Staking APY up to 22037%? Quick calculation reveals USUALs mathematical magic

Original | Odaily Planet Daily ( @OdailyChina )

Auteur : Azuma ( @azuma_eth )

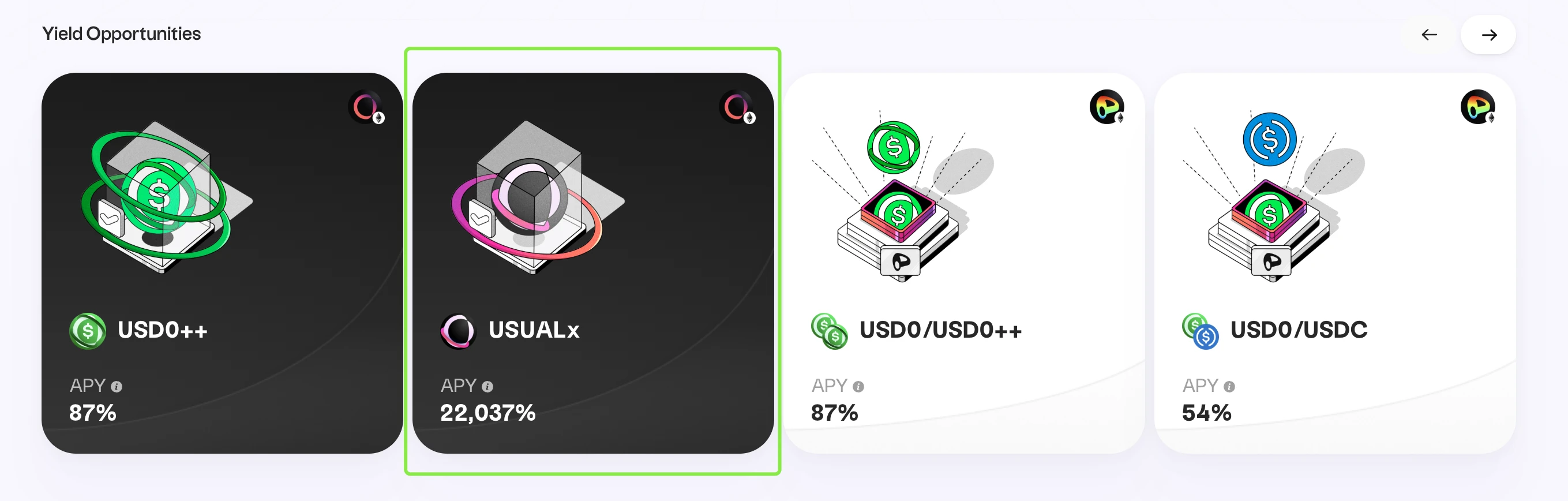

Usual (USUAL), a new stablecoin, has performed well recently. While the price of the coin continues to rise, the amazing yields offered by USUALs official staking channels have also attracted the attention of a large number of users.

Comme le montre la figure ci-dessous, information on Usual’s official website shows that the current real-time APY for staking USUAL is as high as 22037%.

-

Odaily Note: Staking USUAL can unlock governance rights and obtain 10% of newly issued USUAL, which is also the source of USUAL staking income.

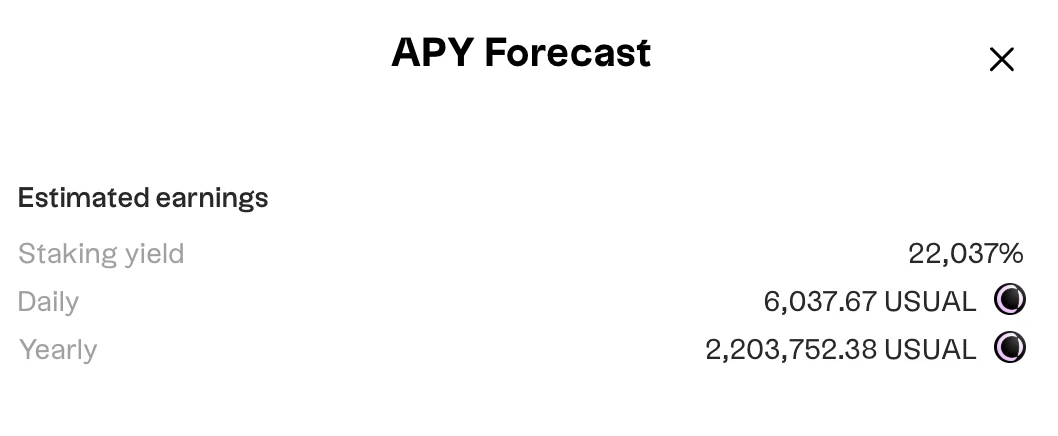

After clicking on the pledge homepage and entering the pre-deposited USUAL amount, the calculation simulation result is exaggerated and more intuitive – assuming that 10,000 USUAL are pledged, it is expected that 2,203,752 USUAL can be obtained in a year, and 6,037 USUAL can be obtained every day…

When many users first saw these numbers, their reaction was “Isn’t this just picking up money?” But is this really the case? Below, we will uncover the magic of USUAL’s staking yield numbers through a series of calculations.

APR vs APY

The older generation of DeFi players may be more aware that although APR and APY, two seemingly similar indicators, are often used to measure the returns of cryptocurrency investments, the actual impact on returns is very different.

En bref, APR does not take into account the effects of compound interest, while APY does incorporate the effects of compound interest into its calculations, which usually results in the APYs returns often appearing to be higher.

For example, if you deposit $1,000 into a pool with an APR of 100%, your income after one year will be $2,000; but assuming that the pool uses a daily compounding mechanism, that is, the interest is calculated and reinvested every day, then your income after one year will be approximately $2,718, corresponding to an APY of 171.8%.

The conversion between APR and APY can be calculated based on the following consensus, where n is the frequency of compounding. If daily compounding is adopted over a one-year period, n is 365.

APY = (1 + APR/n)^n – 1

USUALs math magic

Back to the USUAL staking scenario, the 22037% here is the APY income, and the official clearly mentioned that it will be automatically compounded every day.

According to the formula in the figure above, APY is 22037%, n is 365, and the APR calculation result is 543.65%, corresponding to a daily yield of approximately 1.49%.

Some friends may ask, USUALs pledge mechanism clearly provides a daily compounding mechanism, why should it be ignored? The reason is that under the compounding model, daily income will gradually increase as the timeline lengthens, and when evaluating shorter-term yields, APR figures are actually more reliable.

Let’s take the example mentioned in the previous article, “Assuming 10,000 USUALs are pledged, it is expected that 6037 USUALs can be obtained every day within one year”.

If the deposit is really completed for a full year, the calculation result is indeed valid if the APY remains unchanged. However, in reality, after the user pledges 10,000 USUAL, he will not receive 6,037 USUAL in equal amounts every day.

The reality is that after a user stakes 10,000 USUAL, he will only receive about 149 USUAL on the first day. After that, the daily income will gradually increase with compound interest, because the pledged principal will continue to grow with the reinvestment, and the number 6037 is only the daily average over a one-year cycle – note that all of this is based on the premise that APY remains unchanged.

Potential risks

Putting aside users who make long-term pledges for other reasons, if you rush to buy coins and pledge just because of the high interest rate of 22037%, please be sure to understand the following risks.

Eliminate the risk of pledge wear and tear

Il convient de mentionner que USUAL’s unstaking requires a mandatory 10% fee, which means that based on a daily yield of 1.49%, it will take at least a week for users to recover the 10% unstaking cost after staking.

Risk of increasing pledge scale

The scale of USUAL staking may further expand, thereby diluting the yield.

The current scale of USUALx (staking version of USUAL) is about 26 million, corresponding to about 27.81 million USUAL stakes; the initial circulation supply of USUAL is 494.6 million, and Binance has not yet opened USUAL withdrawals. This means that the scale of USUAL staking is expected to have a large room for growth, which may seriously dilute the real-time yield of the staking pool.

Risk of currency price decline

We cannot predict the market, but the current buying attracted by high interest rates may be an important buying force for USUAL.

All the above calculations are based on the USUAL currency standard. If the downward risk of the currency price is taken into account, there is a possibility that the actual return may be greatly reduced or even the principal may shrink.

This article is sourced from the internet: Staking APY up to 22037%? Quick calculation reveals USUALs mathematical magic