The next SEC chairman candidate is announced, and Reserve Protocol becomes the biggest winner

Original | Odaily Planet Daily ( @OdailyChina )

Auteur : Wenser ( @wenser 2010 )

The current U.S. SEC Chairman Gary Gensler has not yet officially stepped down, but the game surrounding the selection of the new SEC Chairman has quietly begun.

On the evening of December 3, market news said that Trump had nominated former SEC Commissioner Paul Atkins as the next SEC Chairman. As soon as the news came out, the market reacted differently: some investors immediately discovered the stablecoin protocol Reserve Protocol, which is closely related to it, and purchased RSR tokens; some media said that the news could not be confirmed, and Equation News, which has always been known for its millisecond-level message tracking, even made a translation mistake, translating Paul Atkins hesitation whether to accept this position as refusal to accept; in terms of on-chain performance, the Meme coin project DJT supported by Reserve Protocol became the main target.

Amid various opinions, Odaily Planet Daily will sort out the News Trading Related to the New US SEC Chairman incident in this article.

Paul Atkins is the top candidate for the new SEC chairman

It’s worth noting that Paul Atkins is no unknown figure.

Dans l'article précédent Who will be the new chairman of the US SEC after Gary Gensler? , we briefly introduced him. He is not only a former SEC commissioner, but also a key figure in the Trump system and a firm supporter of digital assets.

As an SEC commissioner during the Bush administration, he was known for opposing heavy fines for companies that violate securities laws and previously opposed the Dodd-Frank Act, which strengthened federal regulatory powers after the 2008 financial crisis. Atkins played a key role in Trumps political transition team after his election in 2016 and was instrumental in influencing Trumps laissez-faire approach to financial regulation.

Atkins currently still works at Patomak Global Partners, the consulting firm he founded in 2009. At the same time, since 2017, he has also served as co-chairman of the Jeton Alliance, an industry association that advocates for the digital asset and blockchain industries.

At the time, the market did not view him as a popular candidate due to his current position, but as time approached the end of November, the wind direction began to gradually change.

On November 27, FOX Business reporter Eleanor Terrett a écrit that according to two sources close to the Mar-a-Lago discussions, former SEC Commissioner Paul Atkins is still the most popular candidate among the top transition team members to lead the SEC. Not only is he proficient in cryptocurrency technology, but he also has a deep understanding of the internal operations of the SEC. He has served as a commissioner and staff member for two SEC chairmen, Richard C. Breeden and Arthur Levitt. Atkins is considered to be able to develop an agenda that supports innovation while restoring the agency to the so-called gold standard, which many in the Republican Party believe has disappeared under the leadership of outgoing Chairman Gary Gensler.

On November 28, selon to people familiar with the matter, the transition team of US President-elect Trump has interviewed Paul Atkins, a senior financial regulator and a behind-the-scenes figure in the conservative financial community, as a candidate for the chairman of the US Securities and Échange Commission (SEC). People familiar with the matter said that Atkins is the top contender to replace the outgoing Gary Gensler. On the same day, the news was supported by John Deaton, a well-known crypto-friendly lawyer , who said that if Atkins is appointed, he will lead the SEC towards a more balanced and transparent regulatory framework.

In addition, the rise of Paul Atkins was also seen by the media as a signal that the US SEC may relax its legal fight against cryptocurrency exchanges.

When the news was actually released, the market performance was like a roller coaster.

News Trading: Even experienced traders make mistakes: Formula News staged a circus

At 1:14 a.m. Beijing time on December 4, crypto media Unchained annoncé que Trump has chosen Paul Atkins as chairman of the U.S. Securities and Exchange Commission (SEC).

At 1:26, the well-known encrypted source DB published an article on the X platform citing the above news, which further spread the news that Paul Atkins was elected as the chairman of the US SEC. Formula News followed up immediately. Later, the news was confirmed by the encrypted source zoomer.

As the news came out, the RSR jeton related to the stablecoin protocol Reserve Protocol, for which Paul Atkins serves as an advisor, rose in response, quickly rising by more than 20%.

But soon, as more media reports emerged, the market began to have further doubts and hesitations about Paul Atkins identity storm.

At 1:41, the well-known crypto source Watcher Guru publié on the X platform: It is impossible to confirm the reports circulating in the market that Trump has chosen Paul Atkins as SEC chairman. There is no official announcement from Trump.

Original message

At 1:44, Formula News reposted the news from Zoomer citing Coindesk, but translated the “PAUL ATKINS HESITANT TO ACCEPT SEC CHAIR JOB” into “Paul Atkins is unwilling to accept the position of Chairman of the US Securities and Exchange Commission” (Odaily Planet Daily Note: It is worth mentioning that the original translation of Formula News was “reject”). Subsequently, it also reposted a similar nouvelles from DB, once again confirming Paul Atkins’ hesitation to accept the position of Chairman of the US SEC.

In response to this incident, many users complained about Formula News, believing that it might be suspected of manipulating the media news market. Later, Formula News founder Vida also responded to user comments on the X platform many times : DB ZOOMER is fully automatic, there is no time for manual screening, Users can try to use Google Translate to translate this paragraph. Formula News uses API to fully automatically translate, and there is no time for manual modification. He even posted the translation of Google Translate and ChatGPT to clarify the explanation .

But in any case, the market has begun to buy in on the news that Paul Atkins was selected as the chairman of the US SEC.

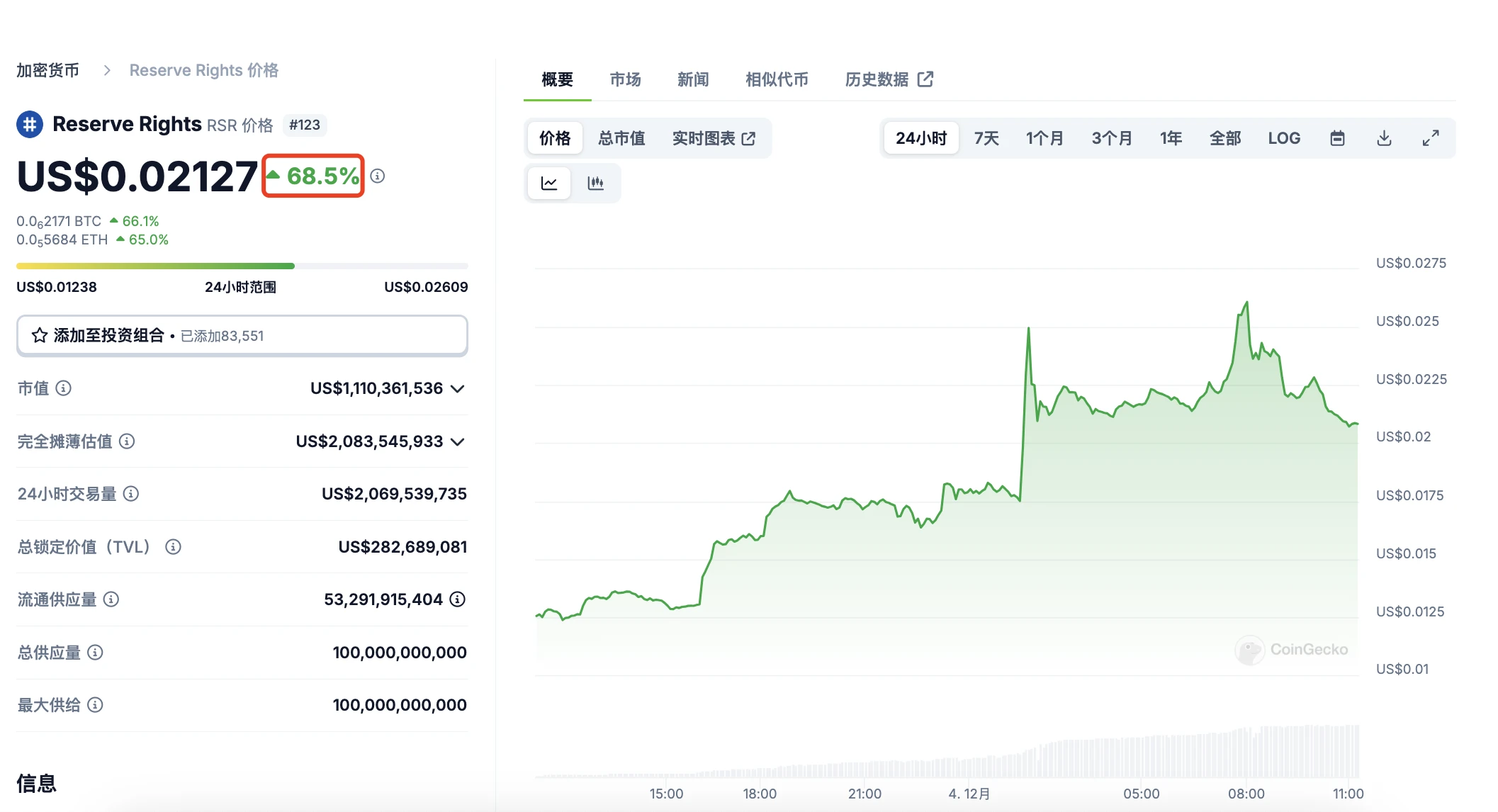

Selon Coingecko data , the RSR token is currently priced at $0.021, with a 24-hour increase of 68.5%, and a market value of $1.11 billion.

RSR Token Information

In addition, at 1:43, Equation News also published a message that well-known trader GCR said in a private discord chat that he had sold his long RSR position for a long time. Currently, the message has been deleted.

On the other hand, selon to The Data Nerd, the well-known market maker GSR deposited a total of 280 million RSR (about 6.66 million US dollars) to Binance earlier today; in the past 24 hours, it deposited a total of 265 million RSR (about 10.82 million US dollars) to Binance. According to le on-chain analyst @ai_ 9684 xtpa, the RSR market maker is GSR Marchés. In addition to the recent exchange transfer operation, GSR has also been frequently trading RSR recently, boosting its price rise and fall.

Summary: Sell the News VS Buy the News

Throughout this farce, the question of whether Paul Atkins will eventually take over Gary Gensler’s position as SEC Chairman has not yet been settled, but the market game surrounding this matter has come to a temporary end: market users voted with their feet and purchased RSR tokens; Equation News played a not-so-glorious negative role in manipulating the market with news; the on-chain Meme coin DJT also gained a certain amount of value.

But when it comes to the ultimate winner, it may be Reserve Protocol. After all, the market attention it has gained, the increase in token prices, and the potential good news from Paul Atkins taking office are real.

This article is sourced from the internet: The next SEC chairman candidate is announced, and Reserve Protocol becomes the biggest winner