Colonne de volatilité SignalPlus (20240924) : Oscillation ? Percée ?

The markets expectation of a rate cut maintains the optimism in the digital currency market. BTC ETF continues to receive capital inflows from leading institutions, and the recent approval of the ETF has attracted great attention from the community. Although ETH is a little weak in this regard, the flow from TradFi is still very small, and it even has to continue to face the selling pressure brought by Grayscale ETHE. However, its recent rise in price relative to BTC is still an active topic in recent days. It once touched 2700 yesterday and was immediately reported by the media, but the strong resistance from above could not wait to give up the gains, and after the intraday shock, it finally closed almost flat.

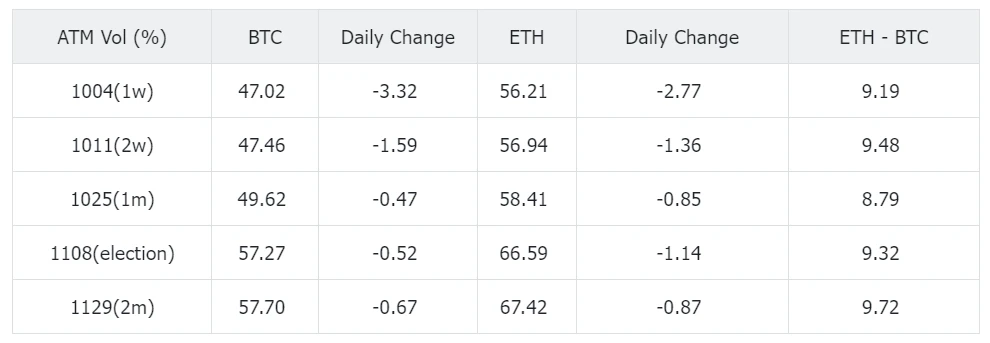

Source: Deribit (as of 24 SEP 16: 00 UTC+ 8)

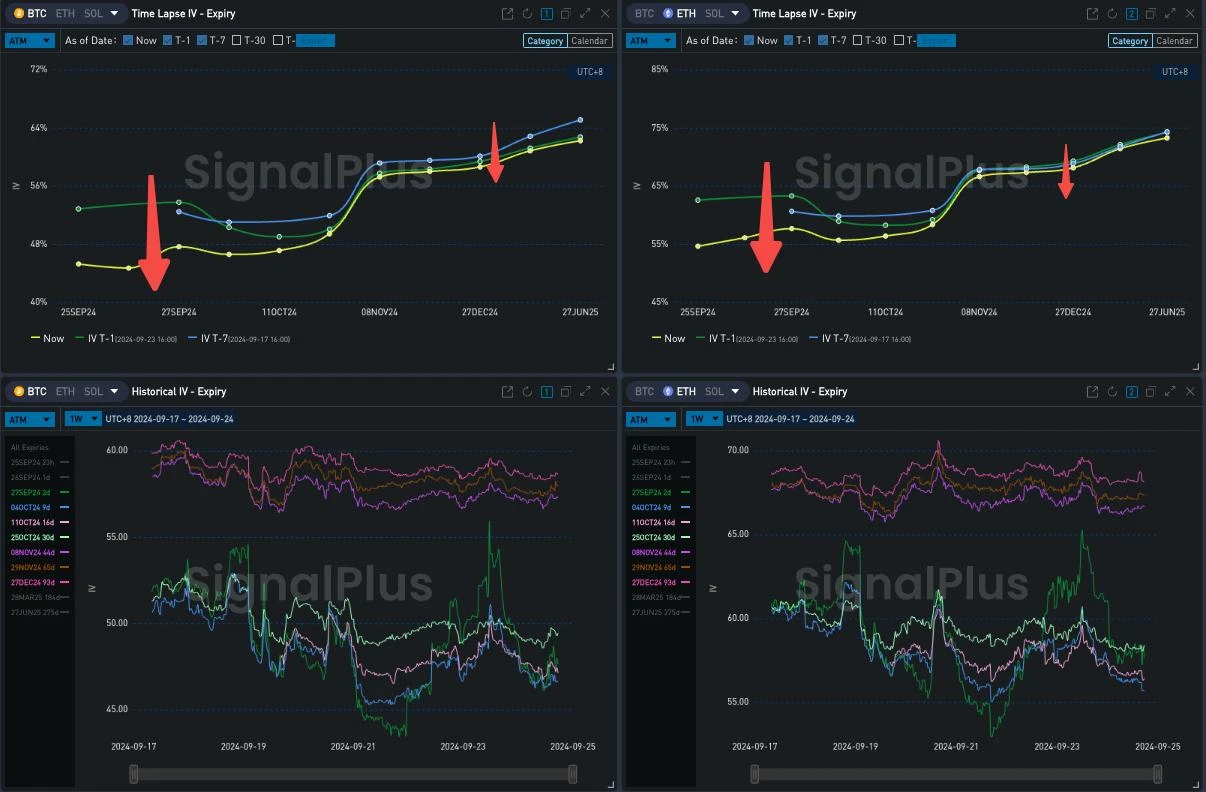

Source: Deribit (as of 24 SEP 16: 00 UTC + 8)

The implied volatility showed a positive correlation with the rise and fall of the benchmark locally. After a wave of price correction, it quickly steepened downward, causing the front end to fall back to the low percentile range of the past three months. This is consistent with the range-bound shocks in recent days and the declining actual volatility index, which means that Vol Premium still exists, but we need to be careful about the risks at the tail, especially in the upward direction.

Source : SignalPlus

Source : SignalPlus

From the perspective of volatility Skew, we can clearly see the impact of transactions in the past 24 hours on the slope of the surface. Specifically, the selling of BTC put options at the end of September confirmed the markets confidence in short-term price stability, and also expressed a bullish view in the form of a bullish spread; but on the other hand, the large demand for 55k Put at the end of October caused the surface to rotate to the bearish side in the middle section, becoming the focus of market discussion. The trading volume on the ETH side is also concentrated in September and the end of October. Among them, the selling of 23k Put at the end of October responded to the demand for BTC, reflecting the markets divergence in cross-currency correlation. However, perhaps it is ETHs recent unexpected performance that has made the bullish demand in September stronger and pushed the Skew of that expiration date to a local high.

Source: SignalPlus, BTC Vol Skew Flow

Source: SignalPlus, ETH Vol Skew Flow

You can use the SignalPlus trading indicator function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

Site officiel de SignalPlus : https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240924): Oscillation? Breakthrough?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Odaily Planet Daily takes stock of the airdrop projects that can be claimed from August 25 to August 31, and also organizes the interactive tasks and important airdrop information added last week. For detailed information, see the text. Sharpe AI Project and air investment qualification introduction Sharpe AI is an AI-driven all-in-one crypto application for institutions and professional traders. The project opened airdrop eligibility inquiries on August 27 and airdrop claims on August 31. Early supporters and users of the Sharpe platform are eligible for airdrops. Financing Sharpe AI completed its seed round of financing on April 11, 2024. The amount was not disclosed. Animoca Brands, Morningstar Ventures, GBV Capital, Maven Capital, Contango Digital Assets and others…