Nouvel article d'Arthur Hayes : L'escalade du conflit au Moyen-Orient et la hausse des prix de l'énergie augmenteront la valeur du bit

Auteur original : Arthur Hayes

Traduction originale : TechFlow

(The opinions expressed in this article are the author’s personal opinions only and should not be used as the basis for investment decisions, nor should they be considered as investment advice.)

I spent the first two weeks of October skiing in New Zealands South Island. My guide, who had spent the previous season with me in Hokkaido, assured me that New Zealand was one of the best places in the world for backcountry skiing. I believed him and set off with him in Wanaka for two weeks chasing powder and spectacular ski lines. The weather cooperated and I skied down several stunning peaks and crossed huge glaciers. In addition, I improved my knowledge of alpine climbing.

Storms in the South Island are extremely severe. When the weather is bad, you stay at home or in a mountain cabin. To kill time, one day my guide gave a course in avalanche science. I have trained for avalanches many times since my first wilderness adventure in British Columbia as a teenager, but I have never taken a formal certification course.

This knowledge is both fascinating and sobering because the more you learn, the more you realize that there is always a risk when skiing in avalanche terrain. Therefore, the goal is to keep the risk within an acceptable range.

The course covers different types of snow layers and how they can cause avalanches. One of the most dangerous is a persistent weak layer (PWL), which can trigger a persistent slab avalanche when stressed.

In avalanche science, a persistent weak layer (PWL) is a specific layer in the snow that remains structurally weak for an extended period of time, greatly increasing the risk of avalanches. These layers are particularly dangerous because they can be buried deep in the snow, remaining unstable for long periods of time until they are triggered by additional stresses, such as skiers passing by or new snowfall. Knowing the presence of PWLs is critical to predicting avalanches, as they are often the cause of large, deep, and deadly avalanches.

The geopolitical situation in the Middle East after World War II is like a layer of PWL under the modern global order, and the trigger point is usually related to Israel. From the perspective of financial markets, the avalanche we are concerned about includes fluctuations in energy prices, the impact on global supply chains, and whether it will lead to the use of nuclear weapons if hostilities between Israel and other Middle Eastern countries (especially Iran or its proxies) escalate.

As investors and traders, we are in a dangerous and exciting situation. On one hand, major economies are reducing the price of their currencies and increasing the money supply, as China has already embarked on a massive money printing reflation campaign. This is the time to take the biggest long-term risks, and obviously, I mean cryptocurrencies. However, if tensions between Israel and Iran continue to escalate, resulting in the destruction of Persian Gulf oil fields, the closure of the Strait of Hormuz, or the detonation of nuclear weapons, the crypto market could suffer. As they often say, you cant invest in war.

I’m faced with a choice: continue selling fiat to buy crypto, or reduce my crypto holdings and move to cash or U.S. Treasuries? If this is truly the start of a new crypto bull run, I don’t want to miss out. But I also don’t want to lose a ton of money when Bitcoin plummets 50% in a day because of a financial market avalanche sparked by Israel and Iran. Bitcoin will always bounce back, but I’m more worried about some worthless things in my portfolio… like memecoins.

I would like to walk readers through a simple scenario analysis to understand my thinking when considering how to configure the Maelstrom portfolio.

Scenario Analysis

Scenario 1: The conflict between Israel and Iran devolves into a small-scale military confrontation. Israel continues its assassination campaign, and Iran responds with a few predictable, non-threatening missile strikes. No critical infrastructure is destroyed, and no nuclear strike occurs.

Scenario 2: An escalation of the conflict between Israel and Iran culminates in the destruction of part or all of the Middle East oil infrastructure, the closure of the Strait of Hormuz, or even a nuclear attack.

In Scenario 1, the persistent weak layer remains stable, but in Scenario 2 it fails, leading to a financial market crash. We focus on the second scenario because it poses a threat to my portfolio.

I will evaluate the impact of the second scenario on the crypto market, especially Bitcoin, which is the reserve asset among cryptocurrencies, and the entire crypto market will fluctuate accordingly.

I am more concerned that Israel may step up its offensive now that the United States has committed to deploying the THAAD missile defense system in Israel. Israel may be planning a large-scale strike and expects a strong response from Iran. Therefore, they are asking US President Biden to send reinforcements. In addition, the more Israel publicly states that it will not attack Irans oil or nuclear facilities, the more I doubt that this is their true intention.

The United States announced on Sunday it would send U.S. troops and an advanced anti-missile system to Israel, a very rare deployment aimed at bolstering Israel’s air defenses following a missile attack by Iran, Reuters reported .

Risk 1: Physical destruction of Bitcoin mining machines

War is extremely destructive. Bitcoin mining machines are the most valuable and important physical assets of cryptocurrency. What kind of damage will they suffer if war breaks out?

The main assumption in this analysis is to which region the conflict will spread. Although the war between Israel and Iran is just a proxy war between the United States/EU and China/Russia, I assume that neither side wants to fight directly. It is more preferable to limit the conflict to these countries in the Middle East. Moreover, the final belligerents are all nuclear powers. The United States, as the most aggressive global military power, has never directly attacked another nuclear power. This is saying something because the United States is the only country that has used nuclear weapons (when they used nuclear explosions to force Japan to surrender in order to end World War II). Therefore, it is reasonable to assume that the actual military conflict will be limited to the Middle East.

The next question is, are there any countries in the Middle East that are doing a lot of Bitcoin mining? According to some media reports , Iran is the only country where Bitcoin mining is booming. According to different sources, Iranian Bitcoin miners account for 7% of the global computing power. If Irans computing power drops to 0% due to internal energy shortages or missile attacks on its facilities, what will be the impact? Basically nothing.

This is a graph of the Bitcoin network hashrate from January 2021 to March 2022.

Remember when China banned Bitcoin mining in mid-2021, hashrate quickly dropped by 63%? Hashrate recovered to its May 2021 high in just eight months. Miners either relocated out of China or players in other countries increased their hashrate due to more favorable economic conditions. On top of that, Bitcoin hit a new all-time high in November 2021. Severe drops in network hashrate have no discernible impact on price. So even if Iran were completely destroyed by Israel or the United States, reducing global hashrate by as much as 7%, it would have no impact on Bitcoin.

Risk 2: Sharp rise in energy prices

Next, consider what would happen if Iran destroyed major oil and gas fields in retaliation. The Achilles’ heel of the Western financial system is the shortage of cheap hydrocarbons. Even if Iran could destroy Israel, it would not prevent a war. Israel is just a useful and expendable appendage of the US hegemonic system. If Iran wants to strike at the West, it must destroy hydrocarbon production and prevent tankers from passing through the Strait of Hormuz.

Oil prices will soar, taking all other energy prices with them as oil-starved countries turn to other energy alternatives to sustain their economies. So what will happen to the fiat price of Bitcoin? It will go up with it.

Bitcoin can be thought of as energy stored in digital form. Therefore, when energy prices rise, the fiat currency value of Bitcoin will also rise. The profitability of Bitcoin mining will not change because all miners face a synchronized increase in energy prices. For some large industrial miners, it may be difficult to obtain energy because the government requires utility companies to invoke force majeure clauses and cancel contracts. But if the computing power decreases, the mining difficulty will also decrease, making it possible for new entrants to still be profitable at higher energy prices. The elegance of this mechanism designed by Satoshi Nakamoto will be fully demonstrated.

If you want a historical example showing the resilience of hard currencies to energy shocks, look at how gold traded from 1973 to 1982. In October 1973, Arab countries imposed an oil embargo on the United States in retaliation for the U.S. support for Israel in the Yom Kippur War. In 1979, Iranian oil supplies were withdrawn from the global market due to the revolution that overthrew the Western-backed shah and established the current theocratic regime.

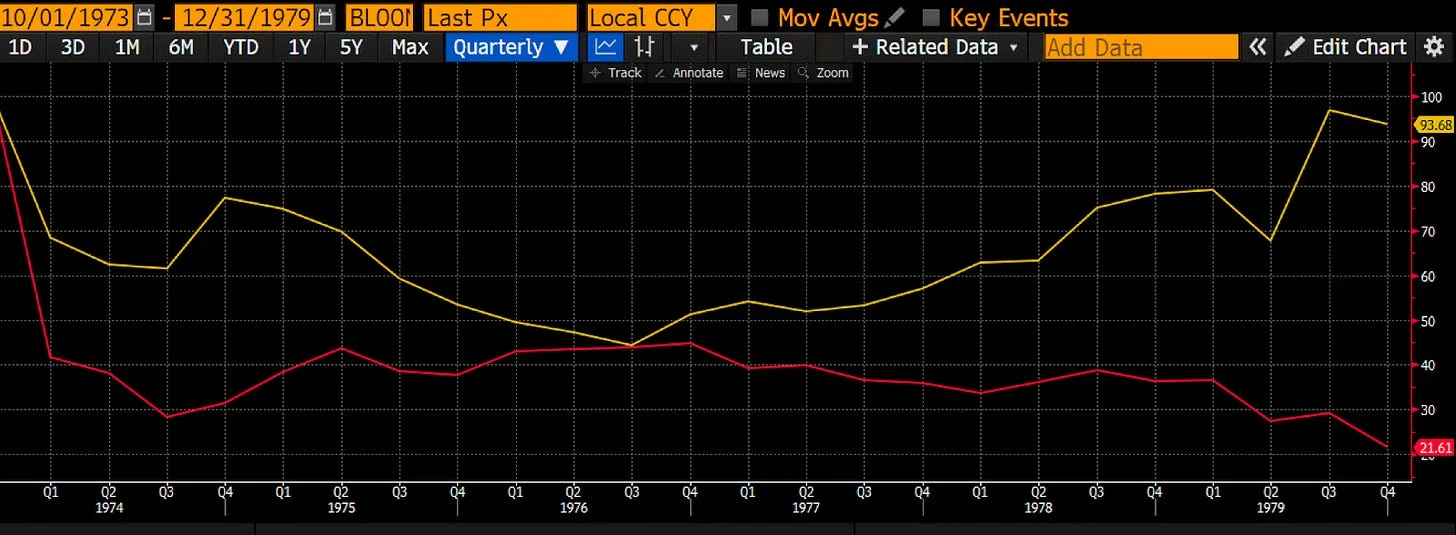

Spot oil prices (white) and gold prices (yellow) are plotted against a U.S. dollar benchmark of 100. Oil prices have risen 412%, while gold prices have almost caught up, rising 380%.

Here is the price of gold (gold) compared to the SP 500 (red) divided by the price of oil, with the base being 100. Gold has only lost 7% of its purchasing power, while stocks have lost 80%.

Assuming that either party removed Middle Eastern hydrocarbons from the market, the Bitcoin blockchain would continue to function and its price would at least maintain its value relative to energy and would certainly rise in terms of fiat currencies.

Now that I have discussed physical and energy risks, let’s explore the last one, currency risk.

Risk 3: Currency

The key question is how the United States responds to the conflict. Both the Democratic and Republican parties firmly support Israel. Even if innocent civilians suffer losses in the process of the Israeli armys attempt to destroy Iran and its proxies, the political elites in the United States will continue to support Israel. The United States supports Israel by providing weapons. Since Israel cannot pay for the weapons needed to fight Iran and its proxies, the US government borrows money to pay American arms dealers such as Lockheed Martin to provide ammunition to Israel. Since October 7, 2023, Israel has received $17.9 billion in military aid.

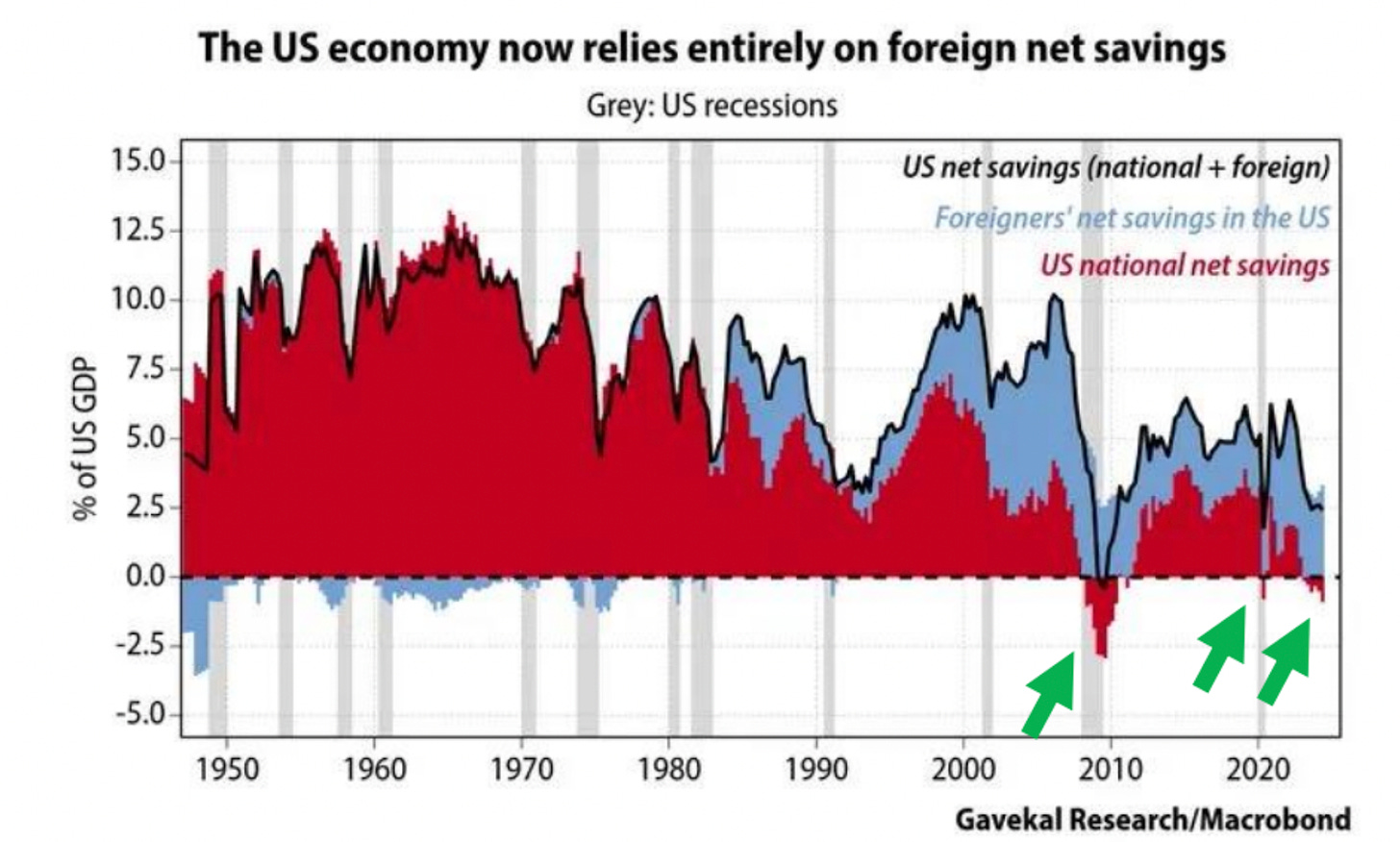

The US government makes purchases by borrowing, not saving. That’s what the chart above tells us. In order to provide Israel with free weapons, the heavily indebted US government needs to borrow further. The question is, who will buy this debt when national savings are negative? The green arrows in the chart mark periods when the US national net savings were negative. Luke Gromen points out that these arrows correspond to a sharp expansion of the Federal Reserve’s balance sheet.

The United States, playing the role of warlord in its military operations in support of Israel, will need to borrow more. As in the aftermath of the 2008 global financial crisis and the COVID-19 lockdown, the balance sheets of the Federal Reserve or the commercial banking system will grow dramatically to absorb the additional debt issuance.

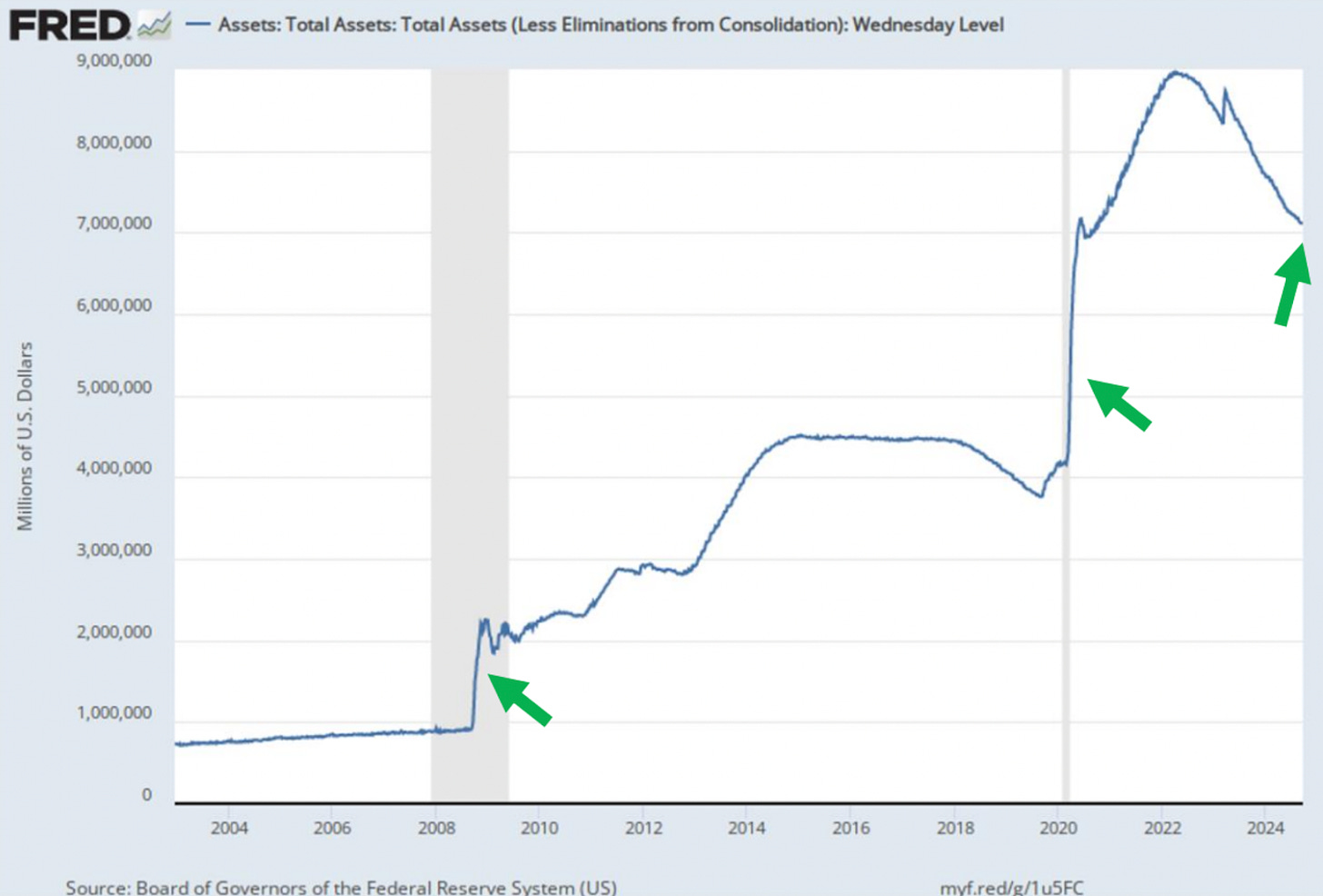

How would Bitcoin respond to another major expansion of the Fed’s balance sheet?

This is the price of Bitcoin divided by the Fed’s balance sheet, with the value being 100. Since Bitcoin’s inception, it has outperformed the growth of the Fed’s balance sheet by 25,000%.

We know that war is inflationary. We understand that the U.S. government needs to borrow money to sell weapons to Israel. We also know that the Federal Reserve and the U.S. commercial banking system will buy up this debt by printing money and expanding their balance sheets. Therefore, it is foreseeable that the fiat price of Bitcoin will rise significantly as the war intensifies.

Regarding Irans military spending, will China and Russia support Irans war effort in some way? China is willing to buy Irans hydrocarbons, and China and Russia also sell goods to Iran, but these transactions are not conducted on credit. From a more realistic perspective, I think China and Russia will probably play a post-war role. They will publicly condemn the war, but will not actually take effective measures to prevent Irans destruction.

Israel is not interested in nation-building. Instead, they may hope that their attack will trigger the collapse of the Iranian regime due to popular unrest. This would allow China, in particular, to use its usual diplomatic tactics and offer loans to the newly weak Iranian government to help rebuild the country using Chinese state-owned enterprises. This is effectively the Belt and Road Initiative that Chinese President Xi Jinping has promoted during his tenure. Iran, with its rich mineral and hydrocarbon resources, would be fully integrated into Chinas economic sphere. China could find a new market in the Global South to dump its overproduction of high-quality, low-priced manufactured goods. In exchange, Iran would provide China with cheap energy and industrial raw materials.

If you look at it this way, China and Russia’s support will not increase the global supply of fiat currency. Therefore, it will not have a noticeable impact on the fiat price of Bitcoin.

The intensification of conflict in the Middle East will not destroy any of the critical physical infrastructure that supports cryptocurrencies. As energy prices soar, the value of Bitcoin and cryptocurrencies will rise. Hundreds of billions or even trillions of newly printed dollars will once again drive a bull run in the Bitcoin market.

Trade with caution

While Bitcoin may rise in the long term, this does not mean that its price will not experience wild fluctuations, nor does it mean that all altcoins will benefit equally. The key is to properly control the scale of investment.

Im prepared for wild swings in market value for every investment I own. As some readers know, Ive invested in several memecoins. When Iran launched missiles at Israel, I cut those investments decisively because its hard to predict how crypto assets will react to an escalation of conflict in the short term. I realized I was overinvesting because I would be very upset if I lost my entire capital on some joke cryptocurrency. Currently, the only memecoin I own is Church of Smoking Chicken Fish (ticker: SCF). Ramen.

I have not asked Akshat, Maelstrom’s head of investment, to slow down or stop investing in our pre-sale tokens. For the idle funds held by Maelstrom, I plan to stake them on Ethena to earn a decent yield while waiting for the right time to enter various liquid altcoins.

The worst thing you can do as a trader is to make trades based on who you think is on the right side of a war. This approach will lead to failure as both sides of a war will face financial repression, asset confiscation, and destruction. The wisest thing to do is to ensure the safety of yourself and your family first, and then put your capital into investment vehicles that can withstand the devaluation of fiat currencies and maintain their purchasing power for energy.

This article is sourced from the internet: Arthur Hayes new article: Escalating conflict in the Middle East and rising energy prices will increase the value of Bitcoin in the long run

Related: GoPlus Research: Deep into Eigenlayer, designing and building AVS

Original author: GoPlus background From last year to today, EigenLayer, as a core narrative in the Ethereum ecosystem, has accumulated more than $10 billion in TVL. However, most people may simply regard it as a financial infrastructure, mainly because the most well-known feature of EigenLayer is its Restaking concept. This initial impression makes it easy for people to think that EigenLayer is just a platform that helps users get additional staking income. In fact, when we think deeply, a key question emerges: Why can re-staked ETH or LST (liquidity staking tokens) generate additional income? The answer to this question reveals the true nature of EigenLayer. I think EigenLayer is actually a revolutionary financial-driven cloud computing infrastructure. This definition may sound contradictory at first, but it precisely reflects the innovation of…