dappOS : un réseau d'exécution d'intentions soutenu par les meilleures institutions

Original article by Lawrence Lee, Research Fellow at Mint Ventures

Since the development of the crypto economy, the infrastructure on the chain has been gradually improved, but the user experience is still in its infancy. After the user operation experience is improved, it is expected to attract more users to enter the chain ecosystem, which in turn promotes the further development of infrastructure and the enrichment of business forms, forming a ladder cloud effect of stepping on the left foot and the right foot. The 1995 moment of cryptocurrencies may depend on the emergence of a user-oriented killer application or operating system.

The intention track is committed to this, changing the current on-chain operation logic of assuming that users are experts to assuming that users are novices, hiding the complex operations and logic, and providing users with a simpler, more convenient and safer experience. AI can also help users realize their intentions more easily.

This article focuses on the intention execution network dappOS that is backed by top institutions.

1. Intention: From usable to easy to use – encrypted on-chain experience upgrade

Encrypted experience upgrade

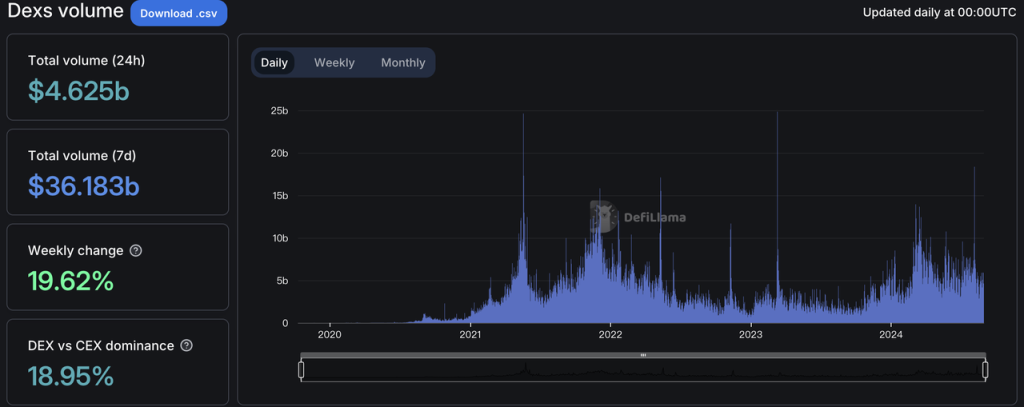

In the DeFi Summer of 2020, people began to conduct large-scale commercial activities on the blockchain for the first time. Subsequently, on-chain commercial activities flourished. In addition to financial-related businesses, pan-entertainment NFTs, games, and social networking have also developed vigorously. Currently, there are still more than US$90 billion of various assets (excluding NFT assets) active on several mainstream blockchains, and the total assets at the peak of the last bull market were close to US$200 billion. The recent average daily trading volume has also exceeded US$5 billion. The average daily trading volume in March once exceeded US$10 billion, which is close to half of the daily trading volume of the Hong Kong Stock Exchange.

Source: Defillama

Market participants vote with the money in their pockets, and blockchain, which has greater freedom and cheaper trust (see What is the underlying value of Web3, and how to invest with it? ), is continuously being verified for its potential to carry more infrastructure for commercial activities.

Despite the rapid development, this is still an emerging market that has been in existence for less than 7 years and has been in business for less than 4 years. We can still see many signs of industry development being in its early stages, such as the industry-leading blockchain Solana, which was down for 30 hours in February this year, and the current mainstream blockchain wallets still require users to back up lengthy mnemonics or private keys. For example, the applications that currently have a truly sustainable business model on the chain are still centered around the native assets on the chain, and we have not seen the organic combination of pure off-chain business and blockchain.

Looking back at the development of the industry in the past few years, Ethereum or Solana and other smart contract public chains that are intended to carry more human commercial activities have made great progress in the past few years, and their market value has continued to rise. At present, there is a clear direction and achievable path to solve the availability problem: Ethereums path is to the left, choosing the Rollup path and gradually deriving the concept of modularization, mainstream L2 such as Arbitrum and Base are booming, and various L2 and L3 exclusive application chains are emerging in an endless stream; while Solanas path is to the right, with extreme performance optimization on a single chain, an average TPS (transactions per second) exceeding 2,000, and new users and new assets on the network are constantly emerging.

However, in terms of “ease of use”, we must admit that the overall experience on the chain is still relatively poor. The current experience may be acceptable for current on-chain users with only a few million daily active addresses (even fewer active users), but if you want to introduce hundreds of millions or even billions of people to achieve “massive adoption” of the blockchain, the current experience is far from enough.

The intent-centric concept proposed by Paradigm in July 2023 has elevated the experience upgrade of web3 to a separate track, namely the intent track.

Simply put, intent refers to the users real needs. For example, buy $1,000 worth of Meme Coin $BRETT is an intent. To achieve an intent, multiple transactions may be required. In addition to the complexity of the demand itself, if there are more constraints, there will be more transactions corresponding to one intent.

In the above example, if I do not have enough stablecoins on the Base chain, but only on the Ethereum network, then to achieve the above intention I need:

-

On the Ethereum mainnet, exchange 1005 USDC for ETH (because the Base chain does not support the use of USDC as gas)

-

Cross-chain ETH to Base network.

-

Use 1000 U worth of ETH to buy $BRETT

Three transactions. And there is a lot of knowledge behind this series of operations. For example, I need to know which cross-chain bridges are available for Ethereum->Base, and which bridge to choose to get the best rate and speed for my current cross-chain assets; I need to understand the RPC information of the Base chain and how to add the network information of Base to my wallet; I need to know whether there is a good enough transaction aggregator on the Base chain to help me get the best price, and if not, which Dex is the main liquidity of BRETT, etc. For a veteran in on-chain operations, the above operations may not be complicated, because a lot of knowledge has been internalized in the process of repeated repetitions, but the whole process is indeed difficult for newcomers. They may have to refer to a tutorial to complete the above process step by step.

To some extent, the current on-chain experience is similar to the experience of people interacting with computers before the advent of Windows 95. At that time, computers had already demonstrated powerful computing and file processing capabilities, but the interaction with computers was mainly carried out through the CMD command prompt. For technicians who are familiar with the underlying logic of computers and have sufficient experience and knowledge, this way of interaction is simple, direct and efficient. Even today, there are still many technical geeks who like to interact with computers in this way. But for ordinary users who are new to it, the difficulty of the whole process is at the nightmare level. At that time, personal computers needed to be accompanied by a thick operating manual to guide users to complete various operations.

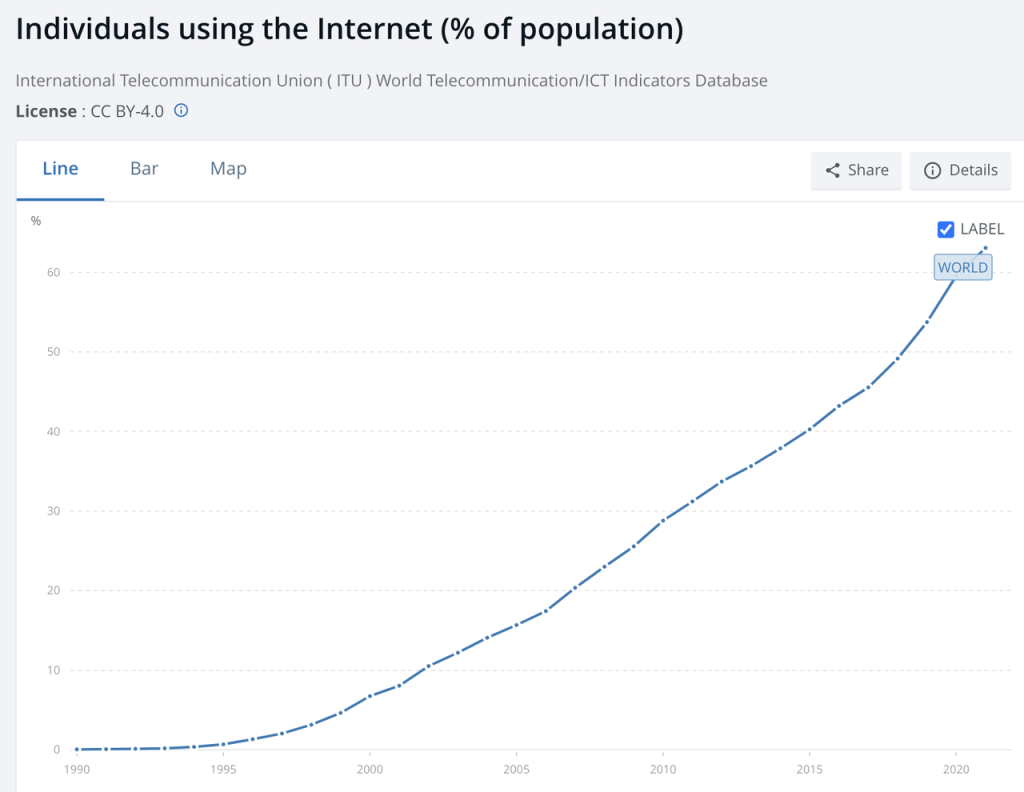

However, after the release of Windows 95 operating system in 1995, the above situation changed completely. After the computer was turned on, it directly entered the graphical operating system (GUI), and users could complete various operations by clicking the mouse. At the same time, the emergence of browsers greatly reduced the threshold for users to enter the Internet. From command character operation to graphical operating system, some people think that it is just a slight improvement in experience. The graphical operating system only packages the underlying command character operation to a certain extent and turns it into a method suitable for ordinary users to understand. Compared with the improvement of hardware performance such as processors, it may not seem to be such a technological advancement. But in fact, it was Windows 95 that lowered the threshold for ordinary users to use computers, which promoted the rapid popularization of personal computers among the general public. The increasing number of computer shipments in turn reduced the cost of Intel CPUs, further improving the performance and experience of personal computers. Finally, the left foot stepped on the right foot and the ladder cloud vertical effect appeared. The penetration rate of computers and the Internet increased rapidly around the world, bringing about the subsequent Internet wave.

Global Internet usage rate Source: World Bank

Looking back, it was this tiny improvement in experience that profoundly changed the life experience of the general public and created most of the great companies on our planet in the past three decades, such as Microsoft, Apple, Google, NVIDIA, etc. This is also known as the 1995 moment in the development history of the Internet and personal computers, and is used by later generations to figuratively describe the beginning of the explosion.

Although the BTC ETF has been successfully approved, the entire crypto industry has received positive recognition from the government, and many users have entered the crypto industry. However, the vast majority of users still only hold cryptocurrencies in centralized exchanges, and the blockchain they use is still just a simple transfer. Judging from the popularity of on-chain applications, the 1995 moment of crypto has not yet arrived. It may take a while for a killer user-oriented application or operating system to appear, and projects in the intended track will most likely facilitate the arrival of this moment.

Intention: One of the best use cases of AI+Crypto

AI has developed rapidly in the past few years. Many people believe that 2023 is the 1995 moment of AI. ChatGPT and other chatbots based on large language models have begun to enter the lives of ordinary people. The capital market and the general public have paid unprecedented attention to AI. At present, the improvement of the capabilities of large language models is far from reaching a bottleneck. We don’t know to what extent we can improve the capabilities of AI, and we don’t know how AI will reshape our industries. With the release of GPT-4 o, the time for AI to fully come into our lives seems to have been quickly moved forward.

The combination with AI is one of the important topics in the crypto space in the past year, and the related concept tokens have risen dramatically. The author believes that if we start from business logic, blockchain AI agents will be one of the best use cases for the combination of AI and encryption, which will also make it easier for people to achieve their intentions.

This is because the rules on the chain are determined manually, the boundaries of the rules are clear, and there is no black box.

AI will run better in the blockchain system, essentially because of the clarity of cryptoeconomic rules and the permissionless access to the system. By performing tasks under limited rules, the potential risks brought by the randomness of AI will also be smaller. For example, AIs performance in chess and card games and video games has crushed humans, because chess and card games are a closed sandbox with clear rules. However, the progress of AI in autonomous driving will be relatively slow, because the challenges of an open external environment are greater, and we are less tolerant of the randomness of AI in dealing with problems.

Source: Mint Ventrues

In this case, as long as there is enough information input, AI will always be able to find the optimal solution faster than humans in solving specific problems, which can help people achieve their intentions more conveniently and quickly.

2. Project Details

2.1 Business Introduction

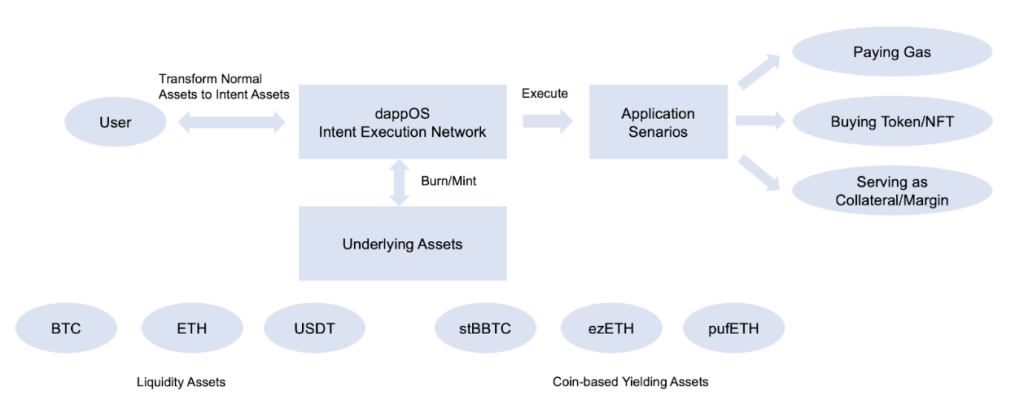

dappOS is an intent execution network. For users, they only need to provide their intent to dappOS, and dappOS is responsible for the interaction with various dAPPs and public chains behind the scenes to complete the transactions required by the users intent. In the example we mentioned above, the user only needs to publish the intention of buying $1,000 worth of Meme Coin $BRETT, and all transactions involved are completed by dappOS driving the relevant parties. In other words, users only need to connect to dappOS, and the connection of all public chains and dAPPs is carried out by dappOS.

It is not difficult to see the ambition of dappOS from the name. They want to become the OS (Operation System) of dAPP, just like Windows 95 became the OS of computers.

Within dappOS, they built an open two-sided market with the developer side (demand side) facing users on one end and the service node (supply side) providing intent execution services on the other end. dappOS uses the OMS (Optimistic Minimum Staking) mechanism to ensure service quality.

dappOS architecture source

The main roles and functions within the dappOS system are as follows:

-

User: Publish intent. User publishes intent based on the intent framework provided by dappOS.

-

Service providers: perform various intent services. After staking a certain amount of dappOS tokens as collateral, they can start receiving user intent and earning income.

-

Execution validator: Responsible for verifying the execution of the service node. If the service node fails to complete the task as required, the validator has the right to vote to punish the service node.

-

Matcher: Responsible for matching user intent with service providers.

During the specific execution process, the user will send the intention to the matcher through front-end interaction, and the matcher will then ask the associated service providers for their quotes for this intention and return the quotes to the user. If the user thinks the quotes are reasonable, he or she can choose the service provider who wants to perform the task, then sign the intention and transfer all the resources needed to realize the intention to the service provider, who will then execute the users intention.

After the specified time of the task, many validators will verify whether the task was successfully executed. If someone finds that the task was not successfully executed, they can challenge the network, and then the validators will reach a consensus through POS voting. If the consensus result is that the task failed, the service provider will need to use the collateral to compensate the user.

In addition to the above functions, dappOS uses an optimistic minimum staking (OMS) mechanism, which allows service nodes to provide services to users by staking funds slightly higher than the total value of unfinished intended tasks (minimum), while allowing service nodes to continue to perform tasks before performing result verification (optimistic). When the verifier successfully verifies the service result of the service node, the service node can successfully obtain the task income; if the verifier finds that the task has failed, the system will punish the service node, and the user can also get pre-specified compensation.

The OMS mechanism hopes to achieve a good balance between the efficiency of user tasks, the capital efficiency of service providers, and the safe operation of the entire system, while ensuring the successful completion of user tasks and reducing the capital cost of service providers as much as possible. At the same time, through the intention execution network, ordinary users can also enjoy the execution cost and efficiency of professional service agencies. On the one hand, professional service providers have many execution channels that ordinary users do not have: such as VIP accounts of exchanges with extremely low handling fees, aggregation of multiple transactions to save gas, better anti-MEV capabilities on the chain, etc. In addition, the competition between service providers will reduce the service price to the optimal level so that users can profit. The dappOS intention execution network can empower the operation channels of institutions and large users to ordinary users, so that ordinary users can get the cost and speed of institutions.

DappOS currently has 3 intent frameworks published:

-

Intentional trading: helping users achieve optimal spot trading costs

-

Intent assets: Universal assets within the dappOS system, which can homogenize a series of equivalent assets within the system while taking into account both the interest-bearing and transaction properties of assets.

-

Intentional dAPP interaction: Our previous example of purchasing $1,000 worth of Meme Coin $BRETT can be achieved through this framework. This framework can help users connect to dAPP more easily and quickly help users bridge assets.

Intent assets largely smooth out the differences between different chains and between homogeneous assets, thus eliminating a lot of cross-chain or homogeneous asset exchange work, thereby greatly improving user experience. Lets take stablecoins and ETH, the two most common assets in the crypto world, as examples:

-

For stablecoins, users can deposit USDT and USDC from any chain into their dappOS accounts to obtain intentUSD. intentUSD can be deposited into various stablecoin projects to automatically generate interest, and the underlying flow is clearly visible to users, ensuring transparency while obtaining benefits; at the same time, it ensures convenience in use: when a user needs to withdraw USDT to recharge into a centralized exchange, he can directly withdraw intentUSD; when a user needs to recharge USDC to GMX as a margin, he can also directly withdraw intentUSD.

-

For ETH, the ETH deposited by users can also automatically generate interest after it is converted into intentETH. At the same time, intentETH can be used to purchase assets on any chain. For example, users can use intentETH to purchase $QUICK on the Polygon chain or $JOE on the Avalanche chain at any time. Similarly, intentETH can also be deposited in Aave on the Arbitrum chain for lending services or used as gas for Ethereum and L2 networks at any time according to user needs.

As can be seen, the intent asset:

-

Taking into account both profitability and convenience, sDAI can obtain stable RWA income but liquidity is difficult to support large-scale transactions, while USDT, USDC, etc. have a wide range of use cases but cannot generate income. IntentUSD can take both points into account.

-

Solving the conversion friction problem of similar assets, intentETH can switch between ETH (mainnet), ETH (Arbitrum), stETH, and aETH without any loss, without paying any cost.

Compared with other typical income-generating assets, intention assets also have obvious relative advantages:

-

LST or LRT assets: intentETH does not require lock-up and has better liquidity

-

sDAI and other RWA stablecoins: intentUSD can be used for transactions at any time

-

Binance and other centralized exchanges’ current wealth management products: Intended assets can be easily used in various dApps

-

Lending platforms such as Aave and other DeFi yield platforms: Intended assets can be seamlessly transferred across chains and used for transactions at any time

In summary, the experience provided by Intent Assets is to some extent similar to the Yuebao service we experienced in web2. It makes a new trade-off in the profitability, usability, and convenience of assets and provides an excellent experience.

A better experience is likely to be the key factor in the crypto economy to introduce hundreds of millions or even billions of users. At present, the crypto economy is still in its early stages of development. As pioneers, we may have become accustomed to the coexistence of USDT and USDC, and have mastered the skills of how to exchange between the two at the lowest cost, and which asset should be used in which scenario. But in the real world, no one thinks that we should accept both JP Morgan dollars and Citi dollars at the same time, even though the two are very similar analogies. For the new generation of crypto economy experiencers, they may not need to understand what is the difference between L1 and L2 and how should I cross the chain and other technical details, just like they do not need to understand how the interbank clearing system works, but only need to realize their needs more directly. The huge experience gap in the middle is exactly what the projects in the intention track want to make up for.

2.2 Business Status and Partners

Due to the particularity of the business model, most of dappOSs business is carried out in cooperation with other dAPPs. At present, dappOS has reached cooperation with many dAPPs.

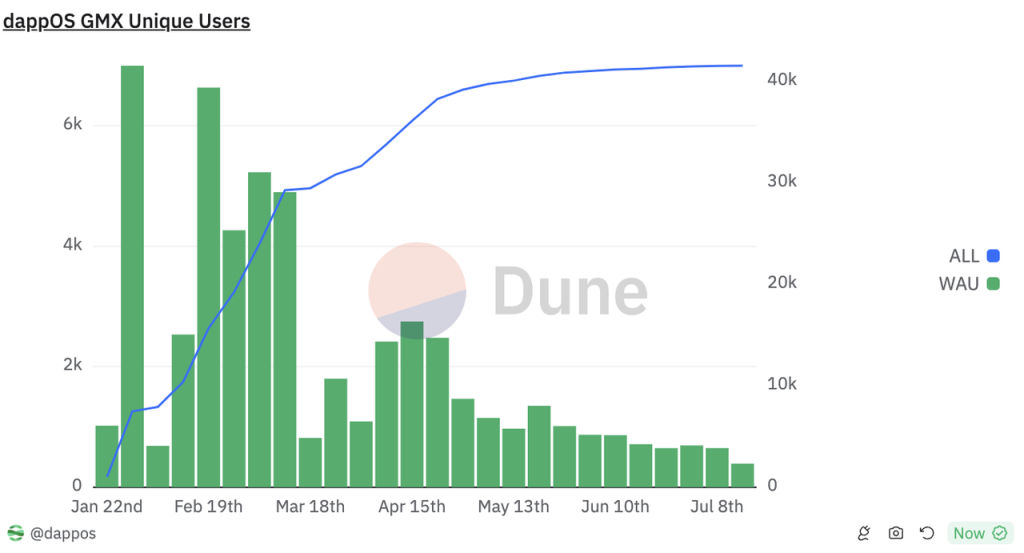

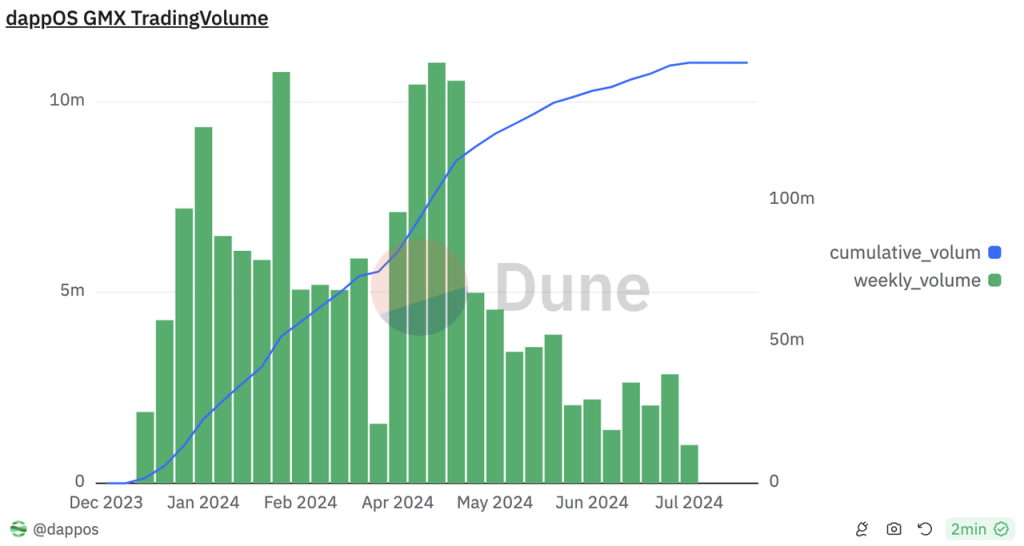

In January 2023, dappOS reached a cooperation with the perpetual contract platform GMX and launched the front-end gmx.dappOS.com. GMX users can use dappOS to further simplify the transaction process, while reducing fees by 20%, and allowing users to pay fees with any token. From January to March of this year, the number of weekly active users exceeded 6,000, and has remained at around 1,000 in recent times. At the same time, it has obtained a transaction volume of nearly 150 million US dollars, and the daily transaction volume exceeded 10 million US dollars during the peak period.

Source: Dune

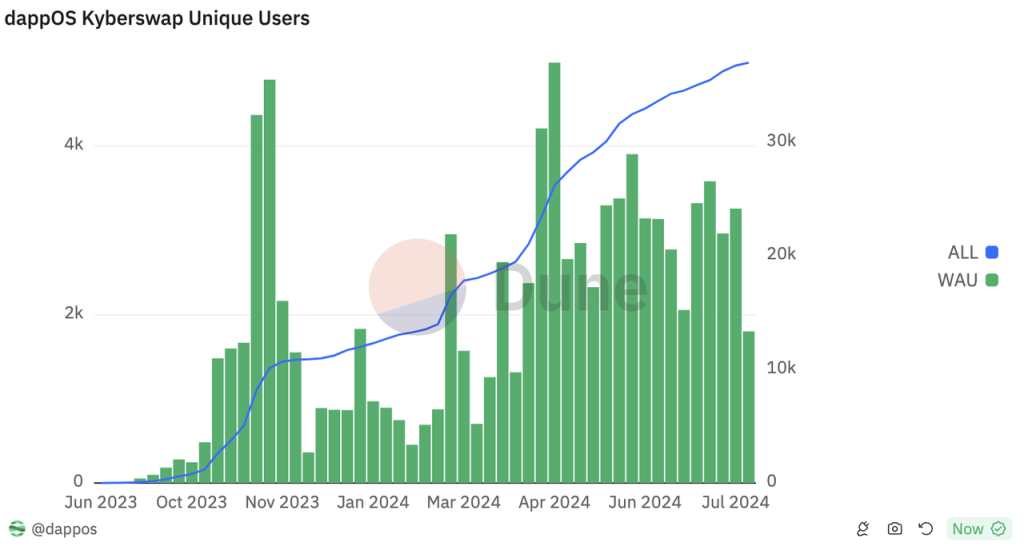

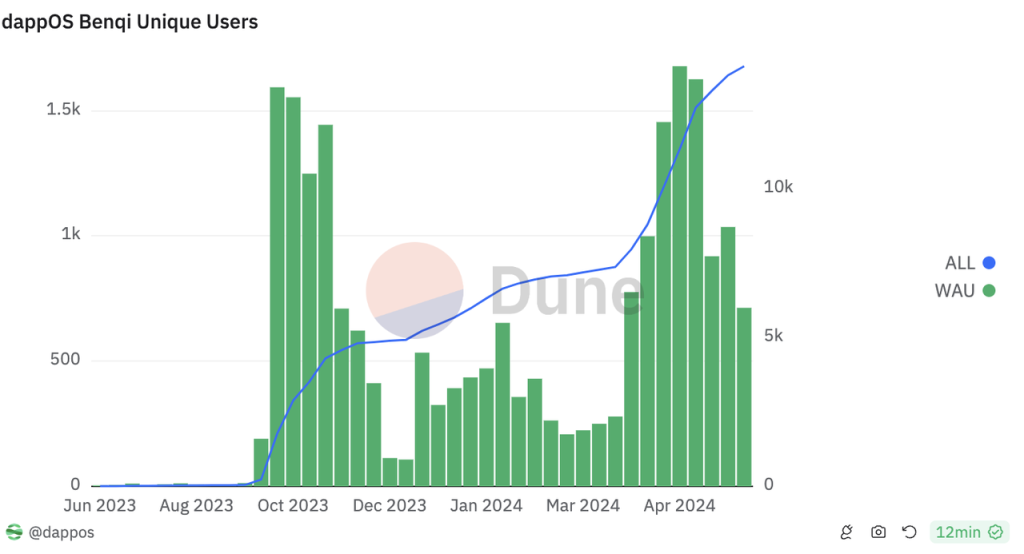

DappOS has also carried out similar cooperation with Dex and liquidity protocols, such as the old dex Kyberswap and Avalanches leading lending and liquidity protocol Benqi, and has also achieved very good data (Kyberswaps weekly active addresses exceed 3,000, and Benqis weekly active addresses are around 1,000)

Source: Dune

In addition, dappOS has also reached cooperation with public chains such as Avalanche zksync and polygon, as well as DeFi protocols such as Quickswap, MakerDAO, and Frax.

Source: dappOS official website

2.3 Financing

DappOS has completed 3 rounds of financing in total.

In November 2022, dappOS was selected for Binance Labs fifth season incubation program, and received Pre-Seed round of financing from Binance Labs on June 20, 2023, but the specific amount of financing was not announced.

On July 21, 2023, dappOS completed its seed round of financing with a valuation of US$50 million, led by IDG Capital and Sequoia China, with participation from OKX Ventures, HashKey Capital, KuCoin Ventures, TronDao, Gate Labs, Taihill Ventures, Symbolic Capital, Foresight Ventures, BlueRun Ventures, Mirana Ventures, Leland Ventures, etc.

On March 28, 2024, dappOS completed a $15.3 million Series A financing round with a valuation of $300 million. Polychain led the investment, and Nomad Capital, IDG, Flow Traders, IOBC, NGC, Amber Group, Uphonest, Taihill, Waterdrip, Bing Ventures, Metalpha, Spark Digital Capital, Web3Port Foundation and Satoshi Lab participated in the investment.

Overall, dappOS has an excellent investment background and has just completed a $15.3 million financing round, so it has sufficient funds.

Résumer

The intent track aims to improve the user experience of web3, thereby opening the 1995 moment of web3 and introducing massive adoption. The intent track has also been a popular track for VC investment in the past year, and many projects have also aligned their projects with the concept of intent.

However, the intention track is still in its infancy. Most of the projects in the track have not yet launched a complete product, and the business model is not very clear. Most of the products and mechanisms of dappOS we wrote in this article have not yet been launched, and there is a lot of uncertainty in the future development of the track and the project.

For projects with relatively little short-term content but long-term narrative value, investment background and business development capabilities may be two important reference indicators.

dappOSs investment background includes top exchanges, traditional VCs and crypto VCs, and its investment lineup is luxurious; and the successful cooperation with a series of excellent DeFi projects such as GMX demonstrates dappOSs outstanding business expansion capabilities.

We will continue to pay attention to the future development of dappOS, which aims to become a leader in the intention track.

This article is sourced from the internet: dappOS: An Intention Execution Network Backed by Top Institutions