Auteur original : Will Awang

Musks journey is to the stars and the sea. Similarly, for the 2 trillion crypto market that wants to move towards Mass Adoption, the 400 trillion to 600 trillion traditional financial market is also a starry sea.

We can see some paths, such as the rise of tokenization, but the current RWA 1.0 early assets are migrating to the chain, but the relatively lack of liquidity model is not a long-term solution. Even if DePIN can revive the Internet of Things, it is still difficult to get to the core.

So we see Web3 payments, which can promote the mass adoption of stablecoins, which is the core, especially for non-transaction scenarios. VISAs stablecoin report tells us: the total supply of stablecoins is about $170 billion, settling trillions of dollars worth of assets each year. About 20 million addresses on the chain conduct stablecoin transactions every month. More than 120 million addresses on the chain hold non-zero stablecoin balances.

Web3 payment can bring instant settlement, 24/7 availability, and low transaction costs to traditional financial payment networks, but this is far from enough. What we should see more is a new financial market brought by PayFis innovative applications. PayFi, a new thing that can integrate Web3 payment, RWA and DeFi, can help us move towards the stars and the sea.

Therefore, this article will first introduce what PayFi is, and its relationship with Web3 payment, DeFi, and RWA, and then look at how Solana, which proposed PayFi, gradually builds its PayFi ecosystem.

1. What is PayFi

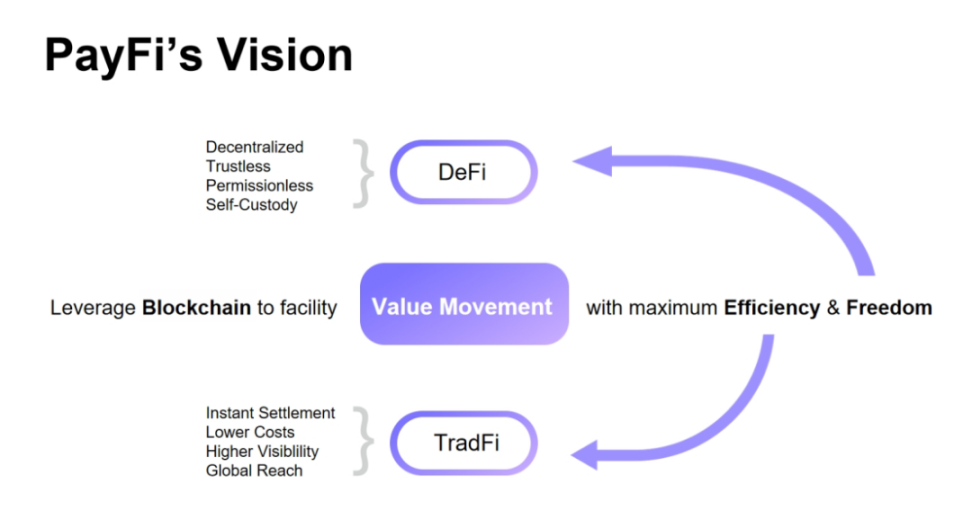

PayFi, or Payment Finance, is an innovative application model that combines payment functions with financial services based on blockchain and smart contract technology. The core of PayFi is to use blockchain as a settlement layer, combining the advantages of Web3 payment and decentralized finance (DeFi) to promote the efficient and free flow of value (Value Movement).

PayFis goal is to realize the vision of the Bitcoin white paper, build a peer-to-peer electronic cash payment network that does not require a trusted third party, and fully leverage the advantages of DeFi to create a new financial market, including providing a new financial experience, building more complex financial products and application scenarios, and ultimately integrating a new value chain.

PayFi was first proposed by Lily Liu, Chairman of the Solana Foundation, at the 2024 Hong Kong Web3 Carnival. In her view, PayFi is a brand new financial market built around the Time Value of Money (TVM). These are difficult or impossible to achieve in traditional finance.

In this new PayFi financial market, not only can Web3 payments achieve efficiency improvements compared to traditional finance: instant settlement, cost reduction, openness and transparency, and global reach, but it can also achieve decentralization of the global network, permissionless access, asset ownership, and personal sovereignty based on decentralized finance.

2. The relationship between PayFi and Web3 payment, DeFi, and RWA

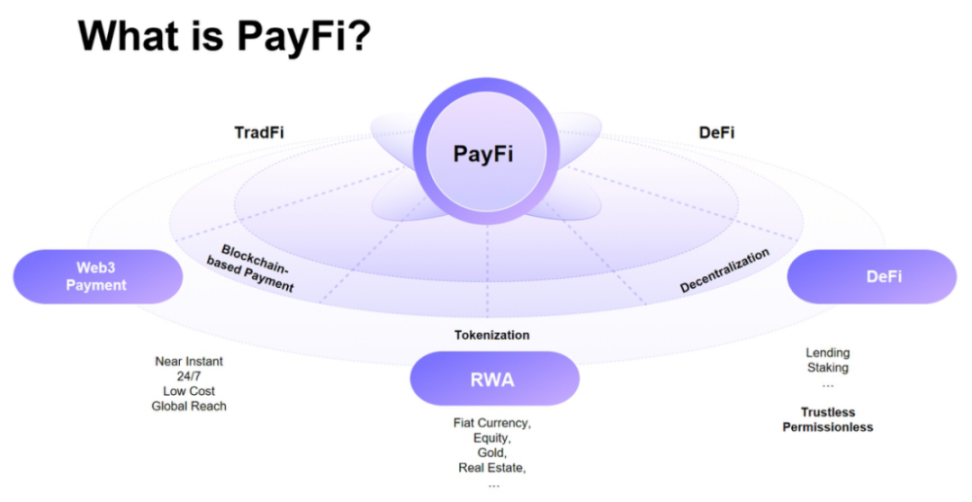

PayFi is not entirely equal to Web3 payment. Although Web3 payment has achieved many efficiency improvements over traditional finance based on blockchain technology, PayFi is a further construction, expansion and deepening of Web3 payment, and on this basis, DeFi is further introduced to build a new financial market.

PayFi is not entirely equal to DeFi. The essence of payment is based on the exchange of value in the real world – one hand pays the other hand delivers goods/services. Therefore, PayFi is more about the sending, receiving and settlement process of digital assets, rather than the mainstream transaction behavior of DeFi. In addition, only by seamlessly connecting Web3 payment with DeFi through blockchain and smart contract technology can we create financial derivative services related to payment, such as lending, financial management, etc.

PayFi is not entirely equal to RWA. RWA here has two meanings. The first is asset tokenization, that is, only after the asset is tokenized and put on the chain, can the value be seamlessly transferred on the blockchain, and smart contracts can be used to build transaction and settlement processes, such as the tokenization of the US dollar – stablecoin;

The second layer is RWA fundraising, which is to provide liquidity support for financing needs in the PayFi scenario. This is how Lily Liu described it: PayFi is a new financial market created around the time value of money. This on-chain financial market can achieve new financial paradigms and product experiences that traditional finance cannot achieve.

Therefore, PayFi is not an innovative independent concept, but an innovative application that integrates Web3 payment, DeFi, and RWA. This model not only covers the payment and transaction of digital assets, but also covers financial activities such as lending, financial management, and investment. Through blockchain and smart contract technology, PayFi not only makes global financial payment activities faster and cheaper, but also reduces the friction and cost of traditional financial payment services.

3. The significance and value of PayFi

From a literal point of view, PayFi is actually not fundamentally different from GameFi and SocialFi, but the real meaning of PayFi is to promote the application of digital assets in real scenarios in the real world.

On the positive side, PayFi can adapt to the migration of the Web2 group to Web3. For example, traditional financial payment companies can use blockchain technology to gain a larger market share and avoid missing out on the trend of the times.

On the other hand, the Web3 community can use Payment as a carrier and leverage blockchain technology to solve the pain points of the traditional financial system and realize new financial paradigms and product experiences that traditional finance cannot achieve.

At present, Web3 payment is still in a very early stage of basic services and primitive state, and digital currency is mostly used as a transaction medium for payment, such as cross-border remittances, OTC, Payment Card and other scenarios. This semi-centralized approach is difficult to open up the on-chain DeFi ecosystem, and the scenarios are relatively limited.

However, with the development and promotion of PayFi, this value transfer method based on blockchain and smart contract technology can accelerate the integration of Web3 payments and DeFi financial services, making digital assets more practical and efficient in daily transactions and more complex financial environments.

The emergence of PayFi can solve the situation where traditional finance and crypto finance live like this for 30 years until the building collapses. In the future global financial ecosystem, PayFi will surely become a key booster for Crypto to move towards Mass Adoption.

Raymond, co-founder of PolyFlow, has a deeper understanding of PayFi: PayFi does not solve the obvious problems that Web3 payments need to solve, such as the challenges of cross-border fund transfers and low financial inclusion. Instead, it needs to solve the most fundamental problem at the moment: effectively separating the information flow and capital flow of transactions, so that everyone can form a consensus on the capital flow on the blockchain unified ledger. Only in this way can the efficiency of the entire Web3 industry be improved and true Mass Adoption be promoted.

4. Why Solana PayFi

Lily Liu鈥檚 answer to this question is: Solana has three major advantages: high-performance public chain, capital liquidity and talent liquidity. These advantages constitute a threshold that other competitors are difficult to cross at this stage.

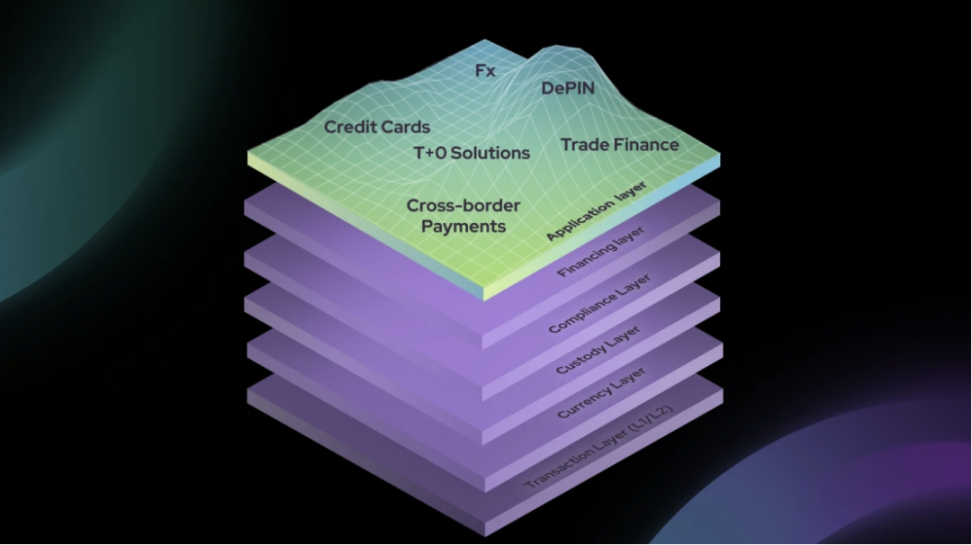

In addition, we can also look at it from the perspective of PayFi Stack: What kind of infrastructure does PayFi need?

4.1 Blockchain Settlement Layer (Transaction Layer)

As the underlying infrastructure for settlement, although there are many blockchain settlement networks to choose from, Solana is undoubtedly unique. High throughput, low cost, fast settlement, and further performance improvements brought by the Firedancer upgrade can all promote the rapid implementation of the PayFi project.

4.2 Currency Layer

In addition to the efficiency and smoothness of the underlying settlement network, there also needs to be enough liquidity to provide support, especially stablecoins as on-chain transaction media. We can see Solana鈥檚 cooperation with Ondo Finance, Visa, Circle, Stripe, and PYUSD launched in June this year.

According to DeFilama data, in August this year, the volume of PYUSD on Solana accounted for 64% of the market share, while Ethereum accounted for only 36%. Since 2023, the volume of on-chain stablecoins has gradually increased from US$1.8 billion to the current US$3.6 billion, mainly including USDC, USDT, PYUSD, and USDY.

4.3 Custody Layer

Asset custody is crucial in finance (on-chain/off-chain). For blockchain-based PayFi, what needs to be considered is how to ensure the security of smart contracts, private key management, and compatibility with traditional finance and DeFi.

On-chain asset custody is the key to achieving personal sovereignty. Not your Key, Not your Coin.

4.4 Compliance Layer

As we all know, only by ensuring compliant access to users can we further promote the healthy development of the financial payment ecosystem and services. At this level, it is fundamental to ensure that all transactions and capital flows comply with KYC/AML/CTF requirements and are adapted to the laws and regulations of the local jurisdiction.

4.5 PayFi Application Layer

Only based on the above basic layer can the actual implementation of PayFi applications be supported.

We can see at this Singapore BreakPoint event that Solana has built many C-end application scenarios through its infrastructure. Its Consumer segment has formed a trend of group combat and has construction reserves far exceeding other public chains.

According to @ZKwifgut, payments at BreakPoint events include:

-

Payment scenarios: online shopping, social e-commerce, offline activities, games

-

Payment medium: PayPal PYUSD, you can buy peripherals on site; MakerDAO bridges StableCoin to Solana through Wormhole; SOL debit card by Sanctum; Fusewallet virtual Visa card; Kast bank card;

-

Payment Gateway: Use StableCoin for shopping through Shopify Blinks; Accept StableCoin for booking flights and hotels based on Helio Pay/Solana Pay;

-

Product supply side: consumer-grade hardware such as mobile phones/SIM cards/watches, exhibition tickets, peripherals, e-commerce products (connected to Shopify), game props, etc.

-

Payment hardware: Solana鈥檚 official second-generation mobile phone Seeker; sports watch Showtime.

Solana is also actively developing the B-end market, providing liquidity support for payment scenarios in cross-border trade and supply chain finance through RWA fundraising.

Compared to Ethereums asset chain positioning, Solana is positioning itself as a payment chain, and is currently the optimal blockchain solution for consumer retail and payment products and services. In the words of @ZKwifgut:

PayFi and DeFi are the two legs of Solanas huge crypto ecosystem. So far, no ecosystem has such a clear strategy: relying on DeFi to build an On-chain Economy and relying on PayFi to move towards Mass-adoption.

(Solana Breakpoint 2024 is in progress)

5. Final Thoughts

In the long run, the entire Web3 industry will shift to off-chain and real consumption scenarios. Whether it is Make DeFi Great Again or Let Crypto Move Towards Mass Adoption, these slogans often mentioned in the market can finally be implemented through PayFi.

This time, the wolf really came.

Blockchain and smart contract technology can make traditional payments faster and cheaper than ever before, but this use case of helping the traditional market reduce costs and increase efficiency is more about capturing value on the B-side of traditional payments, which is good, but not what you and I want.

PayFi can truly bridge the gap between the traditional financial market and the crypto financial market, and accelerate the integration of payment and financial services through the rise of stablecoins. It is not only about reducing costs and increasing efficiency, but also about creating a brand new financial market. In this market, you own me and I own you.

In the future financial ecosystem, PayFi will become a key driving force.

This article is sourced from the internet: What is PayFi and why is Solana PayFi?

Original author: Weilin, PANews On September 19, Solana Mobile, a subsidiary of Solana Labs, released its second encrypted mobile phone Seeker at the TOKEN 2049 conference in Singapore. Seeker, previously known as chapter 2, has received widespread attention since its launch in January this year, and the official announcement is that Seekers pre-sale has exceeded 140,000 units. Unlike before, Seeker is equipped with a mobile-first Seed Vault wallet and integrates the new Solana dApp store. In this article, PANews will take users on a quick tour of this long-awaited Web3 phone. Integrate the new version of the dApp store, expected to be released in the middle of next year According to the official introduction, the name Seeker was inspired by the idea that users are trying to find new opportunities,…