OTC trading outside the spotlight: interpreting the alternative games of crypto VCs

Auteur original : hedgedhog 7, c 0x swain, 0x kinnif, 0x laiyuen, 0x ZhouYeMen

Traduction originale : TechFlow

The Current State of Cryptocurrency Venture Capital

Recently, Pièce de monnaie mème has outperformed many venture capital (VC)-backed projects, which has sparked criticism from market participants towards VCs and their investments. While some of the criticism is valid, some of it lacks a deep understanding of the complexities of the private placement market.

Typically, projects scale their products through multiple rounds of funding before a Jeton Generation Event (TGE). In return for their early, high-risk capital investment, VCs are able to participate at lower token valuations. The resources that projects receive from strategic capital, including marketing support, token economics consulting, and access to VC networks, are not typically available to small, average investors. As fundraising progresses and valuations change, the types of VCs involved will also vary, as each VC has different risk appetites and fund sizes.

Breakdown of crypto venture capital and its size

Source: PitchBook

Most crypto VCs have less than $50 million in assets under management, so they tend to invest in projects that have not yet launched products and have lower valuations. In order to ensure that the long-term interests of VCs and other stakeholders are aligned, tokens acquired through private markets usually have lock-up periods and vesting terms.

The Risk-Return Tradeoff of Venture Capital

During the token vesting period, VCs often see significant unrealized gains, which they may realize through derivative hedging or over-the-counter (OTC) transactions with private buyers. However, they face challenges in implementing hedging strategies due to investment mandates, capital requirements, and liquidity constraints. In addition, some VCs lack the execution knowledge and risk management framework required to manage liquid positions, which makes effective hedging more difficult.

As a result, OTC trading has become the primary means for venture capitalists to realize profits before a token generation event (TGE). Unlike the transparent secondary market, transactions in the OTC market are conducted privately, making it difficult to track global trading data uniformly. Although it is difficult to accurately estimate the size of the OTC market, some trends can be revealed through activity reports from OTC trading desks.

STIX is an OTC trading desk backed by Fisher 8 Capital that has processed over $200 million in volume since its inception in late 2023. STIX primarily trades assets from the top 200 altcoins. Over the past year, there has been a lot of OTC activity, including liquidations (such as FTX selling locked $WLD and $SOL) and direct trades from token foundations (such as $SUI, $AVAX, etc.). We expect this market to continue to grow, primarily due to VCs looking to realize returns early and post-TGE projects need for capital.

En vente libre Marchés: Price Discovery in Private Rounds

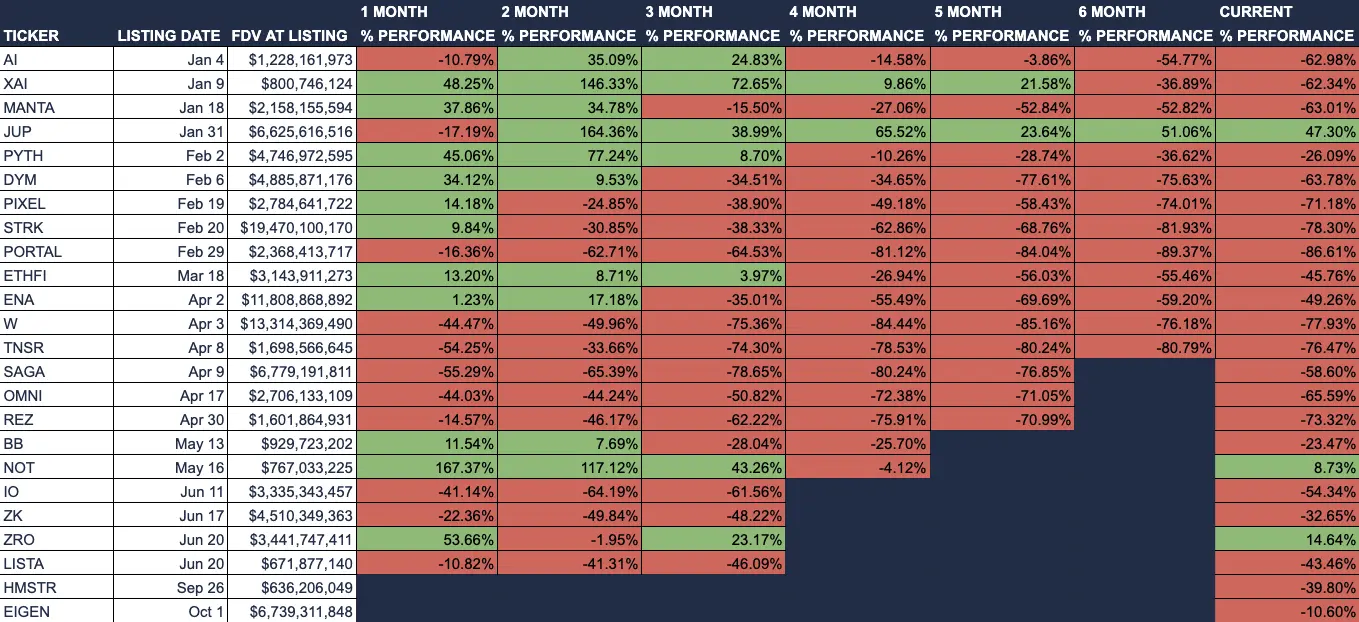

Below is a list of some VC-backed tokens and their performance since their TGE. Most tokens struggle to maintain high valuations after three months, making it difficult for VCs to realize their investments at the highest FDV at the beginning of the vesting period. Such price movements are unfavorable to market participants because investors who bought in at high prices become sellers along with VCs at the end of the vesting period.

Performance of tokens launched on Binance in 2024

Source: Artemis

The practice of frequently increasing valuations during fundraising has concentrated market gains and optimism primarily in the private sector. This situation has resulted in retail investors being primarily exposed to price declines after a Token Generation Event (TGE). Without adequate incentives to support projects, public market participants could be in a lose-lose situation. Both VCs and retail investors will face challenges in the long term as the market converges toward fair value.

Token Performance Example

Source: 0x Louis

We believe that leaving room for secondary market upside helps build a stronger support base, thereby extending the life of the project. One existing approach is to help ordinary investors conduct price discovery before the TGE through spot and/or pre-market trading. In pre-market trading, the tokens on the spot market are regarded as a commitment note (i.e., IOU tokens) that can be exchanged for real assets at the TGE. On the other hand, the perpetual contract pre-market is a synthetic market that aims to track the price trend of the asset, usually hedged by call options issued by the foundation.

Pre-market trading can be conducted on easily accessible derivatives platforms such as Aevo, Whales Market, and major centralized exchanges (CEX). However, these products are subject to liquidity and delta risk. When liquid market buyers purchase tokens before the TGE, the exchange platform, as the counterparty, may suffer significant losses if the token performs well after the TGE. In addition, participants need to consider counterparty risks, such as the lack of legal claims on the underlying assets or the inability of the exchange to bear losses from profitable pre-market participants.

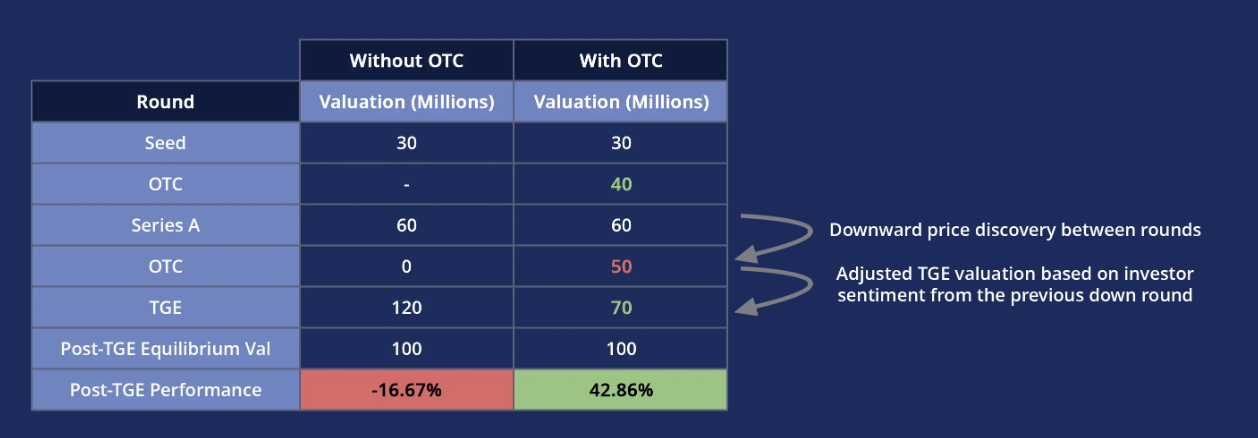

Hypothetical performance of tokens through OTC between funding rounds

Another way to promote secondary market price increases is to allow the private market to experience price declines before the token generation event (TGE). This can reduce the valuation gap between rounds. The chart above shows a simplified comparison of two hypothetical projects, illustrating the potential benefits of OTC trading on post-TGE performance. If a down round occurs between the A round and the TGE, and existing investors sell their holdings below cost, this may remind the team that their TGE price should be lower than originally planned. Such adjustments can help project valuations more closely match market expectations.

Having more profitable token holders from liquid markets can provide more lasting support for the project if it ultimately succeeds and reaches the desired post-TGE price levels.

In-depth analysis of crypto OTC trading desk

While it may seem ideal to allow more price declines in the private placement market, the process is not simple due to legal barriers and the complexity of transaction types. OTC transactions are mainly divided into two types: pure autonomous buying and funding interest rate arbitrage.

Self-directed buy-ins typically attract valuation-sensitive investors who want direct market exposure to the underlying asset. This involves taking over the SAFT/SAFE contract from a previous investor or purchasing tokens directly from the project team. When purchasing SAFT/SAFE contracts from early investors, transactions are typically priced at par or with a 25-30% premium before the TGE.

Funding rate arbitrage buyers have a weaker relationship with valuation. Their profits depend on the difference between the spot discount and the hedging cost, which is in turn affected by the perpetual contract funding rate during the token vesting period. According to the STIX report, such buyers are typically able to purchase at a price 60-65% below the spot price, thereby executing a neutral risk strategy. However, there are three prerequisites for this opportunity: first, there must be a perpetual contract for the underlying asset; second, the market needs to have sufficient liquidity to execute the transaction; and finally, the hedging cost (i.e. the opportunity cost of the collateral) cannot exceed the benefit obtained from the spot discount. In order to avoid being liquidated when performing short-term perpetual hedging, these buyers need to prepare a large amount of collateral, because any liquidation caused by a short squeeze may make the transaction unprofitable.

Due to the varying types of OTC buyers, large OTC transactions announced by token foundations should be viewed with caution. These transactions may reflect more arbitrage opportunities than true long-term demand at current prices.

Challenges of the OTC Market

One complication facing OTC transactions is the presence of anti-assignment clauses in the contract. These clauses restrict investors from transferring their shares to a third party (i.e., a new OTC buyer) without the founders’ consent. According to STIX, such clauses are present in 30%-45% of SAFTs.

If the foundation blocks OTC trading, buyers will have to bear additional counterparty risk. In the absence of the legal protection provided by formalized trading, buyers are very limited in the measures they can take in the face of seller misconduct. This risk is particularly prominent for smaller funds, which may not face the same reputational risks as large, well-known venture capital funds.

Crypto VC Fundraising Activity

Source: Pitchbook

Fundraising levels reached record highs in 2021 and 2022, driven by pandemic stimulus policies and the promise of high returns on previous fundraises. During this time, deals moved quickly as VC funds were flush and eager to invest. However, the bear market in 2022/2023 brought significant changes. Down rounds became more common, investors’ risk appetite decreased, and delayed TGEs became the norm. Changing market dynamics and high-profile collapses such as Terra, FTX, and 3AC led to stagnant fund performance and a decrease in capital inflows into crypto VCs.

PitchBooks report shows that investors interest in venture capital has declined, and the time it takes for new funds to raise funds has increased from 6 months in 2021 to 21 months in 2024. In addition, venture capital funds that adopted the 4+2 structure in 2021 and 2022 will enter the divestment phase, and structural sellers will appear in the secondary market.

As crypto VC funds have underperformed, they have begun to explore other strategies, such as investing in liquidity tokens or conducting OTC transactions. Although OTC transactions usually have lock-up periods and vesting clauses, their investment period is usually shorter than traditional VCs and is more suitable for investors who focus on the investment period. If OTC transactions become more common in the industry, platforms such as STIX may benefit from the comprehensive services they provide and address the fragmentation of the market.

The future direction of venture capital

The current trend of decreasing crypto venture funding poses a challenge to the industry. One possible way out is to adopt an active investment strategy. Instead of looking for the next “from scratch” opportunity, funds can focus on acquiring liquidity tokens and use their expertise and networks to scale projects from “1 to 10”.

If you are interested in this active investment strategy, STIX is actively seeking more venture funds to join. If you are interested, please visit STIX.co or contact taran_ss at X for more information.

This article is sourced from the internet: OTC trading outside the spotlight: interpreting the alternative games of crypto VCs

Depuis son lancement, Telegram a connu une croissance rapide grâce à ses solides fonctions de protection de la vie privée et de communication. En 2024, le nombre d'utilisateurs actifs mensuels a atteint 900 millions, soit une augmentation de 12,5% par rapport à l'année dernière, se classant au deuxième rang après Whatsapp, WeChat et Messenger dans les applications de messagerie mondiales. L'énorme base d'utilisateurs consolide non seulement la position de Telegram dans le domaine de la communication Web2, mais jette également les bases de son expansion dans le domaine Web3. En intégrant l'écosystème TON, Telegram a introduit des expériences de produits Web3 avec des paiements cryptés, la gestion des actifs numériques et des applications décentralisées (dApps) tout en conservant ses fonctions de communication de base. S'appuyant sur l'avantage de trafic de Telegram et les capacités de paiement et de transaction fournies par TON, les mini-applications de l'écosystème Telegram ont couvert plus de 20 types d'applications telles que…