Crypto Evolution Épisode 01 | OKX Ventures Hashed Animoca : revisiter les cycles et les récits

In the context of soaring chaos values, it is very important to perceive the periodicity more clearly and discover the future narrative trends. As innovative narrative catchers, investment institutions have always been relatively cutting-edge. In view of this, OKX specially planned the Evolution of Cryptocurrency column, inviting mainstream crypto investment institutions around the world to systematically output topics such as the periodicity of the current market, the direction of the new round of narratives, and the subdivision of popular tracks, in order to stimulate discussion.

The following is the first issue, which is jointly discussed by OKX Ventures, Hashed and Animoca Digital Research around topics such as Challenges and Opportunities in the Current Cycle. I hope their insights and thoughts will inspire you.

À propos d'OKX Ventures

OKX Ventures est la branche d'investissement d'OKX, une plateforme de trading d'actifs cryptographiques de premier plan et une société de technologie Web3, avec un engagement de capital initial de 100 millions de dollars américains. Elle se concentre sur l'exploration des meilleurs projets de blockchain à l'échelle mondiale, le soutien à l'innovation technologique de pointe en matière de blockchain, la promotion du développement sain de l'industrie mondiale de la blockchain et l'investissement dans la valeur structurelle à long terme. Grâce à son engagement envers les entrepreneurs qui soutiennent le développement de l'industrie de la blockchain, OKX Ventures aide à créer des entreprises innovantes et apporte des ressources mondiales et une expérience historique aux projets de blockchain.

About Hashed

Hashed is a team of blockchain experts and developers from around the world, focusing on investing in and promoting the development of decentralization and blockchain technology. As a core technology contributor, Hashed actively participates in and accelerates the widespread application of blockchain and promotes the transformation of the global economy and Internet structure.

About Animoca Digital Research

After years of investment, Animoca Brands has formed a diversified portfolio of more than 500 blockchain projects, focusing on GameFi and infrastructure. As a dedicated team of Animoca Brands Digital Asset Team, Animoca Digital Research is composed of experts from various fields who are passionate about Web3 and decentralization. Through alpha tracking and practical experience accumulation, Animoca Digital Researchs mission is to bring deep insights and unique insights to the industry while stimulating innovation and vitality in the community. Keep exploring and move forward humbly. WAGMI!

1. Cycles and Market Structure

1. What cycle is the market in now? How has the structure of this cycle changed compared to the past?

OKX Ventures : We believe that we need to understand the industry cycle from the following three perspectives:

The first is the extent to which the industry has begun to enter the mainstream of society. Currently, the growth of the market size of Crypto is maintained at $2 Trillion, Bitcoin and Ethereum ETFs have entered the trading range of the global mainstream financial market, and the scale of Bitcoin ETF exceeds $60 B. The rise of RWA assets and the scale of government bond assets exceeding $1.8 B also represent the integration of the traditional world into the Crypto industry.

Secondly, the entrepreneurial environment has improved. VC capital inflows are on the rise. According to statistics, the total amount of investment and financing in Q2 2024 exceeded 3 billion US dollars, a month-on-month increase of 28%. Overall, investment institutions are more active. At the same time, the continuous influx of outstanding entrepreneurs, entrepreneurs with leading industry backgrounds and top education backgrounds continue to enter the industry, and continue to contribute fresh blood to the industry.

Finally, there is the large-scale entry of users. In the past few years, the blockchain infrastructure has improved. Ethereum, Layer 2 and high-performance public chains provide a friendly development environment and rich block space. User-side applications such as games, social networking and Telegram ecology are allowing more users to enter the Crypto world without feeling. AI applications, Intent and account abstraction are lowering the learning threshold for users. We are on the eve of a large-scale application explosion and remain optimistic about it in the long term.

Hashed: The crypto market cycle is affected by a variety of factors, including macroeconomic conditions, policy changes, and technological advances. The difference between this round of market cycles and previous ones is that institutions are beginning to actively enter the market, which indicates that the industry is beginning to be constrained by the regulatory framework, and it will be difficult for the high market volatility to continue.

There was no significant increase in new funds from retail investors during this cycle, but with the approval of Bitcoin ETFs, institutional interest in Bitcoin has become more active, making the market look upward. But except for a few top-cap coins such as ETH, SOL, and TON, many other top market capitalization players are experiencing difficult times. The legitimacy of each token, especially the role of application tokens, is facing unprecedented challenges.

Many coins that are not on the institutional shortlist face significant challenges, which is why many altcoins have failed to achieve multiple growth in the past. Under current market conditions, the continued issuance of tokens without fundamentals or valuation logic remains a barrier to new capital inflows, as these tokens are viewed negatively in the minds of retail investors, especially on issues such as low circulation and high FDV.

Furthermore, one of the main reasons for the limited flow of funds into the crypto market is the macro-level attention and asset allocation. Retail investors have a greater impact in the public markets than expected. While they poured into the crypto market in late 2020 to early 2022, they are now pouring into the generative AI space. Although most AI startups are not yet significantly profitable, they are still raising large amounts of money, creating valuations that are difficult to justify. This trend is similar to the price phenomenon of major tokens from 2020 to 2022, and from the perspective of the attention economy, these reasons can explain to some extent why this crypto cycle does not have the same impact as previous ones.

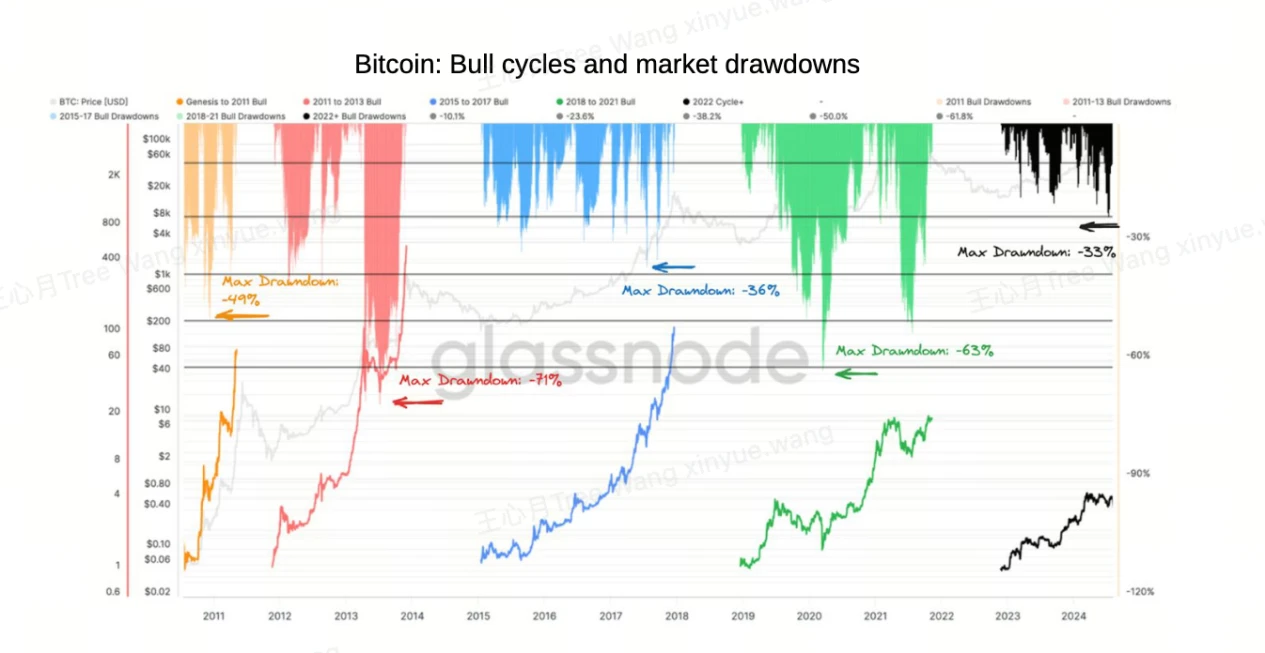

Animoca Digital Research: We believe that the cryptocurrency market is still in a bull cycle as of August 2024. Despite some recent volatility in global asset markets, the medium-term outlook remains positive. The current cycle has not yet reached its peak compared to previous cycles. The recent correction of about 30% is well within the historical range and is in line with the normal pattern of bull market adjustments.

Despite the recent volatility in the TradFi market, we observe several positive drivers for the crypto market in the medium term:

1. German government liquidations: The massive liquidations in July forced the sale of leveraged longs in the system, leaving only strong spot holders. A new round of liquidations in August further cleared out leveraged positions.

2. Exchange Traded Fund Purchases: The majority of cryptocurrency purchases came from BTC and ETH ETFs, showing:

• TradFi buyers have a deep understanding of asset volatility and are not easily affected by market fluctuations. In the recent round of market volatility, the trading volume of the two types of ETFs has only increased slightly, and is still far from its historical peak.

• TradFi buyers are price sensitive and purchasing decisions are influenced by price levels.

1. FTX liquidation: FTX’s bankruptcy liquidation will unlock $10 billion in funds before the end of the year. Although the timing is uncertain, it will have a positive impact on the market.

2. Fed rate cuts: Rising unemployment and cooling inflation increase the likelihood of a rate cut in September. Specific indicators include a 2.8% increase in US GDP in Q2, an increase in unemployment to 4.3%, and inflation stabilizing between 3.1% and 3.5%.

2. In light of the global environment, what core issues in the crypto industry need to be addressed?

OKX Ventures : Considering the current macro environment, we believe the industry needs to focus on two core issues:

First, the sustainability of technological innovation is crucial. Although significant progress has been made in infrastructure, how to further enhance network security while improving transaction efficiency and reducing costs remains a key issue that needs to be addressed. This requires not only continuous iteration of technology, but also close cooperation and collaborative innovation among all parties in the industry.

Secondly, the integration of popular science education and culture cannot be ignored. Although the user base of cryptocurrency is rapidly expanding, the publics understanding of cryptocurrency technology and its applications is still relatively limited. Therefore, we believe that it is particularly important to enhance the publics knowledge of encryption, which will help more ordinary users understand and participate in this industry, thereby promoting the healthy development of the industry.

Hashed: In the current environment, we believe that the crypto industry should focus on solving two core problems.

The first is the need to leverage blockchain technology to decentralize and distribute increasingly centralized technologies, such as closed-source AI. This isn’t just about AI, it’s about the social issues of too much power being accumulated by a few entities. The rise of blockchain technology was born out of dissatisfaction with centralized government agencies, censorship, and financial control, as well as a desire to freely exchange and store value. This topic is resurfacing, this time to include concerns about corporate and government centralization and censorship. AI (particularly AGI) is a technology with huge potential and impact on human history. Due to its nature, it is viewed as a national security issue, leading to higher fortress building. If the development of AI is concentrated in a few centralized companies and institutions, large-scale surveillance issues may arise. If AI is centralized by nature, then addressing these issues through the spirit of blockchain – which is in stark contrast to it – are real issues that the industry should strive to solve.

Second, the incentives in the crypto market need to evolve. Tokens have not yet played their due role as a tool for incentives and ownership. Insufficient precise engineering of token dynamics and market price discovery has resulted in network tokens not being fully utilized as a tool for incentive alignment. Until this fundamental problem is solved, the growth of token-based decentralized networks will face significant limitations.

While various mechanisms have been designed and many protocols have experimented with incentive alignment, effective and capital-efficient incentive allocation and alignment has not yet been achieved. Therefore, it is not difficult to understand why there are not more projects that use tokens to replace traditional companies. We look forward to seeing solutions to these long-term industry challenges. We support industry participants who understand the essence of the economic value of blockchain protocols and promote the replacement of traditional corporate structures with broader decentralized protocols.

Animoca Digital Research:

The expansion of business scenarios and user acquisition remain the core challenges of the industry. This includes direct users, such as converting gamers into Web3 users, or getting ordinary chat users on TON to start using on-chain payments, as well as enterprise-oriented scenarios, such as the penetration of traditional finance through RWA. These are all issues that the industry needs to continue to address. The high valuations of many existing projects, especially infrastructure projects, are based on expectations of a significant increase in future usage. Only the continued growth of real users and usage can support the high valuations of a large number of infrastructure projects, and ultimately transform tokens from speculative funds in the hands of users into payment media that support decentralized collaborative networks, thereby truly realizing the value of the project.

II. Future Challenges and Opportunities

On the challenges:

OKX Ventures : One of the challenges facing the industry is that despite the huge amount of money and resources invested in infrastructure construction, there are not many applications that are truly effective and can attract a large number of real users. Despite the significant technological progress of many infrastructures, the acceptance and practicality of their end users have not improved significantly. In addition, for blockchain infrastructure, there is the problem of how to serve end users more efficiently rather than just being a technology showcase. For example, despite the existence of advanced technologies such as FHE (fully homomorphic encryption) and ZK (zero-knowledge proof), these technologies still face many difficulties that need to be overcome in the real large-scale application and popularization. We need to find a more effective balance between technology promotion and application development.

In addition, in terms of practical applications, the relatively mature DeFi (decentralized finance) field has grown in market size in the past few years, but it still craves for more innovative products that can solve specific needs. Currently, many DeFi projects are trying to include multi-chain operations, increased decentralization, the introduction of more physical assets and derivatives, but to make these products serve a wider range of scenarios and truly achieve a perfect combination of liquidity and functionality, continued efforts and innovation are still needed.

Hashed: We believe that the crypto industry faces two core challenges: regulatory scrutiny and infrastructure scalability.

D'abord, regulatory uncertainty is a major obstacle. Although crypto technology is universally used, to become a legal asset class, it must comply with the regulations of major economies (such as the United States, China, South Korea, Singapore, etc.). Regulations vary greatly from place to place and change rapidly, making compliance more difficult.

To meet this challenge, Hashed actively interacts with global regulators to promote clear, fair and consistent regulatory frameworks. In 2022, Hashed established the Hashed Open Research (HOR) and Hashed Open Dialogue for Law (HODL) initiatives to promote dialogue between the blockchain community and governments, help our portfolio understand the latest regulatory best practices, and work with academia and industry experts to promote company development.

Deuxièmement, infrastructure scalability is also a major challenge. Bitcoin and Ethereum are inefficient, expensive, and slow when processing large numbers of transactions. Although the Ethereum Foundation has improved the scalability of the mainnet through network upgrades, the research and development of Layer 2 protocols and non-EVM L1 chains are equally important. Hashed has invested in Layer 2 projects Taiko and zkSync, and supports Solanas efforts to increase transaction throughput and reduce costs, and has also invested in ecosystem projects such as Backpack. Hashed will continue to identify and invest in projects that can drive growth and scalability in the crypto industry.

Animoca Digital Research: In our view, the current challenge facing the industry is that it is difficult to attract and maintain retail investors to continue to participate in new projects. After this years TGE, the fully diluted value (FDV) of the project declined rapidly, and the transparency of token airdrops also caused controversy. These factors have led to a decrease in retail investors interest. However, retail investors are an important source of market liquidity, and their absence poses a certain threat to the healthy development of the crypto ecosystem.

To address this challenge, venture capital firms and exchanges should take proactive measures, such as jointly improving the price discovery mechanism of projects. This may include developing more sophisticated valuation models and introducing transparent data-driven pricing processes. By improving the accuracy and reliability of project valuations, the market can build more trust and confidence in the minds of users. Project teams should also focus on coordinating the interests of projects and communities, and establish mechanisms for the community to better participate in network effects and share network value.

Talk about opportunities:

OKX Ventures : We believe that a major opportunity in the new cycle is to use cryptographic technology innovation to introduce Web2 users into the Web3 field and achieve effective retention. In addition, the integration of AI technology and Web3 is also a very important sector, which is important for improving transaction efficiency, promoting personalized user services and building new products. For example, using AI to analyze and predict market trends, or automating more financial services through AI-enhanced smart contracts.

In view of the challenges mentioned above and the new cycle opportunities just mentioned, the overall idea of OKX Ventures is to optimize resource allocation, improve the rigor of project review and investment decision-making, and ensure that funds flow to projects that can bring real technological breakthroughs and user growth. At the same time, look for innovative projects that can bridge existing technologies with market demand, such as Web3 applications with highly assimilated Web2 advantages, so as to drive the entire industry forward.

In addition, we will maintain cooperation and exchanges with other participants in the same industry, and constantly adjust and optimize investment strategies to ensure that we can provide support for industry construction in the new cycle. For investment institutions, staying at the forefront of innovation requires not only courage and foresight, but also meticulous strategic planning and execution. We remain optimistic about the development of the industry in the new cycle.

Hashed: We believe that we see two particularly meaningful opportunities in the next five years: the tokenization of real-world assets (RWA) and the use of crypto technology to achieve innovation from 0 to 1.

First, the tokenization of RWAs can unlock accessibility and capital efficiency for illiquid assets. For example, in areas such as real estate, commodities, artworks, and even intellectual property. Tokenized assets can provide fractional ownership, increase liquidity, and make hard or intangible assets that were previously limited to specific individuals or institutions more widely accessible. To advance this area, we are looking for teams that have expertise in handling traditional assets and are committed to tokenizing them. For example, Story Protocol, an open source infrastructure that tokenizes intellectual property with programmable provenance, attribution, and monetization capabilities.

Another opportunity is to discover entrepreneurs who can use blockchain technology to achieve from 0 to 1 innovation. They have the opportunity to redefine existing paradigms and create new market opportunities. On the one hand, we believe that there are certain opportunities in the payment field, such as realizing open finance through mobile devices and blockchain-driven payment systems to provide financial services to people without bank accounts. After all, blockchain technology is suitable for fast settlement and low transaction costs, but there is no clear winner in the payment field yet.

On the other hand, the capital efficiency within the Bitcoin network has not been fully utilized. Despite Bitcoins market cap of $1 trillion, less than 0.1% of the market cap is captured on-chain. There is a huge opportunity in this area of helping users earn yield and develop on-chain strategies. Ethena is a recent example in this area. They tokenized the funding rate to form a synthetic dollar instrument, creating the first native crypto Internet bond. Ethena captures funding payments from CEX traders, tokenizes them into a neutral on-chain tool, and can be used across multi-chain DeFi, such as DEX, collateralized lending markets, derivatives trading, etc.

Animoca Digital Research: In our opinion, the main goal of Web3 at this stage is to attract and retain users who migrate from Web2 by providing real value. Here we mainly discuss 3 directions.

First is l'écosystème TON . TON on Telegram and its Mini Apps framework provide the infrastructure to seamlessly integrate Web3 functionality into daily use. TON has over 900 million monthly active users and has a proven track record in mini-programs and payments. We believe that TON has the potential to create breakthrough applications similar to WeChat Pay’s “Red Packet Moments” through the promotion of mini-programs, quickly introducing and retaining a large number of users. In addition, the application of TONcoin on the Telegram platform also provides an opportunity to improve advertising channels and user value sharing mechanisms.

Next is GameFi . Animoca Brands Mocaverse has built a network of 700 million users and provides multiple powerful platforms. Projects that can effectively integrate and utilize the Mocaverse ecosystem are expected to achieve accelerated growth and increase the value of related digital assets, becoming more attractive targets.

Finally, there are consumer hardware products , such as smartphones and smart watches. These devices can be pre-installed with Web3 products and applications to simplify the users entry experience, while embedding some airdrop mechanisms to stimulate new users to use. In fact, this is especially important for emerging markets where infrastructure is not yet perfect, because Web3 infrastructure can help these countries enter the digital economy that does not rely on traditional institutions.

3. Narratives that OKX Ventures, Hashed, and Animoca Digital Research are focusing on

OKX Ventures : OKX Ventures is still making extensive investments in multiple fields including AI, GameFi, DeFi, Web3, NFT, Metaverse, and blockchain infrastructure, covering more than 300 projects. The core basis of investment is the current market demand and expectations for the future. The main focus is currently on infrastructure construction, promoting DeFi product innovation, and shortening the distance between Web2 users and the Web3 world.

From our portfolio, although infrastructure and DeFi are still the core of the layout, we have also witnessed the rise of Web3 and gamification applications, which to a certain extent reflects that the cryptocurrency market is gradually evolving from a pure financial tool to a platform that includes a broader user experience. With the maturity of technology and the development of the market, the cryptocurrency industry may further integrate more daily application scenarios in the future.

In the next development cycle, OKX Ventures firmly believes that by funding innovation in these key areas, we can drive the industry forward and further promote the maturity and widespread application of the entire cryptocurrency ecosystem. Our goal is to bring users a richer Web3 experience by leading technology and business model innovation.

Regarding infrastructure construction: We will continue to invest a high proportion in high-performance and more cost-effective technical solutions. This includes parallel processing technologies such as MegaETH and Monad, and public chains built for specific needs, such as AI-specific chains and FHE (fully homomorphic encryption) and ZK (zero-knowledge proof) technologies for enhanced privacy protection. These efficient technical infrastructures can not only drive new user growth, but also generate revenue, which can further promote the sustainable development of the industry to a certain extent.

Regarding the innovative DeFi track: Considering that the DeFi field already has a very mature market and user base, the focus is mainly on multi-chain, higher degree of decentralization, introduction of RWA technology, and development of more complex financial derivatives.

Regarding the large-scale introduction of Web2 users: In the process of promoting the migration of Web2 users to Web3, we pay special attention to opportunities that can be integrated through existing large-traffic platforms. For example, by using AI technology and platforms (such as ChatGPT) and leveraging the power of social media (such as Telegram), Web3 projects have the opportunity to reach hundreds of millions of ordinary users who have never been exposed to cryptocurrency, which will bring a huge growth opportunity for the entire industry.

Hashed: The narrative we focus on has not changed, the only thing that has changed is that the industry is maturing, which allows us to see the actual effects of these applications and infrastructure. We focus on applications and infrastructure that inspire positive and meaningful behavioral and lifestyle changes, while cultivating a thriving ecosystem of real builders, users, and producers.

For example, Axie Infinity, one of our investments, has attracted a large number of players in Southeast Asia and Asia Pacific by pioneering a new business model and providing them with substantial income. By building infrastructure such as Katana DEX and Ronin Bridge, Axie Infinitys Ronin ecosystem has now grown to more than 1.5 million daily active users and 3.8 million monthly active users, supporting high-quality games such as Pixels and Apeiron.

In the context of the gradual development of RWA and the large-scale migration of Web2 users to the Web3 market, we have also incubated the blockchain-driven entertainment studio Modhaus, which manages the new generation K-pop girl idol group TripleS and plans to launch more sub-groups. In the past, fans could only passively participate in idols activities by attending concerts, watching shows, or buying peripheral products, and had almost no say in community governance. Modhaus uses blockchain technology to change this situation through on-chain governance and DAO. For example, fans can vote through purchased photo cards (Objekts) to select TripleS debut title song, and each vote is called a Como. All activities are transparently recorded on the chain.

Separately, Story Protocol, in which we invested, pioneered and commercialized programmable intellectual property (IP), attracting the attention of builders in the media, entertainment, and blockchain industries. The gap between the Hollywood writers’ strike in the West and the animation industry in the East shows that IP giants dominate most IP-derived revenues, but fail to provide clear and transparent monetization methods to original creators and stakeholders. To address this centralization issue, Story Protocol’s IP graph allows any stakeholder, including original content creators, to easily track, prove, and manage the flow of IP and its derivatives. Its three core modules—on-chain IP registration, licensing, and royalty management—are currently in the testnet, inspiring stakeholders in the media and entertainment industries to use blockchain to solve the problem of black-box centralization, leading to exponential growth in users and builders before its mainnet launch.

Animoca Digital Research: The Web3 ecosystem has evolved from an initially isolated model to modularity and is now beginning to form a collaborative network. This allows projects to focus on their core value and be able to leverage the capabilities of other projects to expand. Co-processors and intent-centric design are two innovations that can significantly enhance the large-scale development of Web3 and are worthy of our attention.

About Coprocessor

The co-processor offloads a large number of on-chain query and transaction tasks to off-chain processing and returns the results to the smart contract in a trustless manner. It provides a powerful framework for managing and verifying the status of digital assets in a scalable manner while maintaining trustless characteristics, thereby enhancing the security and auditability of asset ownership, transfers, and other key activities.

In GameFi, applications often need to handle complex game mechanics, player interactions, and economic transactions. For example, an on-chain puzzle game may require users to perform tedious signatures or verifications at each step. With the co-processor, computationally intensive game logic can be moved off-chain, leaving the main blockchain to handle only final state confirmation and verification. These innovations enable games to develop more complex game modes and in-game economies, such as fully on-chain loyalty programs.

Intent-centric design

Intent-driven design is a philosophy that prioritizes user outcomes over process complexity. It aims to achieve the desired outcome without burdening users with unnecessary technical details.

In GameFi, intention-driven design lowers the barrier for mainstream users to enter and utilize Web3 capabilities. Users can join Web3 games directly without downloading crypto wallets or managing gas fees; the online identities created and the digital assets obtained can be used seamlessly in other games; the rewards obtained can also be used directly to pay for other services without conversion or transfer.

For OKX Ventures’ Disclaimer, please read https://www.okx.com/en/learn/okx-disclaimer .

Animoca Digital Research’s disclaimer is available at https://research.dat.animoca.space/disclaimers

Avertissement et clause de non-responsabilité concernant les risques

Cet article est fourni à titre de référence uniquement. Cet article ne représente que le point de vue des auteurs et ne représente pas la position d'OKX. Cet article n'est pas destiné à fournir (i) des conseils d'investissement ou des recommandations d'investissement ; (ii) une offre ou une sollicitation d'achat, de vente ou de détention d'actifs numériques ; (iii) des conseils financiers, comptables, juridiques ou fiscaux. Nous ne garantissons pas l'exactitude, l'exhaustivité ou l'utilité de ces informations. La détention d'actifs numériques (y compris les pièces stables et les NFT) comporte des risques élevés et peut fluctuer de manière significative. Vous devez examiner attentivement si le trading ou la détention d'actifs numériques vous convient en fonction de votre situation financière. Veuillez consulter vos professionnels juridiques/fiscaux/d'investissement pour votre situation spécifique. Soyez responsable de la compréhension et du respect des lois et réglementations locales applicables.

This article is sourced from the internet: Crypto Evolution Episode 01 | OKX Ventures Hashed Animoca: Revisiting Cycles and Narratives

Original author: Weilin, PANews Recently, South Koreas virtual asset regulators have frequently announced new regulatory developments, and there was a reversal in the news. First, there were online rumors that the regulator notified nearly 30 registered exchanges to review the more than 600 cryptocurrencies they listed therein and 16 tokens will be delisted. Subsequently, the market fell into a panic of large-scale delisting of tokens, and the prices of related tokens fell sharply. On June 18, the Financial Services Commission (FSC) of South Korea clarified that it would not directly participate in the inspection of cryptocurrencies listed on Korean exchanges, which was actually a self-inspection by the industry. In fact, in order to cooperate with the Virtual Asset User Protection Act that came into effect on July 19, South Koreas…