Une nouvelle ère arrive : comment la DeFi, l’IA et le social remodèlent-ils le paysage financier ?

Original title: Crypto Convergence: How Closing the Exponential Gap in Finance will Upgrade Our World

Original article by Rich Beeman, Medium

Traduction originale : zhouzhou, BlockBeats

Editors Note: This article reveals the advent of a new era of finance: the integration of cryptocurrency, DeFi, AI and social media is sweeping traditional finance and driving a huge change. With the on-chain asset transfer, wealth transfer and the rise of a new generation of investors , the global financial order is gradually being overturned. Although the road to reform is full of challenges, the opportunities are unprecedented – those who dare to explore will stand at the forefront of this wealth explosion and lead the future.

Voici le contenu original (pour une lecture et une compréhension plus faciles, le contenu original a été réorganisé) :

The biggest hot topic in corporate finance right now is a slow-cooked legend that began in 2020 when Michael Saylor made a very risky decision to completely turn his publicly traded company MicroStrategy in a completely new direction. At that time, his Bitcoin strategy was considered ridiculous by most of his peers.

A few years later, this so-called “Bitcoin strategy” — in simple terms, buying and holding the leading cryptocurrency using leverage — has produced impressive results. Now, Bitcoin is eyeing new highs, and Since implementing the strategy, MicroStrategy has outperformed every stock in the SP 500, even 2024s hot Nvidia stock.

It is undeniable that Bitcoin is steadily developing and gradually being seen as more than a simple high-risk asset, and at the same time, the overall landscape of the cryptocurrency industry is also expanding.

Top crypto venture capital firm a16z shared some impressive data in its latest Crypto Industry Report. They estimate that the number of active blockchain addresses in September 2024 will reach 220 million, three times the number at the end of 2023. . Global cryptocurrency activity and usage reached an all-time high, with approximately 617 million people holding cryptocurrencies, accounting for more than 12% of the worlds population over the age of 18. In addition, they analyzed in detail why cryptocurrency has become a major issue in the upcoming US election. Key political issues.

More and more countries, such as Bhutan, Argentina and El Salvador, are taking bold steps to adopt Bitcoin as a reserve currency and devoting national resources to mining it. Currently, several countries are working on their own Bitcoin strategies and proposing A framework to support innovation in digital assets, and even in the United States there is growing bipartisan support for calls to establish a strategic Bitcoin reserve.

At the same time, Bitcoin strategy has gradually gained attention in the traditional financial world, but recently the crypto field has been hotly discussed by another thing. A new MEME coin on the Solana chain called Goatseus Maximus has risen rapidly. Its market value soared to $900 million within a year. Behind this success is the market effect of AI agents driving speculative commerce through memetic communication and social influence on the X platform.

This seemingly bizarre success story actually demonstrates how AI-driven narratives, DeFi liquidity, and social influence can impact speculative markets, and even more amazingly, it gives us a glimpse into a whole new frontier: finance. , a future where technology and culture are seamlessly integrated, and unique “superpowers” are achieved through digital assets.

But from these data and headlines, we can clearly see the bigger picture of cryptocurrency revolution – the global financial system is undergoing an unprecedented transformation.

Saylor said in an interview: The world will be reshaped, and finance is undergoing a digital transformation. Although Saylor and many people still focus on Bitcoin, the reshaping of the world he refers to includes many things related to traditional finance. Major changes in system collaboration.

In short, the digital transformation of finance goes far beyond Bitcoin to encompass multiple forms of currency and assets, as well as diverse operations that rely on advanced programming capabilities. As such, the cryptocurrency industry has prioritized the development of A large amount of infrastructure and ambitious developers are committed to building a decentralized protocol network that can support complex applications and rapid iteration.

Recently, interest and investment from major institutions have pushed this innovation into new areas. Almost every day, major financial institutions around the world take substantial steps towards integrating digital assets and cryptocurrencies. These changes are happening at a rapid pace. The impact is so broad that it is difficult to fully comprehend the full picture, especially as the pace of change continues to accelerate. It is becoming nearly impossible to keep up with every major development, and increasingly difficult to grasp the key points in the endless flow of information. Difficulty in development.

However, one thing should be clear from all this noise: we are at a tipping point. Cryptocurrency is rapidly entering its mass deployment phase and is about to reach a critical mass that will impact the global financial system. The cryptocurrency industry is maturing, driving The digital transformation of finance, which has been brewing for more than a decade, is gradually entering the mainstream. However, the process of reshaping the financial system is extremely complex, which is why this transformation has taken so long to warm up.

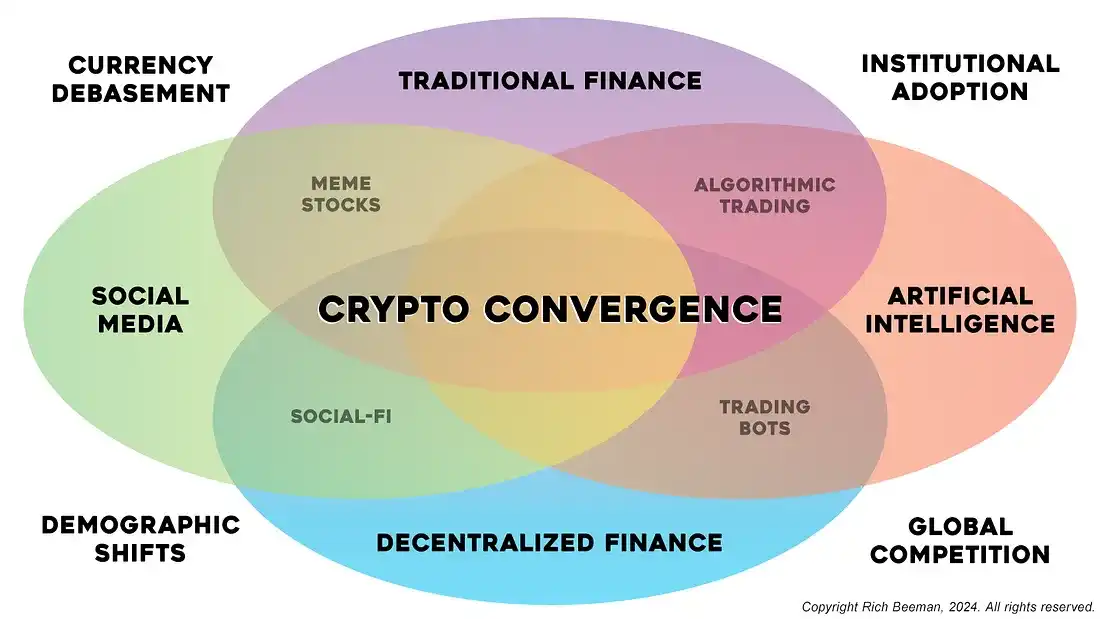

At present, multiple forces are gradually coming into place to jointly promote this transition. What will follow is a super-convergence that will truly change the world – at least three exponential technologies are colliding head-on with the traditional financial system: DeFi, AI and SocialFi. These emerging technologies They are called “exponential” because they rely on the spread and application of underlying digital networks, driving a compounding effect of accelerated growth.

At the macro level, productivity gains drive exponential growth in computing power (Moore’s Law) by reducing costs through cumulative learning (Wright’s Law), while increased network participation leads to greater value for all users (Metter’s Law). As these networks evolve, new subgroups form, unlocking more layers of utility (Reed’s Law). These compounding effects interact to form a feedback loop of continued innovation, accelerating along an exponential curve—ultimately forming Ray Kurzweil calls this the “Law of Accelerating Returns”.

In short, all this illustrates two points:

1. To move an outdated financial system into the 21st century, many factors need to work together;

2. The pace of change will only accelerate in the future.

Fortunately, it’s not just technology that’s driving this convergence and innovation. There are powerful cultural and macro trends like demographic shifts, institutional adoption, currency debasement, and global competition—which explains why traditional financial systems are An update is almost a foregone conclusion.

At the heart of this massive transformation is what I call the “exponential gap in finance”—a term borrowed from Azeem Azhar’s 2021 book, The Exponential Age. The chasm between emerging technologies is complex and wide. Understanding this gap is the simplest way to grasp the urgent need for upgrading the current financial system.

As a Web3 entrepreneur, the past few years of cryptocurrency have been both exciting and confusing. As I re-examine the current financial environment and try to understand why the financial landscape has seemed so chaotic in recent years, I’ve gradually sorted it out. The deep logic behind it. For those who pay attention to and invest in the crypto space, the past few years have been filled with a confusing regulatory environment, contradictory statements from the media, and skepticism from traditional institutions. Not to mention the huge volatility of emerging digital assets. .

This is the hallmark of the “exponential divide” — the difficulty that legacy systems have in adapting to rapid technological change. In this case, the vested interests of legacy industries are obstructing progress at every turn. , it is still difficult to clearly foresee the future direction. This transformation is particularly difficult because it must be carried out without stopping global markets and cannot fundamentally restructure the entire financial system.

But like any major technological revolution, the exponential age divide will close quickly and globally. This process will accelerate in the coming years as technological advances and cultural trends drive the way forward and reshape the financial world. The huge benefits brought about encourage all parties to actively participate. This process, although chaotic, is unstoppable. It is crypto-fusion – a transformation that combines disruptive technologies to build, manage and create wealth in a whole new way.

It is this trend that has forced traditional finance to evolve itself and rely on these powerful digital tools to remain relevant. Traditional systems can no longer ignore this change, as their infrastructure is weak and inadequate in the face of these new financial realities. History has proven time and again that institutions that fail to cross the exponential gap will be left behind.

Global turning point

From the perspective of a millennial investor, we have seen very little substantive innovation in the way financial markets operate.

Aside from mobile banking and commission-free trading offered by Robinhood, there has been little to speak of in terms of digital native finance. That said, the TradFi system has largely managed to resist or absorb any major disruption from new technologies. .

The result is a system that has seen wealth inequality and a devalued dollar reach unprecedented heights. By most measures, most millennials are lagging behind financially, while baby boomers are the most successful generation in history. The wealthiest generation. As of June 2023, they control 52% of America’s net worth, despite making up only 20% of the U.S. population (source: Yahoo Finance ).

For cryptocurrencies, this means that the past decade has almost been spent in the cold shoulder of TradFi institutions. In particular, the Biden administration has placed the U.S. crypto market in an extremely hostile regulatory environment over the past four years, taking The United States has adopted strategies such as Operation Chokehold 2.0 to try to curb the popularity and liquidity of cryptocurrencies. Chinas attitude has also been hostile, and in 2021 it completely banned the holding and mining of cryptocurrencies.

But cryptocurrencies continue to prove their value proposition, and despite the measures taken by traditional institutions, emerging technologies continue to develop and expand unimpeded. The core believers leading the crypto movement continue to double down, continuously testing new uses and promoting important functions. Extensions.

With all these contradictions at the top and apathy in the market, ordinary people are still not ready. Most people do not realize that we are standing on the brink of this technological convergence, or understand the challenges of building a faster, transparent, and globally accessible The significance of the financial ecosystem.

In the next decade, both personal and professional finance will look dramatically different than it has in the past 50. The tide has turned toward crypto, and what happens next will be determined by the speed of this convergence.

Closing the exponential divide in finance will require not only technology but also tremendous cultural forces. This transformation is being driven by profound cultural forces, including active institutional engagement, generational demographic shifts, and the unprecedented scale of global market competition. .

Generational shift: Millennial and Gen Z retail investors are more digitally native, skeptical of traditional institutions, and have embraced these emerging fintechs. They have a higher tolerance for risk and approach investing differently than previous generations. Data shows that four out of five millennial millionaires hold cryptocurrencies, while only one in two hundred traditional portfolios has any exposure to Bitcoin. Nearly 60% of new investors report Claims to invest in cryptocurrencies.

Institutional adoption: Banks, asset managers, and governments are integrating blockchain and crypto-native solutions to stay competitive. This competition is intensifying as Wall Street and TradFi try to stay ahead of crypto’s disruptive impact. Almost all of it is denominated in U.S. dollars, and it completed $8.5 trillion in transactions in the second quarter of 2024, more than double Visa’s $3.9 trillion in the same period. Companies like Microsoft and Tesla are also testing their Bitcoin strategies .

Global Competition: Countries and companies are aware of the global nature of crypto and the huge economic potential that comes with being ahead of this change. Despite banning cryptocurrencies a few years ago, China now seems ready to lift the ban. The BRICS countries are developing Plans to leverage digital currencies. Dubai just announced it will accept cryptocurrencies for real estate investments, while many countries, including the United States, are advancing crypto-friendly policies. Sovereign Bitcoin mining is also gaining popularity.

Currency devaluation: The United States has entered an era of fiscal dominance, increasingly relying on government spending to drive the economy. The top 10% of households control 67% of total wealth, while the bottom half of the population owns only 2.5%. The currency of the US dollar Devaluations exacerbate inequality. Currency devaluations are a growing problem as global debt approaches $100 trillion and countries grapple with stubborn inflation caused by rising money supplies.

These macro trends are driving the continuous adjustment of the strategic allocation and future investment of the TradFi institutions, and more and more strong cases have emerged, giving rise to exciting new enterprises. In addition to the obvious Bitcoin and Ethereum ETFs, there are also Texas Instruments , The New York Stock Exchange (TXSE), which is expected to launch in 2026, aims to compete directly with the New York Stock Échange and Nasdaq.

TXSE has successfully raised $120 million from crypto-backed companies Blackrock and Citadel to build a new exchange from scratch using cutting-edge digital technology. Although specific details have not yet been announced, the new Dallas-based exchange is likely to It will integrate crypto-native features — such as blockchain rails, tokenized assets, and automated market makers — and position itself as a leader in the new financial landscape.

Robbie Mitchnick, head of digital assets at BlackRock, once said: Blockchain is expected to revolutionize financial infrastructure. Especially when it is combined with some DeFi applications built around tokenized assets…If this vision is realized, we will have a more efficient , accessible, low-cost, and flexible financial system rather than the traditional financial track.

One can imagine how much advantage a new US stock exchange with crypto-native functionality would bring, and how many small and medium-sized companies would benefit from improved financing mechanisms and faster transactions in a 24/7 blockchain-based market. Cash flow.

Regardless of whether this vision will be realized on TXSE, the boundaries between DeFi and institutional finance are becoming more blurred every day, and the foundation for deep cooperation has been laid.

Three exponential forces driving finance forward

As the crypto industry matures and becomes a vital part of the global economy, the discussion about it is still very preliminary. Society needs updated mental models to more easily understand the complexity of the financial digital transformation we are experiencing.

Crypto Convergence provides such a framework, explaining in simple terms that traditional finance is on an irreversible collision course with at least three key exponential technologies — DeFi, AI, and social media — that will shape the future of finance. A decade that completely reshaped the financial landscape.

Crypto integration is driving a profound upgrade in the financial world, improving the way financial services work while expanding opportunities for individuals and institutions. Combined with the cultural factors mentioned above, these forces are creating a new landscape that is disrupting finance and accelerating the transition to a more open, efficient, and decentralized financial system. Centralized system evolution.

From this perspective, crypto integration can be likened to the “manifestation” of financial reform that began in 2008. This grassroots movement, driven primarily by the Occupy Wall Street movement and the creation of Satoshi Nakamoto, is reaching a turning point where the big picture is beginning to emerge. .

In fact, U.S. Senator Cynthia Lummis described her proposed legislation — for the United States to establish a strategic Bitcoin reserve — as “our Louisiana Purchase moment,” a key event in the realization of Manifest Destiny.

With this metaphor in mind, we can begin to collectively look beyond Oregon Territory and see the West Coast as a logical place to go. As the bigger picture becomes clearer, the dream of pursuing a fairer financial system becomes more hopeful with each passing day. .

This movement, which began with a historic financial collapse and the daunting task of fixing systemic banking problems, holding banks accountable, and protecting ordinary people’s money, has grown into a powerful force.

Just as the 49ers seeking fortunes and the brave entrepreneurs pioneered the Wild West, it is the crypto “battlefield pioneers” who are constantly blazing new trails on the financial frontier. These risk-tolerant rebels are In the high-stakes field of decentralized finance, unproven cutting-edge technologies are paving the way for mainstream adoption.

DeFi is leading financial innovation by eliminating barriers and providing parallel systems to directly access services such as loans, transactions, and returns. Layer 2 solutions on Ethereum such as Optimism and Base have greatly improved scalability and reduced transaction costs, making DeFi Becoming more accessible. Scalable L1 platforms like Solana and Sui are also increasing accessibility and creating powerful use cases for retail investors.

Meanwhile, projects like MakerDAO and Ondo Finance are bringing RWAs like real estate and government securities to the blockchain, integrating billions of dollars of traditional assets. BlackRock has already used its Ethereum-based BUIDL fund to bring Treasury bonds to the blockchain. Yield tokenization, and publicly stated plans to bring trillions of assets onto the chain in the next few years.

At the same time, AI is transforming financial markets through automation and personalization. Robo-advisors and AI agents are rapidly becoming advanced, able to tailor portfolios to an individual’s financial goals. We are even beginning to see AI agents being applied to decentralized It is encapsulated in a Digital Autonomous Organization (DAO) or Trusted Execution Environment (TEE) as a form of experimental decentralized venture capital organization.

AI-driven trading algorithms are already reshaping most markets, executing trades at speeds beyond human capabilities by analyzing massive data sets, including sentiment trends from social media. In addition, AI-driven fraud detection systems are helping financial institutions monitor transactions in real time. , identifying fraudulent activity more effectively than ever before. The rate at which large language models (LLMs) and other AI are being iterated is exploding and cannot be underestimated.

But the driving force behind all of this convergence is attention as much as computing power, regulatory frameworks or platform capabilities. Social media is evolving into a ubiquitous and powerful Swiss Army knife for smart investors and traders. .

Platforms like Reddit, Discord, and X are at the forefront of SocialFi, where communities organize around shared investment opportunities, giving rise to meme stocks and now MEME tokens. Popular memes like PEPE and BONK drive network liquidity, and they are not only Whether it is a financial instrument or a cultural asset, it is driving the growth of the ecosystem. Although slower than I expected, traditional finance is also moving towards digital management strategies to reach retail investors.

Social media channels are also spreading financial literacy, promoting community-driven investment strategies, and enabling users to actively participate in decentralized governance through tokens like those on Uniswap. Decentralized social platforms like WarpCast and Nostr are also gaining traction.

Obviously, these summaries are just some high-level examples. More importantly, these three exponential technologies are increasingly overlapping, and their convergence is creating a powerful flywheel effect.

As Sam Altman described in 2021, crypto provides a deterministic scarcity mechanism that balances the infinite abundance of artificial intelligence, thereby providing constructive boundaries and limits to the generative process. The decentralized power of crypto, combined with social The democratizing power of the web will offset the centralizing effects of AI. Today, a new trend on Crypto Twitter — AI agents launching MEME coins — is based on an intuitive understanding of these synergies.

During this cycle, many people will realize that AI combined with blockchain is creating new automated and decentralized market opportunities. SocialFi will empower communities around these opportunities and promote more new ways of investing. AI will also Continue to simplify the DeFi process and continue to expand community participation on social platforms in the future.

Each area reinforces the other, accelerating adoption and driving innovation, unleashing the powerful effects of the law of accelerating returns. The synergy of these technologies unlocks a superset of tools and capabilities, forming the interface that takes us into Web3.

This new paradigm empowers Internet users to more effectively leverage network effects in an attention-driven digital economy. It aims to take back the Internet from the monopoly of Web2 and move toward a decentralized, open platform. It is also a continuation of the original vision of the Internet. Web3 achieves this goal by distributing value to builders and core users at the protocol layer, rather than concentrating wealth and control in the hands of a few companies.

While existing power structures will continue to fight these changes, the combination of these technological and cultural forces is pushing the financial industry toward a more inclusive, efficient, and innovative future. As the lines blur, we are witnessing the birth of a new financial infrastructure that will unlock the future of money and wealth.

Why Cryptocurrency Is the Unifying Engine of Change

While each of these exponential technologies is a core component of this transformation, cryptocurrency is the engine that makes the convergence of traditional finance and it possible.

This is because blockchain provides a decentralized infrastructure that ensures trustless transactions, data integrity, digital identity, and secure asset ownership in all of these areas. As ARK Invest CEO Cathie Wood describes it: In that way, blockchain is adding a “financial layer” to the internet, a layer that should have always existed.

The fundamental principles of cryptocurrency — open source, permissionless, immutable, global, transparent, democratic, and censorship-resistant — ensure that new ideas can develop and scale without the friction of relying on the slow, centralized control of outdated traditional systems. The integration of blockchain networks built on this philosophy, and the underlying mechanisms that make these ideas possible, is how a viable new Internet financial layer can be built.

Importantly, the cryptographic properties of blockchain also provide a key mechanism for controlling bad AI activity. As early as 2017, Fred Ehrsam, co-founder of Coinbase, said: “Blockchain This is because AI is a code-based entity that can exist on-chain in smart contracts. On the blockchain, there is no difference between AI and humans, said Fred. Deep observation.

In general, this seems to be true. The Cambrian explosion of new synthetic life forms has arrived, and they are rapidly acting in the real world by owning cryptocurrency tokens to control resources. Facilities will now enable not only interoperability between AI and cryptocurrencies, but also greater collaboration across social networks and digital finance.

This new financial layer based on blockchain networks unlocks the potential of Web3, where the interoperability and interconnectivity of these emerging technologies can converge into rapidly evolving financial innovations. Of course, existing market participants, legacy systems, and policies The inertial resistance of the framers remains. The bad actors have not disappeared. Although we are at a tipping point in financial transformation and many of the edges of cryptocurrencies can be abstracted, these issues still severely hinder the potential of crypto integration.

The mainstream narrative has long viewed the speculative nature of cryptocurrencies as reckless and volatile, sometimes even declaring them to be scams. One could fill a book with all the negative things leaders from all walks of life have said about cryptocurrencies over the past five years or so. For example, rat poison is not difficult.

Ironically, many of these leaders who were once so vocal have now completely transformed and become staunch advocates of cryptocurrency. However, as Fed official Kashkari said publicly this month: “Unless Unless it’s drugs or illegal activity, there’s virtually no trading happening in cryptocurrencies.”

In fact, reality is never as simple and binary as Kashkari et al. believe. The facts emerging from the cryptocurrency front today are far more profound than the sensational headlines, financial nihilism, and over-leveraged gambling would suggest. It’s much more complicated. Many of the innovations driving the digital transformation of finance are actually heavily dependent on the speculative nature of cryptocurrencies.

This pattern of disruptive, countercultural forces in society pushing boundaries and spawning accelerated technological innovation is well documented in other industries. Notably, adult content was at the heart of many of the innovations that are now fundamental to the media and entertainment industries. For example, streaming video, online privacy systems, mobile devices, and broadband Internet have played a key role in the rapid development and adoption of these technologies.

Just as early Silicon Valley startup culture achieved breakthroughs through risk, today’s cryptocurrency “casino culture” has become a high-stakes testing ground for new financial instruments, liquidity mechanisms, and governance models. Perhaps the most notable example at present is the cryptocurrency-based Binary betting platform Polymarket is updating the standard for real-time sentiment analysis and mainstream political coverage.

Regardless of the stigma that cryptocurrency speculation continues to carry, and the negative byproducts it may bring, the startling fact is that speculation is what drives many industries forward.

Contrary to the popular belief that NFTs and memecoins are just gambles for worthless trinkets, projects like the high-stakes DeFi and SocialFi experiments have actually spawned technological advances. The speculative energy harnessed by the breakthrough platform Pump.Fun, Serves as a stress test and catalyst to drive the development of the Solana ecosystem.

Don’t believe it? These speculative behaviors are precisely the forces that will accelerate technological progress and eventually enter the mainstream financial field.

In his widely watched “Jeton 2049 Memecoin Super Cycle ” speech, Murad Mahmudov shared similar insights, saying that the crypto industry is “speculation first, technology later” and that tokens This principle explains why memecoins, NFTs, and other speculative assets not only bring retail users into the crypto ecosystem, but also push the boundaries of technology.

The smart money understands this, whether they’re willing to admit it publicly or not. Why is nearly every blockchain vying to own a top cultural token? Because these speculative efforts are creating vibrant cultural pockets at the forefront of cryptocurrency, where , financial innovation is happening. Like the early Boston district or Montmartre in Paris, these virtual frontiers attract pioneers, builders, and innovators who thrive in these high-stakes environments.

In fact, while traditional financial institutions initially viewed cryptocurrencies as a bunch of speculative “toys,” they are now rapidly beginning to incorporate these technologies into their systems. Venture capitalists and institutional investors are actively using speculation to create liquidity, driving growth and adoption of their projects.

It’s hard to deny now that the rise of tokenized assets and blockchain-based financial products demonstrates how speculative markets are driving the evolution of global finance.

While blockchain infrastructure enables ownership of digital assets and unlocks financial potential, speculative assets and trading have also played a catalytic role in driving financial progress and reform. This is how cryptocurrencies are forcing companies like BlackRock to ) and Fidelity to adopt technologies once considered impractical or irrelevant, and to advance bipartisan legislative agendas.

Some fringe industries, often ignored or demonized by mainstream society, are actually key drivers of technological progress. Just like the speculative cryptocurrency market, these industries incubate new ideas, drive rapid iteration, and refine technologies until they can achieve mainstream adoption. Adoption. This interplay of experimentation and rapid iteration is critical to driving technological progress.

While society is reluctant to acknowledge that the porn industry once drove the forms of media and entertainment we use today, blockchain innovation and speculative cryptocurrency markets are laying the foundation for the financial system of the future. As much as the value of bullshit is worth it, many technological advances will continue to occur on the forefront of cryptocurrency.

Once in a Lifetime Opportunity

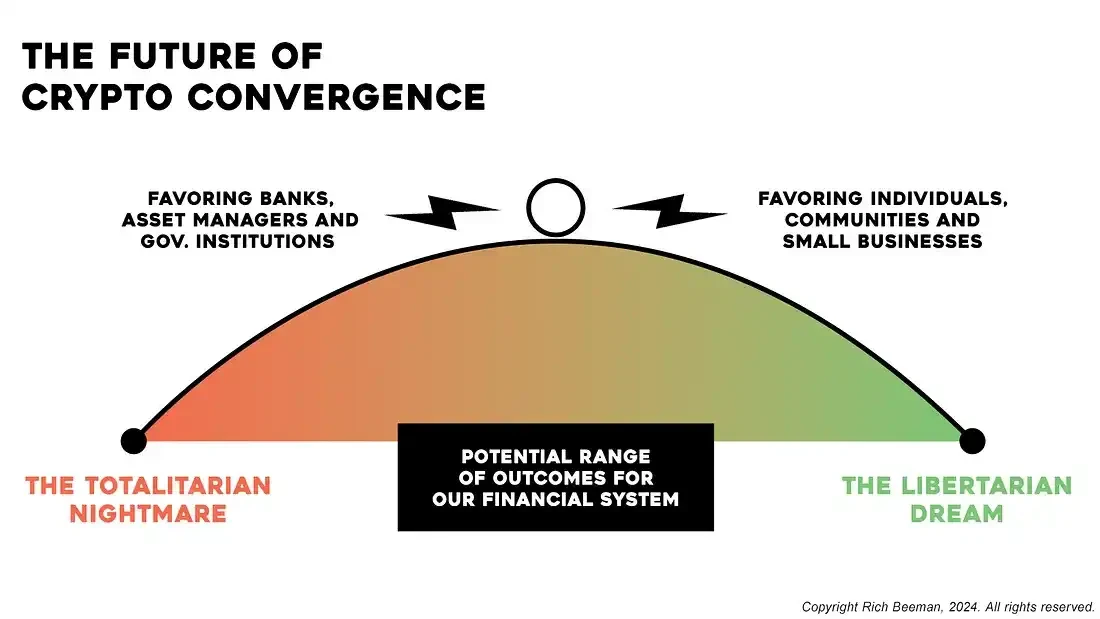

The future of cryptocurrency convergence is impossible to predict, but we can assume it lies somewhere on a spectrum. At one end is the totalitarian nightmare, a world in which crypto is held hostage by governments and financial institutions to extend centralized control.

In this scenario, the U.S. government and regulators would impose strict measures on altcoins and decentralized platforms, allowing only approved networks like Bitcoin and Ethereum to exist under a highly regulated framework. (CBDCs) become a tool to monitor every transaction, essentially dismantling financial privacy.

This vision echoes the worst elements of China’s surveillance state, in which innovation is tightly controlled and individual sovereignty is relegated to a distant memory.

At the other end of the spectrum is the libertarian dream of a decentralized future in which the United States embraces crypto innovation and creates an open financial environment based on self-custody and digital sovereignty. Progressive policies ban CBDCs and create a business environment similar to the early days of the Internet.

In this version of the future, cryptocurrency fulfills its promise of financial freedom, empowering individuals and small businesses while shifting power away from traditional institutions. The ideals of the U.S. Constitution—privacy, autonomy, and liberty—are realized on the blockchain. It has been updated and consolidated in upper governance and protocol layer decision-making.

However, the most likely outcome is probably somewhere between these extremes. In reality, most regulators and policymakers will not continue their full-throttle crackdown to eliminate cryptocurrencies. The game theory of Bitcoin adoption has officially begun, with countries, companies, and Financial institutions gradually realized that they could no longer remain indifferent and began to accumulate crypto assets.

The United States will struggle to strike a balance between innovation and control. On the one hand, the government recognizes the need to remain competitive in the global digital economy; on the other hand, financial giants such as banks, asset managers, and government agencies naturally want to maintain control over Control of critical financial infrastructure.

This mixed middle scenario is likely to continue to be chaotic until a new equilibrium is reached, a process that could take some time. Murad recently made a similar prediction, suggesting that things will get worse before they get better. Compare this chaotic transition period to Germanys ill-fated Weimar Republic.

In the meantime, we may see some elements of decentralization, such as Bitcoin ETFs and blockchain-based clearing systems, gradually integrated into the mainstream financial system. But these developments are likely to be at odds with limiting the disruptive power of DeFi and altcoins. The coexistence of regulatory requirements presents an inharmonious state.

This progressive middle ground presents many challenges, but also new opportunities. Even amid regulation, crypto projects will continue to drive innovation and find niches within the broader ecosystem where decentralization can thrive. Technologies like zero-knowledge proofs, governance tokens, and dApps will help keep the dream of financial sovereignty alive even as institutions try to apply them to more traditional uses.

Ultimately, the outcome of cryptocurrency convergence depends on how policymakers, entrepreneurs, investors, and voters shape this transition. In this complex environment, those who are willing to strike a balance between caution and creativity will have the opportunity to influence the next generation of finance. In this future, cryptocurrency is neither completely controlled nor completely free — it becomes a battleground for progress.

Currently, a revolution is underway driven by exponential technologies that are dismantling legacy structures and potentially building more inclusive, efficient, and community-driven systems. As traditional finance increasingly integrates DeFi protocols, AI automation, and SocialFi ecosystem, we are entering a new era of democratized financial power.

This era of cryptocurrency convergence offers a rare opportunity to build an alternative financial system that serves individuals as well as the powerful, and a path to a more equitable future. But it will require forward-thinking strategies, courageous leadership, and Broad community involvement.

Replacing a financial engine in mid-air is more than a metaphor – it reflects the reality that global markets must keep functioning while undergoing major upgrades, and it also highlights the amount of work that remains to be done and the extremely high risks involved. Traditional financial companies, policymakers, and established service institutions have a positive attitude towards cryptocurrencies, but it is impossible to shut down the traditional financial system for repairs. Therefore, many complex parts of our financial system must be integrated into existing businesses. seamlessly absorb these innovations within the constraints of current cycles and practices.

This is exactly the pain point and embarrassment of the current state of cryptocurrency as an emerging industry, and why this stage can be called the adolescence period. Although cryptocurrency is experiencing many growing pains, this period is also a key leadership motivation. The moment it starts to work.

The central question is: Can we work together to tilt the future toward self-sovereignty, or will we allow ourselves to slide further toward surveillance and control?

As crypto regulation takes shape, recent events have given us a glimpse into both possibilities. Efforts such as the Anti-Surveillance State CBDC Act demonstrate resistance to centralized digital currencies, reflecting concerns about financial privacy and government regulation. Concerns about overregulation. The bill has gained growing support in Congress, signaling a desire to curb state-controlled financial surveillance.

Just this week, Pennsylvania became the latest state to pass a regulatory clarity bill for digital assets, dubbed the “Bitcoin Bill of Rights.” The bill passed with strong bipartisan support, with 76 Democratic members and 100 Republican members voted unanimously in favor. These developments suggest that if pressure is maintained, there is political will in the United States to resist a completely surveillance-oriented financial system.

However, it is a delicate balance, and traditional financial stakeholders, including large institutions and governments, continue to explore ways to control or regulate decentralized assets. As the United States and other major countries navigate the crossroads of cryptocurrency integration The challenge is whether we can harness the momentum of these forces to drive individual empowerment, or be swayed by the gravitational pull of surveillance infrastructure that will défine the future of money and finance.

Only time will tell whether we can redirect the course of history toward individual freedom and self-sovereignty, or fall back into the old path of prioritizing security and convenience over ownership. Personally, I choose to be optimistic. The race to reform the financial system There are huge benefits, and those who move first are expected to control the creation of the next generation of wealth.

I agree with Murad that we will eventually reach the Belle Époque again, an era characterized by social stability, economic prosperity, and cultural flourishing, all driven by great technological advances. Even if this means We have to go through some tough times.

Over the next decade, the “exponential gap” in finance will be largely closed, as waves of cultural and technological innovation will relentlessly impact our outdated financial practices. I believe that by 2034, most of the big opportunities will have emerged. And the era of cryptocurrency convergence will come to an end.

We will see a transfer of wealth from baby boomers to millennials and Gen Z, and see trillions of existing assets being on-chain. More of the world’s money supply will flow into the top cryptocurrencies as people try to escape from the assets that undermine them. I foresee the crypto industry gradually expanding and eventually integrating the entire economy and financial sector.

This means that, just as digital news source X has made mainstream media its downstream, traditional financial institutions will eventually become downstream of crypto platforms if they do not evolve. Similarly, the innovations happening at the forefront of crypto today will ultimately determine the mainstream financial sector. future direction.

As famous venture capitalist and author Chris Dixon said, What smart people do on weekends, other people will do on weekdays ten years from now. There are many geeks with IQs of 200 spending their nights and weekends working on crypto today.

While frontier exploration isn’t for everyone, there are many more passive, low-risk ways to get involved in crypto today. Whatever your role, those who recognize the potential of crypto and are willing to explore this intersection of disruption, creativity, and commerce will will be at the forefront of the global financial revolution.

It’s not easy to keep up with this trend, but it can be life-changing.

We are only beginning to see how the convergence of AI, DeFi, and social media will create a viral financial phenomenon, and along with this “Cambrian explosion” comes new wealth. For those who participate, the impact of these forces is huge. Convergence and the digital transformation of traditional finance constitute one of the most lucrative opportunities of our time.

DeFi is already replacing traditional gatekeepers, allowing anyone with internet access to borrow, lend and trade without the need for intermediaries. AI is enabling higher levels of personalization and automation, streamlining financial processes and risk detection, while providing a platform for the Innovative use cases open up countless possibilities.

Social media networks and the SocialFi platform will also continue to redefine investment behaviors, community collaboration strategies, unite around the most attractive cultural units, and embrace decentralized governance models.

Yes, the economic incentives are great, but those who view “crypto integration” as simply a matter of profit are too narrow-minded — at its core, it is about a fundamental shift that can be traced back to the global Financial crisis. The crypto movement that emerged from that crisis has led us toward a financial paradigm that prioritizes transparency and inclusion, protected from centralized manipulation by mathematical proofs.

The same institutions that caused that crisis are now recognizing the power of this movement and that these disruptive technologies are inevitable developments rather than passing fads. Moreover, the rapid pace of exponential innovation means that traditional finance and Web3 The gap between the frontiers will close faster than many expect.

Unlike traditional finance, many of the best opportunities in crypto are open to anyone who wants to participate.

We can all thrive by seizing these opportunities and leveraging new financial technologies to gain a foothold in the future market. Crypto-convergence provides a theoretical framework that can both identify emerging areas of financial innovation and reveal emerging risks that need to be avoided.

Those who choose to act now — whether developers, investors, or entrepreneurs — will be able to seize the initiative in this new paradigm and perhaps even shape the emerging system at the founding level.

Crypto-integration is more than just an economic trend—it is a multilateral movement of change committed to reforming and reshaping the global financial system. By decisively adapting to this change and embracing integration rather than resisting it, we will all benefit from this Benefit from one of the most important opportunities of our time.

This article is sourced from the internet: A new era is coming: How do DeFi, AI and Social reshape the financial landscape?

Related: 7 DeFi projects worth watching at the Solana hackathon

Original author: DefiSolar Original translation: BlockBeats Editors note: With the recent value discovery of projects such as Raydium, Kamino and Drift, Solana DeFi has become the focus of market attention. According to incomplete statistics, in the past three years of Solanas hackathons, 60,000+ developers participated in the hackathons, 4,000+ projects were launched, and the cumulative financing exceeded 600 million US dollars, and star projects such as Jito, Tensor, io.net, Marinade, and Solend were born. In order to find the next Solana ecosystem star, this article sorted out the high-quality DeFi projects in the latest Solana hackathon Solana Radar. The following is the full text of the article. There are many hidden gems in the DeFi space. I鈥檝e walked through every Solana Colosseum Radar hackathon app so you don鈥檛 have to.…