PYUSD dépense 10T6,5 millions de dollars par mois. Quels autres projets APY méritent d'être pris en compte ?

As the market value of PayPal USD (PYUSD), the US dollar stablecoin launched by Paypal and issued by Paxos, has exceeded the $1 billion mark, the market value of this stablecoin supported by the giant PayPal has increased by 327% compared to the beginning of 2024.

Such a huge increase has triggered extensive discussions in the community. The reason why PYUSD issuance has achieved such a rapid growth is mainly due to the high incentive strategy recently launched by PYUSD. According to the authors estimation based on the current TVL and APY of PYUSD on the chain, the interest paid to users by PYUSD incentive activities alone exceeds 6.5 million US dollars per month.

As of the time of writing, the APY yield of PYUSD on the DeFi protocol on the Solana chain is generally higher than 13%. Taking Kamino, the largest lending platform on Solana, as an example, 470 million PYUSD enjoy an annualized return of 13.24%, while another lending platform Marginfi has an APY return of 13.46%. Such generous rewards also allowed PYUSD on the Solana chain to surpass the Ethereum chain in mid-August and become the largest issuance platform for PYUSD.

The actual source of PYUSDs high APY is highly controversial in the community. Some community members croire that the Solana Foundation pays incentives to encourage users to use Sol chains PYUSD. However, core members of the Solana community, Helius founder Mert and Multicoin managing partner Kyle both clearly stated that the Solana Foundation did not pay any incentives, and all PYUSD incentives came from PayPal.

There is a characteristic of the crypto market: everyone is talking about how to make money and how much money others have made, but few people talk about how to control drawdowns, how to deal with the stablecoins earned, and how to have a more reasonable cash flow.

Therefore, Rhythm also sorted out some APY projects that have received high attention from the community recently, mainly stablecoins, in addition to PYUSD, and explained the corresponding sources of income. The main source of DeFi is the subsidy of the protocols own tokens, and CEXs financial management projects come from the cooperative subsidies between CEX and projects. Among them, the highest-yielding activity APY is as high as 200%. Although it has ended temporarily, the idea can still be used as a reference.

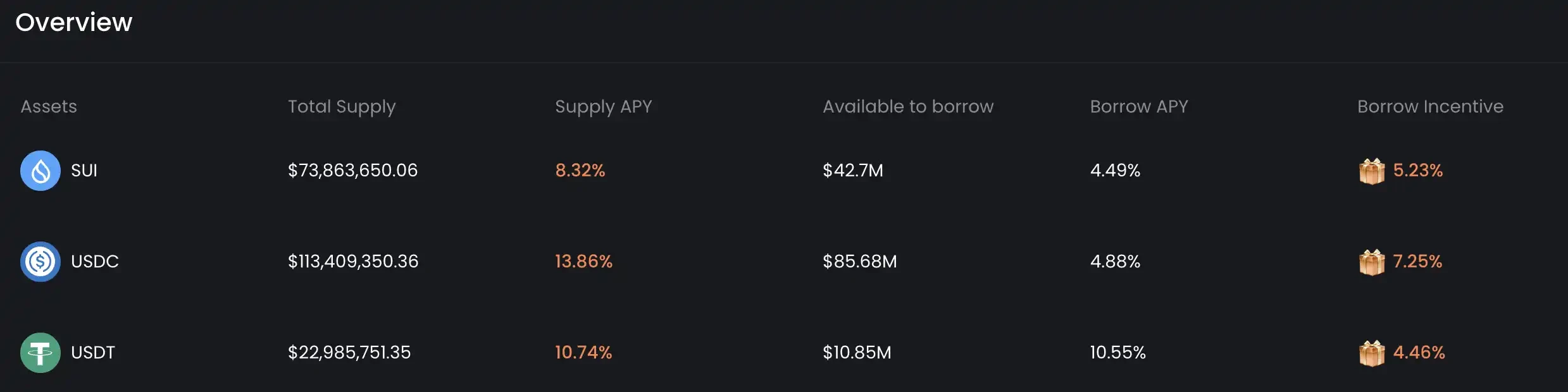

USDC-Sui

As a popular Sol Killer recently, in addition to technological development, Sui has never stopped promoting the development of DeFi on its own network. As the largest lending platform on the Sui network, USDC on NAVI currently has a TVL of over 100 million US dollars and provides an APY return of 13.89%. Similarly, most of the income comes from Suis incentives to users.

Since the current entry and exit of the USDC network requires cross-chain methods such as Wormhole, and Wormhole has performance restrictions on cross-chain, users who want to participate in the Sui network need to plan their time reasonably and leave time margin.

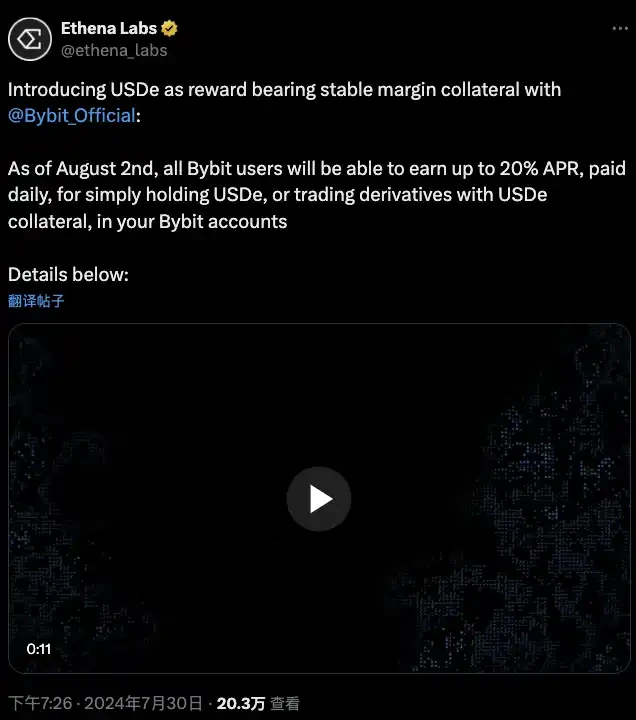

Bybit-USDE

As previously reported by Rhythm, on July 30, Ethena Labs announced that starting from August 2, all Bybit users can earn up to 20% APY income, paid daily, by simply holding USDe in their Bybit accounts or using USDe as collateral to participate in derivatives transactions…

As of todays posting, Bybits USDe APY is 12.25%, which is still competitive. However, according to the event announcement, the total prize pool for this event is 3.3 million USDe. If users still want to participate in the USDe event, they should reasonably estimate the event stop time to avoid concentrated sales after the event stops, which may cause potential slippage of USDe.

Aave GHO

Aave, one of the benchmarks of DeFi protocols, is also providing incentive subsidies for its stablecoin GHO. This incentive plan has increased GHOs APY to more than 20%. Currently, about 78 million GHO are staked in it.

After staking GHO, users need to claim this part of the incentive reward on the merit interface built by the community.

But it is worth noting that the unlocking period of GHO pledged to the protocol is 20 days, which makes the liquidity flexibility of GHO less than that of other protocols.

Binance-TON

Binance Launchpool not only launched Toncoin, but also launched a series of financial activities related to TON. The most notable one is the Super Earn activity that has ended. The activity provides TON holders with a high annualized APY of 300%, even if each user only deposits a maximum of 1,350 TONs and the activity market is 20 days. But the expected income is more than 200 TONs. Super Earn reached the subscription limit within a few minutes after it was opened.

Since the activity requires the deposit of non-stable coins, in order not to be affected by the rise and fall of tokens. Users can pledge stable coins on CEX to borrow Ton, and get this APY without considering the rise and fall of Ton. If you are a DeFi Degen, you can pledge USDT on the Ton network to borrow Ton. In this case, you don鈥檛 even need to pay the borrowing APY, because USDT鈥檚 APY is higher. This method can be widely used in scenarios that require non-stable coins.

The above article summarizes some of the ways of stable financial management that are highly discussed in the community. As for ways to earn higher APY returns, such as DeFi鈥檚 second pool and the airdrop gameplay of LuMao Studio, the stability of the returns, the source of returns, and the time of redemption are uncertain, so they are not involved yet.

By continuously looking for risk-free returns like this, any user familiar with cryptocurrencies will have the opportunity to participate and enter a Fire-like state where income covers daily expenses. I hope that this basic stablecoin APY income strategy will allow everyone to have the last piece of land for themselves while facing the anxiety of the myth of getting rich quickly.

This article does not constitute investment advice. Users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: PYUSD spends $6.5 million every month. What other APY projects are worth paying attention to?

Related: Will all applications develop towards Appchain?

Original author: Pavel Paramonov Original translation: Alex Liu, Foresight News Is everything really moving towards AppChains? Yes and no. The main reason dApps turn to building their own sovereign chains is that they think they are being exploited. This is not far from the truth, as most dApps do not make money. You can consider the recent example of @zkxprotocol ceasing operations, and many other applications in the past like @utopialabs_, @yield , @FujiFinance , and many more. But is this because their business model is bad, or are the protocols truly exploitative? The main (and often only) source of revenue for a dApp is fees. Users pay the fees because they directly benefit from them. However, users are not the only beneficiaries of the rise in dApp usage. There…