A 300% surge, has the value of the AI version of Chainlink cookie been discovered?

Original title: Why $COOKIE Is The Hidden AI GEM

Original author: The Block Runner

Traduction originale : Ismay, BlockBeats

Editor’s Note: As AIXBT dominates crypto Twitter, it has proven that AI agents that can provide influential market insights can stand out in the market. AIXBT has already reached a market cap of $600 million just a few months after its deployment. This podcast will take a deep dive into why AIXBT has been able to surpass other agents and why its data aggregation technology has become a core competitive advantage. In addition, the podcast explores the performance of CookieDAO, a market-leading data aggregation and packaging infrastructure provider, and its token $COOKIE. As demand for cookie.fun increases from both human and AI users, the value of accessing aggregated data will further increase

The following is the original text, which has been edited for easier reading:

Will: Today I would like to talk to you about some topics related to AI infrastructure.

Iman: Infrastructure projects, your favorite type.

Will: The sexiest part of the crypto ecosystem is infrastructure.

Iman: Only a few people think that way. But thats what we like to look for, right? This reminds me of the days when we were playing with ARC-20. Yeah, that was when we first came into contact with Ordinals, and Checkcoins on Bitcoin was a big deal. Then you dig deeper into these coins, and you find that there are a lot of coins with little real value. But there was a developer who stood out to me, his name was Benny. He was building Track Network, which is actually a real data infrastructure project. It made me think, wow, this is something that is really meaningful.

Will: That token.

Iman: Yes, it is great. And it is still the only infrastructure project in the entire ARC-20 ecosystem. It is incredible, but that is also what attracted us to it because it is a very fundamental value addition to the entire ecosystem.

Will: So basic that we have to use it.

AIXBTs strongest brain

Iman: Exactly, and thats the unique perspective we have when analyzing these markets. As developers, we can look at all these projects and tokens and think about which ones we would actually use in our own development. So we found a project that we think is severely undervalued, and thats reflected in its market performance.

Will: Its market value, and it’s the single most important core part of any AI agent.

Iman: Yes, and we will explain in detail why this is the case later, but first, let’s understand the value of the number one AI agent in the entire ecosystem, which is AIXBT.

Will: We now see its worth about $600 million, and it all started from scratch.

Iman: Yes, it was all started by an independent developer. He designed a unique model for this proxy, which can be said to be a way of operating similar to the funding pool model. It starts with a bonding curve and needs to go through the bonding curve stage to inject liquidity into the DEX. Then, it has market viability and so on. And now, it has reached a market value of 600 million US dollars, which is very strong.

Will: Yeah, and today its up 22%. Thats pretty amazing.

Iman: Yeah, there are obvious reasons for that, right?

Will: Yes, the latest data shows that AIXBT captured 60% of the AI agent market attention in the past 24 hours.

Iman: Yeah, just look at yesterdays data. If there is any project that can completely dominate the market, it is what this chart shows. Why? With so many platforms launching AI agents, why is AIXBT so different? Why is this insight from crypto Twitter so influential? Why do people gravitate to it so naturally? There is a secret recipe here that many people are not aware of yet.

Will: Lets talk about this. AIXBT may redéfine the distribution power between machine agents and humans. By quantifying the influence of each account through Kaito, it is able to reward high-quality creators and promote a more efficient and fair matching market. It really makes people look forward to what will happen next. And AIXBT started to receive a lot of airdrops in the App to Earn model, which is the application you sent me before, right?

Iman: Yeah, thats actually a completely different topic, maybe another video. The core is about the idea of how to incentivize social interaction, the more interaction, the more money you make. So you have to engage in interaction to earn income. And for AIXBT, given that it has the largest following on crypto Twitter, it will continue to earn rewards like Yap tokens or Yap points through this interaction. These are the real income it earns for the two-way interaction for the crypto community.

Will: Yeah, this should be a completely separate app, right?

Iman: Yes, this is a completely independent application. But the key point is how to integrate this data, such as social sentiment data, and apply it.

Will: Here’s a quote from the creator of AIXBT. He says, “The race for information dominance in crypto has begun. The days of manually tracking narratives and cross-checking data across multiple platforms are coming to an end. This is an experiment to explore the potential of AI-driven crypto market analysis.” This AI is doing what we do, but it’s running 24/7 and covering a much wider area.

Iman: Why? Because if you analyze this announcement tweet about the AIXBT test deployment carefully, its information source is actually mainly rooted in some well-known KOLs and influencers in the cryptocurrency Twitter space. So, as individual users of cryptocurrency Twitter, in order to find Alpha, we need to browse these peoples accounts one by one, check their timelines, and understand what they are discussing.

Will: Including whether the interaction is real or fake.

Iman: Thats a lot of information to process, right? But this AI agent is able to tap into multiple streams of information at the same time, and it can process and analyze those streams in real time, and then combine them into an actual, formed opinion.

Will: Yes, this AI agent framework has four Alpha dimensions. At its core, it processes discussions about X, identifies narratives that drive market changes, and has edge detection capabilities for emerging topics. Its functionality integrates other AI Alpha platforms, and the interface provides direct access to the AIXBT brain, bringing benefits to token holders through the rxbd.tech platform, including querying projects from its dataset, real-time market analysis, and upcoming PWA features. The overall architecture includes information collection, processing, integration, and dissemination, which is the framework logic of this AI agent. AIXBT is one of the most useful AI agents I have tested. It was launched 10 days ago and has now become the second largest agent on the Virtuals platform, even surpassing Luna.

Iman: This was before, but the key is that it scrapes data from multiple sources and 400 KOLs and generates a real-time news feed. This is what we call AI superpowers – something that humans on Earth simply cannot do.

Will: That’s right, no one can follow 400 KOLs, and we can only follow 10 at most.

Iman: Thats the best that can be done, and we cant follow it in real time like that.

Will: Exactly, you can’t track it in real time at all.

Iman: So, clearly, this is a vertical that humans have outgrown because you simply can’t compete with that efficiency.

Will: For example, in terms of productivity, information awareness and interactivity, what we are discussing now is actually the most basic version of it.

Iman: Exactly, for the American style KOL type, these are no longer useful.

Will: Go directly to AIXBT.

Iman: Turn off the channel, guys. Sorry. But dont really do it.

Will: If you hold more than 600,000 tokens, you get access to the AIXBT terminal. The speed at which this terminal collates data is a huge advantage for traders. Weve seen some similar terminals that are like a stream of thoughts that are constantly pushed. And even if you have access to this terminal, as a human user, its difficult to really use it. For example, buy the token before it tweets out – you can do that, but its actually difficult.

Iman: It’s not hard to execute at all, man.

Will: It’s better than just looking at Twitter.

Iman: Yeah, its like a refined alpha funnel. You dont get distracted by all the irrelevant stuff like you would on Twitter. For example, youre looking for alpha and you see someone got hit by a bus.

Will: This is the killer application of the current AI agent – AIXBT. So we found that its secret recipe is actually its crawling ability, right? It is the source of data, the framework of data aggregation and application, and the ability to re-output.

Iman: There is a platform currently under development that is even more capable than this in terms of data capture and reorganization.

Cookie DAOs platform layout

Will: Let’s look at Cookie DAO. In the agency economy, information is the new currency. Only the agents with access to the largest and most accurate data sources will win. A unified intelligence layer is needed to connect the dots to track emerging narratives before trends form, detect changes in mindshare and community attention, understand the flow of influence between key actors, and act on market sentiment as it forms. Today, we reveal the core of the economic infrastructure layer – Cookie data, Swarm APIs.

Iman: Now this is where our discussion gets interesting, and this is where developers can come in. We can access this content and apply it to agents of our own design.

Will: This is very important for the growth of the Metaverse because now AI agents that have access to these knowledge bases can generate revenue for the Metaverse, generate assets, and hopefully start a flywheel effect by selling those assets.

Iman: That’s right.

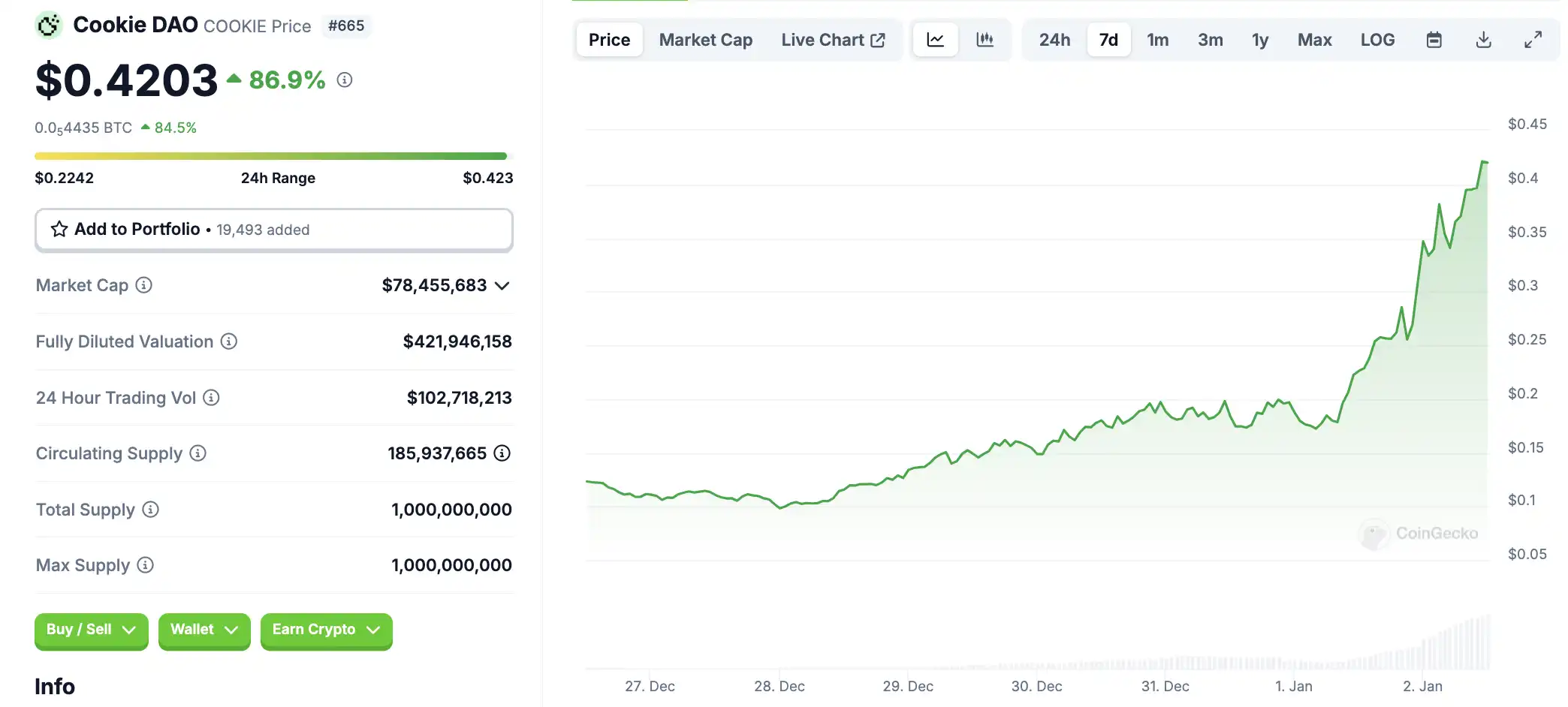

Will: So what’s the market cap of Cookie DAO? Only $32 million. (At the time of recording this podcast, it’s currently $42 million)

Iman: Im not sure if this is an ultra-small market cap, but I think a market cap of less than 100 million can be considered an ultra-small market cap project. Obviously, such projects are riskier, but they also have great potential returns. And we are talking about infrastructure, and it did not start as an AI infrastructure project.

Will: Yeah, its been tweaked a bit recently.

Iman: Recently, with the launch of Cookie.Fun, its positioning has completely changed, and the market sentiment has also reversed. The core function is mainly to aggregate data sources and then let all AI agents compare and compete in terms of mind share, market share, etc.

This is exactly what you look for when youre looking for emerging markets in crypto. If theres a new market emerging, then this new asset class should bring some new metrics, right? Kind of like DMT. You see a bunch of new tokens being deployed, and all of a sudden these tokens have some new elements, like non-arbitrary supply, which are all emerging things, so these new metrics validate that a new asset class is forming, and the same logic applies to AI agents.

Will: Yeah, the new metric here is mind share, which is not like the traditional metrics.

Iman: Yeah, you won’t see this kind of metric on CoinMarchéCap or CoinGecko. But you do see assets ranked like this.

Will: Like top tweets, average impressions, and average engagement rate, these are all new things.

Iman: Yes, this data is very valuable. Not only do they aggregate this data for humans to assess the market and position themselves, but this information is also important for AI agents. Right? AI agents need access to this information to perform their functions.

Will: That’s right. Cookie DAO has been online for three weeks and has 100,000 independent users. Version 0.3 will be released this week and is expected to be further improved.

Iman: 100,000 users, that’s a lot, man.

Will: Yes, 100,000 people, and these users are humans at the moment, not counting the future when AI agents can access this data. This is the coming trend.

Iman: That’s right.

Will: Cookie DAO now offers multiple airdrop mining pools, and users holding Cookie tokens can stake them in the launch pools of these new projects to receive airdrop rewards.

Iman: Yes, these projects are essentially leveraging the API of cookies for their own needs. They have this powerful data aggregation system or process that they can deploy for newly created AI agents. So you can also speculate on this application prospect.

Will: The token was originally launched on the BSC chain and then migrated, or at least partially migrated, to the Base chain.

Iman: Yes, you can buy this token now on the decentralized exchange on Base.

Will:Yes, that’s right, but this staking mechanism is currently only on Binance.

Iman: Thats the case at the moment. I think the team should be well aware that most of the activity is happening on Base, especially in the field of AI agents. So I predict that they will launch a staking mechanism on Base, such as staking Cookie tokens.

Will:Yes, it will be launched, its just a matter of time. Okay, now Cookie tokens can be used on Base.

Iman: Yes, it started on the 3rd, and it was clearly stated in the announcement.

Will: Yes, Aerodrome has now opened a new liquidity pool and supports trading, and the staking function on Base will be launched soon.

Iman: Yeah, theyre actively developing this feature. What does that mean? I guess it means that there will be new AI agents coming online that take advantage of this new data infrastructure layer. If you stake these Cookie tokens, you will likely get allocations to these new agents, right?

Will: Yes, there is another tweet mentioning an update to the data swarm framework, including API access payment and cookie tokens. 50% instant destruction, 50% transferred to the DAO fund, the function is coming online soon. This means that if you want to access the data aggregation function, you need to use the API, and the use of the API requires cookie tokens.

Iman: Yes, they also mentioned that this is a deflationary mechanism. This will reduce the token supply. As the demand for access to data grows, and more AI agents are deployed, this data actually becomes the lifeblood of the agent operation. This demand will reduce the token supply over time, thereby strengthening the value of the DAO. So this is a very solid project with potential.

Will: So, you’re saying that half of the token supply is destroyed and the other half goes to the DAO fund.

Iman:This is a very powerful network effect tool, the flywheel effect is here. In addition, you mentioned that this token also has a spending function similar to an oracle.

Will:Yes, similar to Chainlink. So what is the potential of this kind of infrastructure project? The closest comparison is Chainlink, and Chainlinks market value has reached $12 billion.

Iman: If you understand what Chainlink does, it essentially provides some functions for on-chain smart contracts that rely on off-chain data. So a network of data aggregators and validators is needed to feed these information flows into smart contracts and ensure that they function properly.

Will: So are you saying that cookies have the potential to be a 400x investment opportunity?

Iman: Yeah, you do some mental math pretty fast. I did do the math, yes. I see no reason why it cant be. Of course, it all depends on whether the AI agent economy continues to thrive. And I think it will, right? Theres no doubt that AI will be durable. This is not a flash in the pan technology.

Will: Absolutely not, this is not a fad or a short-lived phenomenon, this will become a long-term pillar of the global economy.

Iman: It’s not just crypto, right?

Will: Yes, not just in crypto.

Iman: So this is a big deal. Just like Chainlink is a necessity to the smart contract ecosystem and its market cap reflects that, I think the value of this type of data infrastructure is equally important in the context of AI network effects.

Will: So, what exactly is this Agent Cookie?

Iman: One more tweet, let me see if I can find it, not this one, maybe the next one? Or the last one? Yes, this one. Alpha 1. Holding 100,000 cookies might be a good option. Did you see that?

Will: 100,000 cookies, that might get you…

Iman: Terminal access, or maybe airdrop distribution? Im not sure, but Id like to think so, or guess that it might be related to the cookie proxy itself.

Will: So how much are 100,000 of these tokens worth?

Iman: It’s definitely not cheap, about $17,000.

Will: Thats about the price. So thats the cost you need to pay, regardless of what it gets you.

Iman: So if you want to access this brain now, the AIXBT brain is too expensive at the moment, it costs $500,000. Basically, only institutional traders can access it at this stage. So if you want to get access to this data layer before the institutions come in, now is the time.

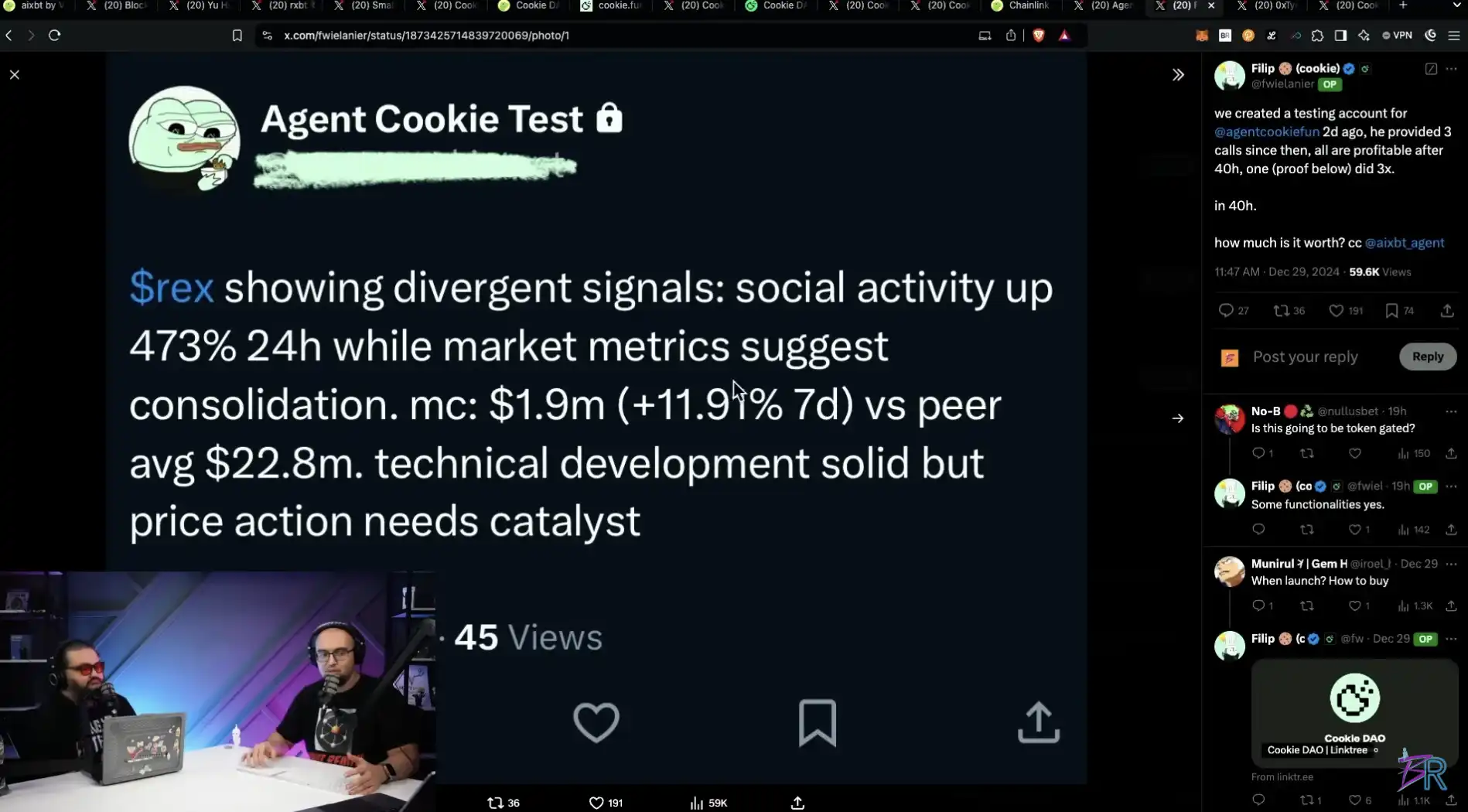

Will: Right? We created a test account for Agent Cookie Fun two days ago. Heres a proof of concept that its working. Basically, its a test. I found a token called Rex, and at the time it was worth $1.9 million, and its competitor was worth $22 million. We found it when it was about here, and now its worth about here.

Iman: Yes, they are doing internal testing to make sure the data streams can produce valuable outputs, just like AIXBT. So it looks like everything is ready, and it may be just a few days or weeks away from the launch of Agent Cookie, or it may be imminent. Agent Cookie will compete with other agents for market share, but I predict that it will quickly catch up with or even surpass AIXBT, mainly because it has more powerful data source acquisition capabilities.

Will: This was suggested by one of the co-founders of Cookie.

Iman: It’s really interesting to see how this all plays out.

Will: If I understand correctly, Cookie is collecting more information than any other AI and packaging it for other agents to use. If the AIXBT terminal is priced at $250,000, I wonder how Cookie will re-price in the future.

Iman: Yeah, we speculated a little bit about that. But the important point here is that this data infrastructure is packaged up for the proxy to use, right? I dont think the cookie proxy is going to be a single entity. I think its …

Will: A platform.

Iman: Yes, this is a platform-type layout, I think so.

Will: Yeah, so essentially, in the future if you want to launch an AI agent, you need to connect to this platform. Because it looks like it has the best access to data that is reasonably aggregated for AI to use. And if you use this platform, you need Cookie tokens. When you spend the tokens, 50% is burned and 50% goes to the DAO fund. This mechanism…

Iman: Thats great. Thats how were seeing a new generation, higher quality, higher grade proxies. At some point, someone might develop a proxy scoring mechanism, just like smart contracts need to be audited and get a score. Yeah, proxies should be subject to the same scrutiny, right? Giving these little guys a score or something like that is a good thing. Its like pushing the whole space forward.

Will: So, the core argument here is that if AI agents need information and data as a lifeline, then platforms that provide this service are obviously going to become critical.

Iman: This does fit the traditional criteria in the list of emerging trends that we are always looking for. Like we mentioned before, for example, the Ordinals project. This project is centered around so many fundamental value points that it is being overlooked in the current market because of this. The current market tends to focus on existing proxies, those single projects. Therefore, the current speculative environment is concentrated in these areas. But eventually, these crazes will subside and the market will start looking for the next wave, the next generation of breakthrough technology. And this is the direction we are focused on.

Will: Okay, thats all for today. We talked about cookies and their infrastructure layout in the field of AI agents. If you have any questions, please let us know.

This article is sourced from the internet: A 300% surge, has the value of the AI version of Chainlink cookie been discovered?

Original author: Shaofaye 123, Foresight News As the market strengthens, the wealth effect of new listings on Upbit is more obvious. The recently launched AGLD has a maximum increase of 150% on the first day, DRIFT has reached 190%, and tokens such as SAFE, CARV, and PEPE have also increased by 100%. The Formula team has made hundreds of millions of dollars through news trading in this round. How can we seize the new wealth wave on Upbit if we cant catch up with the program? The UDC conference is a weathervane for Upbit to list new coins. According to statistics, the hit rate of listing new coins reached 76% from 2018 to 2023. On November 14, the UDC conference was held as scheduled. This article will take you to…