Institut de recherche Bitget : Le marché pourrait connaître la dernière baisse et le BTC pourrait envisager d'acheter le bas par lots lorsque

Au cours des dernières 24 heures, de nombreuses nouvelles devises et sujets populaires sont apparus sur le marché, ce qui peut être la prochaine opportunité de gagner de l'argent, y compris:

-

The sectors with strong wealth creation effect are: SOL Meme coin, RWA sector (ONDO, Pendle)

-

Hot search tokens and topics by users: Solayer, Fractal

-

Potential airdrop opportunities include: Plume Network, Fuel

Data statistics time: August 28, 2024 4: 00 (UTC + 0)

1. Environnement du marché

In the past 24 hours, BTC briefly fell to $58,000, and ETH briefly fell below $2,400. BTC ended its rebound and plummeted yesterday. The gas on the ETH chain dropped to 1 gwei. The market is extremely lacking in hot spots. The number of bitcoins in the exchange has dropped to the lowest level since November 2018. In the short term, the market may usher in a major uptrend after a second drop, and the long-term outlook remains bullish.

From a macro perspective, the US Ethereum spot ETF had a net outflow of $3.44 million yesterday, and the spot Bitcoin ETF had a net outflow of $127 million yesterday. The FOMC meeting minutes and Powells dovish stance have driven the rise of Bitcoin. Short squeezes may push up the price of Bitcoin. At present, it has bottomed out again after the rebound, preparing for the next main uptrend. At the same time, Nasdaq is seeking approval from the US SEC to launch Bitcoin index options. The situation of traditional funds entering the circle is very obvious. The crypto market is expected to have improved liquidity in the future, which may trigger a wave of altcoins. It is recommended to pay attention to the recent trend of altcoins.

2. Secteur créateur de richesse

1) Sector changes: SOL Meme Coin (WIF, BONK, POPCAT)

Main reasons: SOL price is relatively stable, standing firm at the integer mark of 17 US dollars; the DEX trading volume on Solana has reached a new high recently, and funds are relatively active, driving the rise of ecological projects

Rising situation: POPCAT rose 62.5% in the past 7 days;

Facteurs affectant les perspectives du marché :

-

SOL token trend: In the Solana ecosystem, the trend of SOL tokens will affect the price of the entire ecosystem token, because many tokens on DEX are priced in SOL. Keep an eye on the price trend of SOL. If SOL maintains an upward trend, you can continue to hold SOL ecosystem assets;

-

Dynamic performance of top memes: Solana ecosystem鈥檚 Meme coin, which was previously listed on Robinhood, has seen an increase in SOL tokens. Generally, Solana鈥檚 top MEME coins have seen a faster increase in value. The trading volume of Solana鈥檚 core Meme coins has increased recently, and the trading demand is relatively high, so there is room for token layout.

2) Sectors that need to be focused on in the future: RWA sector (ONDO, Pendle)

raison principale:

-

The RWA sector is still the most popular sector in the current cryptocurrency industry, and is considered to have a large market size. ONDO and Pendle occupy the RWA treasury tokenization track and the crypto asset interest rate swap market track respectively. The asset volume ceiling of these two tracks is extremely high, and the protocol income that the protocol can generate increases with the growth of asset volume. Investors should pay special attention to each round of market rebound.

Facteurs affectant les perspectives du marché :

-

Total asset size of the protocol: The cash flow output of this type of protocol mainly depends on the asset size of the protocol. As the asset size accommodated by the protocol gradually increases, the income that the protocol can generate will also gradually increase, and the corresponding currency price will also have a strong performance.

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3. Recherches rapides des utilisateurs

1) Dapps populaires

Solayer:

Solayer is the Solana ecosystem re-staking protocol. Yesterday, it announced the completion of a $12 million seed round of financing, led by Polychain Capital, with participation from Big Brain Holdings, Hack VC, Nomad Capital, Race Capital, ABCDE, and Arthur Hayes family office Maelstrom. Currently, Solayers TVL exceeds $178 million, and users are enthusiastic about participating.

2) Twitter

Fractal:

Fractal Bitcoin, a Bitcoin extension network, posted on social media that it is expected to launch the mainnet on September 9. It also announced the token economics, with 80% allocated to the community and 20% to the team and contributors (with a lock-up period). Among them, POW mining accounts for 50%, the ecosystem treasury accounts for 15%, pre-sales account for 5%, consultants account for 5%, community grants account for 10%, and core contributors account for 15%. Due to the high popularity of the project, users can consider participating in potential airdrop opportunities.

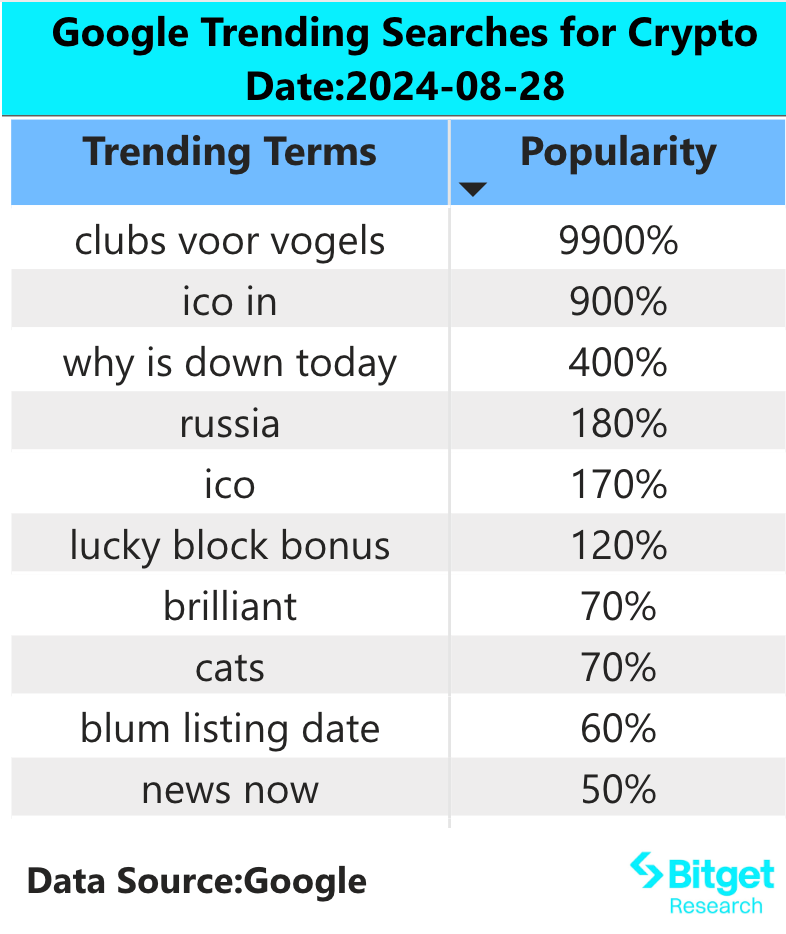

3) Région de recherche Google

D'un point de vue global :

Blum Listing Date:

Blum is a decentralized exchange that offers token trading from centralized and decentralized platforms, as well as simplified derivatives trading. A mobile app and a mini-app were launched within Telegram. Blum will offer futures trading and the ability to buy tokens from various networks. Blums trading function has not yet been launched, but it has gained 10 million users through the model of earning points through mini-game mining. According to the official TG channel information, it is currently in the stage where users collect Blum points, which will be exchangeable for tokens. Due to the high popularity of the project, users can consider participating in the TG BOT mini-game to win future airdrops.

Parmi les recherches les plus fréquentes dans chaque région :

(1) Asia: Hot searches in Asia are very scattered, and there are basically no concentrated hot words.

(2) CIS region: The CIS region still maintains a high enthusiasm for ton app games. For example, the blum project appears frequently, and sunpump also appears in the hot searches, indicating that the CIS region is more enthusiastic about meme tokens on the tron chain.

(3) Latin America: Latin America pays more attention to the dog series tokens. At the same time, there are also depin projects such as grass and meme coin launch platforms such as sunpump. Overall, due to market reasons, Latin Americas attention to specific tokens has decreased.

Potentiel Largage aérien Opportunités

Réseau Plume

Plume Network est un réseau modulaire L2 dédié à la piste RWA. Sa forme de produit consiste à intégrer la tokenisation des actifs et à fournir directement les produits des fournisseurs sur la chaîne. Le projet a récemment terminé un tour de financement d'amorçage avec un montant de financement de 10 millions de dollars américains. Les institutions participantes comprennent Haun Ventures, Superscrypt, Galaxy et SV Angel.

Le projet a récemment lancé un réseau test et lancé des activités telles que Earn Mile, Check In et Passport.

Specific participation methods: 1) Visit the project official website, click Connet Wallet, and then enter the App; 2) Earn mileage through Swap, Stake, Speculate, completing tasks on the platform, Check-in, etc.

Carburant

Fuel is a UTXO-based modular execution layer that brings globally accessible scale to Ethereum. As a modular execution layer, Fuel can achieve global throughput in a way that monolithic chains cannot, while inheriting the security of Ethereum.

In September 2022, Fuel Labs successfully raised $80 million in a round of financing led by Blockchain Capital and Stratos Technologies. Multiple leading investment institutions invested, such as CoinFund, Bain Capital Crypto and TRGC.

Participation method: You can directly deposit the tokens accepted by Fuel into the points you have earned. Participants can earn 1.5 points per day for every $1 they deposit in the following assets:

Points: ETH, WET, eETH, rsETH, rETH, wbETH, USDT, USDC, USDe, sUSDe and stETH; From July 8th to 22nd, depositing ezETH will earn you 3 points per day.

Lien d'origine : https://www.bitget.fit/zh-CN/research/articles/12560603814976

« Clause de non-responsabilité » : le marché est risqué, alors soyez prudent lorsque vous investissez. Cet article ne constitue pas un conseil en investissement et les utilisateurs doivent se demander si les opinions, points de vue ou conclusions contenus dans cet article sont adaptés à leur situation spécifique. Investir sur la base de ces informations est à vos propres risques.

This article is sourced from the internet: Bitget Research Institute: The market may usher in the last drop, and BTC may consider buying the bottom in batches when it drops for the second time

Auteur original : @QwQiao @xyczzcyx Compilé par : TechFlow Chez @alliancedao, nous recevons environ 3 000 candidatures par an pour rejoindre notre accélérateur de startups crypto. Nous collectons des données telles que la blockchain qu'ils utilisent, le type de produit et la situation géographique. En raison de la grande taille de l'échantillon et de notre neutralité à l'égard de ces facteurs, nous sommes en mesure d'obtenir des informations uniques sur l'évolution de l'industrie. Blockchain Layer 1 Ethereum reste l'écosystème dominant. Cependant, Solana se rétablit après avoir touché le fond au second semestre 2022, ce qui peut être lié à l'effondrement de FTX au cours de la même période. Bitcoin connaît une résurgence au milieu de l'engouement pour les ordinaires, les runes et la technologie Bitcoin L2. Évolution de la part L1 au fil du temps Part L1 au premier semestre 2024 Ethereum Layer 2 Focus sur…