Faire face aux baisses de taux de la Fed : stratégies de trading d'options sur des marchés volatils

The market showed bullish optimism this week, mainly due to the positive factors that cryptocurrency traders focus on – interest rate cuts and liquidity, which will be set by the Federal Reserves interest rate decision on Wednesday and Powells statement. The probability of a 50 basis point rate cut doubled in a week, causing the Nasdaq to rise more than 3% this week, while Bitcoin also rebounded from a low of $57,000 to $61,000.

The market is paying close attention to the Federal Open Marché Committee (FOMC) decision on Wednesday.

This week, we鈥檒l dive into rate cut scenarios and analyze their potential impact on Bitcoin鈥檚 short-term price to help you prepare ahead of time. In short: expect significant volatility.

Let鈥檚 dive in.

Expectations of a 50 basis point rate cut by the Federal Reserve surge

source: CME Fedwatch

According to CME data, market expectations for a 50 basis point rate cut have increased significantly from 34% last week to 63% today. This sharp increase has contributed to the rise in the price of Bitcoin from $58,000 to $61,000. Usually, CME data accurately predicts the Feds interest rate decisions, so it is unusual to see such a large fluctuation and divergence so close to the Federal Open Market Committee (FOMC) meeting. This not only indicates market indecision, but also may mean that there is significant uncertainty about the Feds final decision.

The notable rise in expectations for a 50bp rate cut can be attributed to several factors:

1. Insiders view: Jon Faust, Powells former senior adviser, expressed a preference for a 50 basis point rate cut, suggesting there is a reasonable chance the FOMC will opt for this larger cut.

2. Wall Street expectations: JPMorgan Chase published an article discussing the possibility of a larger rate cut, describing it as a tough choice between a half-point or a quarter-point cut.

3. Powerful statement: Former New York Fed President Dudley made a convincing case for a 50 basis point rate cut, noting that the current funds rate is significantly above the neutral rate.

These factors combined have led to a sharp rise in market expectations for larger interest rate cuts.

Attention: Bitcoin鈥檚 volatility increases

Source: The Block

The unprecedented divergence in CME Groups expectations could lead to significant market volatility, especially considering this is the first rate cut by the Fed. Powells statement at the press conference will be crucial. We believe that Powell is more likely to announce a 50 basis point rate cut, while the market is unlikely to see a sharp decline for the following reasons:

1. At the Jackson Hole conference, Powell made a dovish statement, indicating his willingness to take action.

2. Since his speech, weak employment data has been released, further supporting the case for a larger rate cut.

3. If the Fed chooses a 25 basis point rate cut, Powell may have difficulty defending his previous statement, which may create unnecessary market uncertainty – something that both the Fed and Powell want to avoid. The only reason to choose a 25 basis point rate cut may be concerns about a recession, but Powell has made it clear that the economy remains strong.

4. If the Fed does cut rates by 50 basis points, it could raise market concerns about a potential recession. Therefore, Powell鈥檚 response to the future economic outlook will be crucial.

However, the rate cut itself may not be the most important market mover. The Fed鈥檚 overall tone and stance throughout the press conference will be crucial.

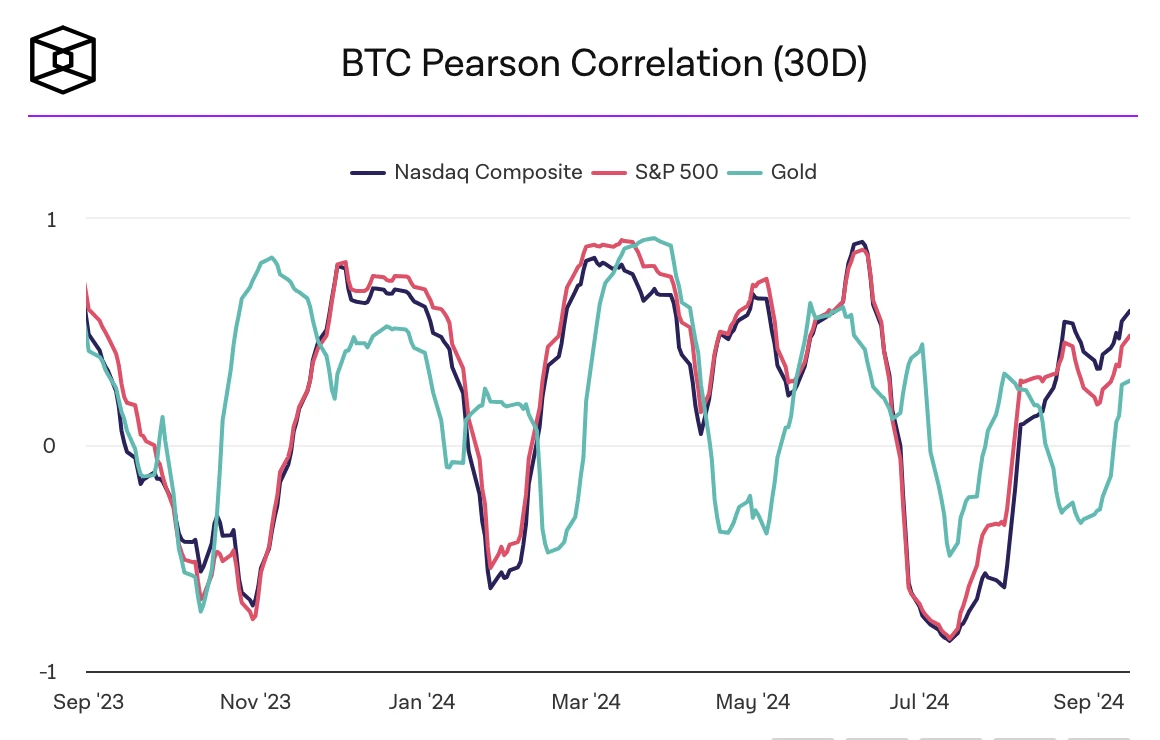

Currently, Bitcoin鈥檚 correlation with traditional markets is increasing rapidly. Therefore, if there is a significant volatility in traditional markets, Bitcoin is likely to be similarly affected.

Mettez en pratique vos opinions sur le marché : Trading d'options

Do you think the upcoming FOMC meeting will be a sign that Bitcoin won鈥檛 drop too much in the day after, regardless of whether a 25 or 50 basis point rate cut is announced?

Consider the long ratio put spread strategy:

A long ratio put spread is an options strategy that involves buying one put option and simultaneously selling multiple put options with a lower strike price, all with the same expiration date. This strategy is suitable for traders who believe that the underlying asset (in this case, Bitcoin) will experience a mild decline or remain relatively stable.

trade:

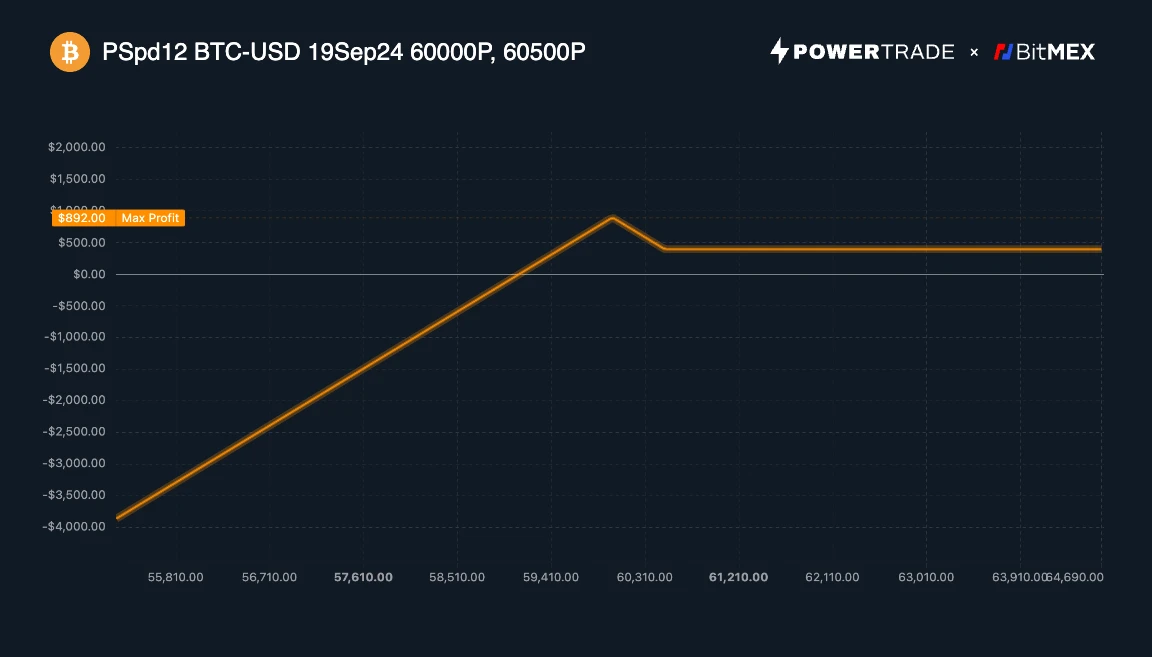

-

Buy 1 $BTC put option with a strike price of $60.5k, expiring on September 19th

-

Sell 2 $BTC put options with a strike price of $60k, expiring on September 19th

Potential Benefits:

-

Max Payout: Achieved when Bitcoin price falls to or slightly below the lower strike price ($60,000)

-

Break-even point: There is a break-even point at $59,000

-

Maximum loss: Unlimited below $59,000 because you sold more puts than you bought

-

Profit: If the $BTC price is $60,000 at expiration, the profit is $892, if Bitcoin is above $60,500, the profit is $480

Avantages

-

Cost-effectiveness: Selling lower-strike put options helps offset the cost of purchasing higher-strike put options, thereby reducing overall strategy expenses.

-

Profit potential when the underlying asset declines moderately: You can profit if the underlying asset declines but remains above the strike price of both sold puts. Maximum profit is realized when the price reaches the strike price of the sold puts, as the sold options expire and the bought puts gain value.

-

Time decay advantage: Since you are selling two puts and buying one, time decay (theta) works in your favor. If the underlying asset stays above the lower strike price, the sold option loses value faster than the bought put, allowing you to potentially close the position at a profit.

risque

-

Unlimited downside risk: If the Bitcoin price drops significantly below the lower strike price, there could be huge losses as more put options are sold than bought.

-

Complexity: This strategy requires careful management and a deep understanding of options trading, so it is not suitable for beginners.

-

Exercise Risk: There is a possibility that the sold put options will be exercised early, especially when they are deeply in-the-money, which can complicate the strategy.

This strategy is often used when you expect a modest decline in the price of the underlying asset, but believe a significant decline is unlikely. You want to take advantage of a range-bound market while avoiding paying a high premium for buying a put option outright.

This article is sourced from the internet: Dealing with Fed rate cuts: Options trading strategies in volatile markets

Bitcoin and Ethereum dominated the early days of the cryptocurrency market, but as the industry rapidly iterates and matures, more and more emerging projects are emerging. The new coin market is an important part of the cryptocurrency field and plays a key role in the innovation and development of the industry. The change in the total market value of the new coin market reflects the progress of innovative technologies and the expansion of application scenarios, which has promoted the evolution of the crypto industry landscape. Its large market penetration potential has increased the global awareness and acceptance of cryptocurrencies. For example, emerging applications such as DeFi and NFT meet users needs for financial innovation and digital art, and in turn promote the further development of the new coin market. As…