Recherche BitMEX : utiliser Babylon comme exemple pour étudier le succès de la mise à niveau de Bitcoin Taproot

Auteur original : BitMEX

Abstract: We examine Babylon, a staking project that has attracted nearly 24,000 Bitcoins. We compare Babylon to CoreDAO, another BTC staking project, and note Babylon鈥檚 unique use of Tapscript. It is worth noting that, unlike Ordinals, Babylon does not use Taproot in a trivial way, but rather in a way that is closer to the original intention of Bitcoin developers. We ultimately conclude that whatever one鈥檚 opinion of Babylon and emerging Bitcoin staking systems, Babylon鈥檚 practice supports this view – Taproot is a clever and impressive upgrade for Bitcoin. Despite some people鈥檚 initial low expectations, Taproot is proving to be a success.

Aperçu

Following up on our August 2024 article on Bitcoin Layer 2 and CoreDAO , this article focuses on another ostensible Bitcoin L2, Babylon. As of this writing, this Bitcoin staking system has even more funds locked up than CoreDAO, approaching 24,000 Bitcoin. Thats worth over $1.6 billion. Like CoreDAO, Babylon is not actually a Bitcoin Layer 2 network, but should be viewed as a system where people can lock up Bitcoin using Bitcoins time-locking functionality and, in return, earn yield in other altcoins.

Babylon Labs

Despite 24,000 BTC and a whopping $1.6 billion TVL, the Babylon blockchain or staking system does not yet exist and is still under development. Currently, large holders appear to be staking in exchange for earning reward points. The platform is backed by an impressive group of crypto VCs and is associated with Binance, which may explain how it has been able to attract so much funding. The platform also aims to position itself as the Bitcoin version of EigenLayer. Babylon wants to be the EigenLayer of Bitcoin. Many of the culture and ideas that Babylon is developing seem to be derived from the Ethereum ecosystem. The core concept of EigenLayer is repeated staking, which allows the same batch of coins to be staked in multiple systems at the same time to obtain higher returns.

We will not be evaluating the re-staking concept itself or Babylon鈥檚 staking protocol or the underlying Babylon blockchain, as with our CoreDAO article we will be focusing on the Bitcoin side of things.

Staking Mechanism and Taproot

As with CoreDAO, to stake in Babylon you create a custom complex transaction that essentially sends your own Bitcoin to yourself. You add a custom OP_Return output that provides details about the stake, such as which validator will be used and where the rewards will be sent.

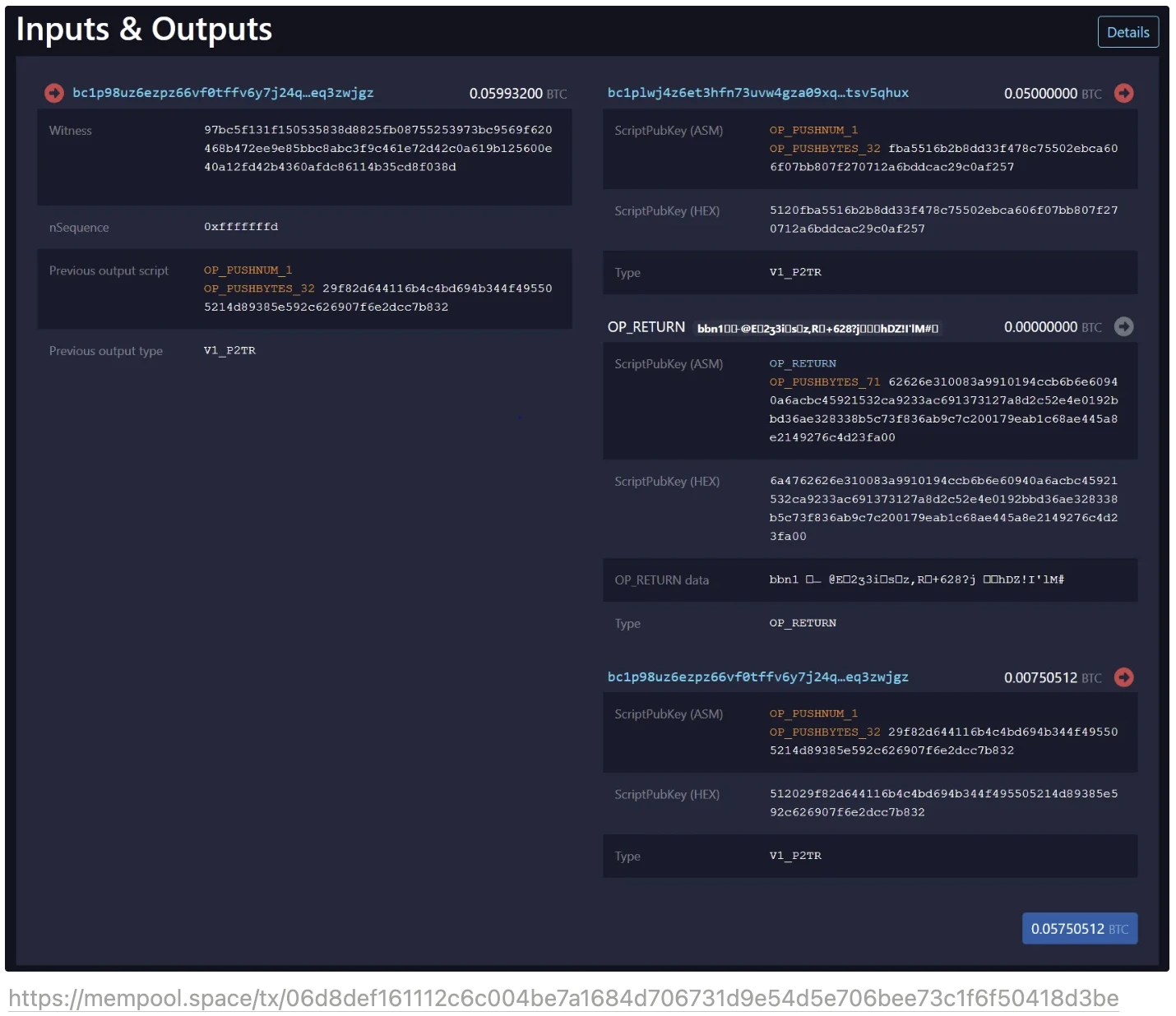

Here is an example of a Babylon pledge transaction:

The contract that turns on staking itself is nothing special compared to CoreDAO. The first output 0.05 BTC is staked, the third output is the change, and the middle output is OP_Return. The Babylon team informed that many exchanges had to upgrade their Bitcoin wallets to enable customers to send Bitcoin to P2TR outputs with Bech 32m formatted addresses.

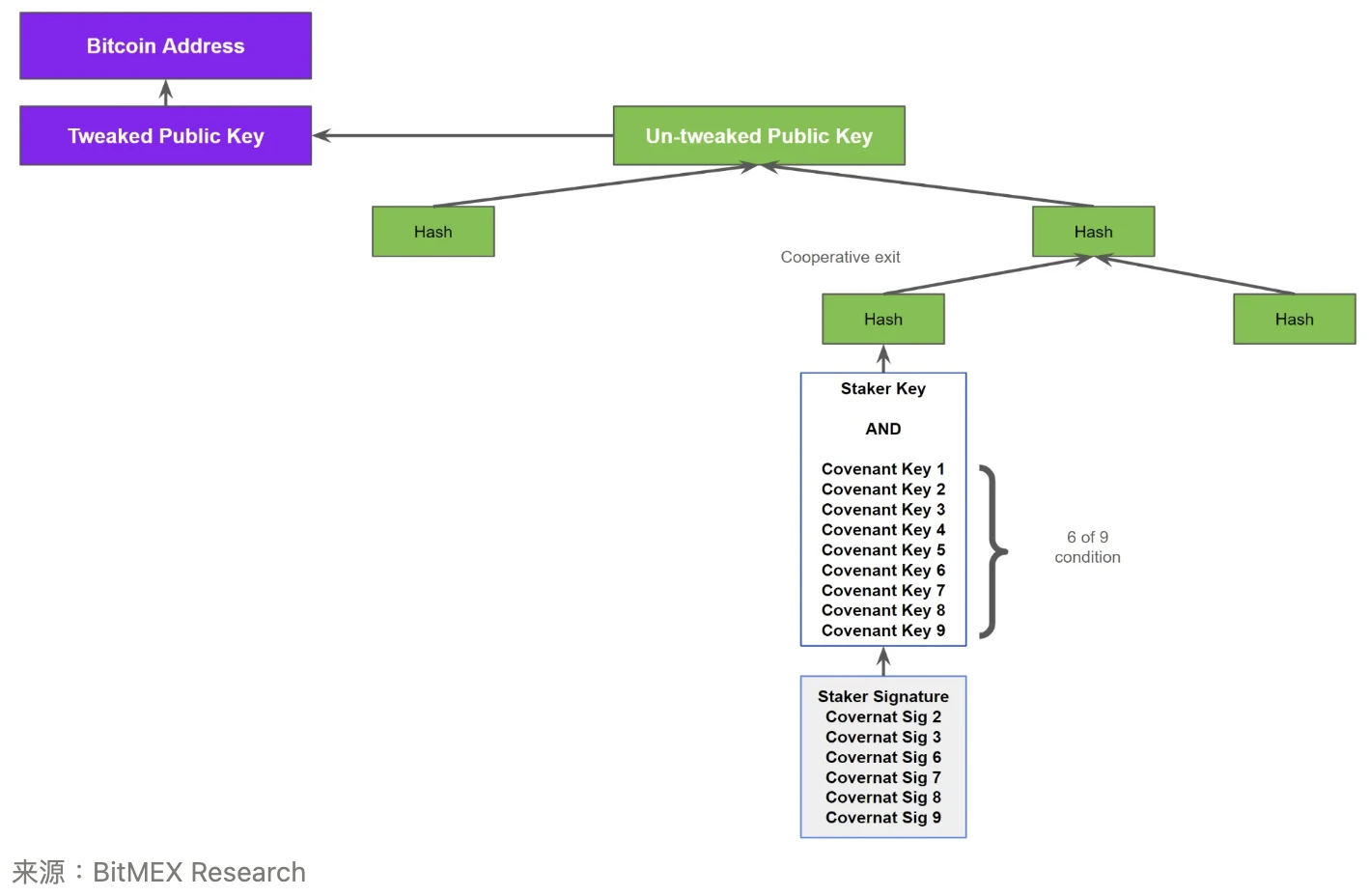

However, when the staked Bitcoin needs to be redeemed from Babylon, the magic of Taproot begins to reveal itself. The redemption transaction from the same address bc1plwj4z6et3hfn73uvw4gza09xqmc8hwq87fc8z2ntmh9v98q27ftsv5qhux can be viewed ici . The redemption process reveals that Babylon utilizes multiple spending paths in the Tapscript and Taproot trees. The following figure shows the information revealed when collaborating to exit from the staking system. It is important to note that to redeem Bitcoin from the Taproot tree, the conditions of exactly one leaf node must be met and the path to the Merkle root must be displayed by the hash value.

Taproot redemption demo for Babylon stakers – portion visible during normal collaborative exit

In the redemption scenario above, the two transfer paths are hidden and two additional hashes are required to reach the Merkle root. The selected transfer path requires the signature of the staker and the multi-signature of 6 of the 9 Babylon alliance members. This spending condition is essentially a combination of 1-of-1 and 6-of-9.

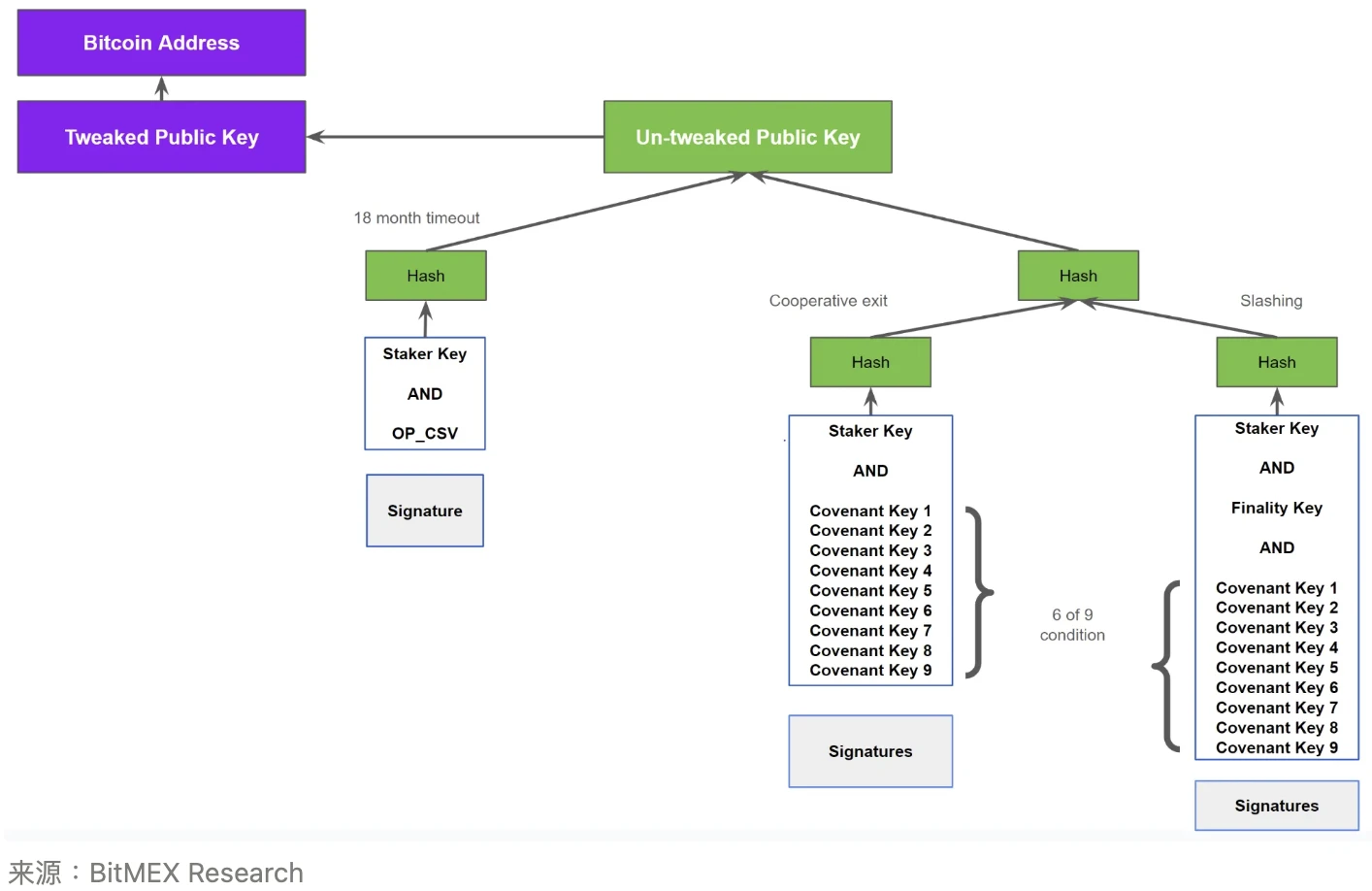

By studying Babylon鈥檚 protocol specification and analyzing other transactions , we were able to draw a complete Taproot tree graph, including all spending paths. The tree graph below shows three redemption scenarios.

The complete Taproot redemption tree for Babylon stakers

1. Timelock – This scenario requires the stakers signature and the OP_CHECKSEQUENCEVERIFY (OP_CSV) opcode. The timelock period is 15 months. This allows stakers to withdraw funds without relying on the federation. This path is higher in the tree and allows for more efficient redemptions.

2. Unlock on Demand – This is considered a normal or collaborative redemption scenario and requires the signature of the staker and approval of the federation. This is similar to collaborative exits in the Lightning Network.

3. Slashing – This is the last scenario, which is similar to the unbonding case, but requires an additional signature from the finality provider. We will discuss this in detail in the next paragraph.

Slashing Mechanism

We criticized CoreDAO for not having a slashing mechanism and therefore called CoreDAO fake staking. However, Babylon, with its technical background in EigenLayer and Ethereum staking, believes that slashing mechanisms can be implemented in Bitcoin.

In a way, we believe that Babylon has chosen the harder path, although only by implementing slashing can a more sustainable protocol be built that makes its revenue and network security less fake. However, as we explained, Babylons revenue generation system does not actually exist yet, so slashing does not exist at present, but there is still a redemption path in the Taproot tree. Therefore, the third redemption path in the Taproot tree is not currently implemented because there is no blockchain or finality agent yet. Babylons vision is that once the system is live, stakers will need to pre-sign a slashing redemption path, that is, the Bitcoin will go to a Bitcoin address controlled by others or may be destroyed. Who these funds may be sent to has not yet been determined by Babylon Labs. If stakers have pre-signed the third path, then there is real counterparty risk. But while it remains unsigned, Bitcoin stakers can consider Babylon to be risk-free.

Once the slashing mechanism is live, if the third path is not pre-signed by the staker, then the pledge will not be considered valid and no rewards will be received. We consider this a minor flaw because an observer of the Bitcoin blockchain cannot tell whether it is a valid staking deposit. However, currently, since this is not live yet, such pre-signing is not required. Therefore, **For now, babylon is the same as CoreDAO, staking is counterparty-free. You can always withdraw your Bitcoins without relying on anyone (although the lock-up time is longer). **Therefore, for now, this may be a good place to stake bitcoins before the system goes live, although how much babylon token rewards you can get for this is uncertain.

Criticism of Bitcoin Core Developers

Bitcoin core developers and protocol engineers have been criticized in recent years, mainly for not implementing new protocol upgrades or adding enough new features to Bitcoin. In addition, some critics claim that Bitcoin developers are out of touch with the crypto industry and that even if new features are added to Bitcoin, no one cares about or uses them.

We believe that Babylons use of Taproot is a strong counter to the above criticisms. In our opinion, Taproot is actually a pretty smart upgrade that enables many new custom spend conditions without increasing downside risk. Hiding the unused portion of the tree helps improve privacy and scalability. Additionally, Taproots adoption metrics are very strong, much stronger than we would have expected a few years ago. As of today, nearly 100,000 Bitcoins are stored in Taproot outputs.

Bitcoin stored in Taproot

Conclusion – Taproot is successful

Who would have thought that the Merkle-ized abstract syntax tree, an idea originally proposed by Bitcoin engineer Johnson Lau on the BitcoinTalk forum in 2013 and formalized in 2016 , would actually be introduced into Bitcoin and succeed?

Babylon alone has attracted $1.6 billion in TVL using taproot鈥檚 functionality. And it鈥檚 not used in a trivial way, like storing Ordinals-related images that some people think is a bit silly, on the contrary, these script paths are actually being utilisé , and there is a lot of money involved.

On the other hand, many readers may question the fundamental efficacy of proof of stake (POS), and re-staking is even more difficult to understand. In fact, liquidity staking and re-staking may be manifestations of fundamental problems with proof of stake systems. Some readers may also think that Babylon is a bit like an altcoin, because Bitcoin stakers are being incentivized to earn token rewards that do not yet exist. However, Taproot adoption must start somewhere. Capital needs to be invested to build the Taproot script system, and examples of Taproot script usage are needed for others to follow. Perhaps one day, projects that do not rely on token rewards or build PoS will be able to follow suit.

However, whatever one thinks of Babylon, Taproot is being used and has proven beyond a doubt that it is an ingenious idea and a success. Given the constraints faced by Bitcoin developers, it is admirable that they were able to achieve this.

This article is sourced from the internet: BitMEX Research: Using Babylon as an example to explore the success of Bitcoin Taproot upgrade

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Three days ago, after a sharp drop to the price of 55,500 USDT, BTC began to rebound sharply and led the overall market to rise. OKX market shows that BTCs highest price today reached 60644 USDT, a 24-hour increase of 4.1%. The largest recent increase occurred at 23:00 yesterday, from 58450 USDT to 59660 USDT, a 1-hour increase of 2.06%; ETHs highest price today reached 2466 USDT, a 24-hour increase of 3.2%; SOLs highest price today reached 139.8 USDT, a 24-hour increase of 3.4%; BNBs highest price today reached 560 USDT, a 24-hour increase of 2.3%. It can be seen that BTC still occupies a dominant position, and its growth rate is ahead of other mainstream currencies.…