Grayscale: The crypto bull market has not yet reached its peak, and the rise may continue beyond 2025

Original author: Zach Pandl, Michael Zhao

Traduction originale : Luffy, Foresight News

-

Historically, the cryptocurrency market follows a clear four-year cycle, with prices experiencing successive rising and falling phases. Grayscale Research believes that investors can monitor a variety of blockchain-based and other indicators to track cryptocurrency cycles and provide reference for their own risk management decisions.

-

Cryptocurrency is a maturing asset class: new spot Bitcoin and Ethereum ETFs are expanding market access, while the incoming Trump administration is likely to bring greater regulatory clarity to the crypto industry. For these reasons, cryptocurrency market valuations could break out to new all-time highs.

-

Grayscale Research believes that the current market is in the middle stage of a new crypto cycle. As long as the fundamentals (such as application adoption and macro market conditions) are reliable, the bull market is likely to continue until 2025 or even longer.

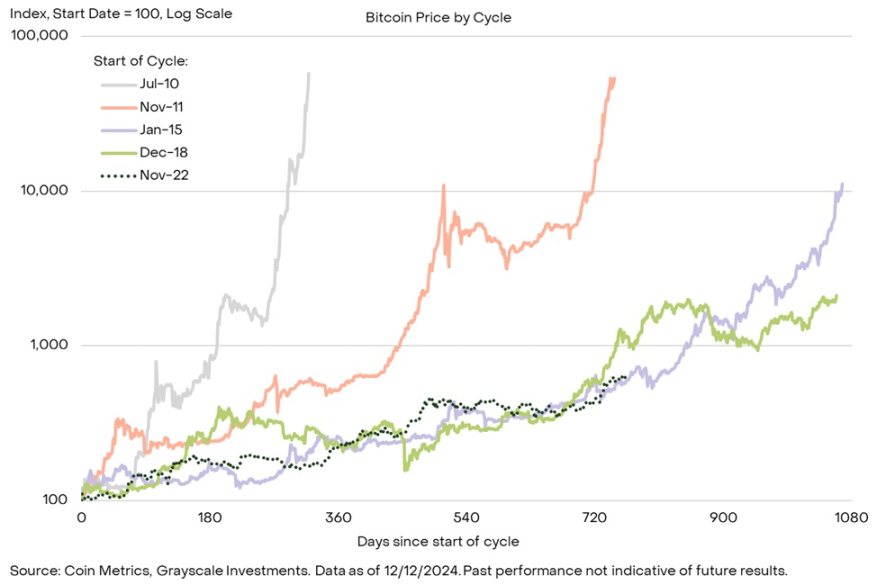

Like many physical commodities, the price of Bitcoin does not strictly follow the random walk model. Instead, Bitcoin price movements show the characteristics of statistical momentum: ups tend to be followed by ups, and downs tend to be followed by downs. Although Bitcoin will rise or fall in the short term, in the long run, its price shows a significant upward cyclical trend (Figure 1).

Figure 1: Bitcoin prices fluctuate repeatedly, but the overall trend is upward

Each past price cycle has had its own unique drivers, and future price movements will not completely follow past experience. In addition, as Bitcoin matures and is adopted by a wider range of traditional investors, and the impact of the four-year halving event on supply decreases, the cyclical changes in Bitcoin prices may be reshaped or disappear completely. Nevertheless, studying past cycles can still provide investors with some guidance on Bitcoins typical statistical behavior, which can provide a reference for their risk management decisions.

Bitcoin historical cycle observation

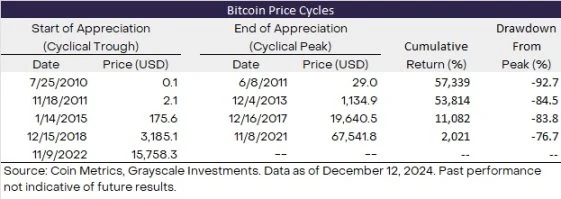

Figure 2 shows the price performance of Bitcoin during the up phase of each previous cycle. The price is indexed at 100 at the cycle low (the beginning of the cycle up phase) and tracked all the way to the peak (the end of the up phase). Figure 3 shows the same information as Figure 2 in a tabular form.

The first price cycles in Bitcoins history were relatively short and volatile: the first cycle lasted less than a year, and the second cycle lasted about two years. In both cycles, the price of Bitcoin rose more than 500 times from its lows. The two subsequent cycles lasted less than three years each. In the cycle from January 2015 to December 2017, the price of Bitcoin rose more than 100 times, and in the cycle from December 2018 to November 2021, the price of Bitcoin rose about 20 times.

Figure 2: Bitcoin has followed similar trends over the past two market cycles

After peaking in November 2021, the price of Bitcoin fell to a cyclical low of approximately $16,000 in November 2022. The current price rally phase began at that time and has lasted for more than two years. As shown in Figure 2, the latest price rally is relatively close to the past two Bitcoin cycles, both of which lasted about three years before the price peaked. From a magnitude perspective, Bitcoin is currently up about 6x in this cycle, which, while a considerable return, is significantly lower than the returns achieved in the past four cycles. In summary, while we cannot be sure that future price returns will be similar to past cycles, Bitcoins history tells us that the latest bull run has room to run in terms of both duration and magnitude.

Figure 3: Four different cycles in Bitcoin price history

On-chain metrics

In addition to observing price performance in past cycles, investors can also apply various blockchain-based indicators to measure the maturity of the Bitcoin bull market. For example, common indicators include: profitability of Bitcoin buyers, new capital inflows into Bitcoin, and price levels related to Bitcoin miners’ revenue.

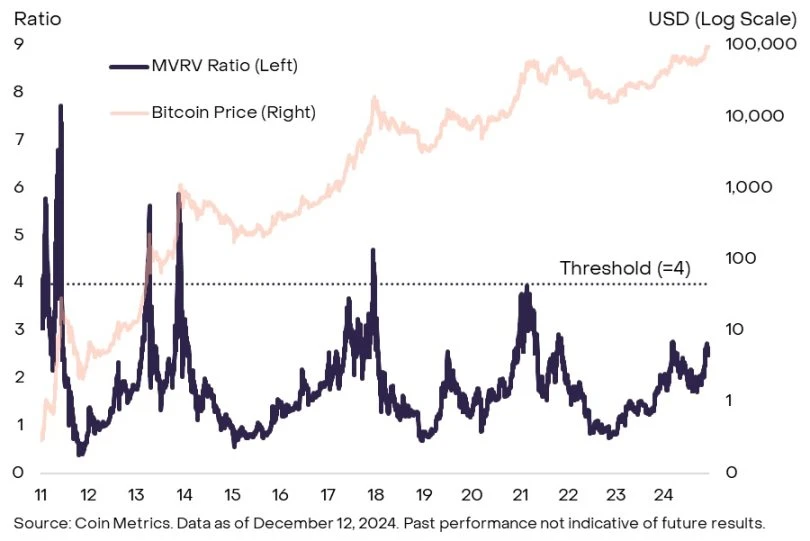

One particularly popular metric is to calculate the ratio of Bitcoin’s market value (MV) (the amount of Bitcoin in circulation * the current market price) to its realized value (RV) (the sum of the prices of each Bitcoin at the time of its most recent on-chain transfer). This metric is called the MVRV ratio and can be thought of as the degree to which Bitcoin’s market value exceeds the market’s total cost basis. In each of the past four cycles, the MVRV ratio has been at least 4 (Figure 4). The current MVRV ratio is 2.6, which suggests that the latest cycle may continue for a long time. However, the MVRV ratio has been declining from its peak in past cycles, so this metric may never reach 4 in this cycle.

Figure 4: Historical trend of Bitcoin MVRV ratio

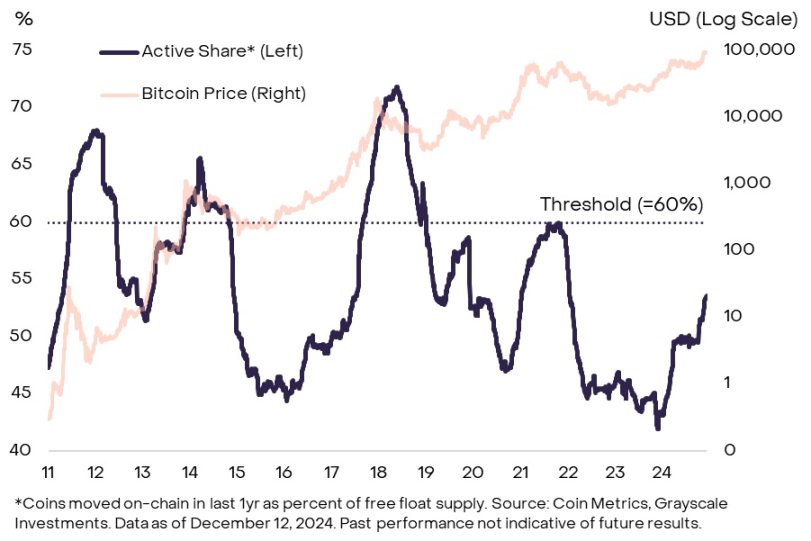

Several on-chain metrics measure the extent to which new money is entering the Bitcoin ecosystem. Experienced cryptocurrency investors often refer to this framework as HODL Waves. There are a variety of such metrics to choose from, but Grayscale Research prefers to use the ratio of the number of tokens moved on-chain over the last year relative to Bitcoins total free float supply (Chart 5). This metric has reached at least 60% in each of the past four cycles. This means that during the upswing, at least 60% of the free float supply was transacted on-chain over the course of a year. Currently, this number is around 54%, which suggests that we may see more Bitcoin changing hands on-chain before prices peak.

Figure 5: The ratio of active Bitcoin to circulating supply in the past year is less than 60%

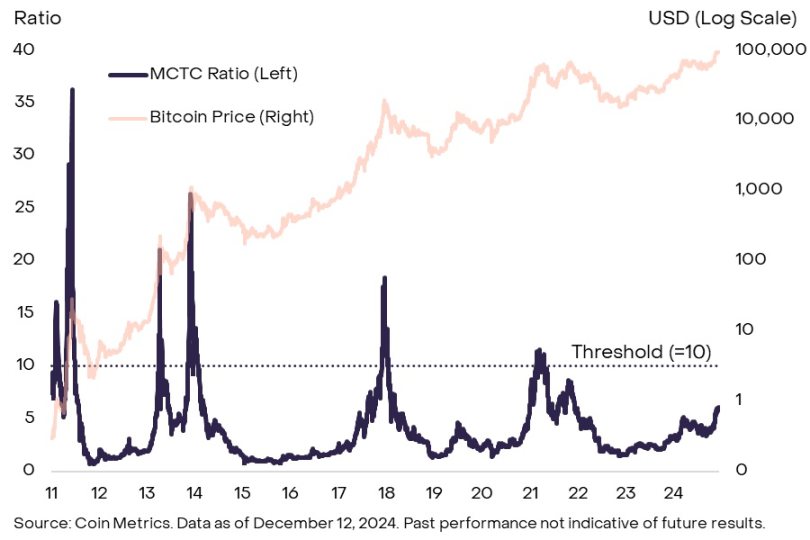

Some cyclical indicators focus on Bitcoin miners, the professional service providers who secure the Bitcoin network. For example, a common measure is to calculate the ratio of miner holdings (MC) (the dollar value of all Bitcoin held by miners) to the so-called thermocap (TC) (the cumulative value of Bitcoin issued to miners through block rewards and transaction fees). Generally speaking, when the value of miners assets reaches a certain threshold, they may start to make a profit. Historically, when the MCTC ratio exceeds 10, the price will subsequently peak in the cycle (Figure 6). Currently, the MCTC ratio is about 6, indicating that we are still in the middle of the current cycle. However, similar to the MVRV ratio, the peak of this indicator in the recent cycle is constantly decreasing, so the price peak may come before the MCTC ratio reaches 10.

Figure 6: The cycle peak of Bitcoin miner indicator MCTC is also decreasing

There are many other on-chain metrics that may differ slightly from those from other data sources. Additionally, these tools only provide a rough idea of how the current phase of Bitcoin price increases compares to the past, and there is no guarantee that the relationship between these metrics and future price returns will be similar to the past. That being said, when combined, common metrics for Bitcoin cycles are still below past price peaks. This suggests that the current bull run could continue if the fundamentals are solid.

Marché indicators beyond Bitcoin

The cryptocurrency market is more than just Bitcoin, and signals from other parts of the industry may also provide guidance on the state of the market cycle. We believe that these indicators may be particularly important in the coming year due to the relative performance of Bitcoin and other crypto assets. In the past two market cycles, Bitcoins dominance (Bitcoins share of the total cryptocurrency market value) peaked about two years into the bull market (Figure 7). Bitcoins dominance has recently begun to decline, which is about two years into the current market cycle. If this trend continues, investors should consider focusing on a wider range of measures to determine whether cryptocurrency valuations are approaching cyclical highs.

Figure 7: Bitcoin’s dominance has been declining in the third year of the past two cycles

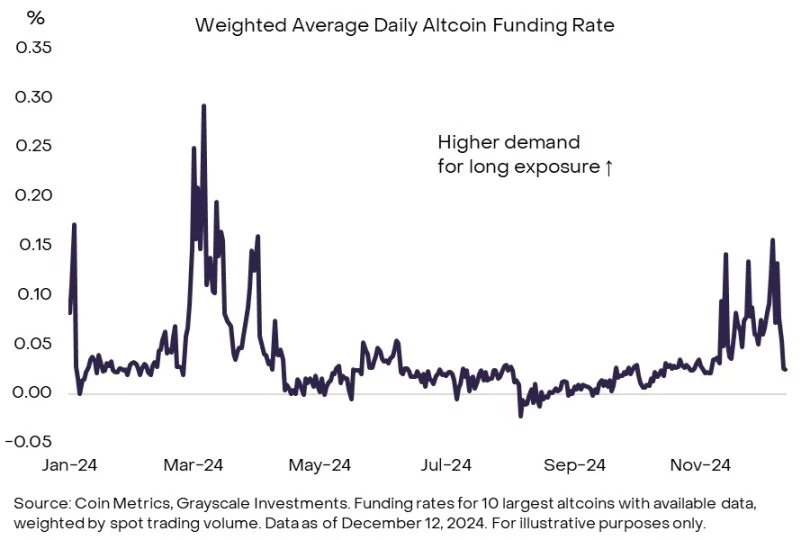

For example, investors can monitor funding rates, which is the cost of holding a long position in a perpetual futures contract. Funding rates tend to rise when speculative traders have high demand for leverage. Therefore, the level of funding rates across the market can indicate the overall holdings of speculative traders. Chart 8 shows the weighted average funding rate of the 10 largest crypto assets after Bitcoin (i.e., the largest altcoins). Currently, funding rates are clearly positive, indicating demand for long positions from leveraged investors, despite a sharp drop in funding rates during the past weeks decline. Moreover, even at the current local high, funding rates are still lower than levels earlier this year and the highs of the previous cycle. Therefore, we believe that the current funding rate level indicates that the markets speculation has not yet reached its peak.

Figure 8: Funding rates suggest altcoins are moderately speculative

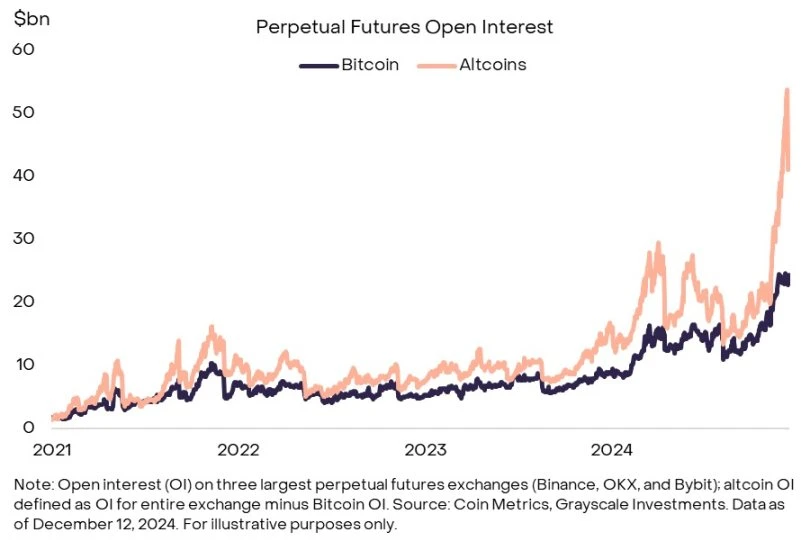

In contrast, altcoin perpetual futures open interest (OI) has reached relatively high levels. Prior to the major liquidation event on December 9, altcoin open interest on the three major perpetual futures exchanges had reached nearly $54 billion (Chart 9). This indicates relatively high open interest among speculative traders across the market. After the large liquidation, altcoin open interest fell by about $10 billion, but remains elevated. High long positions among speculative traders may be consistent with the late stages of the market cycle, so it may be important to continue monitoring this indicator.

Figure 9: Altcoin holdings were high before recent liquidations

The bull market will continue

Cryptocurrency markets have come a long way since Bitcoin’s inception in 2009, and many features of the current crypto bull run are different from those of the past. Most importantly, the approval of spot Bitcoin and Ethereum ETFs in the U.S. market has brought $36.7 billion in net capital inflows and helped integrate crypto assets into broader traditional investment portfolios. In addition, we believe that the recent U.S. election may bring more regulatory clarity to the market and help ensure a permanent place for crypto assets in the world’s largest economy. This is a significant change from the past, when observers have repeatedly questioned the long-term prospects of the crypto asset class. For these reasons, the valuation of Bitcoin and other crypto assets may not follow the historical patterns of the early days.

At the same time, Bitcoin and many other crypto assets can be considered digital commodities and, like other commodities, may exhibit a certain degree of price momentum. Therefore, an assessment of on-chain indicators as well as altcoin data may be helpful for investors to make risk management decisions. Grayscale Research believes that the current set of indicators generally shows that the crypto market is in the mid-term stage of a bull market: indicators such as the MVRV ratio are well above the cycle lows, but have not yet reached the levels that marked the previous market tops. As long as the fundamentals (such as application adoption and macro market conditions) are reliable, we believe that the crypto bull market will continue until 2025 and beyond.

This article is sourced from the internet: Grayscale: The crypto bull market has not yet reached its peak, and the rise may continue beyond 2025

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) The community-discussed meme project Wise Monkey will be launched at 6 pm today. Will the meme craze also come to the BNB Chain ecosystem? Recently, Binance and OKX have successively announced that they will airdrop MONKY tokens to FLOKI holders, with a distribution ratio of 0.35 MONKY tokens for every 1 FLOKI token held. Previously, Simons Cat project, which had airdropped to FLOKI holders, had a bright performance after the opening of the market, and its current market value has reached 320 million US dollars. This also makes the Wise Monkey project, which will open this afternoon, attract much attention. Next, Odaily Planet Daily will take you to understand the highlights, token economic model and opening…