come in and sell when the market cap reaches 500k-1m, and then the project dies. This happens every day on the ETH mainnet.

-

Combining some fundamental analysis and machine learning, snipers who identify which contracts are likely to bring in profits of over $5 million in market cap or more have significantly outperformed others over the past year.

-

Most snipers hold their coins for less than a few hours.

On-chain data traders

Tracking the actions of snipers and insiders:

-

Track the movements of profitable (highest PNL) wallets.

-

Track volume and holder alerts.

-

Often buy strong projects after snipers sell off; or, even if they know snipers are holding a large supply, they will buy if the launch is very promising.

-

Some basic or narrative analysis is usually performed on newly launched projects.

-

Long term holder.

-

As on-chain transactions become a growing segment of the space and more on-chain services become available for retail use, their popularity has diluted and increased.

-

It is the exit liquidity for the above participants.

-

These traders often bet against each other on newly launched projects that will eventually go to zero. Its just a matter of who gets in first.

-

Relying on dumb crypto-twitter (CT), opinion leaders (KOLs) or other later on-chain traders as exit liquidity.

Other traders

Haven’t learned how to use Etherscan or check basic metrics for a token:

-

Get information from call groups, opinion leaders (KOLs), and Crypto Twitter (CT).

-

Slower traders, tend to buy the hype.

-

Believe that cryptocurrencies have utility beyond speculation.

-

One step behind in narrative.

-

Probably only been in the field for less than a year.

-

These traders have most likely given up on buying new utility projects or meme coins. Or they are slowly starting to learn about on-chain transactions and gradually upgrading to the above categories.

संक्षेप

On-chain trading is a liquidity game for developers, snipers, on-chain data traders, and others. As liquidity entering the on-chain space decreases, competition between participants becomes more intense, with the result that those at the top of the pyramid reap most of the rewards.

This article is sourced from the internet: On-chain liquidity game: the hunt of developers, snipers and traders

संबंधित: यह बुल मार्केट 2021 के ऑल्ट सीज़न को क्यों नहीं दोहरा सकता है?

मूल लेखक: डिस्टिल्ड मूल अनुवाद: टेकफ्लो परिचय पिछले दो वर्षों में, मैंने पूरे दिल से ऑल्टकॉइन बाज़ार का अनुसरण किया है। हालाँकि, बाज़ार में हमेशा एक सवाल रहा है: 2021 जैसा लंबे समय से प्रतीक्षित ऑल्ट सीज़न अभी तक नहीं आया है। यहाँ, मैं समझाऊँगा कि क्यों और आपकी ऑल्टकॉइन रणनीति को अनुकूलित करने के लिए सुझाव दूँगा। आइए सबसे पहले "ऑल्ट सीज़न" को परिभाषित करें। परिभाषा: जब ऑल्टकॉइन बिटकॉइन ($BTC) से बेहतर प्रदर्शन करते हैं और कीमतें हर जगह बढ़ जाती हैं। यह ऑल्टकॉइन में बहुत उछाल का दौर है और बाज़ार में उत्साह का माहौल है। इसे एक बढ़ते ज्वार की तरह समझें जो सभी नावों को ऊपर उठाता है। यही एक मजबूत ऑल्टकॉइन सीज़न कर सकता है, जो लगभग हर क्षेत्र को बढ़ावा देता है। प्रेरक शक्ति क्या है? बाजार में आने वाली भारी मात्रा में तरलता। तरलता प्रवाह पर नज़र रखना ऐतिहासिक रूप से,…