Crypto dopamine effect: the integration of AI agents, social finance and applications for the younger generation

Original author: Josh Cornelius

Traduction originale : TechFlow

Welcome to my weekly Crypto Thoughts, which are some of my thoughts and discoveries while exploring the Internet. This week I think it’s worth discussing:

Regarding Web 4, Jeffy Yu, founder of Zerebro, a écrit a wonderful article this week, exploring the advent of the Web 4 era. In this era, the Internet will have the ability to predict, plan, and act autonomously. Web 4 builds on the social foundation of Web2 and the financial foundation of Web3, opening up a world where artificial intelligence and intelligent agents are everywhere. In the article, he elaborates on the functions that can be achieved at present, the remaining shortcomings, and the conditions required to achieve general artificial intelligence (AGI). His core point is that we are actually closer to achieving our goal than most people think.

I know you may be tired of discussing these agents, but I am still very interested.

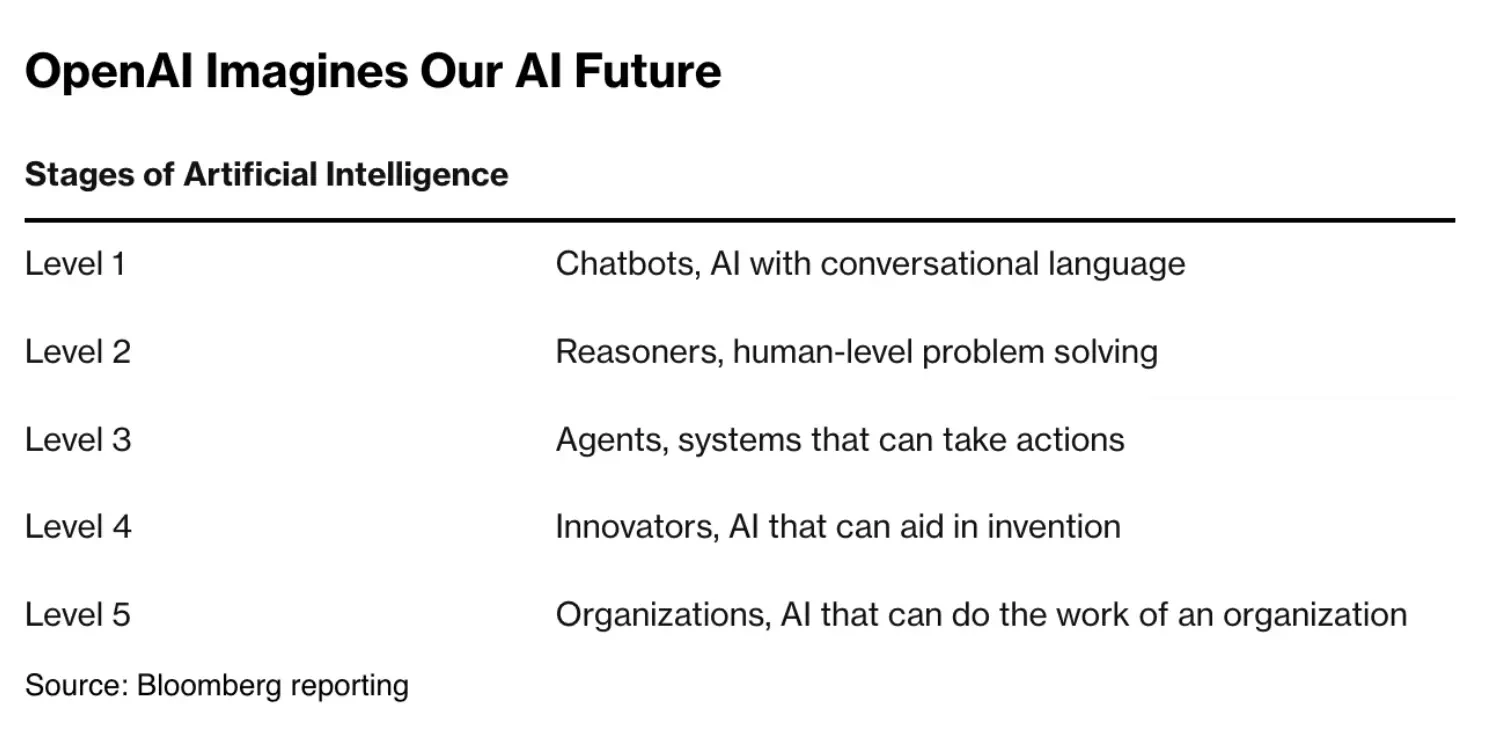

The two points that stood out to me most in the article were his thoughts on where we are in the five stages toward AGI described by OpenAI, and how cryptocurrency is quickly becoming the dominant platform for AI experimentation.

First, despite OpenAI’s claims that we are in stage 2 (see below), those active in the cryptocurrency space know that we are already firmly in stage 3. Clearly, current agents leave much to be desired, as they often require some level of human supervision and are only capable of operating autonomously in specific, narrow applications. However, agents like Zerebro et Cents , which have been able to outperform 99% of users in Twitter interactions, launch their own tokens, and create and mint their own artwork, are amazing. These agents have demonstrated autonomy in every aspect.

Projects like Fungi et Ai16z (more on that later) are also on the verge of launching agents with true financial autonomy, able to trade autonomously, learn, and adjust strategies in real time. They can not only communicate with people, but also build influence on Twitter and Warpcast, accumulate financial resources, and hire humans to complete tasks they cannot perform.

We also see signs of Level 4 capabilities in creative areas, such as Truth Terminal creating his own religion, Zerebro developing his own PFP series , et Botto perfecting his style over many years of art. Obviously, achieving innovation in broader areas such as science and technology would be a major breakthrough.

Jeff compares the development of AGI to the invention of electricity. It was not enough to invent electricity (i.e. the basic model), it took a series of inventions such as the light bulb, the electric motor, and the power grid to truly change society.

This is why cryptocurrencies will play a major role in the development of AGI. Permissionless and standardized financial and application infrastructure, combined with the free flow of capital and enthusiasm for novelty, provide an excellent experimental platform for new applications of superintelligence.

We have entered an agent-infrastructure loop. Improvements in base models unlock new agent capabilities, which, when bottlenecks are reached, inspire more infrastructure development, which drives further capability improvements.

Once agents are able to demonstrate their prowess in the DeFi space, run effective token trading strategies, create popular meme coins and NFTs, and manage DAOs, the traditional financial world will spare no effort to try to bring them in. Putting these products on the chain is the answer we expect, but agents will also become more mature in their interactions with traditional systems and the real world, so let’s wait and see.

Ultimately, a massive disruption will occur when traditional companies must move beyond simply leveraging AI to become more efficient and begin to adapt and serve smart protocols to survive in an increasingly important economic system.

So the key is that we have to take all of these seemingly strange experiments were seeing seriously. Today, its easy to see the problems, but they will be solved. What we need to focus on is what changes will happen when all of these technologies really start to work.

Ai16z

ai16z is a tokenized venture capital DAO managed entirely by AI. The agents on this platform will evaluate investment opportunities proposed by the community, execute trades, and evaluate the reputation of members based on the success of these trades, while increasing the funds assets under management (AUM). In recent weeks, it has experienced a wave of crazy speculative enthusiasm due to its grand vision and strong evangelism (such as ai16z, marc aindreessen, flip a16z). It is expected that they will have the agents ready to start trading and launch their virtual trust market in the coming weeks.

My interest in Ai16z is not just because it is a fund. It is an attention network and an agent coordination center, a combination of memory coins, an agent launch platform, and a social network. With the opening of its trading, the expected flywheel effect will bring amazing impact.

Let me explain.

Technology Flywheel. They developed an open source framework called Eliza, and many top cryptocurrency projects develop and contribute to it. It is quickly becoming a natural technology choice for people who want to create crypto-agents. They also offer a standard agreement that if you develop on Eliza and donate 10% of the token supply to the DAO, you will be added to their list of portfolio companies and receive project support.

Therefore, as more people want to take advantage of the projects attention base, more people will build on the technology, donate tokens, and increase the AUM of the DAO. As more people build on the technology, the technology will continue to improve and expand, making it more attractive and further expanding the projects attention base. A larger attention base means more developers, more donations, better technology, and more attention.

Social flywheel. Their virtual trust market allows token holders to make trade suggestions to agents and evaluate their reputation and influence based on the success of those suggestions. High reputation scores and high rankings on leaderboards are not only socially enviable, but can also economically influence agents to purchase the assets you hold.

Therefore, I expect a lot of people to participate in this game, driving demand for the token. People will advertise their rankings, which will attract more people to participate, create a richer social experience, reduce selling pressure, and further increase demand for the token.

Economic flywheel. The core goal of the DAO is to become an efficient trading firm and increase its assets under management (AUM). All assets held by the DAO are public, and due to the widespread attention the project receives, any of its trades will be quickly copied (just like any reputable trader sharing trading advice in their Telegram channel).

Therefore, the virtual trust market will ensure that the agents have a comprehensive understanding of market dynamics, and the agents will become increasingly adept at selecting appropriate trades, which will be replicated, ensuring the spread of memory effects and initiating market reflexivity. AUM will grow rapidly, and with it, attention will also increase, more people will participate in copy trading, and so on.

Obviously, there are still a lot of issues to be worked out here (such as complex reputation systems and how to gracefully exit transactions, etc.), but the potential for rapid growth is clear. While it sounds crazy that it is currently trading at 100x its current AUM, is it really?

Interface

If you’ve been following us or are active in the Ethereum ecosystem, you may have heard of Interface . It’s a social trading product based on an on-chain activity stream, similar to Twitter’s “For You” and “Following” streams. They’ve been developing it for years and have a loyal core user base, but they’ve recently reached a growth inflection point, with weekly growth rates stabilizing at 50% over the past few months.

Interface passed SC 06 at the end of 2023. They are a technically strong cryptocurrency native team with unique insights into the future of on-chain social networking. I have always believed that on-chain transactions are inherently social and are an ideal starting point for new social networks, rather than simply relying on content competition.

Over the past year, they have made significant progress in product development, and the product has become increasingly useful for those who spend a lot of time on the chain. However, they have not found a way to attract a wider user base, lacking a key highlight that can quickly attract users and achieve an epiphany moment.

A few months ago, they launched the “Copy Trade” feature, which allows users to seamlessly copy any trade directly from the feed, with the transaction fee going to the trade initiator. Since the launch of this feature, their user growth and daily active users have reached new peaks.

Now, talking about Interface, you can say “This is the best platform to discover and trade alpha”. You can download the app, follow recommended users based on their earnings, see new trades instantly, copy trades and make money.

After the user experience solidifies the value of the product, you can start finding friends, building your own fan base, using it to explore the on-chain world, and gain more social-centric experiences.

A truly powerful hook is one that taps into a user’s deep desires (like making money and fear of missing out), and the product is designed to deliver that experience quickly. The power of this cannot be underestimated.

Hyperliquid

Hyperliquid is a Level 1 (L1) and decentralized perpetual swap exchange known for top speed, liquidity, and price. Ive been using it for a while now because I wanted to learn more about perpetual swap trading. After trying out multiple platforms, I found Hyperliquid to be the clear winner. Their volume and total value locked (TVL) have grown significantly over the past year, and from what I saw on DefiLlama, their derivatives volume exceeds all other chains. They are about to launch the HYPE token, and have some unique features that deserve special attention.

We all know that in recent years, the market has been flooded with chains with low circulation and high fully diluted valuation (FDV). Usually, these projects raise a lot of private funds, conduct mining activities on the test network, airdrop a small amount of tokens to participants, and list on centralized exchanges (CEX), attracting investors with high FDV to get rich, while the community may be restricted or even suffer heavy losses, and no useful construction is produced on the chain.

However, Hyperliquid is taking a completely different path:

-

They have not raised any venture capital (VC) funding

-

In building L1, they created a product that is unrivaled in its category.

-

The development team does not charge any fees, and all profits belong to the agreement

-

Their token launch has a high circulation and most of it is allocated to early users

They could have easily raised a lot of money and earned huge returns, but they completely rejected these short-term temptations in order to lay the foundation for long-term success. They realized the importance of maintaining neutrality and not letting insiders interfere with their goal of becoming the platform where all financial activity happens.

I really hope this model succeeds and becomes a powerful example for other teams to follow.

GenZ App Usage Trends

This week, Techcrunch published a great article analyzing some of the key trends and app usage of Generation Z in 2024. For anyone working in consumer products, especially consumer social, it is crucial to understand the focus and usage habits of Generation Z. They are trendsetters, are in a socially active period, frequently make new connections, and are willing to try new things.

Nikita Bier once pointed out an interesting statistic: from 13 to 18 years old, the sharing rate drops by 20% for every additional year. Therefore, if your target users are older, you may need to pay more for user acquisition. In recent years, all successful social products have risen because of their rapid spread among young people.

If you are developing a consumer-facing product, I recommend reading this article. There are a few points worth noting:

-

Temu, an e-commerce platform with gaming elements, was the most downloaded app in 2024.

-

A new product called ShortMax is hot in the short video entertainment space, combining features of TikTok and Netflix to offer scripted ultra-short dramas in a swipeable interface.

-

Threads is Metas most downloaded product, significantly outperforming Twitter.

-

ChatGPT and Gauth, an AI learning assistant developed by ByteDance, have performed outstandingly in the field of AI.

-

All the traditional streaming apps are lagging in downloads, but you’ll need to look at usage data to tell if that’s because they’ve been widely downloaded.

The dopamine effect is everywhere. Its amazing.

This article is sourced from the internet: Crypto dopamine effect: the integration of AI agents, social finance and applications for the younger generation

Author: @Web3 Mario Abstract: We know there is a proverb, Buy the rumor, sell the news. Before the October election, the article DOGEs New Value Cycle: Political Traffic Potential and Musks Department of Government Efficiency (DOGE) Political Career published by the author has received good responses and expected results, and the author has also reaped a relatively rich return on investment. I would like to thank everyone for their encouragement and support. I personally think that there will be a lot of similar trading opportunities in this window period before Trump officially takes over, so the author decided to start a series of articles, Buy the rumor series, to explore and analyze the hot spots that are currently being hyped in the market and refine some trading opportunities. Last week,…