Paper Hand or Diamond Hand? A New Way to Play with AI Agent Infrastructure REVOX Stake-to-AI

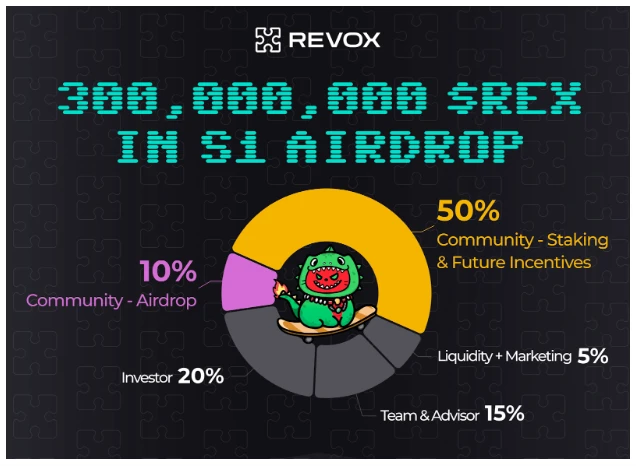

According to official news, AI Agent infrastructure REVOX announced its token economics. The total amount of REX tokens is 3 billion, of which 60% is allocated to the community and the total amount of airdrops in the first phase is 10%.

REVOX token economics includes two tokens: REX and sREX.

REX is the main governance token of REVOX and plays a core role in platform governance, payments, and ecosystem rewards. The core uses of REX include:

1. Pay for AI services. REVOXs core products (such as Lense, SmartWallet, Studio, Agent Marchéplace) and third-party products that support REVOX AI payments all accept REX as a payment method. Paying with REX can enjoy discounts based on dynamic prices.

2. Convert to sREX to receive ecosystem rewards. Users can convert REX to sREX and participate in multiple benefits in the REVOX ecosystem.

sREX is a special staking token that can convert REX to sREX at a 1:1 ratio and can only be transferred back to REX within a specific redemption period. sREX provides flexible redemption options, but redemption before the lock-up period will result in token deductions. The specific rules are as follows: 50% are permanently destroyed and removed from circulation, reducing the total supply. 50% are injected into the sREX staking pool to increase reward income for long-term holders. The core uses of sREX include:

1. Stake-to-AI mechanism. sREX holders receive AI service points based on their holdings every day, which can be used for REVOX products and partner ecosystems.

2. Participate in the staking pool rewards. sREX holders can join the staking pool and receive additional rewards: within 180 days after the TGE, the staking pool will be directly funded by the REVOX Foundation. After 180 days, the source of the staking pool rewards will be the foundation’s capital injection and the deduction of tokens redeemed in a short period of time.

3. Participate in future token airdrops. For projects built in REVOX Studio or distributed in REVOX Marketplace, sREX holders will have the opportunity to receive airdropped tokens based on their participation and holdings.

REVOX token economics achieves a dynamic balance between long-term incentives and market deflation through innovative design. The payment attributes and governance functions of $REX, together with the staking income and ecological rights of $sREX, jointly build a token system that encourages long-term holding. The advantages of this design are:

1. Delayed staking inflation.

The staking reward inflation of sREX is dynamically delayed and does not directly affect the tradable REX, thereby reducing market volatility.

2. Alleviate the impact of “paper hands” on inflation.

“Paper hands” who choose short-term redemption will face a higher token deduction rate, effectively alleviating the inflation pressure of REX.

3. Dynamically balance the paper hand and the diamond hand.

The staking pool obtains high deductions from short-term redemptions, further rewarding long-term holders and forming a positive incentive mechanism of diamond hands.

4. Long-term deflation design.

By permanently destroying 50% of the deducted tokens, REX is designed to be a deflationary token, enhancing the return rate for holders in the long term.

This article is sourced from the internet: Paper Hand or Diamond Hand? A New Way to Play with AI Agent Infrastructure REVOX Stake-to-AI

En lien : Le récit IA + Crypto évolue rapidement. 10T800 millions est-il la fin du mème IA ?

Il y a six mois, la plupart des projets d'IA cryptographique sur le marché étaient des concepts liés à la technologie d'IA traditionnelle, tels que AI+DePIN et la location de puissance de calcul. Mais maintenant, les projets d'IA cryptographique ont adopté une approche différente. Du jeton AI Bot GOAT, qui a une valeur marchande de $800 millions sans la participation de Binance, au modèle d'investissement DAO AI d'AI 16 Z le week-end dernier, l'IA semble avoir ouvert un nouveau monde au vieux récit du cercle monétaire. Cependant, le simple récit de l'émission de mèmes par l'IA ne semble pas pouvoir soutenir l'immense espace d'imagination requis par les investisseurs. Par conséquent, de l'engouement pour les mèmes de l'IA à l'engouement actuel pour les agents d'IA, le récit et le principal champ de bataille de l'IA + Crypto évoluent rapidement, laissant derrière eux…