In November, capital inflow hit a new high, BTC rose another 9.06%, and there is a need for short-term adjustment (11.18

Écrit par: 0xWeilan

Les informations, opinions et jugements sur les marchés, projets, devises, etc. mentionnés dans ce rapport sont fournis à titre indicatif uniquement et ne constituent aucun conseil en investissement.

Marché Résumé

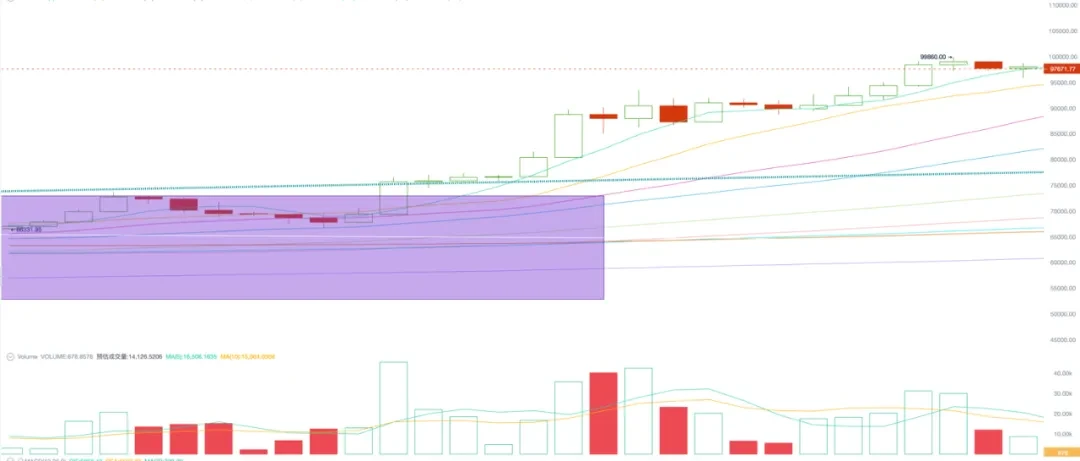

After several days of consolidation last week, BTC resumed its upward trend this week, rising on 6 out of 7 trading days, ultimately achieving a weekly increase of 9.06%.

This week, BTC opened at $89,877.11 and closed at $98,028.18, with the volume effectively increasing, achieving four consecutive weeks of growth. On November 22, it hit a record high of $99,860, just one step away from the psychological $100,000 mark.

Expectations of crypto-friendly policies in the United States and continued capital inflows provide both emotional and financial support for BTCs exuberant rise.

Réserve fédérale et données économiques

The market believes that Trump will boost the dollar after taking office, and the Feds statement also reinforces the weakening of expectations for interest rate cuts next year, which has led to a three-week rise in the dollar index, reaching as high as 108 and finally closing at 107.503. Under the expectation of a strong dollar and the overall health of the US economy, capital continues to flow into the United States, pushing the three major US stock indexes that adjusted last week to stabilize and rebound.

The yields of 2-year and 10-year U.S. Treasury bonds remained above 4.3%. Global economic uncertainty and geopolitical conflicts have caused gold to regain its upward trend, rising for five consecutive trading days.

Previously, we judged that BTC would move independently from the Nasdaq, and it seems that this is becoming a reality. This week, BTC rose 9.06%, much higher than the 1.73% of the Nasdaq. According to statistics, the correlation between Bitcoin and the Nasdaq on a 30-day rolling basis has dropped to 0.46, the lowest level in 5 years.

The global, especially American, view of crypto assets is undergoing profound changes. Whether it is the continued inflow of BTC Spot ETF or the unexpected progress of the U.S. Bitcoin Strategic Reserve Act, it not only provides expected gravity for the market, but also provides continued capital inflow.

Stablecoins and BTC Spot ETF

Funds are flowing in explosively through both channels.

This week, the inflow of BTC Spot ETF exceeded the 1.6 billion scale in the previous two weeks, reaching 3.333 billion, setting a record for the largest single-week inflow since its launch. Funds are still flowing in, and the BTC concept stocks in the US stock market are also continuing to increase in volume.

The stablecoin channel has inflows of 6.721 billion this week, the highest since the start of this cycle. The continuous inflow of funds not only pushed BTC to the $100,000 mark quickly, but also began to flow into Altcoins in the second half of the week. Various competing coins that are still at low levels have started to record a sharp rise.

Although there is still about a week left, the scale of capital inflow in November has reached 10.054 billion, becoming the highest month in this cycle. After the second half of the bull market starts, with the rise in asset prices and the spread of the wealth-creating effect, funds are likely to continue to flow in.

In addition to these two channels, according to the announcement, MicroStrategy purchased $4.6 billion worth of BTC last week. This shocking scale also explains why the BTC price has not adjusted despite the huge short-term gains and fierce selling.

Selling off

In November, BTC rose by nearly 42%, and both long and short positions showed substantial floating profits. In addition, as the price of $100,000 was approaching, the sell-off continued after last week. More than 240,000 BTC flowed into the exchange throughout the week, and long and short positions locked in more than $700 million in profits on the 21st alone.

However, the overall profit of short-hands is still over 30%, and it can be expected that the short-term sell-off will continue.

The good news is that more than 40,000 BTC have been outflowed from exchanges throughout the week. More and more BTC are flowing into the hands of medium- and long-term investors.

All technical indicators are overbought, but enthusiasm and funds are extremely fierce. We believe that there will be adjustments, but it is difficult to judge when and how long they will last. The best strategy is still to hold long-term, and it is far from the time to leave.

Indicateurs de cycle

The EMC BTC Cycle Metrics indicator is 0.875, and the market is in an upward phase and is showing a vigorous upward trend.

EMC Labs a été fondé par des investisseurs en actifs cryptographiques et des data scientists en avril 2023. Il se concentre sur la recherche sur l'industrie de la blockchain et les investissements sur le marché secondaire de la cryptographie, prend la prospective, la connaissance et l'exploration de données de l'industrie comme son cœur de compétitivité et s'engage à participer à l'industrie en plein essor de la blockchain. grâce à la recherche et à l’investissement, et en promouvant les actifs blockchain et cryptographiques pour apporter des bénéfices à l’humanité.

Pour plus d'informations, veuillez consulter : https://www.emc.fund

This article is sourced from the internet: In November, capital inflow hit a new high, BTC rose another 9.06%, and there is a need for short-term adjustment (11.18~11.24)

Headlines Cboe submits 4 Solana spot ETF listing applications to the US SEC James Seyffart, senior ETF analyst at Bloomberg, wrote on the X platform, “Cboe has just submitted applications to the US SEC for four Solana spot ETFs, the issuers are VanEck, 21Shares , Canary Capital and Bitwise. If the SEC does not reject the above-mentioned application, the final deadline is around early August next year.” Tether has issued 9 billion USDT since November 8 According to Lookonchain monitoring, Tether has issued a total of 9 billion USDT since November 8. BTC breaks through 98,500 USDT in a short period of time, setting a new record high OKX market data showed that BTC rose in the short term and briefly broke through 98,500 USDT, with a 24-hour increase of…