Pourquoi les revenus du réseau Ethereum L1 ont-ils chuté de manière spectaculaire ?

Original title: Ethereum layer-1 network revenue collapses鈥擶hat鈥檚 causing it?

Original article by Vince Quill, Cointelegraph

Original translation: Eason, MarsBit

Despite a sharp increase in monthly users and daily transaction costs on Layer 2, Ethereum Layer 1 network revenue has plummeted 99% since March 2024.

Selon Jeton Terminal, network fees reached an annual high of $35.5 million on March 5, 2024. The Dencun upgrade went live on March 13, 2024, which significantly reduced fees for Ethereum Layer 2 transactions.

Ethereum network fees in 2024. Source: Token Terminal

After the upgrade, network fees steadily decreased, hitting a low of $566,000 on August 31, and rose slightly to $578,000 on September 2, 2024.

Too many L2s?

After the Dencun upgrade, Ethereum L2 fees dropped significantly, sparking competition for L2 scaling solutions. The Layer 2 data resource L2 Beat currently lists 74 Ethereum L2 scaling projects and 21 Layer 3 projects.

Anoma CEO Adrian Brink believes that the number of L2 solutions currently being built on the Ethereum network far exceeds market demand. Brink estimates that the number of Layer 2 scaling solutions is about 10 times the industry demand.

Average network fees for Ethereum Layer 2 L2 network. Source: Token Terminal

This highly competitive environment encourages a race to the bottom, with rival L2s competing to offer the lowest transaction fees to their customers. The resulting competition draws users away from settling directly on the Ethereum base layer and acts as a self-reinforcing mechanism, further driving down network fees.

Low fees create inflationary supply pressures

Dencun鈥檚 reduced transaction costs offset the deflationary pressure brought about by EIP-1559, an Ethereum Improvement Proposal that introduced a mechanism to destroy part of the fees on the network.

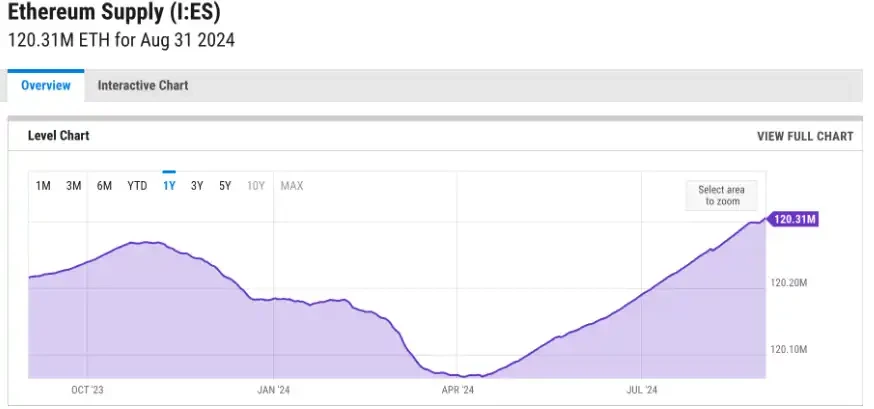

Ethereum supply. Source: Y Charts

The significant reduction in fees means a drop in demand for Ether, the currency needed to pay for network transaction fees. As a result, the supply of ETH has been steadily increasing since the Dencun upgrade went live. Ethereums historically low transaction costs, and the corresponding lack of demand, have caused the price of ETH to drop below $3,000.

This article is sourced from the internet: Why did Ethereum L1 network revenue drop sharply?

L'ETF spot Ethereum américain officiellement approuvé La Securities and Exchange Commission (SEC) des États-Unis a informé au moins deux des huit sociétés qui ont demandé le lancement des premiers ETF spot Ethereum américains que leurs produits peuvent commencer à être négociés mardi (23 juillet). Les produits de BlackRock, VanEck et six autres sociétés commenceront à être négociés sur trois bourses différentes mardi matin : le Chicago Board Options Exchange (CBOE), le Nasdaq et le New York Stock Exchange, qui ont tous confirmé qu'ils étaient prêts à commencer à être négociés. Eric Balchunas, analyste ETF chez Bloomberg, a déclaré : L'ETF spot Ethereum a été mis en ligne auprès de la SEC. Le formulaire 424(b) est en cours de soumission, ce qui constitue la dernière étape, ce qui signifie que tout est prêt pour commencer à être négocié à 9h30 mardi (21h30 heure de Pékin ce soir). Le jeu est lancé.…