Débloquer signifie se débarrasser des actions ? Comment résoudre le problème de désalignement des incitations dans l'industrie de la cryptographie ?

Original title: Crypto’s Incentive Misalignment Problem

Original article by Sergio Gallardo

Traduction originale : zhouzhou, BlockBeats

Editors note: This article discusses the incentive misalignment problem in the cryptocurrency industry, pointing out that many market participants ignore the long-term success of projects for short-term gains, resulting in improper allocation of capital and resources and weakening the credibility of the industry. To solve this problem, the article recommends increasing transparency, strengthening self-regulation, optimizing token attribution design, and promoting sustainable development of the industry by setting clear project goals and incentive mechanisms.

Voici le contenu original (pour une lecture et une compréhension plus faciles, le contenu original a été réorganisé) :

1. Introduction

In traditional Web2 businesses, significant returns are often tied to the long-term success of the business. Founders and early investors are incentivized to build sustainable businesses because their profitability is closely tied to the companys long-term performance. However, in contrast, Web3 allows some market participants to earn high returns relatively quickly without requiring projects to achieve product-market fit (PMF) or demonstrate actual utility because liquidity is much easier to obtain.

Unlike initial public offerings (IPOs) in traditional finance, Jeton Generation Events (TGEs) in Web3 can be conducted at any time without requiring projects to reach specific milestones. This weak correlation between success and exit in Web3 has led to significant incentive misalignment, with many market participants pursuing short-term returns without long-term success. The lack of transparency and regulation in the cryptocurrency space has made predatory behavior not only profitable, but often unpunished.

If this issue is not addressed, the growth and popularity of the industry will be threatened as predatory behavior will be more incentivized and rewarded than long-term sustainable development. While there are many well-intentioned people in the industry, this article aims to explore the problems caused by those who are motivated by short-term gains without considering the long-term.

2. Description of the incentive misalignment problem

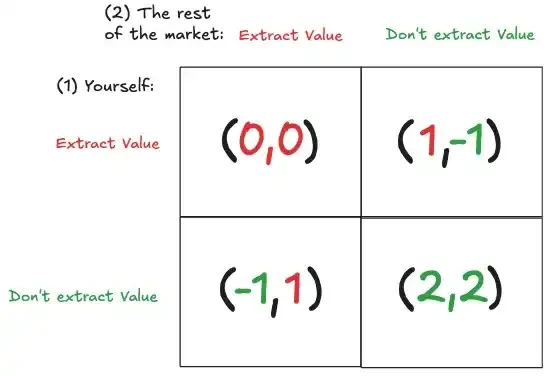

The tragedy of the commons caused by the prisoners dilemma

In the crypto space, the decisions made by market participants in different scenarios often resemble the prisoner’s dilemma.

For example, KOLs’ choices in deciding whether to disclose promotional activities, centralized exchanges’ considerations in setting token listing standards or determining token listing valuations, some Pièce de monnaie mème insiders selling large amounts of tokens in the early stages, or project founders quickly cashing out and abandoning projects through over-the-counter (OTC) transactions after the token generation event (TGE). Many participants tend to extract value through short-term gains, even though their long-term return potential will be reduced if the industry develops.

As the Prisoner’s Dilemma continues to emerge, it often leads to the Tragedy of the Commons phenomenon. This theory explains how individuals pursuing their own interests deplete shared resources, ultimately causing losses for everyone. In the crypto space, this type of predatory behavior can lead to the misallocation of capital and other resources, hinder the development of sustainable projects, and damage the industry’s credibility.

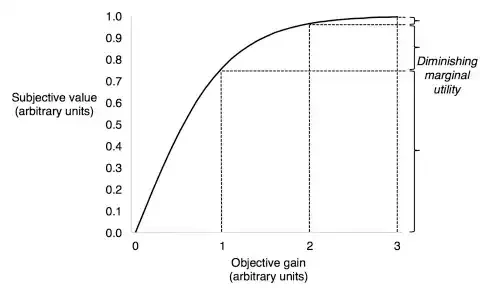

Logarithmic Utility of Wealth

As wealth increases, the marginal utility of additional wealth decreases nonlinearly: initial gains can significantly improve quality of life, but further gains bring diminishing returns. This concept is particularly important for crypto market participants as they evaluate their incentives.

In many cases, pursuing short-term value can significantly improve financial outcomes. However, the additional benefits of choosing to align with the long-term interests of a project may have limited impact, further encouraging participants to prioritize short-term gains.

For example: Assume that the tokens held by the founder are worth $10 million shortly after the Token Generation Event (TGE), but they need to be locked for 3 years. If the founder chooses to cash out early at a 60% discount over-the-counter (OTC), he can still get enough money for retirement. However, holding on to the long-term return of product market fit (PMF) is riskier: these tokens may be less than $4 million in 3 years. Even if the project is successful, the founder may choose the certain $4 million because the risk/reward of waiting for a higher return is not attractive enough.

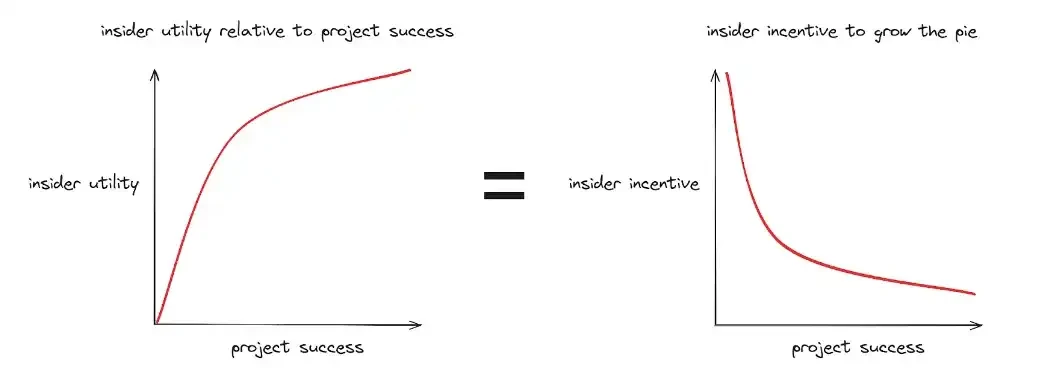

“The more successful a project is, the weaker the incentive for insiders to further develop it. This explains why many projects gradually decline after going from 0 to 1.” – Proph 3 of MetaDAO

Who benefits from this and who suffers from it?

Beneficiaries of Misaligned Incentives

It is important to note that there are often people in more advantageous positions who have the opportunity to benefit from misaligned incentives, although this does not mean that they all have malicious intent. Within these groups, the various actors have motivations ranging from good intentions to malicious ones.

1. Team and founders: They have control over the project design, token economics, and strategy, and therefore can choose to exit early without necessarily ensuring the long-term sustainability of the project.

2. Venture Capital Firms : Early capital allocation is critical. If investing in unsustainable short-term projects and exiting early can bring higher returns, many venture capital firms will also tend to choose this approach.

3. Centralized Échanges: While their incentives should be aligned with users, we often see CEXs extracting value against the interests of users by listing tokens at overvalued valuations, charging high listing fees, or listing low-quality assets.

4. Marché Makers: Some market makers may leverage their advantageous position and the team’s reliance on their services to negotiate highly favorable terms.

5. KOLs: We often see undisclosed promotional activities, misleading information, and pump and dump designed to harvest short-term value from the audience.

In most cases, participants in these groups are incentivized to maximize returns because they are profit-oriented in nature. Therefore, it is reasonable to expect that they will act in a way that optimizes their own profits.

victim

Retail investors: They often lack sufficient experience and information to become “exit liquidity” for more sophisticated participants. Lack of transparency coupled with predatory behavior by some groups makes it more difficult for retail investors to participate in liquid markets.

Long-term players: Developers, community members, and investors committed to sustainable growth may become frustrated by the prevalence of short-term behavior. This can lead to a loss of talent and a lack of innovation in the industry.

Is misaligned incentives slowing down industry progress?

This is a subjective opinion, but I think incentive misalignment is indeed slowing down the industry and putting its future at risk. If key market participants can focus on long-term goals, prioritize supporting sustainable projects, and make it easier to extract value in the short term, the industry will benefit greatly, a topic that has also been widely studied outside the cryptocurrency industry.

3. The path to incentive alignment

Possible solutions

a. Regulatory intervention:

The development of laws and guidelines to regulate behavior and ensure transparency will help the industry grow healthily. However, since cryptocurrencies are global and not subject to a single jurisdiction, effective global regulation is almost impossible. In addition, regulation is beyond our direct control, and even if we can push for it, implementation is still uncertain and may be detrimental to the industry. Therefore, while appropriate regulation may help address the incentive misalignment problem, we cannot rely solely on regulation in the short to medium term.

b. Do nothing and wait for the market to correct itself:

Emerging markets typically self-correct over time to address inefficiencies. However, in the crypto industry, the lack of regulation, transparency, and accountability makes self-correction more difficult. Many participants may not even be aware of the value extraction that is occurring. While self-correction has its role, improvements are needed, such as better valuation frameworks. Without greater transparency, market self-correction may be delayed, wasting significant time and resources.

c. Encourage self-discipline:

Although self-regulation is difficult and imperfect to implement, it may be the most practical solution in the short to medium term. It requires the community to advocate for greater transparency, improve accountability by exposing bad actors, and promote a culture of ethical behavior. Better self-regulation will help accelerate the process of market self-correction.

4. Encourage self-discipline: transparency and accountability

The role of transparency

Greater transparency is critical to reducing information asymmetries, improving accountability for bad actors, and allowing markets to more effectively self-correct current problems.

Areas where more transparency is needed

Founders/Venture Capital:

-

Increase transparency of internal address holdings

-

Disclosure of over-the-counter (OTC) sales or hedging strategies

-

Be transparent about your teams commitments, roadmap, and progress

Centralized Exchanges (CEX):

-

Public token listing criteria, including listing fees and any associated terms

-

Disclose any conflicts of interest

-

Providing transparency into upcoming token listings

Market Makers:

-

Open Market Making Agreement and Related Terms

-

Disclose incentive structures and potential conflicts of interest

-

Publish activity reports including possible market impact

KOLs:

-

Disclose your financial relationship with the project

-

Declaration of token holdings or recent purchases where relevant

-

Public paid promotion information

Hold participants accountable

Community monitoring: Encourage open discussion and criticism of unethical behavior.

Example: Publicly calling out key market players on community platforms for lack of transparency or engaging in predatory behavior.

Support groups providing transparency: Key market players and independent researchers who make the industry more transparent should be rewarded and incentivized to encourage them to continue providing transparent information.

-

Example: Providing resources and funding programs for independent researchers to recognize their contributions to industry transparency and ensure they remain motivated.

Reputation System: Build a public platform where market participants can access information and understand the ethical behavior of key market players. This will ensure accountability and prevent predatory behavior from going undetected.

-

Example: Establishing a neutral body to provide public reputation scores for key market participants.

It is worth noting that in some cases, the anonymity of participants can also make it more difficult to hold them accountable.

5. Improve token attribution design

Token vesting design plays a key role in shaping the incentives of market participants. Current common vesting designs fail to address incentive misalignment and even encourage value extraction in many cases.

Key design requirements:

Avoid low circulation at the time of the Token Generation Event (TGE): A reasonable proportion of the token supply should be unlocked early, mainly for non-insiders, while also including a small portion of internally held tokens.

Moving away from a fixed token supply model: Most projects would benefit from a flexible and uncapped token supply, allowing for more tokens to be minted as needed or to be minted continuously. The fixed supply model is derived from BTC, but most projects have very different characteristics.

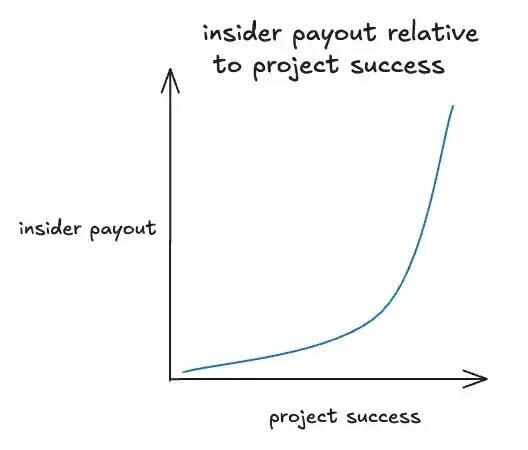

Design a convex revenue distribution for insiders: tie token unlocking to project success to incentivize long-term behavior, similar to the incentive structure of traditional finance and IPOs.

Introduce goal-based unlocking: Not all token unlocking needs to be time-based. Milestone-based insider unlocking is more likely to incentivize consistency, but be wary of certain metrics that can be manipulated. This approach has not been fully explored and is worth trying.

Example: Token vesting design allocated by the Ethereum L2 project team

This is an example intended to provide general guidance rather than a precise design framework.

-

20% vesting linearly over 4 years: allows the team to sell some tokens when necessary, which is especially beneficial for founding teams whose net assets are 99% locked tokens. Partial cashing out can provide a significant financial buffer and help the team focus on long-term development.

-

80% Goal-based allocation:

30% Valuation-based: 1% unlocks for every $1 billion increase in fully diluted valuation (FDV) between $1 billion and $10 billion; 2% unlocks for every $1 billion above $10 billion, based on the long-term moving average.

20% based on delivery: e.g. product launch (completing Phase 2, decentralized sequencer).

20% based on performance: such as sustained uptime, throughput, and other long-term operational metrics.

10% based on key metrics: such as long-term locked value (TVL), revenue, or number of successful ecosystem applications.

-

Continuous distribution: linear + target driven:

-

Linear distribution: 2% of tokens are issued each year to incentivize the team.

-

Target driven: For every FDV exceeding USD 20 billion, an additional 3% will be issued.

Avantages

-

Success is more closely tied to exit: Incentivizes founding teams that are interested in building high-quality projects, and token unlocking is tied to product development and project success.

-

It is more difficult to exit early through over-the-counter (OTC) transactions: If the team plans to exit through OTC and abandon the project, it will be more difficult to achieve the goal, which may lead to larger discounts and reduce the willingness to exit early.

-

Clear goals: Transparent, quantifiable milestones increase accountability while providing a clear direction to work towards.

challenge

-

Prevention of manipulation: Some key performance indicators (KPIs) can be manipulated and therefore need to be chosen carefully.

-

Enforcement guarantees: A decentralized governance process or an objective third party is needed to ensure fair unlocking of tokens.

-

Choose appropriate goals: Goals should be relevant to the long-term success of the project and reflect varying levels of complexity.

Currently, there are few practices for target-driven unlocking in our industry. Related cases include:

Algorand: Extended the vesting period to 5 years in 2019, but allowed early unlocking based on token valuation.

UMA: In 2021, KPI options were airdropped that can be redeemed based on the total locked value (TVL).

Filecoin: Part of its ownership is tied to the performance of the storage network.

While these attempts are innovative, none of them have incorporated goal-driven unlocking as a core element in the early stages of vesting design, or have only allocated a small portion of tokens. MetaDAO seems to have adopted this concept at the core of its design, and I hope more teams will try similar approaches in the future.

Is there token vesting for early investors?

Early stage investors also need to be aligned with long term goals, but they have less control over achieving specific milestones. For this, a hybrid approach may be more appropriate (e.g. 50%-50% linear and goal driven allocation, rather than 20%-80% of the team).

6. Conclusion: Call to Action

Since we cannot rely solely on regulation, especially when there is uncertainty about its implementation, the community cannot wait for the market to automatically adjust. While in the long run, more projects may achieve market fit (PMF), better valuation frameworks may emerge, and ethical actors may lead the way for others to follow suit, we can take immediate steps to address incentive misalignment:

-

Face the problem: Recognize that misaligned incentives can undermine the industry’s long-term foundation for growth, innovation, and trust.

-

Promote transparency: Requiring all market participants to disclose information, reducing information asymmetry and thus promoting more informed decision-making.

-

Holding bad actors accountable: Encourage the community to be vigilant, support actions to expose value extractors, and establish identification mechanisms.

Call for innovative token vesting designs: Explore methods such as goal-driven unlocking, continuous issuance, uncapped token supply, and convex revenue distribution to better incentivize long-term behavior.

Improvements in these areas will increase the likelihood of sustainable project success and drive long-term industry growth. Finally, it is worth mentioning that I would have liked a more quantitative analysis of value extraction in the industry, however the lack of transparency makes it impossible to obtain relevant data, which also reflects the problems pointed out in this article.

This article is sourced from the internet: Unlocking means dumping the stock? How to solve the incentive misalignment problem in the crypto industry?

En lien : Entretien avec Raymond Qu, co-fondateur de PolyFlow : Création d'une infrastructure PayFi

Auteur original : Will Awang Source originale : Web3 Lawyer Le livre blanc de Bitcoin de 2008 décrivait un réseau de paiement électronique en espèces peer-to-peer qui ne nécessite pas de tiers de confiance. Le paiement est l'une des premières promesses faites par la monnaie numérique et la technologie blockchain, et c'était aussi la solution blockchain donnée par Satoshi Nakamoto au système financier défaillant de l'époque. Bien que l'industrie ait investi des milliards de dollars dans le développement de l'infrastructure blockchain sous-jacente au cours de la dernière décennie, et que nous puissions maintenant assister à l'essor fulgurant des blockchains hautes performances telles que Solana et les stablecoins, la plupart des infrastructures de marché actuelles sont toujours construites autour des transactions et ne peuvent pas véritablement prendre en charge le temps réel et l'évolutivité des paiements, ce qui entrave également la popularisation à grande échelle des paiements Web3. Alors, quel type de…