Dites adieu à la fièvre des infrastructures et accueillez l’âge d’or des applications ?

Auteur original : Adrian

Traduction originale : Luffy, Foresight News

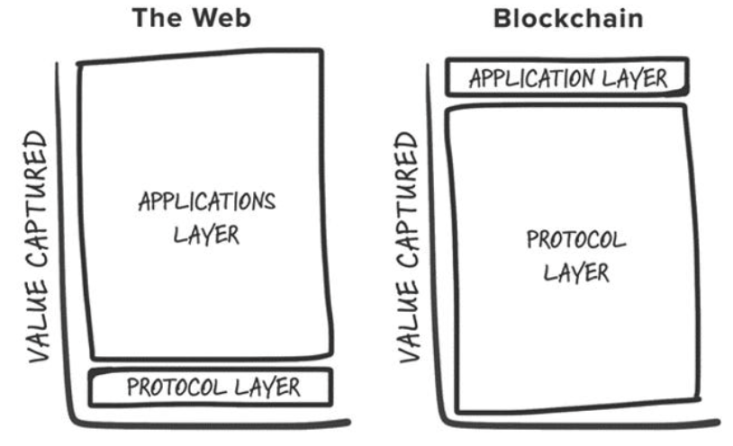

Les meilleurs retours sur investissement de chaque cycle cryptographique à travers l'histoire ont été obtenus en misant tôt sur de nouvelles primitives d'infrastructure sous-jacentes (PoW, contrats intelligents, PoS, haut débit, modularité, etc.). Si nous regardons les 25 principaux jetons sur Coingecko, nous constatons qu'il n'y en a que deux qui ne sont pas natifs des blockchains L1 (à l'exclusion des actifs indexés) : Uniswap et Shiba InuCe phénomène a été théorisé pour la première fois en 2016 par Joel Monegro, qui a proposé la Théorie du protocole Fat . Monegro estime que la plus grande différence entre le Web3 et le Web2 en termes d'accumulation de valeur est que la valeur accumulée par la couche de base de la crypto-monnaie est supérieure à la somme de la valeur capturée par les applications construites dessus, et la valeur provient de :

-

Les blockchains comportent une couche de données partagée sur laquelle les transactions sont réglées, favorisant la concurrence à somme positive et permettant une composabilité sans autorisation.

-

Jeton appréciation -> introduction de participants spéculatifs -> spéculateurs initiaux convertis en utilisateurs -> utilisateurs + appréciation du jeton attirent les développeurs et plus d'utilisateurs, etc. Ce chemin forme un volant d'inertie positif.

En 2024, l’argument original a survécu à de nombreux débats au sein de l’industrie, et plusieurs changements structurels dans la dynamique de l’industrie ont remis en cause les affirmations originales de la théorie du protocole Fat :

1. La marchandisation de l’espace de bloc : l’espace de bloc Ethereum étant devenu très cher, les L1 compétitifs ont émergé et sont devenus des éléments déterminants de la classe d’actifs. Les L1 compétitifs sont souvent valorisés en milliards de dollars, et les constructeurs et investisseurs sont attirés par les L1 compétitifs presque à chaque cycle. De nouvelles blockchains différenciées émergent à chaque cycle, ce qui enthousiasme les investisseurs et les utilisateurs mais finit par devenir des chaînes fantômes (comme Cardano). Bien qu’il existe des exceptions, en général, cela a conduit à une surabondance d’espace de bloc sur le marché sans suffisamment d’utilisateurs ou d’applications pour le prendre en charge.

2. Modularité de la couche de base : à mesure que le nombre de composants modulaires spécialisés augmente, la définition de la couche de base devient de plus en plus complexe, sans parler de la valeur générée par la déconstruction de chaque couche de la pile. Cependant, à mon avis, ce changement est certain :

-

La valeur d'une blockchain modulaire est décentralisée sur la pile, et pour qu'un seul composant (par exemple Celestia) reçoive une valorisation plus élevée que la couche de base intégrée, il faut que son composant (par exemple DA) devienne le composant le plus précieux de la pile et qu'il y ait des « applications » construites dessus qui génèrent plus de revenus d'utilisation et de frais que le système intégré ;

-

La concurrence entre les solutions modulaires génère des solutions d'exécution/disponibilité des données moins chères, réduisant encore les coûts pour les utilisateurs

3. Vers un avenir d’abstraction de chaîne : la modularité crée intrinsèquement une fragmentation dans l’écosystème, ce qui conduit à des expériences utilisateur fastidieuses. Pour les développeurs, cela signifie trop de choix quant à l’endroit où déployer les applications ; pour les utilisateurs, cela signifie surmonter de nombreux obstacles pour passer de l’application A sur la chaîne X à l’application B sur la chaîne Y. Heureusement, beaucoup de nos brillants collaborateurs construisent un nouvel avenir dans lequel les utilisateurs peuvent interagir avec des applications cryptographiques sans connaître la chaîne sous-jacente. Cette vision est appelée abstraction de chaîne. La question est maintenant de savoir où la valeur s’accumulera dans l’avenir abstrait de la chaîne ?

Je pense que les applications cryptographiques sont les principales bénéficiaires du changement dans la façon dont nous construisons les infrastructures. Plus précisément, les chaînes d’approvisionnement commerciales centrées sur l’intention, avec l’exclusivité du flux d’ordres et des actifs intangibles tels que l’expérience utilisateur et la marque, deviendront de plus en plus le terrain fertile des applications phares, leur permettant d’être commercialisées beaucoup plus efficacement qu’aujourd’hui.

Exclusivité du flux d'ordres

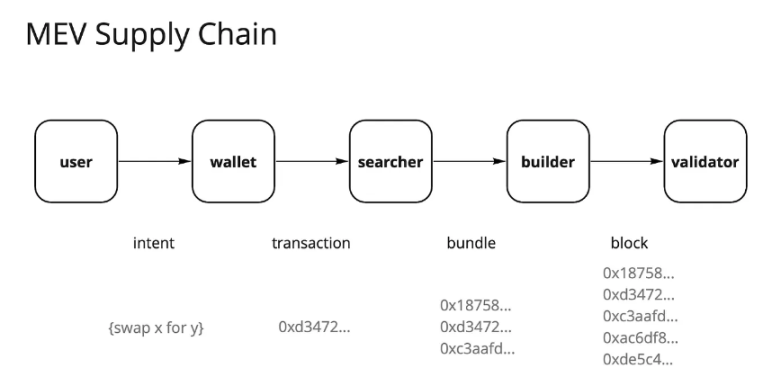

Depuis la fusion d'Ethereum et l'introduction de Flashbots et MEV-Boost, le paysage MEV a radicalement changé. La forêt sombre autrefois dominée par les chercheurs est désormais devenue un marché de flux d'ordres partiellement banalisé, et la chaîne d'approvisionnement MEV actuelle est principalement dominée par les validateurs, qui capturent environ 90% de MEV sous forme d'offres de chaque participant à la chaîne d'approvisionnement.

La chaîne d'approvisionnement MEV d'Ethereum

La plupart des participants à la chaîne logistique commerciale sont mécontents du fait que les validateurs captent la majorité de la valeur extractible du flux d'ordres. Les utilisateurs veulent être rémunérés pour la génération du flux d'ordres, les applications veulent conserver la valeur du flux d'ordres des utilisateurs, et les chercheurs et les constructeurs veulent des profits plus importants. En conséquence, les participants à la recherche de valeur se sont adaptés à ce changement et ont essayé plusieurs stratégies pour extraire l'alpha, dont l'une est l'intégration chercheur-constructeur. L'idée est que plus la certitude d'inclusion d'un bloc packagé par un chercheur est élevée, plus le profit est élevé. Une grande quantité de données et de littérature montre que l'exclusivité est la clé pour capturer de la valeur sur un marché concurrentiel, et que les applications avec le trafic le plus précieux auront le pouvoir de fixation des prix.

Ce modèle commercial est similaire à celui de Robinhood. Robinhood vend des flux d'ordres aux teneurs de marché et obtient des remises pour maintenir un modèle de trading « sans frais ». Marché Les fabricants comme Citadel sont prêts à payer pour le flux d'ordres car ils peuvent profiter de l'arbitrage et de l'asymétrie d'information.

Cela est encore plus évident dans le nombre croissant de transactions effectuées via des pools de mémoire privés, qui ont récemment atteint un sommet historique de 30% sur Ethereum. Les applications réalisent que la valeur de tous les flux de commandes des utilisateurs est extraite et filtrée dans la chaîne d'approvisionnement MEV, et les transactions privées permettent une plus grande personnalisation et une plus grande commercialisation autour des utilisateurs fidèles.

https://x.com/mcutler/status/1808281859463565361

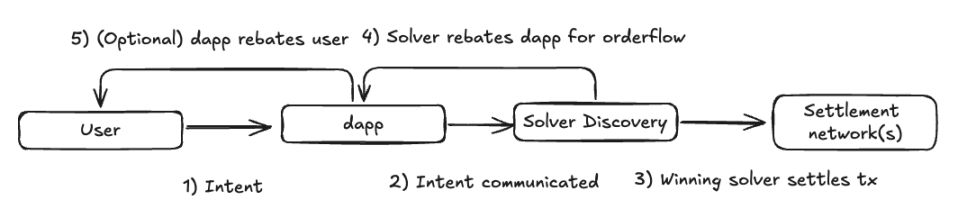

À l’aube de l’ère de l’abstraction de la chaîne, je m’attends à ce que cette tendance se poursuive. Dans un modèle d’exécution centré sur l’intention, la chaîne d’approvisionnement commerciale est susceptible de devenir plus fragmentée, les applications dirigeant leur flux d’ordres vers le réseau de solveurs qui peut fournir l’exécution la plus compétitive, ce qui pousse la concurrence entre les solveurs à réduire les marges bénéficiaires. Cependant, je m’attends à ce que la majorité de la capture de valeur se déplace de la couche de base (validateurs) vers les couches orientées utilisateur, les composants middleware étant précieux mais avec de faibles marges bénéficiaires. Les frontends et les applications capables de générer un flux d’ordres précieux auront un pouvoir de tarification sur les chercheurs/solveurs.

Moyens possibles d’accumuler de la valeur dans le futur

Nous voyons déjà cela se produire aujourd'hui, avec des protocoles de prêt récupérant le flux d'ordres d'enchères de liquidation qui autrement irait aux validateurs, en tirant parti du flux d'ordres de niche issu d'une commande spécifique à l'application (par exemple, les enchères de valeur extractible Oracle, Pyth, API 3, UMA Oval).

L'expérience utilisateur et la marque comme douves durables

Si nous décomposons davantage les 30% de transactions privées mentionnées ci-dessus, la plupart d'entre elles proviennent de frontends tels que TG Bots, Dexes et portefeuilles :

Malgré la croyance de longue date selon laquelle les utilisateurs natifs de la cryptographie ont une capacité d'attention limitée, nous constatons enfin un certain niveau de rétention. L'image de marque et l'expérience utilisateur peuvent toutes deux constituer un avantage significatif.

Expérience utilisateur : les interfaces alternatives qui introduisent une expérience complètement nouvelle en connectant un portefeuille sur une application Web attireront sans aucun doute l'attention des utilisateurs qui ont besoin d'une expérience spécifique. Un bon exemple est celui des bots Telegram tels que BananaGun et BONKbot, qui ont généré 10T150 millions de dollars en frais et permet aux utilisateurs d'échanger des Memecoin dans le confort d'une discussion Telegram.

Marque : Les marques bien connues dans le domaine des crypto-monnaies peuvent augmenter leurs frais en gagnant la confiance des utilisateurs. Il est bien connu que les frais d'échange d'applications dans le portefeuille sont très élevés, mais ils constituent un modèle commercial mortel car les utilisateurs sont prêts à payer pour plus de commodité. Par exemple, les échanges MetaMask génèrent plus de 110T200 millions de TP de frais par an. Les échanges de frais frontaux d'Uniswap Labs ont rapporté 110T50 millions de TP depuis leur lancement, et les transactions qui interagissent avec les contrats d'Uniswap Labs d'une manière autre que le front-end officiel ne facturent pas ces frais, mais les revenus d'Uniswap Labs continuent de croître.

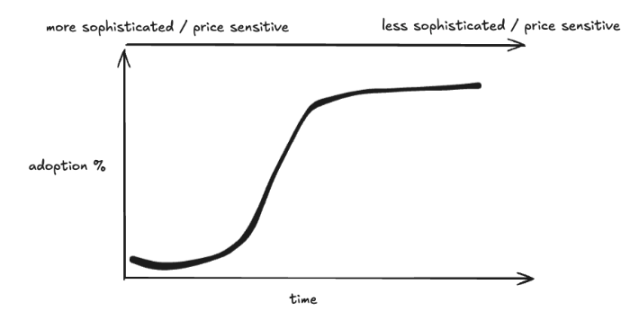

Cela suggère que l’effet Lindy dans les applications est cohérent, voire plus prononcé, que dans les infrastructures. En règle générale, l’adoption de nouvelles technologies (y compris les cryptomonnaies) suit une sorte de courbe en S : à mesure que nous passons des premiers utilisateurs aux utilisateurs grand public, la prochaine vague d’utilisateurs sera moins sophistiquée et donc moins sensible aux prix, ce qui permettra aux marques capables d’atteindre une masse critique de monétiser de manière créative.

La courbe en S des crypto-monnaies

Conclusion

En tant que praticien de la cryptographie qui se concentre principalement sur la recherche et les investissements en matière d’infrastructures, cet article ne nie en aucun cas la valeur de l’infrastructure en tant que classe d’actifs investissable dans la cryptographie, mais plutôt un changement d’état d’esprit lorsque l’on pense à des catégories d’infrastructures entièrement nouvelles. Ces catégories d’infrastructures permettent à la prochaine génération d’applications de servir les utilisateurs au-dessus de la courbe en S. Les nouvelles primitives d’infrastructure doivent apporter des cas d’utilisation entièrement nouveaux au niveau de l’application pour attirer suffisamment d’attention. Dans le même temps, il existe suffisamment de preuves qu’il existe des modèles commerciaux durables au niveau de l’application où la propriété de l’utilisateur guide directement l’accumulation de valeur. Malheureusement, nous avons peut-être dépassé le stade du marché de L1, où parier sur chaque nouveau L1 brillant apportera des rendements exponentiels, même si celles qui présentent une différenciation significative peuvent encore valoir la peine d’être investies.

Malgré tout, j’ai passé beaucoup de temps à réfléchir et à comprendre différentes « infrastructures » :

-

Intelligence artificielle : une économie d'agents qui automatise et améliore l'expérience de l'utilisateur final, un outil de calcul et d'inférence marché qui optimise en permanence l'allocation des ressources et une pile de validation qui étend les capacités de calcul des machines virtuelles blockchain.

-

Pile CAKE : la plupart des points que j'ai évoqués plus haut indiquent que je pense que nous devrions nous diriger vers un avenir d'abstraction de chaîne, tandis que les choix de conception pour la plupart des composants de la pile restent vastes. À mesure que l'infrastructure prend en charge l'abstraction de chaîne, l'espace de conception des applications va naturellement s'élargir et peut entraîner un flou dans la distinction entre application et infrastructure.

-

DePIN : Je crois depuis un certain temps que DePIN est le meilleur cas d’utilisation réel pour les cryptomonnaies (juste après les stablecoins), et cela n’a jamais changé. DePIN exploite tout ce que les cryptomonnaies savent faire : coordination sans autorisation des ressources par le biais d’incitations, démarrage des marchés et propriété décentralisée. Bien que chaque type spécifique de réseau DePIN ait encore des défis spécifiques à résoudre, valider une solution au problème du démarrage à froid est énorme, et je suis très heureux de voir des fondateurs ayant une expertise du secteur apporter leurs produits dans l’espace crypto.

Cet article provient d’Internet : Dites adieu à la fièvre des infrastructures et accueillez l’âge d’or des applications ?

Dans le nouveau monde du Web3, une révolution autour de la souveraineté des utilisateurs se déroule tranquillement. Dans cette révolution, en tant que pionnier dans le domaine social du Web3, INTO redéfinit la relation entre les utilisateurs et les plateformes grâce à des technologies innovantes telles que le système d'identité SBT (Soul Bound Token) et le stockage de données basé sur des contrats intelligents. Il ne s'agit pas seulement de construire une plateforme sociale, mais aussi de créer une nouvelle ère qui respecte les droits des utilisateurs et revient à l'essence du service. 1. La souveraineté des utilisateurs est-elle la proposition centrale du Web3 ? Dans le monde du Web3, la souveraineté des utilisateurs n'est plus une fonctionnalité supplémentaire facultative, mais est devenue un facteur clé du succès d'un projet. Il y a une profonde logique technique, sociale et économique derrière cela. Tout d'abord, d'un point de vue technique, la…