Lorsque la valeur marchande de SOL dépasse les 100 milliards, parlons du potentiel et des contraintes de Solana

Original | Odaily Planet Daily ( @OdailyChina )

Auteur : Wenser ( @wenser 2010 )

On November 10, Coinmarketcap data showed that SOLs market value once exceeded 100 billion US dollars, surpassing the traditional listed company Vanguard Group and ranking 192nd among 20,666 assets in the world; on the 11th, according to the statistics of the 8 marketcap website , SOLs market value fell back to 97.78 billion US dollars, and the 7-day increase was still as high as 27.83%, ranking 199th among 20,666 assets in the world, and ranking fourth in the market value of cryptocurrencies. At the same time, relevant practitioners from Bitwise, Standard Chartered Bank, Coinbase and other institutions have expressed high affirmation of the subsequent development of the Solana ecosystem.

Odaily Planet Daily will share with readers in this article a glimpse into the mystery behind Solanas market value exceeding 100 billion yuan.

Overview of outlook: Solana is the Future

Since the FTX bankruptcy incident in 2022, the popularity of the Solana ecosystem has dropped to a freezing point, and the price of SOL has fallen below US$10 (December 30, 2022). However, with the continuous construction of the official and the continuous efforts of Solana ecosystem developers and project parties, the Solana ecosystem finally ushered in a revival again with the development of multiple sectors such as RWA, DePIN, DeFi, and Meme coins.

In addition, considering Solana’s “capital pedigree” in its previous financing stage, countless investment institutions, traditional financial institutions, and even relevant departments in the political and economic fields of the United States have a positive attitude towards it. Many institutions and individuals have spoken out to support the Solana ecosystem. The following is a list of representative views:

The SOL price low occurred in the second month after the FTX crash

President of The ETF Store: Several new spot cryptocurrency ETFs, including SOL, are expected to be filed this week

Nate Geraci, president of The ETF Store, a écrit : “Issuers are expected to submit several new spot cryptocurrency ETF applications this week, including XRP, SOL, ADA, etc. Assuming that multiple issuers are fully prepared for the election results, it doesn’t hurt to be aggressive now.”

Arthur Hayes: Solana will be “high-beta Bitcoin” during the US election

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, previously expressed his bullishness on Solana ahead of the U.S. election in early November, calling it a “high-beta Bitcoin” during an appearance on the Unchained podcast. He explained that Solana is a good choice because it is highly liquid and if Bitcoin performs well, Solana is likely to rise.

In addition, Hayes said that in the long run, it doesn’t matter who wins the US election because the primary impact on digital assets will be the Federal Reserve’s decision on whether to cut interest rates on November 7.

Hayes also said that he is more optimistic about SOL than ETH, and he believes that Ethereum is currently too slow and needs to change the narrative to change peoples perception of its poor performance in recent months. He pointed out that Solana currently occupies mind share and moves quickly, and its performance is likely to outperform Bitcoin when the market is booming, while Ethereum has the same beta coefficient as Bitcoin, or even slightly lower.

Trump’s election is good news for Solana and Bitcoin

Previously, with Donald Trump’s victory in the 2024 US election, a large number of Trump-related tokens and prediction activities quickly emerged on the Solana (SOL) blockchain, demonstrating the deep interweaving of blockchain and political events. At the same time, Polymarket, a decentralized prediction market that is different from traditional polls, successfully predicted Trump’s victory by paying attention to the flow of funds and changes in market sentiment, thus becoming an effective reference for analyzing the political situation.

En outre, some people believe that Trump will implement crypto-friendly policies after his successful election, which will directly benefit Solana and Bitcoin. As an important platform for DeFi and NFT projects in the United States, Solana will attract more innovative projects and capital injections under a loose regulatory environment, which is expected to accelerate user growth and capital accumulation. Moreover, as a local blockchain platform in the United States, Solana is expected to obtain the SOL ETF application with Trumps election, further boosting its influence in the capital market.

Coinbase: Solana on-chain trading ecosystem profitability is second only to stablecoins and L1 network fees

Coinbase analysts pointed out in a report that Meme tokens have been the core narrative of this bull run and are the best performing cryptocurrency sector this year (measured by total market capitalization growth). Most of the Meme coin activity occurs on Solana, mainly around the growing popularity of pump.fun as the main Memecoin launch platform. To date, more than 3 million tokens have been issued on pump.fun. The dominance of transaction-related activities on Solana is reflected in its contribution to network transaction fees, which account for more than 82% of all non-voting fees paid on the network.

In addition to pure network fees, Solanas token issuance and transaction process also captures high value. If the Solana on-chain transaction ecosystem is regarded as an independent financial category, it is currently ranked third in profitability, second only to stablecoins and Layer 1 network fees. The report pointed out: Solanas transaction-related activities typically account for 75%-90% of on-chain transaction fees, which is much higher than other networks such as Ethereum, Base and Arbitrum. Although L2 solutions have also shown growth and innovation, they generally face different scalability challenges and user fragmentation issues compared to Solana. Solanas fee dynamics and user activity patterns are still unique.

Bitwise CEO: Solanas market value is expected to exceed $100 billion

On November 10, Bitwise CEO Hunter Horsley a écrit ça Solana’s market value is about to exceed $100 billion. Currently, only three crypto assets have reached this level (note: USDT is not included). On the same day, SOL’s market value exceeded $100 billion as expected, ranking fourth among crypto assets.

Standard Chartered Bank analyst: SOL hitting a new high before the end of the year seems inevitable and may outperform Bitcoin

Standard Chartered analyst Geoff Kendrick predicts that Bitcoin will continue to rise until the end of the year, easily reaching $100,000 before certain Bitcoin options expire on December 27. It is worth mentioning that he successfully predicted that the price of Bitcoin would reach $80,000 before the US presidential election.

“I’m predicting $125k by year end, which is the next level, although I note that after the 2016 election, a lot of Trump-related activity peaked around the inauguration on January 20th… So if Bitcoin doesn’t get to $125k by December 31st, I think it will get there by January 20th,” Kendrick, the bank’s head of foreign exchange and digital asset research, said in an email on Sunday.

Kendrick further predicted that a rise in Bitcoin prices could “benefit all investors” given Ethereum and Solana’s recent gains, and that some tokens could outperform Bitcoin. “It seems inevitable that SOL will hit a new all-time high (all-time high of $260 in November 2021) before the end of the year,” Kendrick wrote. “A new all-time high for ETH (4,866 in November 2021) may not happen until around the inauguration. Overall, we think all of these assets will continue to rise, but SOL may perform the best.”

SOL/ETH exchange rate hits a record high recently

Auparavant, selon OKX market data , the SOL/ETH exchange rate rose to 0.0724 on November 6 , setting a record high.

Based on the above views and data, Solana has a bright future, which is naturally inseparable from its past performance and ecological efforts.

Solana’s past performance: a “Meme coin mecca” with multi-faceted development

Specifically, the excellent performance of the Solana ecosystem in the past is mainly reflected in the following aspects:

Active ecosystem: The number of monthly active addresses in October exceeded 123 million, a record high

Les données montrent that the number of Solana monthly active addresses hit a record high of more than 123 million in October. The number of unique addresses signing transactions on Solana increased by more than 42% compared to September. In January of this year, the network had less than 12.7 million active addresses. Analysts say Solanas recent surge in activity is driven by the Memecoin craze on the network, including support from platforms such as Pump.fun and decentralized exchange Raydium, both of which have experienced strong growth in the past few months.

In addition, the “State of Cryptocurrency” report released by a16z in October showed that Solana had over 100 million monthly active addresses, while Ethereum and other EVM chains had only about 57 million, indicating that user engagement on Solana is higher.

Capital bloodsucking: In October, more than $600 million of tokens were bridged from other chains to Solana, of which more than 90% came from Ethereum

SolanaFloor previously disclosed data that more than $600 million worth of tokens were bridged from other chains to Solana in October, of which more than 90% came from Ethereum.

Frequent transactions: Solana’s on-chain DEX transaction volume surpassed Ethereum in October

Selon Deflama data In October, the transaction volume of Solanas on-chain DEX reached US$52.157 billion, surpassing the transaction volume of Ethereum DEX in the same period (US$41.499 billion).

Financing Profile: Solana Ecosystem DApps Raised $173 Million in Q3

Selon Messari report In the third quarter of 2024, institutional investment in Solanas native blockchain applications recovered. 29 Solana-based decentralized applications (DApps) raised a total of $173 million, an increase of more than 54% from the previous quarter. Despite a 37% decrease in financing rounds, these financings are the largest investments on the Solana chain since the second quarter of 2022. It is reported that asset management giant Franklin Templeton plans to launch a money market fund on Solana.

Offline expansion: Solana gift cards are now available in retail stores across Switzerland

According to SolanaFloor’s previous disclosure , Solana gift cards have been launched in retail stores across Switzerland. After users purchase and activate them, the tokens will be stored offline in the Cryptonow wallet. This shows that Solana has also made great efforts in offline market expansion.

Liquidity Introduction: cbBTC Launches on Solana

Coinbase précédemment announced that its cbBTC was launched on Solana, which is also the first token issued by Coinbase on Solana.

Meme Holy Land: The total market value of the Meme coin sector on Solana exceeds 15 billion US dollars, setting a new record high

Selon the latest data disclosed by Solana Floor, the total market value of Meme coins on Solana has exceeded 15 billion US dollars, a record high.

As for the subsequent development of the Solana ecosystem, its officials are also confident about it, but it still faces considerable challenges in the future.

The Future and Concerns of Solana: Large-Scale Synchronous Composability vs. Centralized Power

Regarding the subsequent development direction of the Solana ecosystem, Solana co-founder Anatoly Yakovenko previously gave a detailed explanation in an interview.

He mentioned the unique position of the Solana ecosystem in the blockchain field and compared its deployment with L2 scaling solutions and other L1 blockchain systems.

Solana’s strengths and challenges coexist: the only way to achieve large-scale synchronous composability

Previously, Anatoly Yakovenko asked: What would happen to the vitality of the Ethereum ecosystem without the contribution of L2 solution Base?

This question was raised while observing Base’s growth metrics, especially in terms of user activity and transaction volume. He then elaborated: “In my opinion, scalability, infrastructure focus, and transaction efficiency are the three major advantages of Solana, ” recognizing the challenges Solana faces in the context of the continuous evolution of blockchain technology and further development of the platform.

Yakovenko highlighted Solana’s unique architecture, which was developed to democratize access to transaction validation. Unlike traditional finance, Solana allows anyone to set up a validator and submit transactions directly, bypassing intermediaries. This level of decentralization is difficult to replicate in traditional finance. While the functionality exists, he acknowledged that it remains a challenge to scale effectively.

Yakovenko compared Solana to Ethereum and various L2 solutions, highlighting the trade-offs between L1 and L2. L2 solutions typically use centralized sorters for low-latency transaction ordering. However, these can cause the same congestion issues as L1 chains. While L2s are often seen as short-term solutions to congestion, they face scaling bottlenecks when multiple applications or markets use them.

He emphasized that Solana’s strategic focus is on building a strong L1 chain that is capable of supporting high throughput without the need for L2 solutions.

Another key factor is synchronous composability, where multiple applications can interact in real time on a single chain. He believes this is critical to DeFi, and monolithic chains or application-specific L2s cannot support this level of composability, limiting scalability. Solanas last competitive advantage lies precisely in this: it is fully committed to large-scale synchronous composability, which makes it different from Ethereum and L2 chains.

Furthermore, Solana’s advantage lies in execution. While Ethereum is scaling through L2, Solana’s development remains focused on making its L1 perfect. He acknowledged that one day blockchains will offer similar functionality to Solana and provide faster iterations, but for now, the pace of Solana’s improvements puts it far ahead of its competitors. The core of Solana’s potential lies in perfecting its infrastructure to support fairer and more open transaction processing for a truly decentralized future, which will make Solana one of the leading blockchains in the coming years.

Of course, the issue of power centralization is still one of the concerns of the outside market about the Solana ecosystem. The most recent representative view on this point is Snowden’s remarks.

Snowden: Calls for Solana to be decentralised, questions VC’s potential influence on Solana

Edward Snowden, the whistleblower of the Prism Gate, spoke about decentralization at the Near Redacted conference held in Bangkok, Thailand. When mentioning topics such as cryptocurrency, artificial intelligence, and blockchain technology, Snowden used Solana as an example to talk about the impact of VC on blockchain projects – he described Solana as born in prison because it received a lot of VC funding, which means that financial support may hinder the ability of its blockchain network to operate independently.

While he acknowledged Solana’s rapid growth, he also worried about giving away too much ownership to investors, though he also noted that Solana could “achieve something” in the future.

Summary: Solana’s ecological end is far from coming

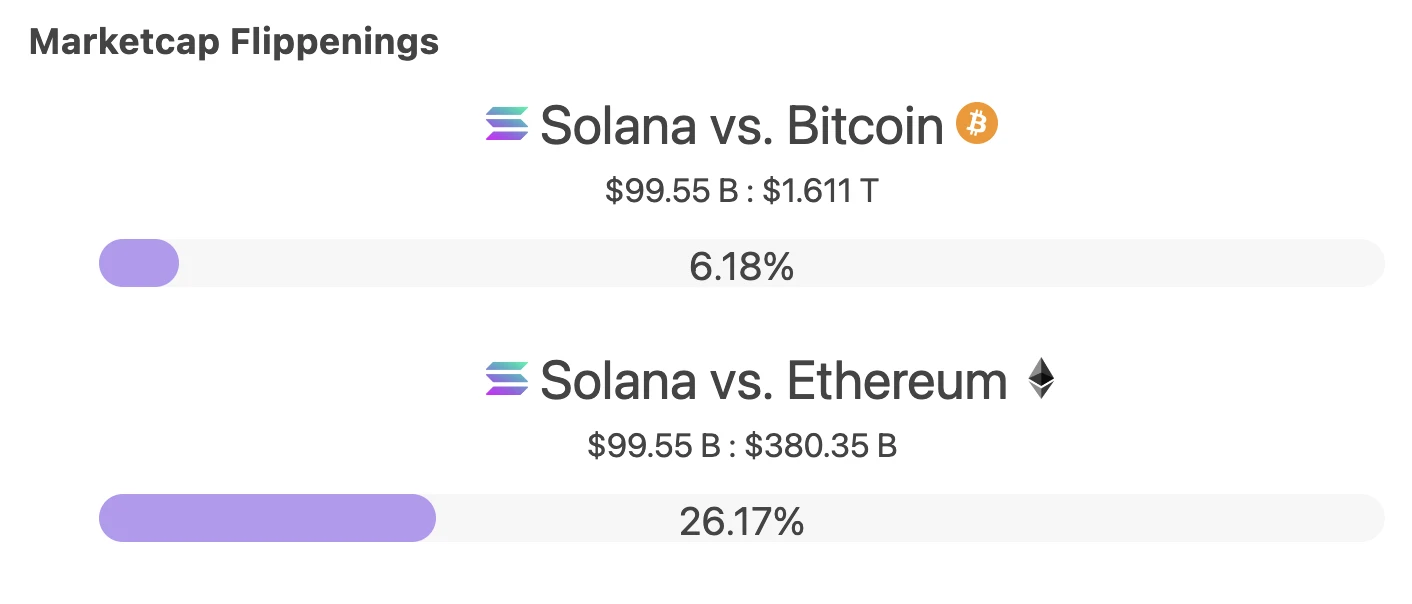

As of the time of writing, Solanas price has returned to around $210, and its market value is once again close to $100 billion. At the same time, according to information from the 8 marketcap website , compared to Bitcoin, Solanas market value is currently about 6.18%; compared to Ethereum, Solanas market value is currently about 26.17%.

After the potential of ETH, DeFi and even more fields is discovered, the Solana ecosystem may be able to truly compete with Ethereum and become a veritable Ethereum killer.

Solana vs ETH vs BTC Marché Cap

This article is sourced from the internet: When the market value of SOL exceeds 100 billion, let’s talk about Solana’s potential and constraints

Related: Say goodbye to infrastructure fever and welcome the golden age of applications?

Original author: Adrian Original translation: Luffy, Foresight News The greatest returns on investment in every crypto cycle throughout history have been achieved by betting early on new underlying infrastructure primitives (PoW, smart contracts, PoS, high throughput, modularity, etc.). If we look at the top 25 tokens on Coingecko, we see that there are only two that are not native to L1 blockchains (excluding pegged assets): Uniswap and Shiba Inu. This phenomenon was first theorized in 2016 by Joel Monegro, who proposed the Fat Protocol Theory . Monegro believes that the biggest difference between Web3 and Web2 in terms of value accumulation is that the value accumulated by the cryptocurrency base layer is greater than the sum of the value captured by the applications built on it, and the value comes…