Dernier rapport de Grayscales : les marchés d'investissement attendent avec impatience la victoire de Trump, les flux d'ETP ont atteint un niveau record et la crypto A

Original article from Recherche en niveaux de gris

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Summary of key points:

-

Bitcoin has rallied in October as markets have focused on the U.S. election. Polls show a tight race for the White House, but changes in financial assets and implied odds in prediction markets suggest investors now see a better chance of Trump winning.

-

Bitcoin exchange-traded products (ETPs) have seen significant net inflows this month, although some of the new demand may reflect basis trades by hedge funds (who may be long Bitcoin ETPs and short Bitcoin futures).

-

The intersection of crypto and AI technologies continues to have far-reaching implications, including autonomous chatbots promoting their own meme coins. While it’s easy to overlook the significance of these projects because they’re fun, they show that blockchain technology can be an effective tool for mediating economic value between humans, AI agents, and connected physical devices.

In October, the market expected Trump to win the election

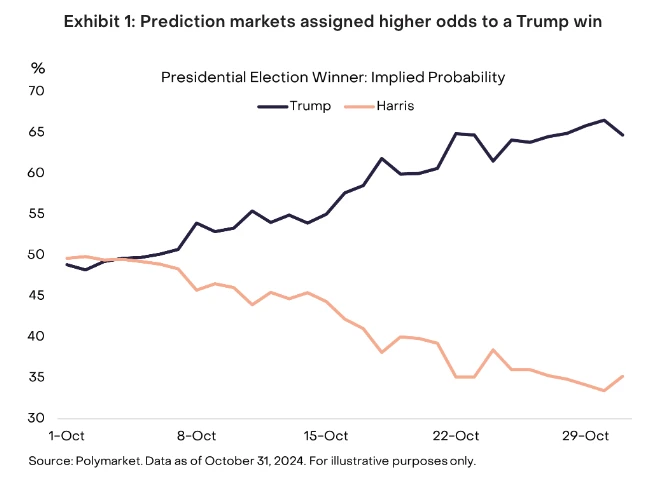

US voters will head to the polls on Tuesday, November 5, in an election that is expected to have a significant impact on the digital asset industry. While polls show a tight race for the White House, investor expectations appear to have shifted toward a victory for former President Trump over the last month. For example, at the end of September, odds on blockchain-based prediction market Polymarket showed Vice President Harris with a slight edge over Trump at the time. However, by the end of October, Polymarket’s presidential election market showed a 65% probability of Trump winning (Chart 1). Prediction markets are not infallible, and Harris could win the election, but the shift in investor expectations for a Trump victory appears to have driven asset markets higher over the last month.

Figure 1: Prediction markets show Trump has a better chance of winning the election

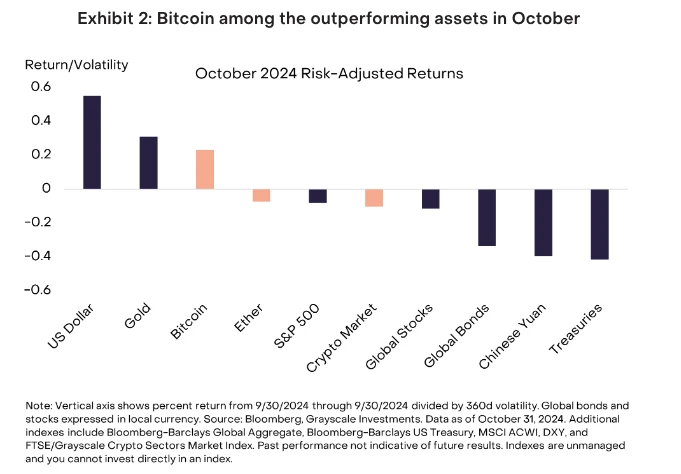

Whether financial markets expect a higher probability of a Trump victory can only be inferred indirectly, but Grayscale Research believes that cross-asset returns in October are consistent with the Trump trade (Figure 2). From a macro perspective, the appreciation of the US dollar and the depreciation of the RMB may reflect peoples increased perception of tariff risks. Similarly, the increase in bond yields (bond prices fall) and the increase in gold prices may reflect expectations of larger budget deficits and higher inflation under the Trump presidency. Bitcoin has appreciated by 9.6% this month and is one of the better performing assets on a risk-adjusted basis. Trump is enthusiastic about Bitcoin and cryptocurrencies, so the increase in Bitcoin prices may reflect the markets expectations of a regulatory environment that supports Bitcoin. In addition, Bitcoin, like gold, may be responding to potential macro policy changes during the Trump presidency.

Figure 2: Bitcoin was one of the best performing assets in October

The results of the U.S. election could have a significant impact on the digital asset industry. The next president and Congress may enact legislation targeting cryptocurrencies and may change tax and spending policies that affect broader financial markets. Grayscale Research believes that changes in Senate control may be particularly relevant to cryptocurrencies given the Senate’s role in confirming the president’s appointment of key regulators, such as the chairmen of the U.S. SEC and CFTC.

However, at the voter level, data shows that cryptocurrency is a bipartisan concern, with Democrats slightly more likely to own Bitcoin than Republicans. In addition, specific candidates from both parties have expressed support for cryptocurrency innovation. Regardless of which party is in power, Grayscale Research believes that comprehensive bipartisan legislation may be the best long-term solution for the U.S. digital asset industry.

Bitcoin arbitrage trading weakens the impact of spot Bitcoin ETP net inflows on price increases

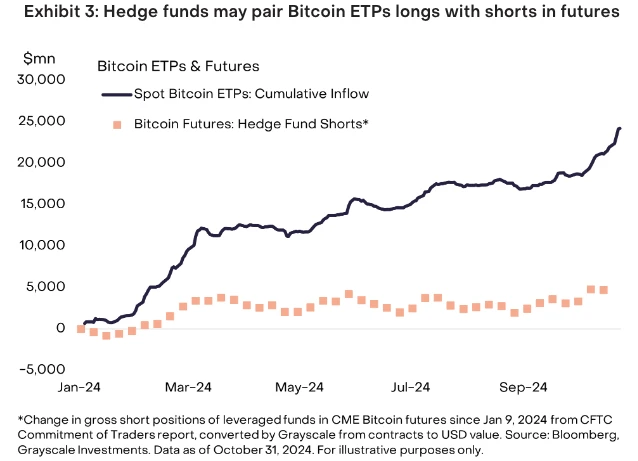

Demand for spot Bitcoin exchange-traded products (ETPs) listed in the United States increased in October. Net inflows totaled $5.3 billion as of October 31, up from $1.3 billion in September and the highest level since February. Since the launch of spot Bitcoin ETPs in January, net inflows have totaled more than $24.2 billion, and U.S. ETPs currently hold about 5% of the total Bitcoin supply.

Net inflows into spot ETPs this year could put upward pressure on Bitcoin prices. However, the relationship may not be one-to-one, in part because of the growing popularity of hedge fund trading. Specifically, a hedge fund (or other sophisticated and/or institutional investor) can buy a Bitcoin ETP while simultaneously shorting an equivalent amount of USD in Bitcoin futures. This strategy seeks to profit from the difference between spot and futures prices and is sometimes referred to as a Bitcoin basis trade or carry trade. Because the strategy involves both buying Bitcoin (via the ETP) and selling Bitcoin (via futures), it should not have a significant impact on Bitcoins market price.

There is no exact measure, but a report from the U.S. Commodity Futures Trading Commission (CFTC) noted that some hedge funds have increased their net short positions in Bitcoin futures by nearly $5 billion since the launch of spot Bitcoin ETPs in January. Based on this estimate, Grayscale Research believes that about $5 billion of the $24.2 billion in net inflows into U.S.-listed spot Bitcoin ETPs this year may have been used to match spot/futures positions and therefore may not have contributed to the rise in Bitcoin prices (Chart 3).

Chart 3: Hedge funds may pair Bitcoin ETP longs with futures shorts

Blockchain becomes a value intermediary for AI agents

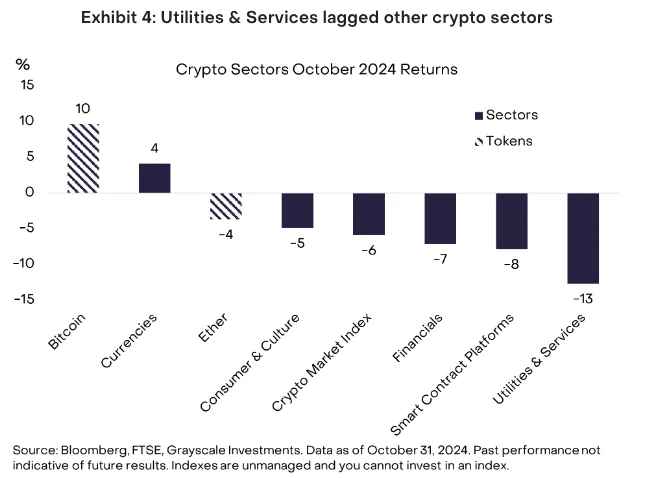

Despite the significant gains in Bitcoin prices in October, other crypto segments have had lackluster returns. For example, the Crypto Sector Marché Index (CSMI), a composite index we developed in partnership with FTSE/Russell, fell by about 6% (Exhibit 4). The worst-performing segment wasthe Utilities and Services crypto sector . This diverse crypto sector includes many tokens related to decentralized AI technology, some of which have retreated this month after early-year gains, including FET, TAO, RENDER, and AR.

Figure 4: Utilities and Services sectors lag behind other crypto subsectors

Despite a pullback in some token valuations, the decentralized AI theme remains a focus of the crypto market. We believe this is largely due to new applications demonstrating the use of blockchain by “AI agents” – software that can understand goals and make autonomous decisions.

A key “persona” is Truth Terminal, an AI chatbot created by researcher Andy Ayrey. The chatbot has an account on X (formerly Twitter) and interacts with other X users autonomously (i.e., without any input from Andy). The innovation is that Truth Terminal expresses interest in creating a Meme coin, GOAT, and then deposits the new Meme coin into an associated blockchain address. After taking ownership of the Meme coin, Truth Terminal takes steps to promote the token to its social media followers.

Due to the strong interest in this narrative, the associated meme coin has also appreciated by about 9 times, leading many to call Truth Terminal the first AI agent millionaire. While this project appears humorous and lighthearted, it shows that AI agents can understand economic incentives and can use blockchain to send and receive value. Other innovative projects are making breakthroughs in co-owned AI agents, and there will be many use cases in the future.

While these are still in their early stages, the latest wave of decentralized AI applications may deliver on one of the promises of blockchain technology in a tangible way: it can serve as the core financial infrastructure of the future, acting as a value intermediary between humans, AI agents, and potentially a variety of physical devices. We believe that using a permissionless blockchain can be a better way for AI agents to accumulate and transfer resources than traditional payment infrastructure.

Résumer

The US election on November 5th is likely to dominate the cryptocurrency and traditional financial markets in the short term. There are important issues facing the digital asset industry, and the results of the White House and the Senate and House of Representatives may affect the development of cryptocurrency businesses in the United States to a certain extent. At the same time, we are encouraged by the bipartisan ownership of digital assets, the numerous macro trends driving Bitcoin adoption, and recent technological breakthroughs, especially at the intersection of cryptocurrency and AI. Therefore, regardless of the results of next weeks election, we are optimistic that cryptocurrency will continue to grow in the United States.

This article is sourced from the internet: Grayscales latest report: Investment markets look forward to Trumps victory, ETP inflows hit a record high, and crypto AI is accelerating integration

In the past week, the market fluctuated between $65,000 and $69,000. On the 28th, BTC started to rise at the support level of $67,600 and broke through $70,000 in the early morning of the 29th. Although the short-selling counterattack caused the BTC price to fall back for a short time, the upward momentum of BTC remained unabated. At 10:00 on the 29th, the BTC price reached a maximum of $71,587, a 24-hour increase of 5.6%. As of the publication of this article, the BTC price fluctuated around $71,000 (the above data comes from Binance spot, 15:00 on October 29). Based on the intensified FOMO sentiment in the market, the boost from the rise of US stocks and the rising chances of Trumps victory, BTC may hit a new high before…