HashWhale BTC Mining Weekly Report | Miners’ trading volume share has fallen below 5%; US-listed Bitcoin mining companie

1. Bitcoin market and mining data

From January 6 to January 12, the price trend of Bitcoin showed a certain volatility. The main changes during this period are as follows:

On January 6, the price of Bitcoin fluctuated and rose. At the end of the day, the price rose sharply, closing at $102,248.7, an increase of 3.97%, indicating strong buying demand in the market and active trading volume. On January 7, it fluctuated sideways at a high level near $10,100, and fell sharply at the end of the day, closing at $96,929.8, a drop of 5.20%. There were signs of profit-taking in the market, but the trading volume remained high.

By January 8, the price of Bitcoin fell for the second consecutive day. The intraday trend fluctuated downward, reaching a low of $92,716.6. The trading volume continued to rise to 100.36 K, indicating that the selling pressure in the market has not subsided.

On January 9, Bitcoin fell to $91,314.34, the lowest point of the week. Although it recovered slightly in the late trading, it still closed down 2.66%. The trading volume increased significantly to 132.78 K, indicating that the market entered a panic selling phase. On January 10, Bitcoin rebounded after three consecutive days of decline. It opened at $92,540.5, hit a low of $92,310.6, rose to a high of $95,760.6, and finally closed at $94,724.1, an increase of 2.36%. The trading volume reached 125.42 K, indicating that the market buying rebounded, but the bulls and bears were still playing at key positions. From the 11th to the 12th, the bulls and bears continued to play at key positions, and the market fluctuated sideways around 94.41 K. In terms of market sentiment, despite the short-term correction in Bitcoin prices, the overall sentiment remains optimistic. Some analysts predict that Bitcoin may break through $150,000 in the future, or even reach a historical high of $200,000.

Bitcoin price trend (2025/01/06-2025/01/12)

Marché dynamics and macro background

1. Impact of fluctuations in the US dollar index (DXY):

-

The overall strength of the US dollar index this week was mainly affected by the hawkish statements of Federal Reserve officials that high interest rates may continue to be maintained. A strong dollar usually puts pressure on risky assets such as Bitcoin, attracting funds to flow back to US dollar assets.

-

The US dollar index climbed significantly after January 7, reinforcing market expectations of tightening liquidity and weakening investment sentiment in the cryptomarché des devises.

2. Fund Flow in the Cryptocurrency Market:

-

As the price of Bitcoin surged and then fell, the trading volume increased significantly this week, especially reaching a peak on January 9 (132.78 K). This shows that there is a lot of profit-taking and panic selling in the market.

-

At the same time, demand for stablecoin trading pairs (such as USDT) has increased, indicating that investors are withdrawing funds from crypto assets and turning to safe-haven assets.

3. Technical pressure:

-

After Bitcoin broke through the psychological barrier of $100,000 on January 6, it faced strong resistance. Technically, profit-taking formed a sell-off at high levels, causing the price to fall rapidly on January 7.

4. Changes in market sentiment:

-

Market sentiment was optimistic on January 6, with some investors expecting Bitcoin to break new all-time highs.

-

From January 7 to January 9, the market turned into a panic sentiment, especially after falling below the key support ($96,000).

-

From January 11 to 12, the short key position game continued, and the price fluctuated sideways around US$94,410.

Hash rate changes

The hash rate of the Bitcoin network experienced significant fluctuations between January 6 and January 12, 2025. On January 6, the hash rate fluctuated from 769.54 EH/s to a peak of 912.38 EH/s, and then continued to decline to 674.19 EH/s. On the evening of January 7, the hash rate rebounded slightly to 805.67 EH/s, and from January 8, it continued to fall back to 723.65 EH/s, and continued to fluctuate and decline to 636.93 EH/s. On January 9, the hash rate rose slightly from 636.93 EH/s to 753.28 EH/s, and then broke through again, continuing to rise to a peak of 917.21 EH/s on January 10. On January 10, it fluctuated down from the highest point of 917.21 EH/s to 725.83 EH/s on the 11th. It rose slightly to 850.27 EH/s on the 11th, and finally fluctuated down to 715.32 EH/s on the 12th. As of the time of writing, the hash rate of the Bitcoin network remained around 715 EH/s. Overall, the changes in hash rate during this period were affected by multiple factors such as miner participation, mining difficulty adjustment, and market price fluctuations.

Meanwhile, the share of US-listed Bitcoin mining companies in global computing power continues to rise. According to a Jefferies report, in December 2024, US-listed Bitcoin mining companies accounted for 25.3% of global computing power, showing that their dominant position in the industry is gradually consolidating. Bitcoin prices rose by 15% in December, significantly exceeding the 6.5% growth in network computing power, which significantly improved the profitability of miners. Data shows that US-listed mining companies mined a total of 3,602 Bitcoins in December, up from 3,404 in November. Among them, Mara (MARA) had the highest output, reaching 890, followed by CleanSpark (CLSK), which produced 668. MARAs installed computing power reached 53.2 EH/s, the highest in the industry, while CleanSpark followed closely behind, reaching 39.1 EH/s.

In summary, this week’s fluctuations in hash rate and the computing power performance of US mining companies reflect the dynamic changes in the Bitcoin mining industry, and also indicate that the importance of large mining companies in the distribution of computing power is increasing.

Bitcoin network hash rate data

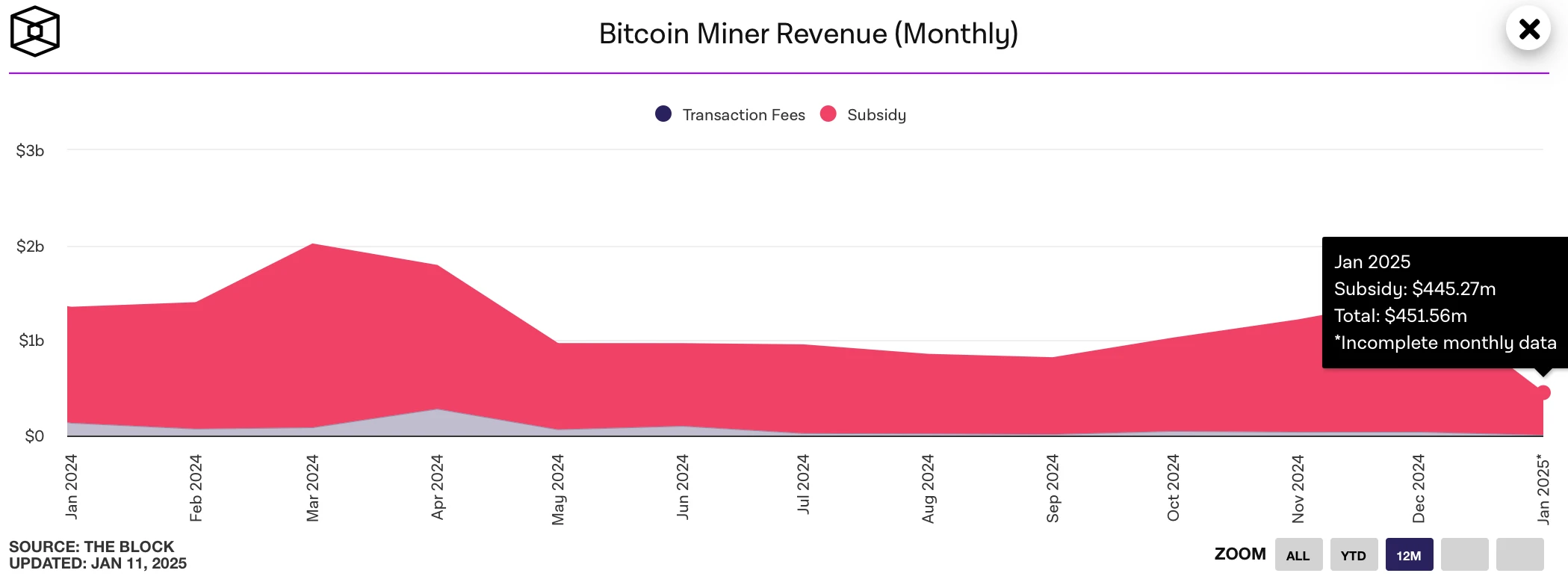

Mining income

According to data from TheBlock, as of January 12, 2025, the total revenue of Bitcoin miners in January 2025 reached $451 million, indicating that the overall profitability of Bitcoin miners remained at a high level at the beginning of the year. However, while revenue grew, the proportion of miners transaction volume showed a significant downward trend.

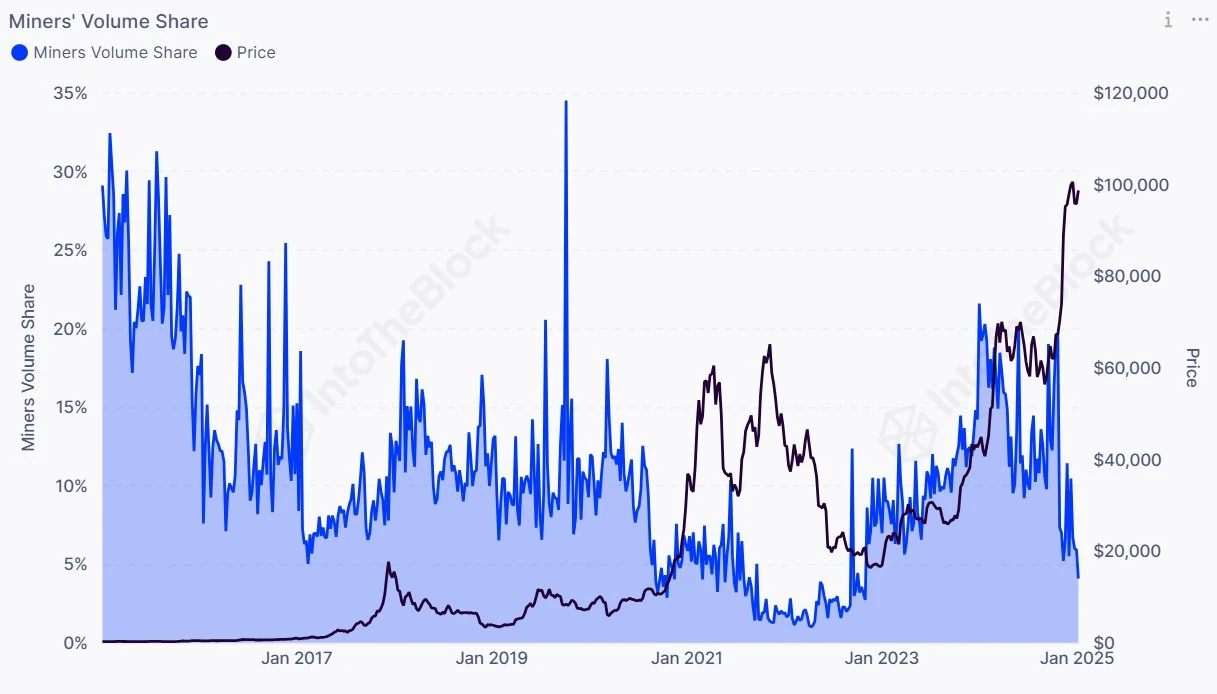

On January 10, the Bitcoin miners transaction volume share has recently fallen below the critical level of 5%, which is lower than the bottom of the cycle in 2017. This indicator is used to track the percentage of miner-related transactions in the total Bitcoin transaction volume. Data shows that in the first quarter of 2024, the miners transaction volume share exceeded 20%, reflecting that miners were transferring a large amount of funds on the blockchain at that time. However, since this peak, the indicator has shown a continuous downward trend and has now fallen below 5%. Although this value is lower than the bottom of the cycle in 2017, it is still higher than the historical low during the 2021 bull market.

In summary, this week Bitcoin miners showed a mixed bag of revenue and transaction volume share. On the one hand, overall revenue remained strong, while on the other hand, the decline in transaction volume share indicated that miners’ on-chain activity had weakened.

Bitcoin Miner Income Data

Bitcoin miners’ share of transaction volume over the past decade

Energy costs and mining efficiency

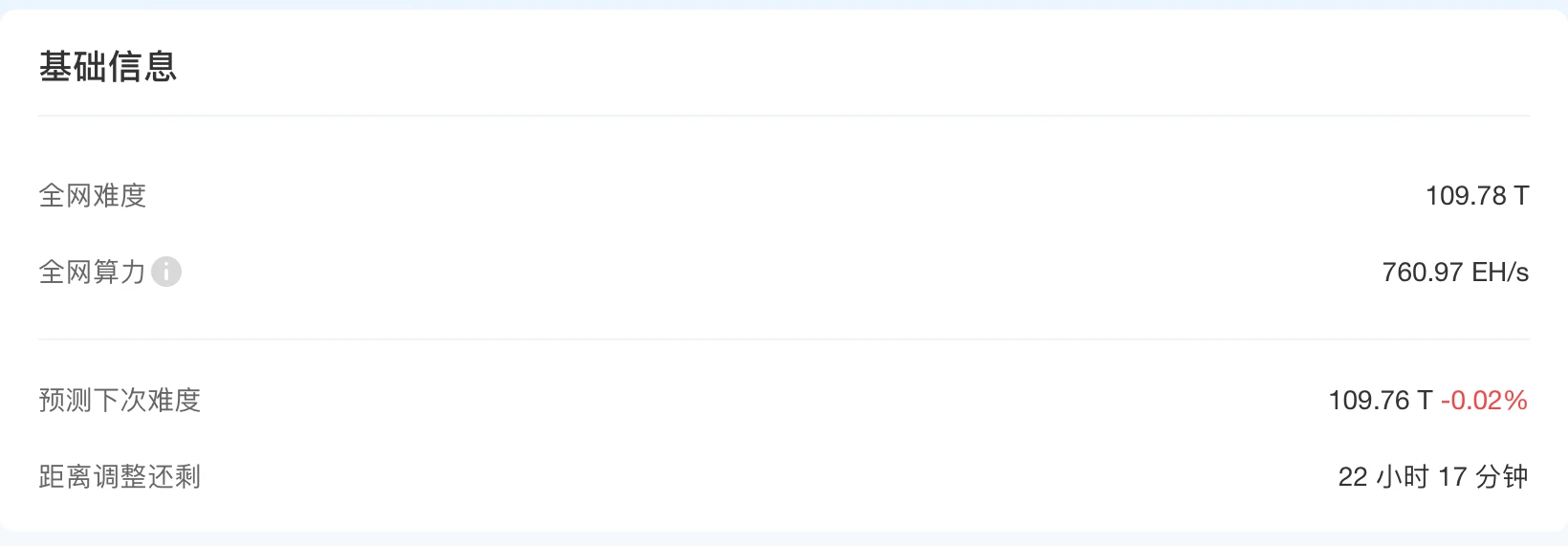

According to CloverPool, Bitcoin mining difficulty will increase by 1.16% to 109.78 T on December 30, 2024, a record high. As of writing, the total network computing power on January 12 was about 760.97 EH/s, and the next mining difficulty is expected to decrease by 0.02% to 109.76 T.

From January 6 to January 12, 2025, the mining difficulty and computing power of the Bitcoin network were at historical highs. The sharp fluctuations in Bitcoin prices directly affected miners income. Although international energy prices have risen, the impact on miners electricity costs in the short term is limited. However, with the rapid growth of global computing power and changes in energy costs, miners need to continue to pay attention to market dynamics and optimize operational strategies to maintain their competitive advantage.

In addition, JPMorgans report pointed out that the daily income of Bitcoin miners in December 2024 rose for the second consecutive month, although it was still significantly lower than the level before the halving. This shows that despite the high mining difficulty and computing power, the profitability of miners has improved.

In summary, miners should pay close attention to Bitcoin price trends and changes in energy costs, optimize mining equipment and strategies to cope with market uncertainties, and ensure the sustainability and profitability of mining activities.

Bitcoin mining difficulty data

2. Policy and regulatory news

Wang Yongli, former vice president of Bank of China: A rational view of Trumps new Bitcoin policy

On January 8, Wang Yongli, former vice president of the Bank of China, wrote an article titled A Rational View of Trumps New Bitcoin Policy in the 2025 issue of China Foreign Échange. It mentioned that Bitcoin highly imitates gold at the currency level, and its total amount and phased increase are completely set by the system, which is more stringent than gold (it is not clear how much gold reserves there are). The amount that can be used for exchange transactions is more limited, and it cannot grow with the growth of the value of tradable wealth, which does not meet the essential requirements of currency. In addition, Bitcoin is a purely chain-born digital asset, not a natural physical asset. Once trust is lost, it will be wiped out and worthless, and the risk is far greater than gold.

With Trump winning the US presidential election, the new Bitcoin policy he proposed has attracted widespread attention and heated discussions. We need to calm down, look at it rationally and objectively, and avoid making subversive mistakes. It is difficult for the United States to guarantee that all new Bitcoins can be produced in the United States, and it is even more difficult to guarantee that they all belong to the US government. The so-called national strategic reserve of Bitcoin, whether it is the strategic reserve of the government (finance) or the strategic reserve of the Federal Reserve (central bank) as the US dollar, has risks and uncertainties.

Oklahoma lawmakers introduce the Bitcoin Freedom Act, which would allow state employees to receive wages in Bitcoin

On January 9, U.S. Oklahoma Senator Dusty Deevers submitted the Bitcoin Freedom Act numbered SB 325, which will allow Oklahoma employees to choose to receive wages in the form of Bitcoin and allow suppliers to accept Bitcoin payments. The SB 325 bill ensures that participation is completely voluntary, respects free market principles, and gives employees, employers, and businesses the right to choose the payment method that best suits them. The SB 325 bill is eligible for consideration in the 60th legislative session that begins on February 3.

3. Mining News

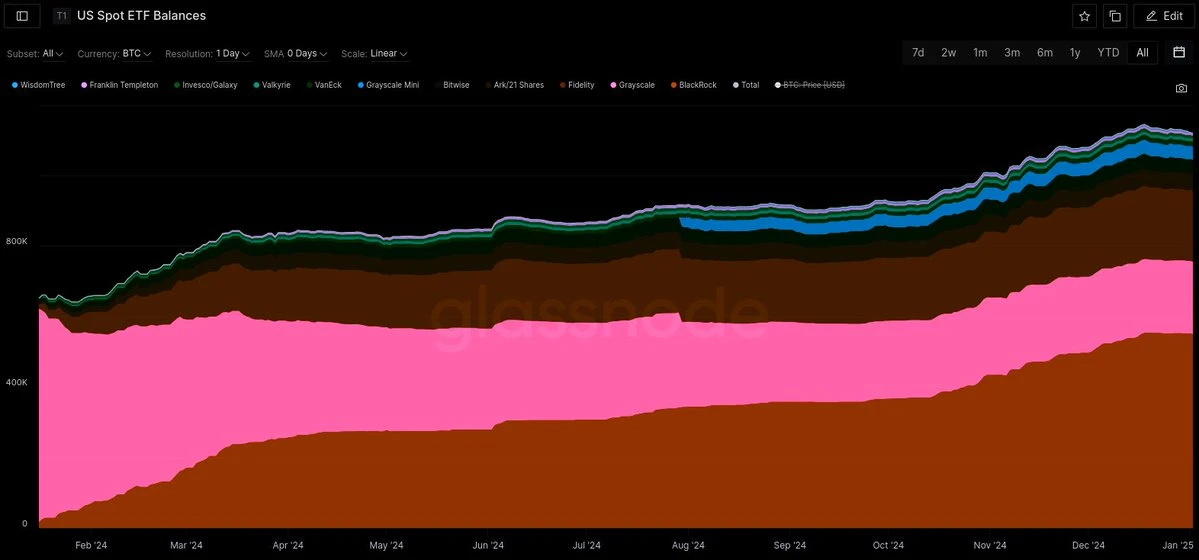

Bitcoin ETFs Absorbed Almost 3 Times More BTC Than Miners Produced in December

On January 7, according to the average data of Apollo and BiTBO, in December, the US spot Bitcoin ETF absorbed as many as 51,500 bitcoins, while miners produced nearly 14,000 bitcoins that month. The purchase volume of the US spot Bitcoin ETF was almost three times the output of miners.

Cumulative Bitcoin Inflows into US Spot ETFs

Data: ETF issuers are buying Bitcoin 20 times faster than mining output

On January 8, according to analyst Shaun Edmondson, Bitcoin ETF issuers purchased more than 9,000 BTC on Friday, January 3, and more than 9,600 BTC on Monday. Since the first approval of the Bitcoin ETF, all 12 issuers have become large position holders in the industry. In October, they purchased 5 times the amount of BTC in the worlds mining output. Now this number has exceeded 20 times. Analysts believe that bearish market signals will only bring greater purchases.

In 2024, many listed Bitcoin mining companies will increase their holdings of BTC and develop AI businesses to achieve business diversification.

On January 8, according to a report released by NiceHash and Digital Mining Solutions on January 7, listed Bitcoin mining companies have followed MicroStrategys footsteps and increased their Bitcoin treasury holdings.

“In 2024, there was a notable shift in the Bitcoin mining industry, with several companies choosing to retain more of their output or not sell it at all,” the report states.

Miners may not sell Bitcoin for a variety of reasons, including anticipation of further BTC price appreciation or to strengthen their balance sheets and as a hedge against currency depreciation.

The report mentioned that MARA Holdings, Riot Platforms and Hut 8 used borrowed funds to increase their Bitcoin holdings, further expanding their treasury strategies. Four of the 16 largest Bitcoin holding companies are mining companies.

In addition to the core mining business, some miners will further diversify into high-performance computing and artificial intelligence by 2024, generating predictable revenue streams to buffer against mining volatility, the report said.

4. Bitcoin related news

U.S. ETFs’ Bitcoin Holdings Surge 81% to 1.125 Million BTC in 2024

On January 6, according to Bitcoin News, in 2024, US ETFs Bitcoin holdings surged 81% to 1,125,335 BTC.

US ETF Bitcoin Holdings Data

Former Barclays executive: Bitcoin may have completed the correction wave and may rise to a record high of $125,000 in the first quarter

On January 6, John Glover, former managing director of Barclays Investment Bank, said that according to the technical analysis tool Elliott Wave Theory, Bitcoin is expected to break through $125,000 in the first quarter of 2025. He pointed out that earlier this week we saw Bitcoin fall below $92,000, but the correction wave may have been completed. If Bitcoin breaks through $125,000, it may have another pullback and then move to the top of the cycle near $160,000. It is reported that the Elliott Wave Theory believes that asset prices are composed of five waves in line with the main trend direction and three correction waves in the opposite direction of the trend in each cycle, and each correction wave follows a wave in line with the main trend direction.

Nasdaq applies to increase BlackRock Bitcoin spot ETF holding limit from 25,000 to 250,000

On January 7, according to a public regulatory document, Nasdaq has submitted an application to the U.S. Securities and Exchange Commission (SEC) to increase the position limit of the BlackRock Spot Bitcoin ETF (IBIT) from 25,000 to 250,000. It should be noted that this application still needs the approval of the SEC to take effect. The position limit refers to the maximum share of the ETF that a single investor or institution can hold.

The director of Bitwise Alpha Strategies said: Considering the increasing trading volume of the ETF, it is reasonable to at least increase the holding limit to 400,000. The demands of Nasdaq and BlackRock are reasonable and supported by facts.

Santiment and Bitwise analysis: Bitcoin and US stock correlation dynamics diverge, or indicate bullish signals

On January 8, crypto market research firm Santiment and Bitwise European Research Director Andre Dragosch both pointed out the recent dynamic changes in the correlation between Bitcoin and U.S. stocks (SP 500 Index).

Santiment posted on the X platform that since Trump was elected as the 47th President of the United States, the correlation between cryptocurrencies and stocks has remained high. However, recently, Bitcoin has shown a trend of deviating from the normal volatility trajectory compared to the SP 500 index, which is seen as a potential bullish signal. From historical experience, cryptocurrencies usually usher in a significant bull market during periods of low correlation with the stock market. If Bitcoin can continue to achieve strong growth independently of the SP 500 index in January, the possibility of setting a new record high will increase significantly.

However, Andre Dragosch pointed out that the recent 20-day moving average correlation between Bitcoin and the SP 500 has reached 0.88, indicating that there is still strong synchronization between the two. He warned that although on-chain factors may provide impetus before mid-2025, the deterioration of the macroeconomic situation may still pose a short-term risk to Bitcoin, especially considering its high correlation with the stock market.

Overall, there is uncertainty in the current trend of Bitcoin in the short term, but if it can gradually break away from its close connection with the U.S. stock market, it may usher in more optimistic market expectations.

Bitcoin ($BTC) vs. SP 500 (SPX) vs. Gold Price

Bernstein and KULR both predict that Bitcoin will reach $200,000 by 2025

On January 6, Bernstein analysts reiterated in their 10 predictions for the crypto industry in 2025 that the Bitcoin price target is $200,000, and called 2025 the beginning of the infinite era, believing that this is a long period for the evolution and widespread acceptance of crypto technology. The report pointed out that the stablecoin market size will exceed $500 billion, the net inflow of funds into the US spot Bitcoin ETF will exceed $70 billion, and the integration of encryption and artificial intelligence will be further deepened.

On January 8, Michael Mo, CEO of KULR Technology, a NYSE-listed company, said that Bitcoin could reach a peak of $200,000 in the 2025 market cycle, mainly driven by the adoption of global strategic BTC reserves. In addition, KULR purchased more than $21 million worth of Bitcoin on January 6 at an average price of $97,391.

Bernstein and KULRs consistent views reflect the markets high optimism about Bitcoins medium- and long-term potential.

This week, the global corporate and national Bitcoin holdings dynamics are as follows:

Canadian listed company Kontrol Technologies holds 25 BTC.

Australias Monochrome Spot Bitcoin ETF (IBTC) holds 267 BTC with a market value of approximately US$41.534 million.

Japans Metaplanet plans to increase its bitcoin holdings to 10,000 this year. It currently holds 1,761.98 bitcoins, worth approximately $167 million.

CleanSpark holds 9,952 BTC with a total value of $1.01 billion, making it the fifth largest corporate holder, surpassing Tesla.

MicroStrategy has increased its Bitcoin holdings for nine consecutive weeks, with total holdings valued at $44.3 billion.

Bitwise data shows that the number of bitcoins held by global companies increased by 63% year-on-year to 590,649.

El Salvador now holds 6,025 bitcoins, worth $5.7 billion.

Thumzup Media Corporation announced that it had purchased 9,783 bitcoins, with a total value of approximately $1 million.

SUNation Energy announced that its board of directors has approved the inclusion of Bitcoin as an asset in the company’s treasury management plan. Under the plan, SUNation will use 30% of its excess cash to purchase Bitcoin.

BlackRock’s Bitcoin Trust ($IBIT) purchased 5,830 bitcoins on January 7, worth approximately $596.1 million.

US entities hold record share of Bitcoin reserves, 65% higher than non-US entities

On January 9, Cryptoquant CEO Ki Young Ju stated on a social platform that the share of Bitcoin reserves held by U.S. entities has hit a record high and is currently 65% higher than that of non-U.S. entities.

BTC Reserve Rate Data

Timothy Peterson predicts Bitcoin will reach $1.5 million by 2035

On January 10, Timothy Peterson, founder of CaneIsland Alternative Advisors, said that based on network growth and Metcalfes Law, Bitcoin is predicted to reach $1.5 million in 2035. Petersons previous accurate predictions included a rebound in 2024 and a Bitcoin price bottom line of $10,000.

Oklahoma Senator: Bitcoin has gone mainstream

On January 10, Oklahoma Senator Dusty Deevers said that Bitcoin has become mainstream in the economy and is undoubtedly an important part of the future of finance.

New Hampshire introduces bill to create ‘strategic bitcoin reserve’

On January 11, Dennis Porter, co-founder and CEO of Satoshi Action Fund (SAF), posted on the X platform that New Hampshire State Representative Keith Ammon submitted a bill proposing the establishment of a strategic reserve to allow the state treasury to invest in precious metals (such as gold, silver, platinum) and digital assets (including Bitcoin).

The bill will introduce new regulations to clarify the définitions of “qualified custodian” and “secure custody solution” to ensure the safe custody of digital assets and operate through regulatory-approved trading products.

Whole Foods and other US food and beverage companies are accelerating their deployment of Bitcoin payments and reserves

On January 12, Israeli alternative protein company Steakholder Foods has approved the purchase of up to $1 million in Bitcoin, and CEO Arik Kaufman expressed optimism about the development prospects of cryptocurrencies as an asset class. In addition, Santa Fe meat company Beck Bulow supports online and offline Bitcoin payments, plans to convert 20% of its assets into Bitcoin and hold all Bitcoin income, and supports employee 401(k) plans to invest in BTC.

Chipotle, Whole Foods, and Starbucks already support Bitcoin payments through third-party payment platforms such as Flexa. Shareholders of Whole Foods parent company Amazon have proposed allocating at least 5% of their assets to Bitcoin, a proposal that will be considered at the 2025 annual shareholders meeting.

This article is sourced from the internet: HashWhale BTC Mining Weekly Report | Miners’ trading volume share has fallen below 5%; US-listed Bitcoin mining companies account for 25.3% of global computing power (01.06-01.12)

Original | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) First, the fat penguin made everyone rich and celebrated, and then Azuki issued a coin. After 3 years, the Azuki coin issuance has finally come to fruition. At 8am this morning, @animecoin released a detailed announcement about the official launch of ANIME tokens in January, which mentioned that 37.5% of the tokens will be allocated to the Azuki community. Subsequently, the news was forwarded and confirmed by Azuki officials. As soon as the news came out, the Azuki series of NFTs generally rose, and the floor prices of Azuki Elementals and BEANZ rose by more than 20% in 24 hours. Many community members expect that Azukis coin issuance can create another wave of NFT wealth-making miracles…