Bilan complet des opérations d'investissement de la rédaction d'Odaily (4 septembre)

Cette nouvelle rubrique est un partage d'expériences d'investissement réelles par les membres de la rédaction d'Odaily. Elle n'accepte aucune publicité commerciale et ne constitue pas un conseil d'investissement (car nos collègues sont très doués pour perdre de l'argent) . Son objectif est d'élargir les perspectives des lecteurs et d'enrichir leurs sources d'information. Vous êtes invités à rejoindre la communauté Odaily (WeChat @Odaily 2018, Groupe d'échange Telegram , Compte officiel X ) pour communiquer et se plaindre.

Recommandateur : Qin Xiaofeng (X : @QinXiaofeng 888 )

Introduction : Option chien fou, preneur de mème

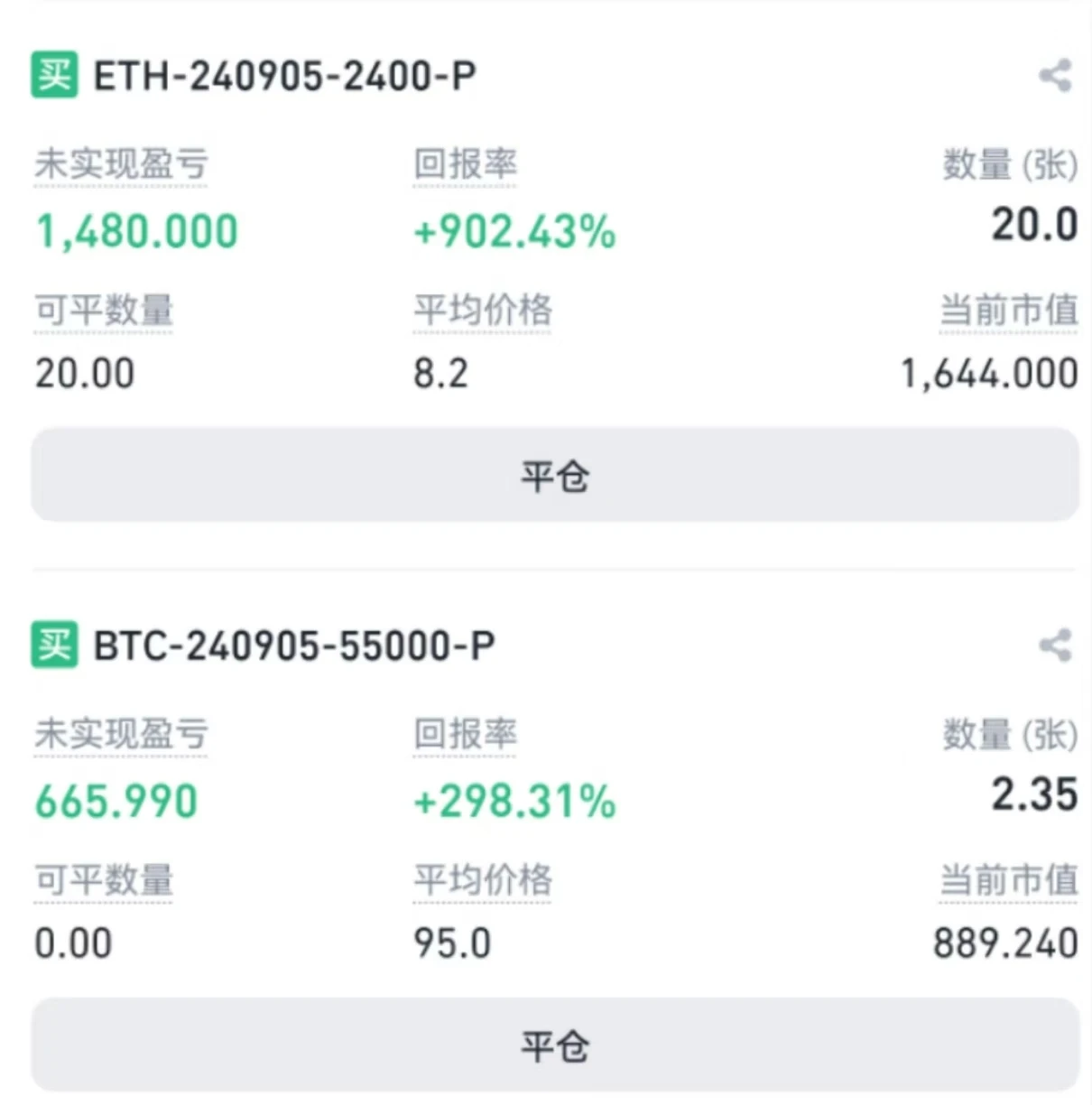

Partager : The 94 curse has come true again. Today, Bitcoin fell 4% again in a short period of time. In fact, since last week, Bitcoins lows have continued to move down, continuously testing the 58,000 and 57,000 levels, but it has not fallen below several times. After each sharp drop, it quickly recovered. The 58,000 US dollar line has accumulated long positions again, and a part of it was successfully liquidated this morning. At present, it is still bearish in the short term, and Bitcoin may continue to test the 55,000 US dollar and the 50,000 US dollar mark. If it can fluctuate and consolidate in the next two days, and the non-agricultural data released by the US Department of Labor on Friday night tends to be positive, the market is expected to rebound again.

In terms of operation, the market is experiencing wide fluctuations and volatility is increasing. It is more cost-effective to open both long and short positions. We recommend ETH – it has tried to rise again several times but was beaten back to its original form. Its ups and downs have been stronger than Bitcoin several times, and its amplitude is larger.

Recommandateur : Nan Zhi (X : @Assassin_Malvo )

Introduction :Acteur on-chain, analyste de données, joue à tout sauf aux NFT

partager :

-

The 55,800 bottom-fishing that was shared on Monday, 90% of the current purchases are spot. I believe that September will be a V-shaped trend with a lower right side. Personally, I choose to guess the bottom.

-

In yesterday鈥檚 article, I selected long-term short-selling targets, including some Restaking and AI that have not fallen yet. For details, please see Comparison of new and old VC coins, these new coins have fallen out of cost-effectiveness .

Recommandé par : Wenser (X: @wenser 2010 )

Introduction : A heartbroken player in the exchange, I am the only one in the group who has not shipped anything

partager :

-

BTC NFT is starting to pick up. From current observations, Aneemoos style and the CryptoKitties teams Egg series Ethereum NFT floor price have performed well. Their characteristics are small total volume, good style or background, pure cultural consumption or high returns;

-

CryptoKitties has also extended its hand to Telegram, launching a small game All The Zen, which allows users to enter the official channel first and wait for the subsequent experience qualification to be opened;

-

Apples press conference will start on the 10th. iPhone 16 will be equipped with Apple Intelligence. Although the overall market is bearish, there is still a certain rebound expectation for the AI sector. I personally pay more attention to RENDER, ARKM, and WLD. There were also whales who bought PEPE, FLOKI, and WLD before, which can be regarded as a little adjustment during the decline;

-

There seems to be no solution to the September curse at the moment. Considering the world situation, turbulence is still the main theme. Maybe things will stabilize a little after the US election in late October or even November.

Records précédents

Lectures recommandées

This article is sourced from the internet: Full record of Odaily editorial department investment operations (September 4)

Les dernières données montrent que les dépenses de vente au détail aux États-Unis ont augmenté de 1% en glissement mensuel pour atteindre $709,7 milliards en juillet. Les fortes dépenses de consommation ont temporairement apaisé les craintes du marché selon lesquelles l'économie pourrait tomber en récession. Les actions américaines ont bien réagi à cela. À la clôture de jeudi, le SP 500 et le Dow Jones Industrial Average ont réalisé six gains consécutifs. Cependant, les actifs cryptographiques n'ont pas reçu les dividendes positifs de ces données macroéconomiques. Limité par les défis de l'été, le BTC est toujours dans une phase de consolidation volatile. Au cours des dix dernières années, le BTC a augmenté de plus de 227% au total, 56% au cours de l'été, et a rebondi au quatrième trimestre. Sur la base des données historiques et des données de l'année dernière, le BTC pourrait également augmenter au quatrième trimestre de cette année. Afin de…