pump.funs monthly revenue exceeds $100 million, 16 pictures reveal Solana ecosystem performance in November

Original | Odaily Planet Daily ( @OdailyChina )

Auteur : Wenser ( @wenser 2010 )

Le crypto market has seen a general pullback in recent days, but the Solana ecosystem still performed extremely well last month and is expected to quickly recover prices and continue the bull market in the ecosystem.

Selon statistiques , in November 2024, Solana native DApps earned $365 million in revenue, a monthly record high; nearly 84% of the revenue came from the DeFi ecosystem, and wallets and infrastructure accounted for less than 15%. In addition, 20 Solana DApps had monthly revenues exceeding $1 million, and pump.fun became the first Solana protocol ever to have monthly revenues exceeding $100 million. Odaily Planet Daily will combine Syndicas relevant reports to sort out the performance of the Solana ecosystem in November in this article for readers reference.

Solana: Ecosystem and Protocol Revenues Both Hit New Highs

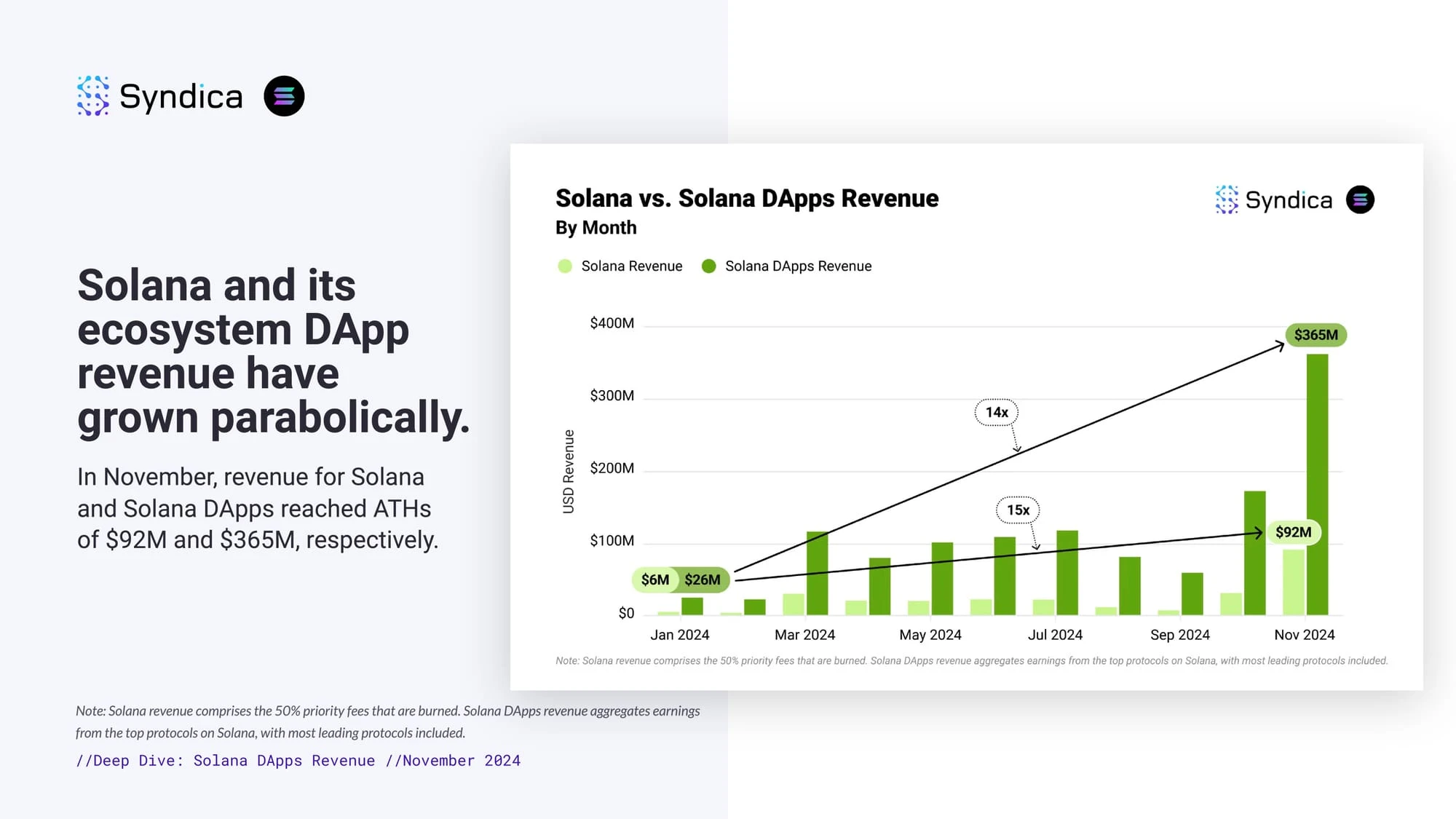

According to statistics, in November, Solana ecosystem revenue and DApps revenue reached US$92 million and US$365 million respectively, both hitting new highs of the year. The former was only US$6 million at the beginning of the year, a 15-fold increase; the latter was only US$26 million at the beginning of the year, a 14-fold increase.

It is worth mentioning that 50% of Solana ecosystem revenue is mainly used for SOL token repurchase and destruction; DApps revenue statistics mainly come from head protocol data, which is an incomplete statistics.

At the same time, according to Coingecko data, the price of SOL was only around US$101 at the beginning of the year. It had previously broken through a new high of US$263 on November 23, and has now fallen back to around US$188. The annual increase remains at around 88%.

Solana Ecosystem and DApps Revenue Chart

Solana Ecosystem Protocol: pump.fun stands out, with 10 protocols generating monthly revenue exceeding 10 million

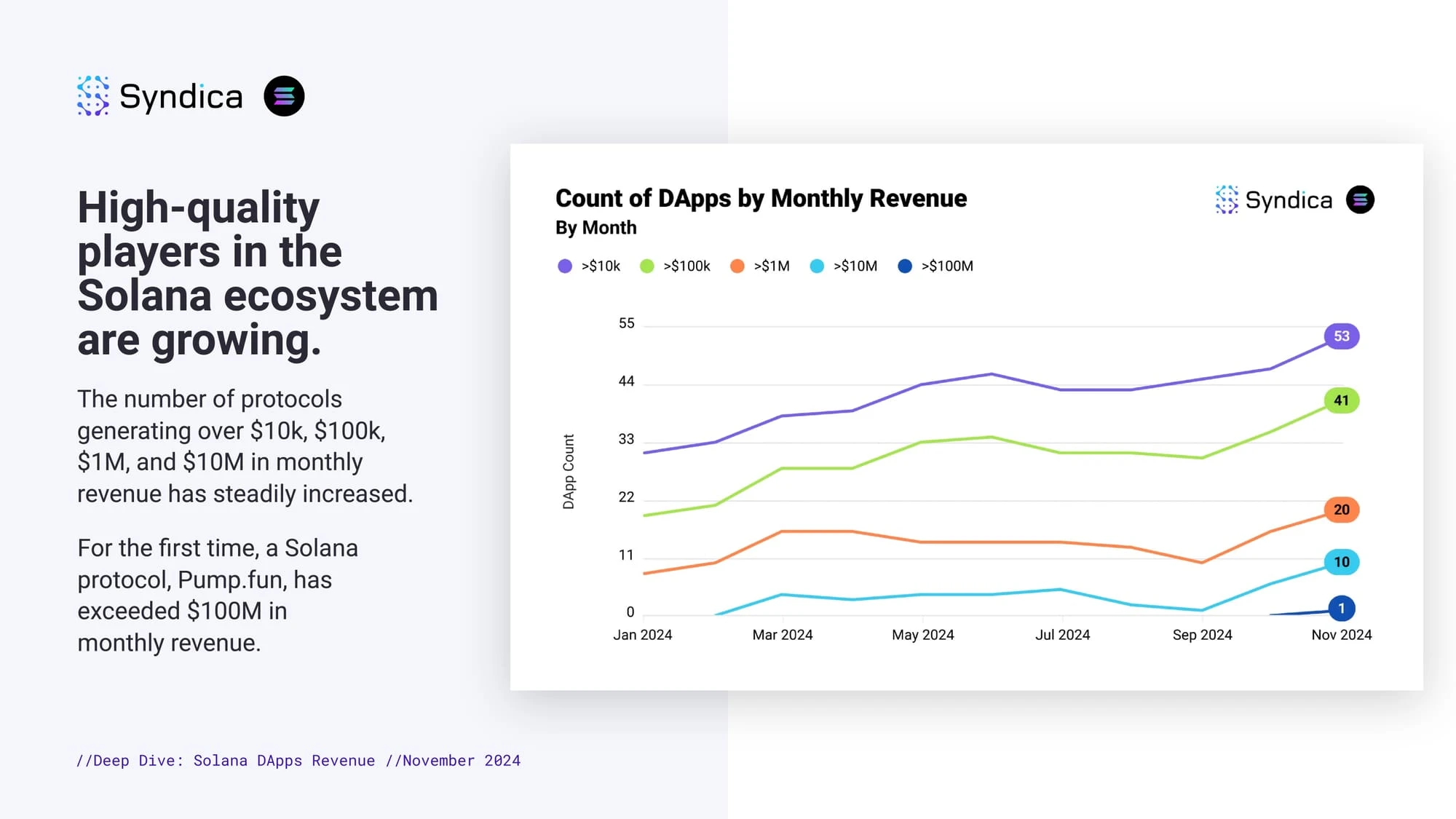

Another example of the rapid development of the Solana ecosystem is the number of protocols with impressive revenues. In November, 41 protocols had monthly revenues exceeding $100,000; 20 protocols had monthly revenues exceeding $1 million; 10 protocols had monthly revenues exceeding $10 million; and only one protocol, pump.fun, had monthly revenues exceeding $100 million.

According to Syndica statistiques , pump.fun ranked first in Solana protocol revenue in November with a revenue of US$106 million, thus winning the title of Solana ecosystem protocol with revenue exceeding US$100 million in the first month; other top-ranked Dapps include Photon, Raydium, BullX, Trojan, BONKbot, Phantom, Jupiter and other DEX, Telegram Bot, wallet and other infrastructure projects.

Solana Ecosystem Dapps Monthly Revenue Segment Statistics

Top 8 data on agreement revenue

The main reason for Solanas growth: DeFi sector is king, and the Meme ecosystem has skyrocketed more than 300 times

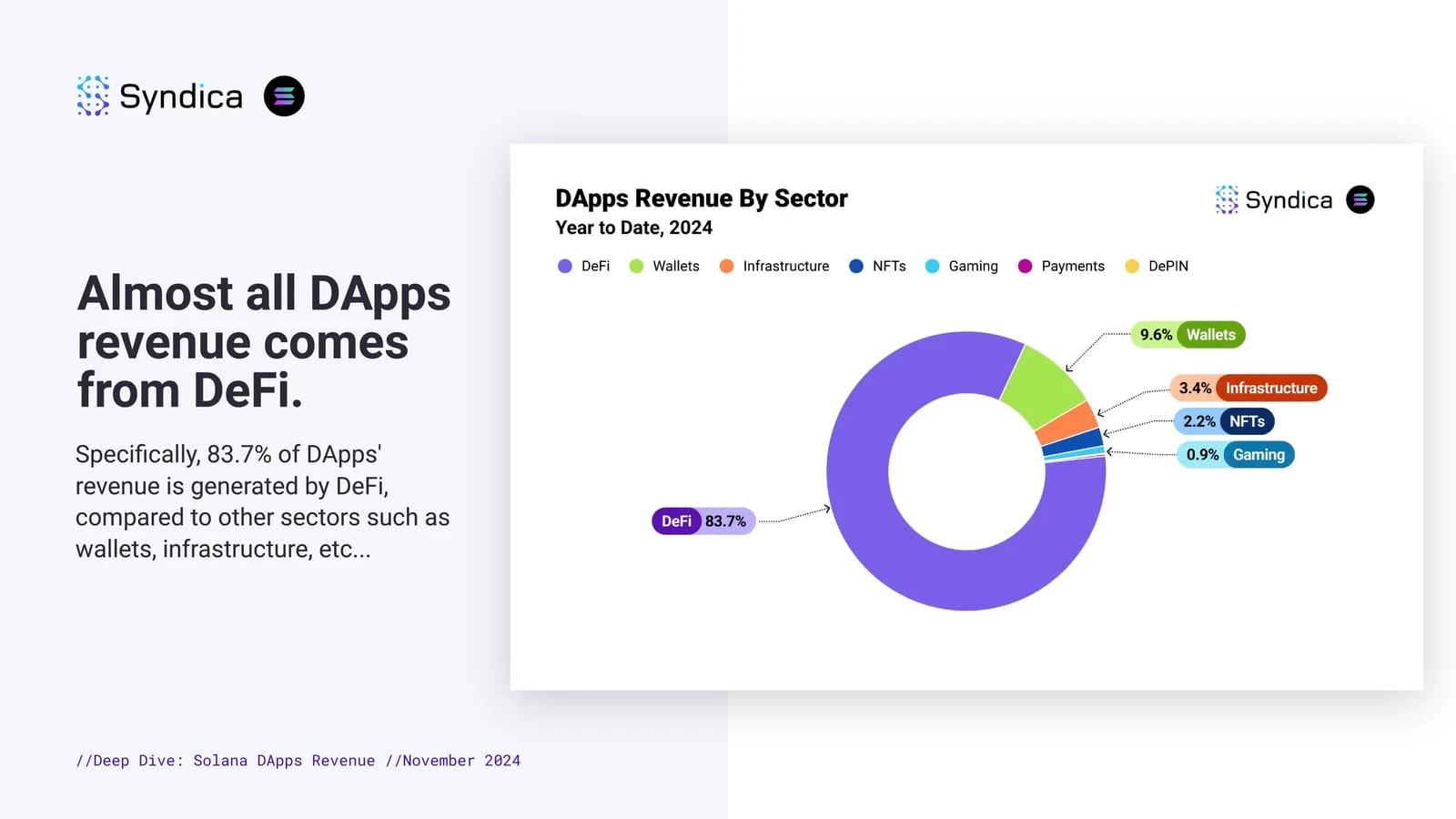

According to statistics, 83.7% of Solanas ecological protocol revenue comes from the DeFi sector; in contrast, wallet-related protocol revenue accounts for 9.6%; infrastructure project revenue accounts for 3.4%; NFTs sector revenue accounts for only 2.2%; the game sector revenue accounts for even less, only 0.9%; the smallest is the payment sector and DePIN sector, accounting for less than 1%.

From another perspective, there is still a lot of market space in the Solana ecosystem, and there is great potential in the gaming, payment, and DePIN sectors.

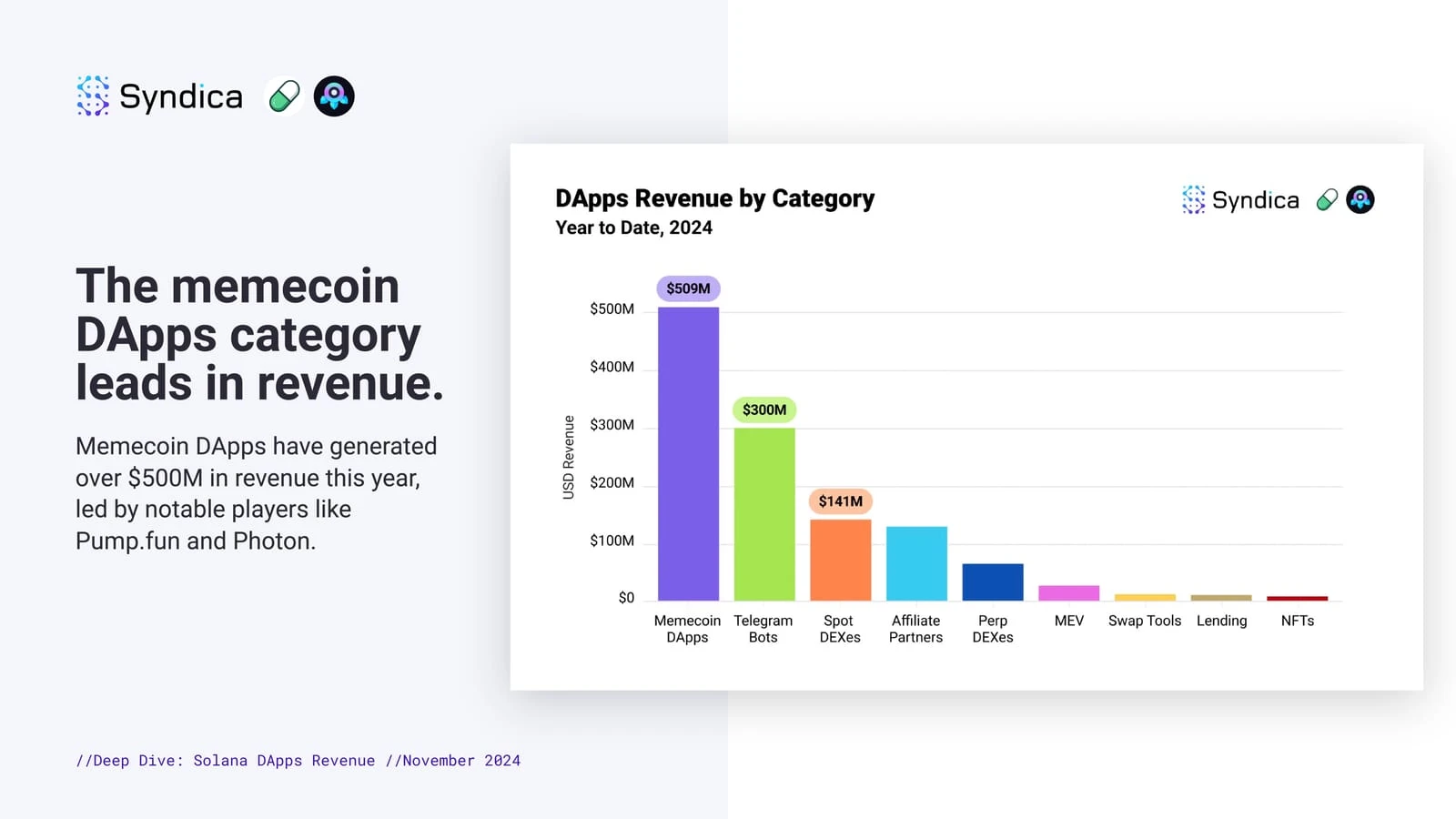

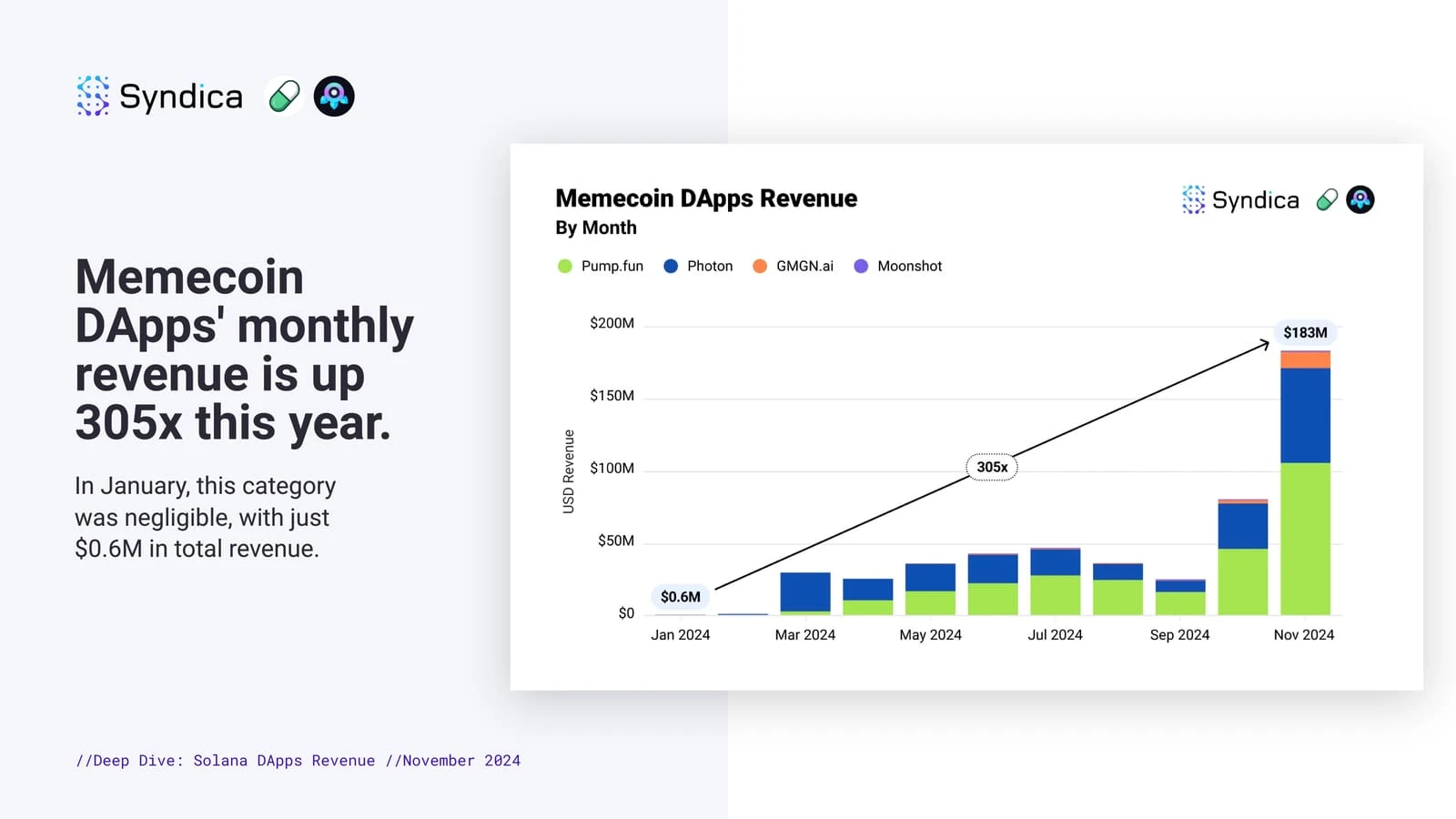

In the DeFi sector dominated by the Solana ecosystem, Meme coins and protocols supporting Meme coins account for the largest share of revenue, with annual revenue of $509 million, followed by the Telegram Bot sector, with annual revenue of $300 million, and spot DEX ranked third with annual revenue of $141 million. It is worth mentioning that the monthly revenue of Meme coin-related DApps increased from $600,000 in January to $183 million in November, a growth multiple of 305 times, which can be called an industry wonder.

In addition, thanks to pump.fun, Raydium has also become the biggest beneficiary of this sector. In November, the platforms monthly revenue reached 32 million US dollars, far exceeding Orca and Lifinity, equivalent to 8 times the monthly revenue of Orca; equivalent to 32 times the monthly revenue of Lifinity. In addition, since April, the ratio of FDV of DEX tokens to the monthly revenue of the protocol has gradually stabilized and gradually remained in the range of 85% ± 10%.

Thanks to the good performance of the project, Raydium repurchased a total of 5.4 million RAYs in November, worth up to US$28 million, for distribution to pledgers.

Solana Ecosystem Revenue Proportion Statistics

Meme coin-related DApps dominate the market

Meme coin-related DApps have increased dramatically

Raydium leads the spot DEX track

RAY token holders enjoy Raydium spillover effects

A niche track with unlimited potential: Telegram Bot becomes an ecosystem wealth-making machine

Also benefiting from the booming Meme coin ecosystem, Solana has provided a fertile ground for the growth of a large number of Telegram Bots.

With the growth of DEX trading volume, the total revenue of Telegram Bot-related protocols reached 82 million US dollars, which is twice the total revenue in October; accounting for 4.5% of the DEX trading volume, and this proportion is becoming more and more stable. BullX and Trojan have become the top two DApps in this track, with monthly revenues exceeding 20 million US dollars and total revenues approaching 60 million US dollars.

Telegram Bot becomes a money-making powerhouse in niche markets

Solana Ecosystem’s “Super Application”: Jupiter’s JLP Becomes the Best Target

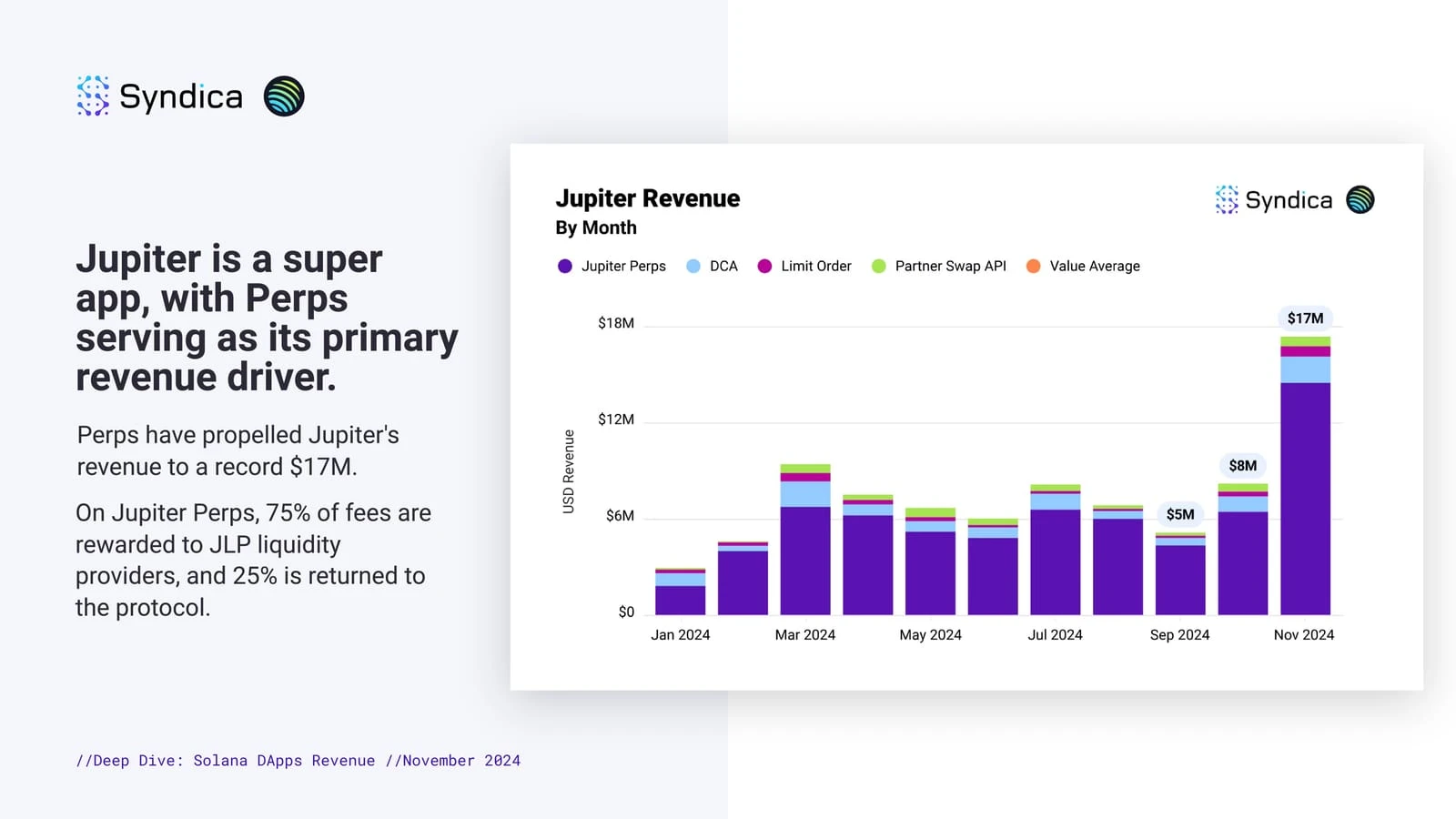

In November, driven by the Jupiter perpetual contract, its protocol revenue grew to $17 million. 75% of the perpetual fee is allocated to reward JLP LP, and the remaining 25% is returned to the Jupiter protocol. Therefore, JLP has become a popular investment target for a lot of funds.

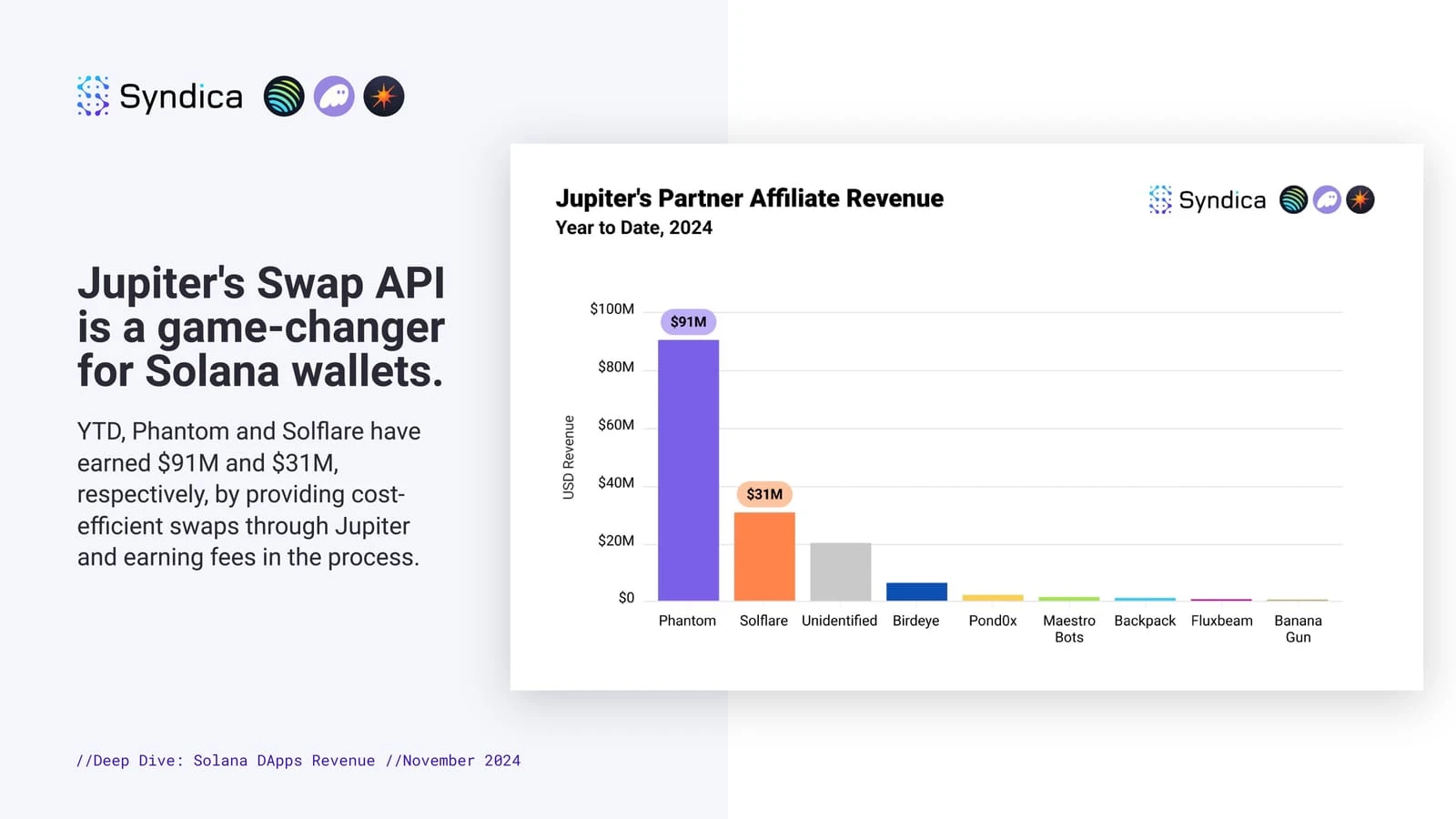

As for partners who have integrated the Jupiter Swap API, their overall protocol revenue has grown to US$153 million this year, with Phantom Wallet ranking first with annual revenue of US$91 million; Solflare ranked second with US$31 million in revenue; and aggregation platforms such as Birdeye followed closely behind.

Jupiters monthly income in 2024

Jupiter Swap API Partner Revenue at a Glance

Phantom is the biggest winner

Solana Ecosystem Potential Sectors: Lending, NFT, Payment, DePIN

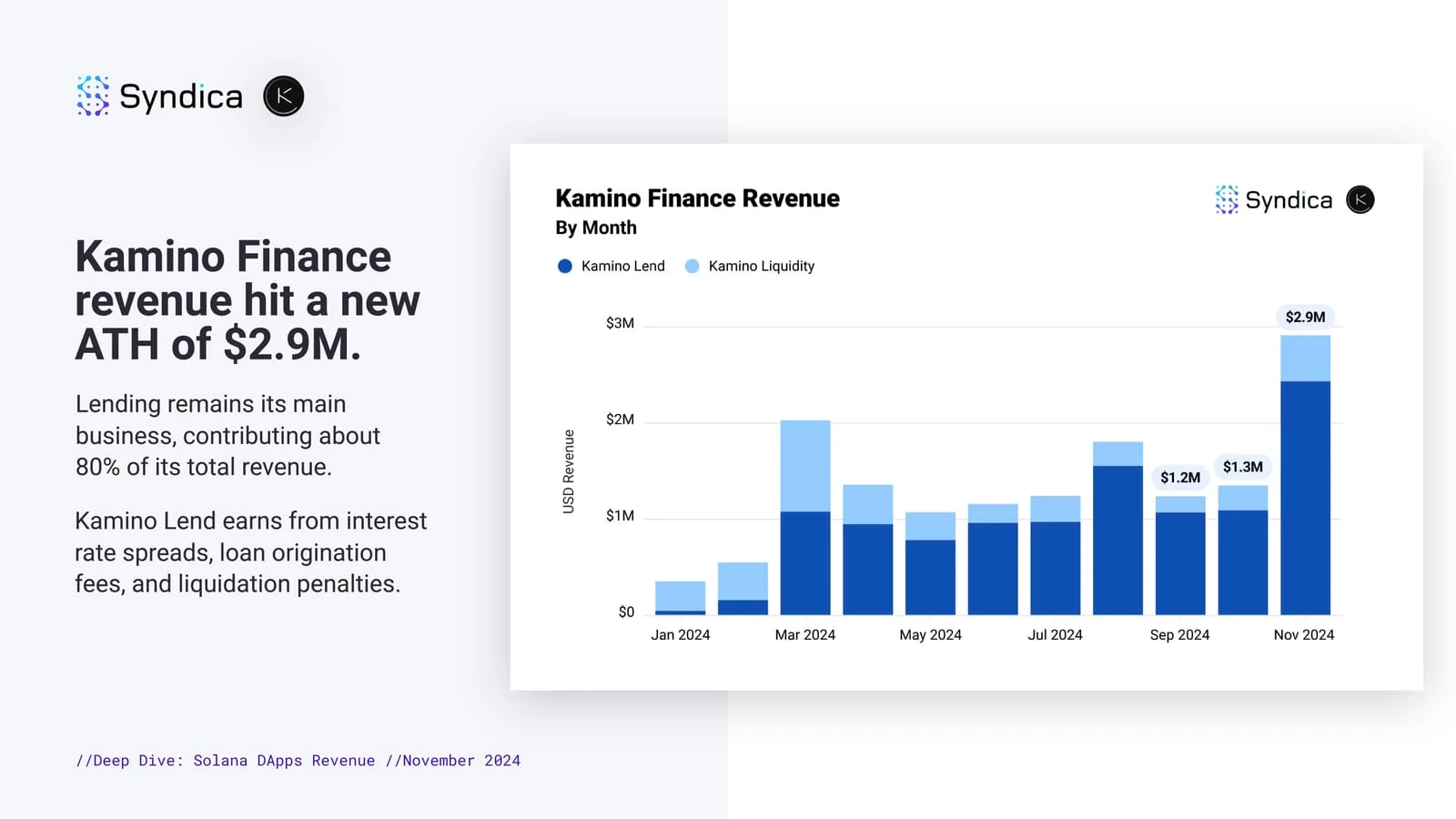

In November, Kamino, the leading lending platform in the Solana ecosystem, also performed extremely well, with its protocol revenue breaking a new high of US$2.9 million, of which 80% came from lending.

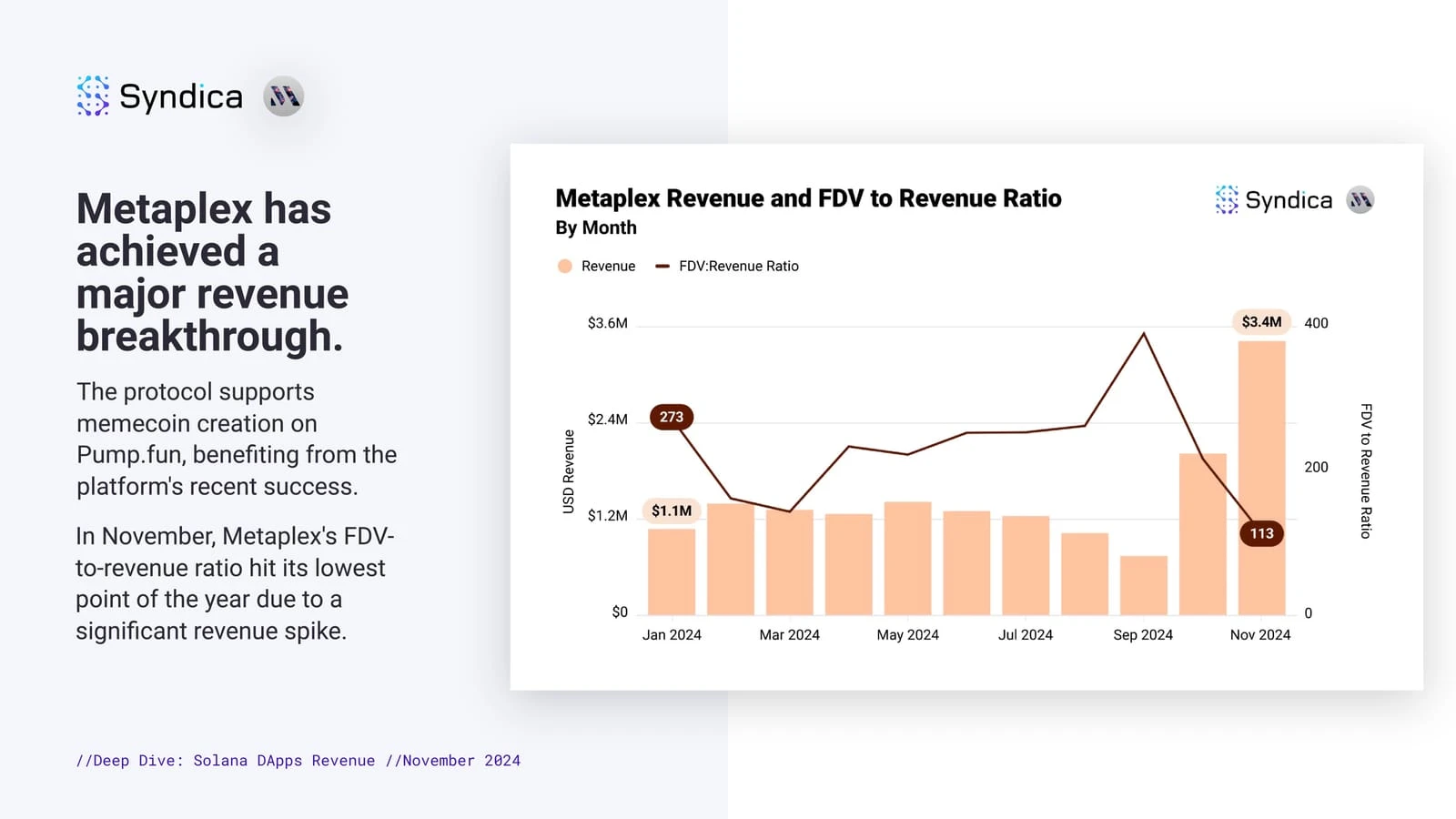

Solana Ecosystem NFT Platform Metaplex is a low-key and almost invisible player. As the underlying blockchain protocol for almost all tokens, meme coins and NFTs on the Solana network, it also set a record high protocol revenue in November, reaching $3.4 million; and its FDV/protocol revenue ratio also dropped from 273 in January to 113 in November. The stability of the project operation has improved a lot, and it has lost some of its previous false fat. Its token MPLX once rose by more than 20% because the Metaplex Foundation announced the launch of the Aura network in September.

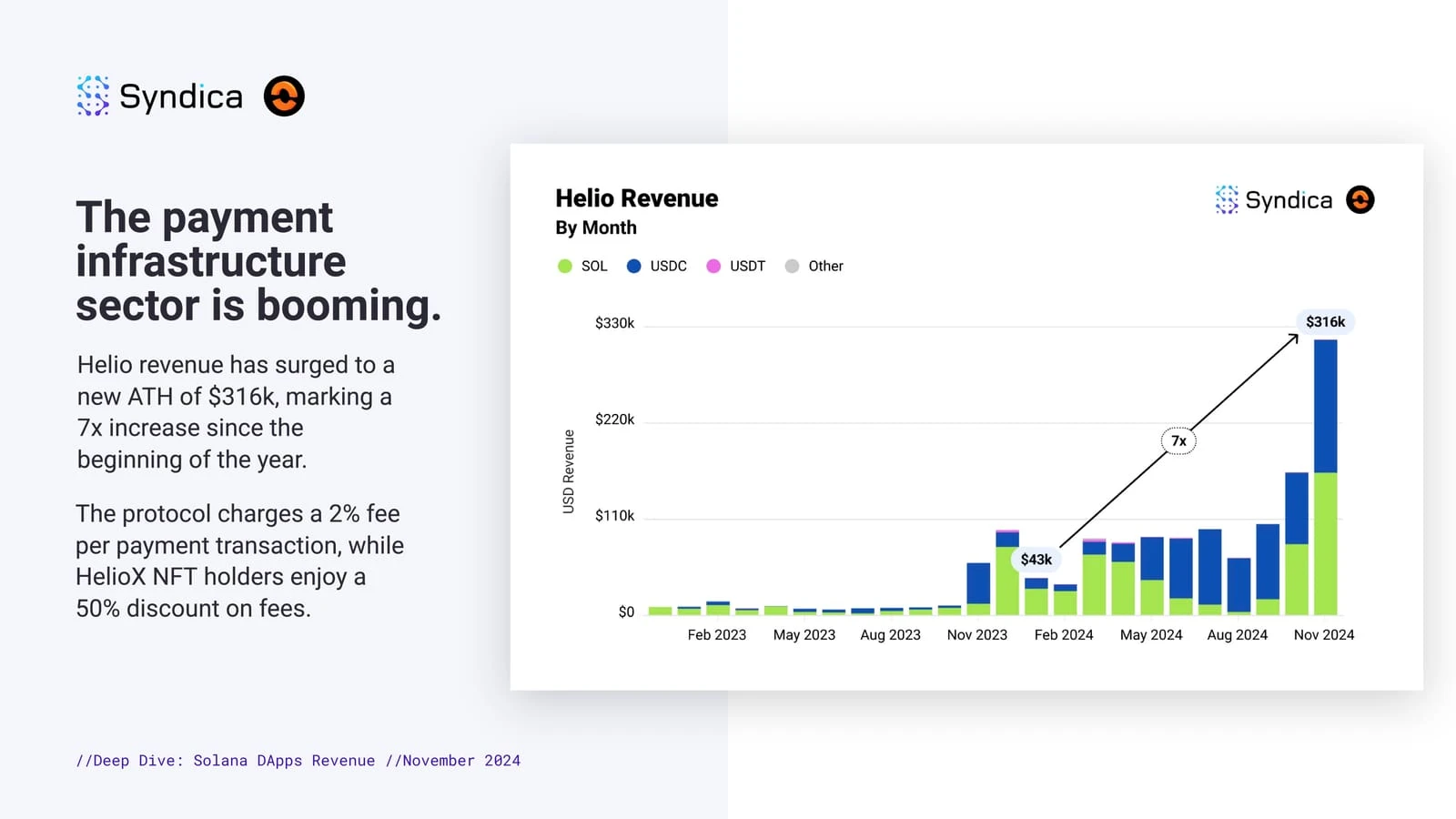

In the payment sector, many projects in the Solana ecosystem now seem to be on the eve of an explosion. Among them, the monthly revenue of the crypto payment company Helio has increased from $43,000 in January to $316,000, an increase of nearly 7 times. The project charges a 2% handling fee for each transfer payment, and HelioX NFT holders enjoy a 50% discount, with only a 1% handling fee.

In the DePIN sector, the top projects of the Solana ecosystem mainly include Render Network, Nosana, Helium, and Hivemapper. The monthly revenue of the four projects has steadily increased from about US$150,000 in January, and the total revenue in November reached US$669,000, an increase of about 446%. It is worth noting that the income calculation here is based on the destruction value of RENDER, HONEY, NOS and other tokens, for reference only.

Kamino becomes the leading lending platform

Metaplex FDV/Revenue Ratio Declines Significantly

Payment infrastructure is on the eve of an explosion

DePIN sector is stable and making progress

Conclusion: Solana is still walking on one leg in the short and medium term, and hopes for Trumps favorable crypto economy in the long term

In the short and medium term, the bulk of Solana ecosystem revenue still comes from the DeFi and Meme coin sectors. The DePIN track, which has always been highly anticipated by the Solana Foundation and the Solana community, has not yet fully opened up despite the dream start of the SAGA mobile phone; the payment sector is in the early stages of development. Perena, a stablecoin exchange pool project founded by Anna Yuan, a former member of the Solana Foundation, is expected to bring new changes to the current situation, but it will still take some time to attract more liquidity.

In the long run, the continued development of the Solana ecosystem still depends on a series of crypto-economy-related benefits launched by Trump after he officially takes office as US President, allowing more funds, capital and blockchain infrastructure construction to be deeply integrated with the US economy, achieving a win-win situation of ecology, token market value, and token price.

This article is sourced from the internet: pump.funs monthly revenue exceeds $100 million, 16 pictures reveal Solana ecosystem performance in November

Related: IOSG Ventures: How does AI Meme grab attention and traffic economy?

Original author: IOSG Ventures The amount of news coverage surrounding $GOAT over the past two weeks may have been surprising to many. That an AI-powered token could attract so much attention, including from a16z founder Marc Andreessen and Coinbase CEO Brian Armstrong. Last Thursday, $GOAT reached a new milestone, with its market cap soaring to $840 million and the number of holders continuing to increase. This significant price growth ultimately led to the listing of $GOAT’s perpetual contract on the Binance exchange. Source: Binance website For those who are experiencing FOMO and are ready to jump in, it’s best to first understand what’s happening in the MEME market recently. $GOAT, $GNON, $ACT, $FARTCOIN, $SHOGGOTH, $FUN, $FLAVIA, $LUNA… a series of artificial intelligence-related tokens have emerged one after another. So what…