गैलेक्सी पार्टनर्स: क्रिप्टोकरेंसी भुगतान में बहुत संभावनाएं हैं, स्टेबलकॉइन सर्वव्यापी होंगे

मूल लेख माइक गिआम्पापा, जनरल पार्टनर, गैलेक्सी वेंचर्स द्वारा

मूल अनुवाद: लफ़ी, फ़ोरसाइट न्यूज़

2008 के बिटकॉइन श्वेतपत्र में भुगतान को प्राथमिक उपयोग के मामले के रूप में रेखांकित किया गया था। पिछले कुछ वर्षों में, पारंपरिक भुगतान विधियों की तुलना में ब्लॉकचेन-आधारित भुगतान अधिक व्यवहार्य और लोकप्रिय हो गए हैं। पिछले दशक में अंतर्निहित ब्लॉकचेन अवसंरचना को विकसित करने में अरबों डॉलर का निवेश किया गया है, और अब हमारे पास एक ऐसी प्रणाली है जो बड़े पैमाने पर भुगतान प्राप्त कर सकती है।

ब्लॉकचेन की लागत और प्रदर्शन वक्र मूर के नियम के अनुरूप है। पिछले कुछ वर्षों में, ब्लॉकचेन पर डेटा संग्रहीत करने की लागत में कई गुना कमी आई है। एथेरियम के डेनकन अपग्रेड (EIP-4844) के बाद, आर्बिट्रम और ऑप्टिमिज़्म जैसे लेयर 2 नेटवर्क की प्रति लेनदेन औसत लागत भी $0.01 तक गिर गई है, और वैकल्पिक लेयर 1 की लेनदेन लागत कुछ सेंट के करीब है।

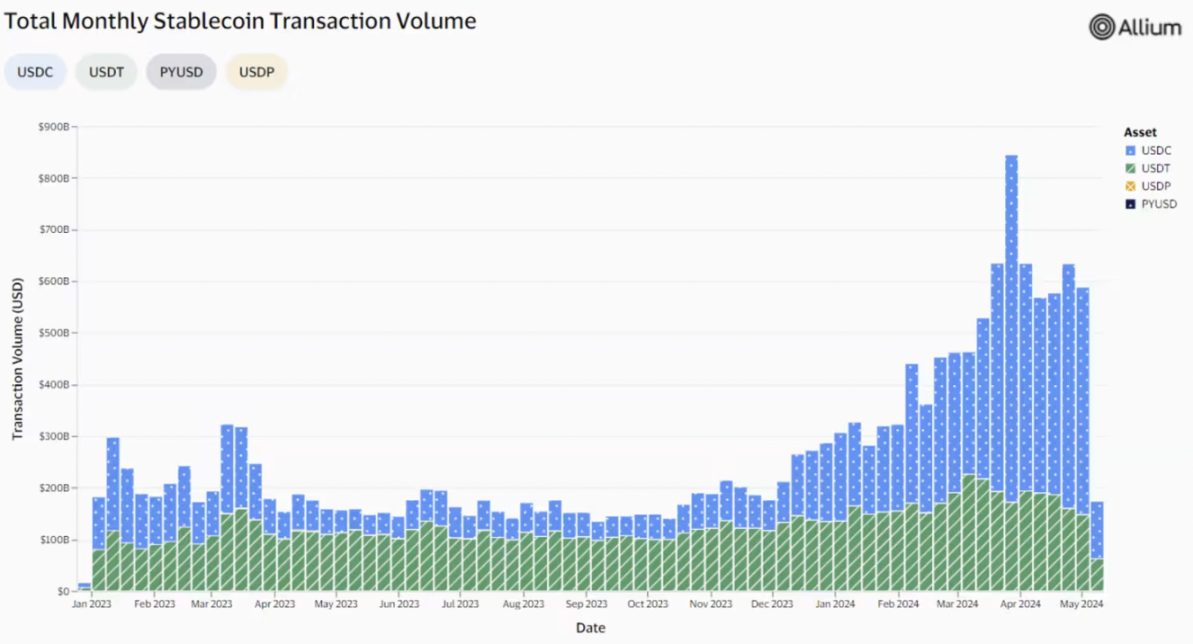

बेहतर प्रदर्शन करने वाले, लागत प्रभावी बुनियादी ढांचे के अलावा, स्टेबलकॉइन का उदय विस्फोटक और लगातार रहा है, और यह स्पष्ट रूप से अस्थिर क्रिप्टोकरेंसी उद्योग में एक दीर्घकालिक प्रवृत्ति है। वीज़ा ने हाल ही में एक सार्वजनिक-सामना करने वाला स्टेबलकॉइन डैशबोर्ड (वीज़ा ऑनचेन एनालिटिक्स) लॉन्च किया है, जो इस विकास प्रवृत्ति की एक झलक प्रदान करता है और दिखाता है कि वैश्विक भुगतानों को सुविधाजनक बनाने के लिए स्टेबलकॉइन और अंतर्निहित ब्लॉकचेन बुनियादी ढांचे का उपयोग कैसे किया जा रहा है, पूरे बाजार के लिए स्टेबलकॉइन लेनदेन की मात्रा साल-दर-साल लगभग 3.5 गुना बढ़ रही है। जब लेनदेन की मात्रा पर विश्लेषण पर ध्यान केंद्रित किया जाता है जो सीधे उपभोक्ताओं और व्यवसायों (स्वचालित लेनदेन या स्मार्ट अनुबंध संचालन को छोड़कर) द्वारा शुरू किया जाता है, तो वीज़ा का अनुमान है कि पिछले 30 दिनों में स्टेबलकॉइन लेनदेन की मात्रा लगभग $265 बिलियन (लगभग $3.2 ट्रिलियन की वार्षिक मात्रा) थी, जो 2023 में PayPal के भुगतान की मात्रा से लगभग दोगुनी है और लगभग भारत या यूनाइटेड किंगडम के सकल घरेलू उत्पाद के बराबर है।

स्रोत: वीज़ा ऑनचेन एनालिटिक्स

हमने इस वृद्धि के अंतर्निहित कारणों पर शोध करने में बहुत समय बिताया है और हमारा दृढ़ विश्वास है कि ब्लॉकचेन में भविष्य की मुख्यधारा भुगतान पद्धति बनने की काफी क्षमता है।

भुगतान उद्योग पृष्ठभूमि

क्रिप्टोकरेंसी भुगतान बाजार के विकास के मूल चालकों को समझने के लिए, हमें पहले कुछ ऐतिहासिक संदर्भों को समझना चाहिए। आज अंतरराष्ट्रीय स्तर पर इस्तेमाल किया जाने वाला भुगतान ढांचा (जैसे ACH, SWIFT) 50 साल से भी पहले 1970 के दशक में स्थापित किया गया था। दुनिया भर में पैसे भेजने की क्षमता एक अभूतपूर्व उपलब्धि थी और वित्तीय दुनिया में एक मील का पत्थर थी।

हालाँकि, वैश्विक भुगतान अवसंरचना अब काफी हद तक पुरानी और खंडित हो चुकी है। यह एक महंगी और अक्षम प्रणाली है जो सीमित बैंकिंग घंटों में काम करती है और कई बिचौलियों पर निर्भर करती है। मौजूदा भुगतान अवसंरचना के साथ एक महत्वपूर्ण समस्या वैश्विक मानकों की कमी है। विखंडन निर्बाध अंतरराष्ट्रीय लेनदेन में बाधा डालता है और सुसंगत प्रोटोकॉल स्थापित करने में जटिलता लाता है।

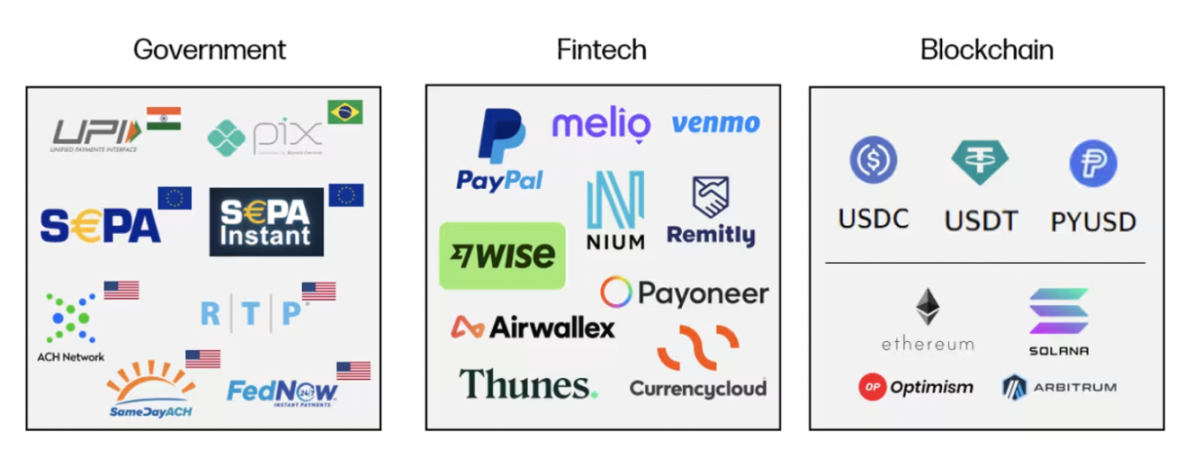

हाल के वर्षों में वास्तविक समय निपटान प्रणालियों का उद्भव एक बड़ी प्रगति है। भारत की UPI और ब्राज़ील की PIX जैसी अंतर्राष्ट्रीय वास्तविक समय भुगतान योजनाओं की सफलता अच्छी तरह से प्रलेखित है। संयुक्त राज्य अमेरिका में, सरकार और संघ के नेतृत्व वाले प्रयासों ने वास्तविक समय निपटान प्रणाली जैसे कि सेम डे ACH, क्लियरिंग हाउस RTP और फेडरल रिजर्व FedNow की शुरुआत की है। इन नए भुगतान विधियों को अपनाने में बाधा उत्पन्न हुई है, कई प्रतिस्पर्धी हितों के बीच विखंडन ने महत्वपूर्ण चुनौतियाँ पैदा की हैं।

फिनटेक कंपनियाँ इस पारंपरिक बुनियादी ढाँचे के शीर्ष पर उपयोगकर्ता अनुभव में सुधार प्रदान करने का प्रयास करती हैं। उदाहरण के लिए, वाइज़, निअम और थ्यून्स जैसी कंपनियाँ ग्राहकों को दुनिया भर के खातों से तरलता एकत्र करने में सक्षम बनाती हैं ताकि वे तुरंत लेन-देन कर सकें। हालाँकि, वे अंतर्निहित भुगतान चैनलों की सीमाओं को नहीं तोड़ते हैं, न ही वे पूंजी-कुशल समाधान हैं।

आज के भुगतान की जटिलता

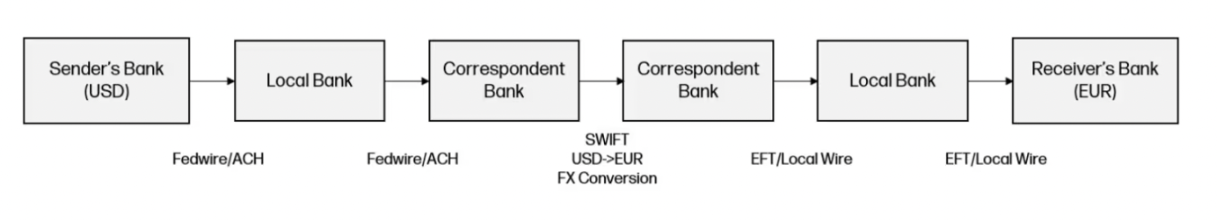

मौजूदा वित्तीय प्रणाली की विखंडित प्रकृति को देखते हुए, भुगतान लेनदेन लगातार जटिल होते जा रहे हैं। इस स्थिति को सीमा-पार भुगतान लेनदेन की संरचना से सबसे अच्छी तरह से समझा जा सकता है, जिसमें कई दर्द बिंदु शामिल हैं:

स्रोत: गैलेक्सी

-

कई मध्यस्थ: सीमा पार भुगतान में अक्सर कई मध्यस्थ शामिल होते हैं, जैसे स्थानीय और संवाददाता बैंक, क्लियरिंग हाउस, विदेशी मुद्रा दलाल और भुगतान नेटवर्क। प्रत्येक मध्यस्थ लेनदेन प्रक्रिया में जटिलता जोड़ता है, जिससे देरी होती है और लागत बढ़ जाती है।

-

मानकीकरण का अभाव: मानकीकृत प्रक्रियाओं की कमी से अक्षमताएं हो सकती हैं। विभिन्न देशों और वित्तीय संस्थानों की विनियामक आवश्यकताएं, भुगतान प्रणालियां और संदेश मानक अलग-अलग हो सकते हैं, जिससे भुगतान प्रक्रियाओं को सुव्यवस्थित करना चुनौतीपूर्ण हो जाता है।

-

मैनुअल प्रसंस्करण: पारंपरिक प्रणालियों में स्वचालन, वास्तविक समय प्रसंस्करण क्षमताओं और अन्य प्रणालियों के साथ अंतर-संचालन क्षमता का अभाव होता है, जिसके परिणामस्वरूप देरी और मैनुअल हस्तक्षेप होता है।

-

पारदर्शिता की कमी: सीमा पार भुगतान प्रक्रियाओं की अपारदर्शी प्रकृति अक्षमताओं को जन्म दे सकती है। लेन-देन की स्थिति, प्रसंस्करण समय और संबंधित शुल्कों में सीमित दृश्यता व्यवसायों के लिए भुगतानों को ट्रैक करना और उनका मिलान करना मुश्किल बना सकती है, जिससे देरी और प्रशासनिक ओवरहेड हो सकता है।

-

उच्च लागत: सीमा पार भुगतान में अक्सर उच्च लेनदेन शुल्क, विनिमय दर मार्कअप और मध्यस्थ शुल्क लगते हैं।

क्रॉस-बॉर्डर भुगतानों को निपटाने में आम तौर पर 5 कारोबारी दिन लगते हैं और इसकी औसत फीस 6.25% होती है। इन चुनौतियों के बावजूद, B2B क्रॉस-बॉर्डर भुगतानों के लिए बाजार का आकार बड़ा बना हुआ है और लगातार बढ़ रहा है। FXC इंटेलिजेंस का अनुमान है कि B2B क्रॉस-बॉर्डर भुगतानों के लिए कुल बाजार का आकार 2023 में $39 ट्रिलियन होगा और 2030 तक 43% बढ़कर $53 ट्रिलियन होने की उम्मीद है।

जाहिर है, वास्तविक समय निपटान आसन्न है, लेकिन वैश्विक एकीकृत भुगतान मानक अभी तक सामने नहीं आया है। सौभाग्य से, दुनिया भर में तुरंत और सस्ते में मूल्य हस्तांतरण करने के लिए हर किसी के लिए एक समाधान उपलब्ध है - ब्लॉकचेन।

स्रोत: गैलेक्सी (इस प्रस्तुति में सभी तृतीय-पक्ष कंपनी के उत्पाद और सेवा नाम केवल पहचान के उद्देश्य से हैं)

क्रिप्टो भुगतान अपनाना

स्टेबलकॉइन भुगतान क्रॉस-बॉर्डर भुगतान जैसे क्षेत्रों में मौजूदा चुनौतियों के लिए एक आदर्श समाधान प्रदान करते हैं, और दुनिया भर में दीर्घकालिक विकास का अनुभव कर रहे हैं। मई 2024 तक, कुल स्टेबलकॉइन आपूर्ति लगभग $161 बिलियन है। USDT और USDC क्रमशः क्रिप्टोकरेंसी बाजार पूंजीकरण में तीसरे और छठे स्थान पर हैं। हालाँकि उनका संयुक्त बाजार पूंजीकरण केवल क्रिप्टोकरेंसी के लगभग 6% के लिए है, लेकिन उनका ऑन-चेन लेनदेन मूल्य पूरे क्रिप्टो बाजार के लगभग 60% के लिए है।

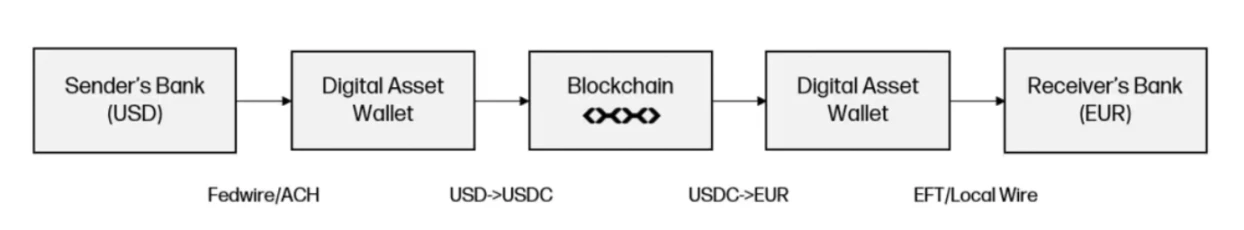

सीमा-पार भुगतान के हमारे उदाहरण पर लौटते हुए, ब्लॉकचेन द्वारा प्रदान किया गया धन का सरलीकृत प्रवाह वर्तमान जटिलता दुविधा का एक सुंदर समाधान प्रस्तुत करता है:

स्रोत: गैलेक्सी

-

लगभग तत्काल निपटान: ब्लॉकचेन दुनिया भर में लेनदेन का निपटान लगभग तुरंत कर सकता है, जबकि अधिकांश पारंपरिक वित्तीय भुगतान विधियों में निपटान में कई दिन लग जाते हैं।

-

कम लागत: विभिन्न बिचौलियों और तकनीकी बुनियादी ढांचे के उन्मूलन के कारण क्रिप्टो भुगतान मौजूदा उत्पादों की तुलना में कम महंगे हैं।

-

अधिक दृश्यता: ब्लॉकचेन धन की आवाजाही पर नज़र रखने और समाधान के प्रशासनिक ओवरहेड को कम करने में उच्च स्तर की दृश्यता प्रदान करता है।

-

वैश्विक मानक: ब्लॉकचेन एक "हाई-स्पीड रेल" प्रदान करता है जो इंटरनेट कनेक्शन वाले किसी भी व्यक्ति के लिए आसानी से सुलभ है।

स्थिर सिक्के भुगतान प्रक्रिया को बहुत सरल बना सकते हैं और बिचौलियों की संख्या को कम कर सकते हैं। पारंपरिक भुगतान विधियों की तुलना में, धन का प्रवाह वास्तविक समय में देखा जा सकता है, निपटान का समय तेज़ है, और लागत कम है।

क्रिप्टो भुगतान स्टैक का अवलोकन

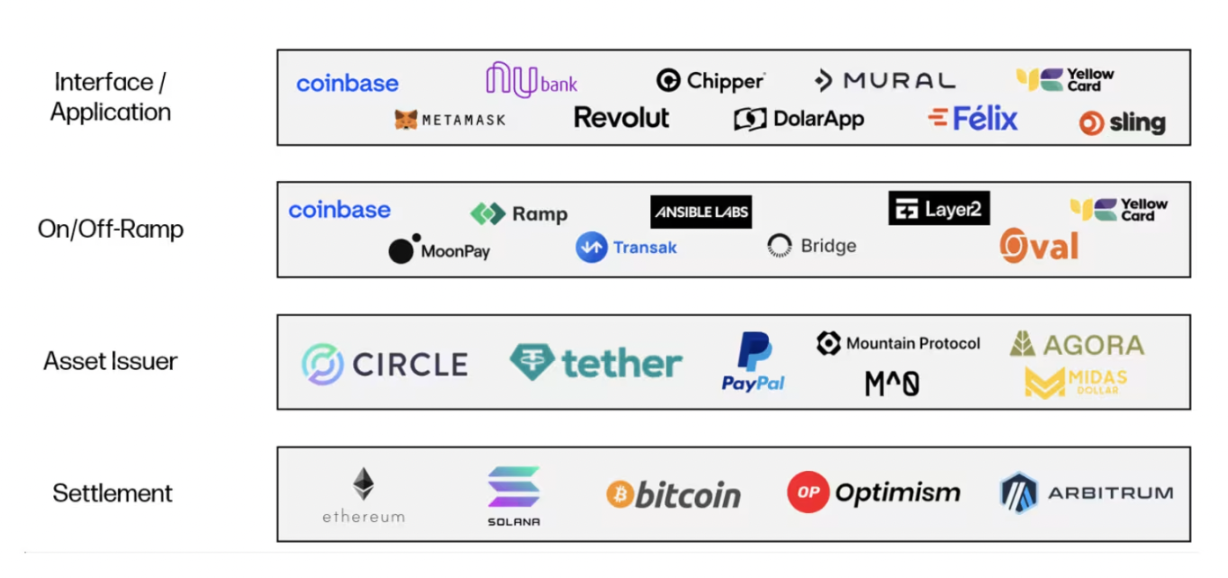

जब हम क्रिप्टो भुगतान बाजार को देखते हैं, तो हम पाते हैं कि इसमें चार मुख्य परतें हैं:

स्रोत: गैलेक्सी (इस प्रस्तुति में सभी तृतीय-पक्ष कंपनी के उत्पाद और सेवा नाम केवल पहचान के उद्देश्य से हैं)

निपटान परत

लेन-देन निपटाने के लिए अंतर्निहित ब्लॉकचेन इंफ्रास्ट्रक्चर। बिटकॉइन, एथेरियम और सोलाना जैसे लेयर 1 ब्लॉकचेन, साथ ही ऑप्टिमिज्म और आर्बिट्रम जैसे सामान्य-उद्देश्य वाले लेयर 2 ब्लॉकचेन, सभी बाजार में ब्लॉक स्पेस बेच रहे हैं। वे गति, लागत, मापनीयता, सुरक्षा आदि सहित कई आयामों पर प्रतिस्पर्धा करते हैं। हमें उम्मीद है कि समय के साथ, भुगतान उपयोग मामला ब्लॉक स्पेस का एक महत्वपूर्ण उपभोक्ता बन जाएगा।

परिसंपत्ति जारीकर्ता

एसेट जारीकर्ता एक स्थिर मुद्रा बनाने, बनाए रखने और भुनाने के लिए जिम्मेदार इकाई है, जो एक क्रिप्टो परिसंपत्ति है जिसका उद्देश्य एंकर एसेट या परिसंपत्तियों की टोकरी (सबसे आम तौर पर यूएस डॉलर) के सापेक्ष एक स्थिर मूल्य बनाए रखना है। स्थिर मुद्रा जारीकर्ता आमतौर पर बैंक के समान बैलेंस शीट-संचालित व्यवसाय मॉडल अपनाते हैं, जहां वे ग्राहक जमा लेते हैं और उन्हें यूएस ट्रेजरी जैसी उच्च-उपज वाली परिसंपत्तियों में निवेश करते हैं, फिर देनदारियों के रूप में स्थिर मुद्रा जारी करते हैं और ब्याज दर प्रसार या शुद्ध ब्याज मार्जिन से लाभ कमाते हैं।

जमा और निकासी

जमा और निकासी प्रदाता वित्तीय लेनदेन के लिए प्राथमिक तंत्र के रूप में स्टेबलकॉइन की उपलब्धता और अपनाने को बढ़ाने में महत्वपूर्ण भूमिका निभाते हैं। मूल रूप से, वे एक प्रौद्योगिकी परत के रूप में कार्य करते हैं जो ब्लॉकचेन पर स्टेबलकॉइन को फिएट मुद्राओं और बैंक खातों से जोड़ता है। उनके व्यवसाय मॉडल ट्रैफ़िक-संचालित होते हैं और अपने प्लेटफ़ॉर्म के माध्यम से प्रवाहित होने वाले डॉलर की मात्रा से एक छोटा कमीशन लेते हैं।

इंटरफ़ेस/ अनुप्रयोग

फ्रंट-एंड एप्लिकेशन अंततः क्रिप्टो भुगतान स्टैक में ग्राहक-सामना करने वाला सॉफ़्टवेयर है जो क्रिप्टो भुगतान के लिए एक उपयोगकर्ता इंटरफ़ेस प्रदान करता है और ऐसे लेनदेन को सक्षम करने के लिए स्टैक के बाकी हिस्सों का लाभ उठाता है। उनके व्यवसाय मॉडल अलग-अलग होते हैं, लेकिन वे प्लेटफ़ॉर्म शुल्क और फ्रंट-एंड लेनदेन वॉल्यूम के माध्यम से उत्पन्न ट्रैफ़िक-संचालित शुल्क का कुछ संयोजन होते हैं।

क्रिप्टो भुगतान क्षेत्र में उभरते रुझान

क्रिप्टोकरेंसी और भुगतान के संबंध में कई रुझान हैं जो हमें उत्साहित करते हैं:

सीमा पार भुगतान पहला युद्धक्षेत्र है

जैसा कि ऊपर बताया गया है, सीमा पार लेन-देन अक्सर सबसे जटिल, अक्षम और महंगे होते हैं क्योंकि इस प्रक्रिया में कई बिचौलिए किराया वसूलते हैं। नतीजतन, हम वैकल्पिक ब्लॉकचेन-आधारित भुगतान समाधानों के लिए बाजार में सबसे अधिक मांग देखते हैं। B2B भुगतान (आपूर्तिकर्ताओं और कर्मचारियों को भुगतान, कॉर्पोरेट ट्रेजरी प्रबंधन, आदि) और प्रेषण उपयोग मामलों का समर्थन करने वाले प्रदाता बाजार में हाइलाइट किए गए हैं।

हम क्रॉस-बॉर्डर भुगतान को लॉजिस्टिक्स के समान मानते हैं, जहाँ "अंतिम मील" (फ़िएट क्रिप्टो के बीच प्रवेश और निकास) नेविगेट करना विशेष रूप से कठिन है। यह वह जगह है जहाँ लेयर 2 फाइनेंशियल जैसे व्यवसाय वास्तविक मूल्य प्रदान करते हैं, क्योंकि वे बैक एंड (ब्लॉकचेन, कस्टोडियन, एक्सचेंज/लिक्विडिटी प्रदाता, बैंक, पारंपरिक भुगतान चैनल, आदि) पर विभिन्न क्रिप्टो और फ़िएट भागीदारों के साथ एकीकरण का भारी काम करते हैं और ग्राहकों के लिए एक सहज और अनुपालन अनुभव प्रदान करते हैं। लेयर 2 लेनदेन के लिए उच्च गति/सबसे कम लागत वाले मार्गों को सुविधाजनक बनाने में भी मदद करता है, और क्रिप्टो का उपयोग करके क्रॉस-बॉर्डर भुगतान के पूरे जीवनचक्र को ~ 90 मिनट में पूरा करने में सक्षम है, जो मौजूदा समाधानों की तुलना में 1-2 गुना तेज़ है।

लागत और दक्षता लाभ को देखते हुए, हम सभी क्षेत्रों और अंतिम ग्राहकों (क्रिप्टो-नेटिव और पारंपरिक व्यवसायों) में अपनापन देख रहे हैं। मांग विशेष रूप से उन क्षेत्रों में अधिक है जहां फिएट मुद्राएं कम स्थिर हैं और अमेरिकी डॉलर का उपयोग करना कम सुविधाजनक है। इन कारणों से, अफ्रीका और लैटिन अमेरिका उद्यमशीलता गतिविधि के केंद्र रहे हैं। उदाहरण के लिए, मुरल ने ग्राहकों को अमेरिका और लैटिन अमेरिका के बीच आपूर्तिकर्ताओं और डेवलपर ठेकेदारों को भुगतान की सुविधा प्रदान करने में बड़ी सफलता देखी है।

भुगतान-ग्रेड बुनियादी ढांचे के प्रारंभिक चरणों का समर्थन करना

क्रिप्टो इकोसिस्टम (जैसे, कस्टडी प्लेटफॉर्म, कुंजी प्रबंधन प्रणाली, तरलता स्थल) के आसपास के अधिकांश बाजार बुनियादी ढांचे को मुख्य रूप से खुदरा व्यापार के लिए बनाया गया था। पिछले कुछ वर्षों में, यह पारिस्थितिकी तंत्र अधिक उद्यम/संस्थागत-ग्रेड सॉफ़्टवेयर और सेवाओं को शामिल करने के लिए परिपक्व हो गया है, लेकिन कुल मिलाकर, यह बुनियादी ढांचा वास्तविक समय और बड़े पैमाने पर भुगतान का समर्थन करने के लिए नहीं बनाया गया था।

हम नए प्रवेशकों और मौजूदा प्रदाताओं के लिए इस उभरते हुए उपयोग के मामले को पकड़ने के लिए अपने प्रस्तावों को लॉन्च/विस्तार करने के अवसर देखते हैं। उदाहरण के लिए, टर्नकी जैसी नई कस्टडी/कुंजी प्रबंधन प्रणालियाँ लगभग 2 ऑर्डर ऑफ़ मैग्निट्यूड द्वारा लेनदेन हस्ताक्षर दक्षता में सुधार करती हैं, जिससे लाखों वॉलेट के लिए हस्ताक्षर विलंबता 50-100 मिलीसेकंड तक कम हो जाती है। वे कंपनियों को स्वचालन और प्रक्रिया मापनीयता को बढ़ाने के लिए परिसंपत्ति संचालन के आसपास नीतियां डिजाइन करने में भी सक्षम बनाते हैं।

लिक्विडिटी पार्टनर भी अपने उत्पादों को पुनः संरेखित कर रहे हैं ताकि जमा और निकासी प्रदाताओं को अधिक लगातार (आदर्श रूप से वास्तविक समय) निपटान क्षमताएं प्रदान की जा सकें। बोर्ड भर में अधिक स्वचालन लागू किया जा रहा है, जो अंतिम उपयोगकर्ताओं के लिए बेहतर अनुभव प्रदान करेगा।

ऑन-चेन राजस्व खेल के नियमों को बदल देगा

ब्लॉकचेन पर डिजिटल फिएट मुद्राएँ जारी करना टोकनकरण प्रवृत्ति का पहला उदाहरण है। जैसा कि ऊपर उल्लेख किया गया है, हमने स्थिर मुद्रा अपनाने में महत्वपूर्ण वृद्धि देखी है, लेकिन इन परिसंपत्तियों के धारक अपनी होल्डिंग्स पर प्रतिफल अर्जित करने में असमर्थ हैं (यूएस ट्रेजरी के लिए 4-5% के सापेक्ष)।

वर्तमान में, Tether/USDT और Circle/USDC स्टेबलकॉइन बाजार पर हावी हैं, जो ~$160 बिलियन स्टेबलकॉइन बाजार में 90% से अधिक के लिए जिम्मेदार हैं। हाल ही में, हमने कई नए प्रवेशकों को देखा है, जो विभिन्न रूपों में ऑन-चेन यील्ड की पेशकश कर रहे हैं। Agora, Mountain और Midas जैसे स्टेबलकॉइन जारीकर्ता धारकों को यील्ड या रिवॉर्ड प्रदान करते हुए अमेरिकी डॉलर से जुड़ी यील्ड एसेट्स की पेशकश कर रहे हैं। हमने BlackRock, Franklin Templeton, Hashnote और Superstate जैसी कंपनियों को ऑन-चेन यील्ड प्रदान करने के लिए टोकनयुक्त अमेरिकी ट्रेजरी उत्पादों की एक श्रृंखला लॉन्च करते देखा है। अंत में, हमने Ethena जैसे रचनात्मक टोकनयुक्त संरचित उत्पादों को अमेरिकी डॉलर से जुड़ी एक सिंथेटिक संपत्ति की पेशकश करते देखा है, जो ऑन-चेन यील्ड प्रदान करने के लिए ETH बेस लेनदेन का उपयोग करता है।

हमें उम्मीद है कि ये नई परिसंपत्तियाँ ऑन-चेन फाइनेंस के विस्तार के लिए एक बहुत बड़ा उत्प्रेरक होंगी। उपज पैदा करने वाली परिसंपत्तियों के लिए एक बाजार का जन्म हो रहा है, और हम एक ऐसा भविष्य देखते हैं जहाँ उपयोगकर्ता अपने उपयोग के मामले, जोखिम/वापसी वरीयताओं और जिस क्षेत्र में वे स्थित हैं, उसके आधार पर विशिष्ट उपकरणों का लाभ उठा सकते हैं। इसका दुनिया भर में वित्तीय सेवाओं पर एक परिवर्तनकारी प्रभाव हो सकता है।

स्टेबलकॉइन की उपयोगिता के शुरुआती संकेत

जबकि स्टेबलकॉइन्स का विभिन्न उपयोग मामलों में स्पष्ट उत्पाद-बाजार फिट है, गैर-क्रिप्टो मूल निवासियों के लिए दैनिक जीवन अक्सर फिएट दुनिया में संचालित होता है। उदाहरण के लिए, व्यवसाय क्रॉस-बॉर्डर भुगतान के लिए स्टेबलकॉइन और ब्लॉकचेन का लाभ उठाने में खुश हो सकते हैं, लेकिन आज अधिकांश कंपनियां फिएट मुद्राओं को रखना और स्वीकार करना पसंद करती हैं।

एक बाधा व्यवसायों के लिए स्थिर मुद्रा भुगतान स्वीकार करने की क्षमता है। स्ट्राइप द्वारा अपने मर्चेंट क्लाइंट को स्थिर मुद्रा स्वीकार करने के लिए समर्थन की हाल ही में की गई घोषणा यथास्थिति से एक बड़ा बदलाव है। यह उपभोक्ताओं को अधिक भुगतान विकल्प प्रदान कर सकता है और व्यवसायों के लिए डिजिटल परिसंपत्तियों को स्वीकार करना, रखना और उनका व्यापार करना आसान बना सकता है।

एक और अवरोधक स्टेबलकॉइन का उपयोग करने की क्षमता है। वीज़ा ने ब्लॉकचेन और वीज़ा नेटवर्क के बीच सख्त अंतर-संचालन का समर्थन करने के लिए स्टेबलकॉइन निपटान क्षमताओं का विस्तार किया है। उदाहरण के लिए, हम स्टेबलकॉइन-समर्थित कार्ड उत्पादों की जैविक मांग देख रहे हैं जो कार्डधारकों को अपने स्टेबलकॉइन का उपयोग कहीं भी करने की अनुमति देते हैं जहाँ वीज़ा कार्ड स्वीकार किए जाते हैं।

जैसे-जैसे स्टेबलकॉइन्स को पारंपरिक भुगतान विधियों में व्यापक रूप से स्वीकार किया जाने लगा है और उनका उपयोग किया जाने लगा है, हम उम्मीद करते हैं कि ये डिजिटल परिसंपत्तियां गैर-डिजिटल परिसंपत्तियों के साथ-साथ सर्वव्यापी हो जाएंगी।

निष्कर्ष के तौर पर

ब्लॉकचेन-आधारित भुगतान सबसे महत्वपूर्ण और रोमांचक रुझानों में से एक है जिसे हम क्रिप्टोकरेंसी और वित्तीय सेवाओं के चौराहे पर देख रहे हैं। हमारा मानना है कि ब्लॉकचेन का उपयोग वित्तीय लेनदेन की बढ़ती संख्या को निपटाने के लिए किया जाएगा, और भुगतान भविष्य में ब्लॉकचेन स्पेस का एक प्रमुख उपयोग मामला और प्रमुख उपभोक्ता बन जाएगा।

यह लेख इंटरनेट से लिया गया है: गैलेक्सी पार्टनर्स: क्रिप्टोकरेंसी भुगतान में बहुत संभावनाएं हैं, स्टेबलकॉइन सर्वव्यापी होंगे

संबंधित: इंजेक्टिव (आईएनजे) मूल्य समेकन में फंस गया है - क्या ब्रेकआउट आसन्न है?

संक्षेप में इंजेक्टिव की कीमत $52 के सर्वकालिक उच्च स्तर को चिह्नित करने के बाद $45 और $35 बैरियर के भीतर वापस आ गई है। इस समय, अधिकांश सक्रिय पते वे हैं जो लाभ के लिए वृद्धि की प्रतीक्षा कर रहे हैं। व्हेल, जो आपूर्ति के 84% को नियंत्रित करते हैं, निष्क्रिय हैं और उनके पुनरुत्थान से कीमत ऊपर की ओर बढ़ेगी। इंजेक्टिव (INJ) की कीमत की गति लगभग दो सप्ताह पहले अपने सर्वकालिक उच्च स्तर के गठन के बाद मंदी में बदल गई। INJ अब फिर से ठीक हो रहा है, पिछले तीन दिनों में 15% से अधिक बढ़ रहा है, लेकिन क्या यह समेकन को तोड़ पाएगा? इंजेक्टिव निवेशक जोर दे रहे हैं इंजेक्टिव की कीमत वर्तमान में $40.17 पर कारोबार कर रही है, जो सिर्फ 72 घंटे पहले $35.02 से ऊपर है। इसने निवेशकों के लिए एक बार फिर तेजी के संकेत दिए हैं, जो 32% सुधार से उबर रहे थे…