बिटगेट रिसर्च इंस्टीट्यूट: यूएस एसईसी ने एथेरियम स्पॉट ईटीएफ 19 बी -4 को मंजूरी दी, ईटीएचएफआई और अन्य पारिस्थितिक परिसंपत्तियों के सह होने की उम्मीद है

Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

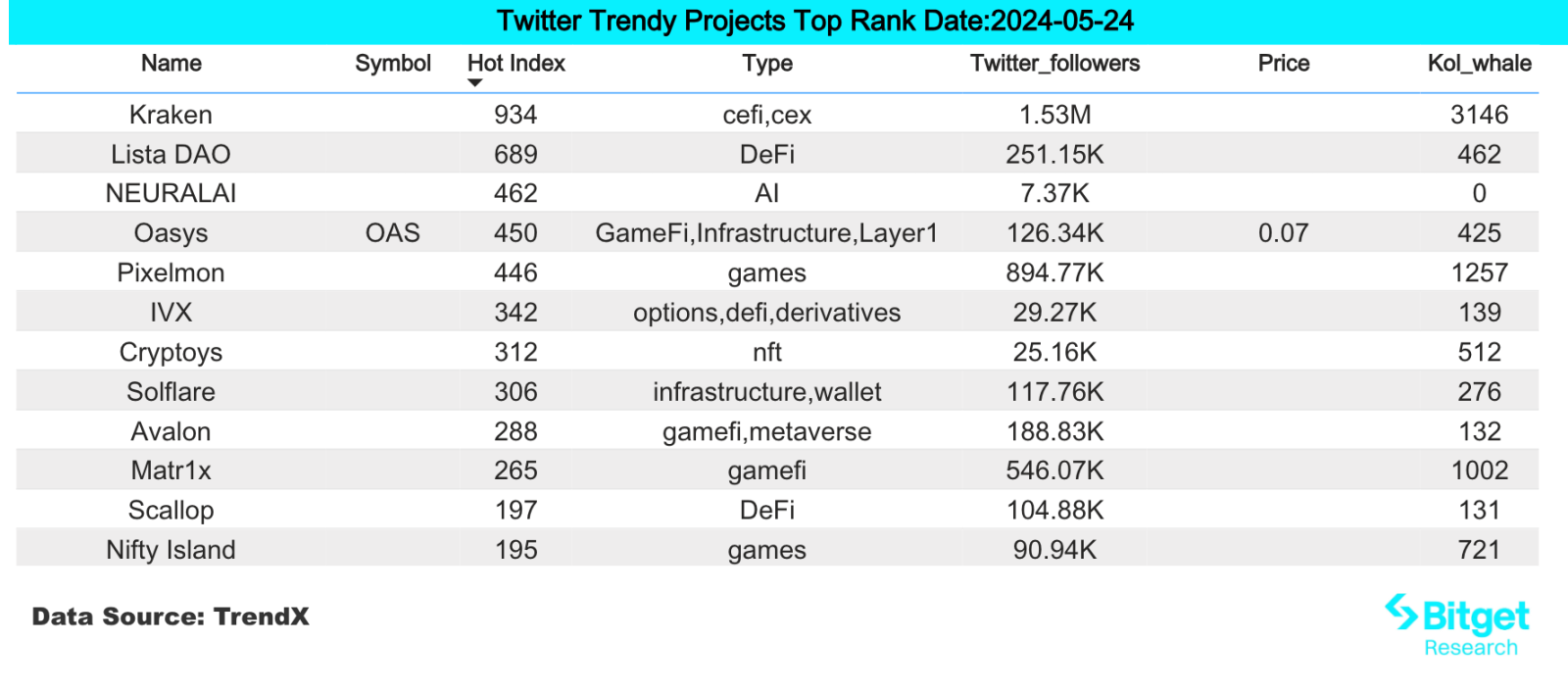

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1. बाजार का माहौल

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. धन कमाने वाला क्षेत्र

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

बाजार के दृष्टिकोण को प्रभावित करने वाले कारक:

-

मैक्रो मौद्रिक नीति में परिवर्तन: मैक्रो पर्यावरण के संदर्भ में, 10-वर्षीय अमेरिकी ट्रेजरी बांड की उपज में वृद्धि आरडब्ल्यूए ट्रैक के मूल सिद्धांतों का समर्थन करती है; हमें अमेरिकी डॉलर सूचकांक, अमेरिकी ट्रेजरी पैदावार और क्रिप्टो बाजार में बाद के परिवर्तनों पर ध्यान देने और व्यापारिक रणनीतियों को गतिशील रूप से समायोजित करने की आवश्यकता है;

-

प्रोजेक्ट TVL में बदलाव: RWA ट्रैक प्रोजेक्ट मूल रूप से TVL द्वारा समर्थित होते हैं। आप RWA ट्रैक के TVL में होने वाले बदलावों पर ध्यान दे सकते हैं। अगर किसी प्रोजेक्ट का TVL लगातार बढ़ रहा है/अचानक बढ़ जाता है, तो यह आमतौर पर खरीदने का संकेत होता है;

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

बाजार के दृष्टिकोण को प्रभावित करने वाले कारक:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

मुख्य कारण:

-

Panteras investment in TON may be at least over US$250 million, which is Panteras largest investment in cryptocurrency in history.

-

Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

-

The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

-

The increase in the issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million within two weeks, making it the eighth blockchain in terms of USDT issuance.

विशिष्ट परियोजना सूची:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3. उपयोगकर्ता हॉट खोजें

1) लोकप्रिय डैप्स

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2) ट्विटर

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3) गूगल खोज क्षेत्र

वैश्विक परिप्रेक्ष्य से:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

प्रत्येक क्षेत्र में सर्वाधिक खोजे गए:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

संभावना एयरड्रॉप अवसर

पवित्र स्थान

सोलाना इकोसिस्टम एलएसटी प्रोटोकॉल सैंक्टम ने आधिकारिक तौर पर लॉयल्टी प्रोग्राम सैंक्टम वंडरलैंड के लॉन्च की घोषणा की। रिपोर्टों के अनुसार, सैंक्टम वंडरलैंड का उद्देश्य गेमीफाइड अनुभव के माध्यम से लाभ प्राप्त करने के लिए एसओएल का पूरा उपयोग करना है। उपयोगकर्ता पालतू जानवर एकत्र कर सकते हैं और एसओएल को दांव पर लगाकर अपग्रेड करने के लिए अनुभव अंक अर्जित कर सकते हैं, और पालतू जानवरों के माध्यम से EXP कमा सकते हैं।

इससे पहले, सोलाना इकोसिस्टम लिक्विडिटी स्टेकिंग सर्विस प्रोटोकॉल सैंक्टम ने ड्रैगनफ्लाई के नेतृत्व में अपने सीड राउंड एक्सटेंशन राउंड को पूरा किया, जिसमें सोलाना वेंचर्स, सीएमएस होल्डिंग्स, डेफिएंस कैपिटल, जेनब्लॉक कैपिटल, जंप कैपिटल, मारिन डिजिटल वेंचर्स और अन्य की भागीदारी थी। कुल वित्तपोषण अब US$6.1 मिलियन तक पहुँच गया है।

विशिष्ट भागीदारी विधि: लिंक खोलें, वॉलेट कनेक्ट करें, आमंत्रण कोड भरें, ② सोल को इनफिनिटी में बदलें, कम से कम 0.122 SOL + 0.05 जमा करें। जमा वॉलेट को कम से कम 0.172 SOL तैयार करने और कम से कम 0.11 SOL जमा करने की आवश्यकता है। पालतू जानवर अपने आप बढ़ेगा और EXP अर्जित करेगा। एक बार जब LST बैलेंस 0.1 SOL से कम हो जाता है, तो पालतू जानवर हाइबरनेशन में प्रवेश करेगा और EXP अर्जित करना बंद कर देगा। जो लोग सक्षम हैं उन्हें 1 SOL से अधिक जमा करने की सलाह दी जाती है। 1 SOL प्रति मिनट 10 EXP अर्जित करेगा, जिसे किसी भी समय निकाला जा सकता है, और GAS शुल्क बेहद कम है।

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

बिटगेट रिसर्च इंस्टीट्यूट के बारे में अधिक जानकारी: https://www.bitget.fit/zh-CN/research

बिटगेट रिसर्च इंस्टीट्यूट ऑन-चेन डेटा और मूल्यवान संपत्तियों के खनन पर ध्यान केंद्रित करता है। यह ऑन-चेन डेटा और क्षेत्रीय हॉट सर्च की वास्तविक समय की निगरानी के माध्यम से अत्याधुनिक मूल्य निवेशों का खनन करता है, और क्रिप्टो उत्साही लोगों के लिए संस्थागत-स्तर की जानकारी प्रदान करता है। अब तक, इसने बिटगेट्स के वैश्विक उपयोगकर्ताओं को [आर्बिट्रम इकोसिस्टम], [एआई इकोसिस्टम] और [एसएचआईबी इकोसिस्टम] जैसे कई लोकप्रिय क्षेत्रों में शुरुआती चरण की मूल्यवान संपत्ति प्रदान की है। गहन डेटा-संचालित शोध के माध्यम से, यह बिटगेट्स के वैश्विक उपयोगकर्ताओं के लिए बेहतर धन प्रभाव बनाता है।

【अस्वीकरण】बाजार जोखिम भरा है, इसलिए निवेश करते समय सावधान रहें। यह लेख निवेश सलाह नहीं है, और उपयोगकर्ताओं को इस बात पर विचार करना चाहिए कि इस लेख में कोई भी राय, विचार या निष्कर्ष उनकी विशिष्ट परिस्थितियों के लिए उपयुक्त है या नहीं। इस जानकारी के आधार पर निवेश करना आपके अपने जोखिम पर है।

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

Original | Odaily Planet Daily Author | Asher In the past week, with the strong rebound of Bitcoin prices, the GameFi sector has also seen a good increase. Perhaps now is a good time to invest in the GameFi sector. Therefore, Odaily Planet Daily has summarized and sorted out the blockchain game projects that have been popular recently or have popular activities. Secondary market performance of blockchain gaming sector According to Coingecko data, the Gaming (GameFi) sector rose 6.9% in the past week; the current total market value is $20,475,708,280, ranking 28th in the sector ranking, down three places from the total market value sector ranking last week. In the past week, the number of tokens in the GameFi sector increased from 360 to 365, with 5 projects added, ranking…