4Alpha Research : Analyse approfondie du développement futur du marché de prédiction Polymarket ?

4Alpha Research Researcher: Stitch, Cloris

4Alpha Research Researcher: Stitch, Cloris

Will Trump be elected president? Will the US economy fall into recession? Will the Solana ETF pass this year? When will GPT5 be released? Will the iPhone 16 have a huge upgrade? There are too many problems in this world that are closely related to life. These problems can be big or small, but they all have one thing in common, that is, search engines can never provide answers to them. The prediction market provides a supplement to the search engine, allowing people to get “conclusions” instead of “analysis”. All analysis is hidden behind the winning rate.

The views in this article do not represent any investment advice

What is the prediction market?

The prediction market is a trading market. Compared with general betting platforms, the prediction market focuses on “events”. Users can buy and sell “contracts” on the “results of future events”. It is essentially a binary options market. The winners gain profits from the betting amount of the losers according to the proportion, and the losers lose all their principal.

By buying and selling contracts, users are actually “betting” on the possibility of an event they think, so the price of the contract reflects the market’s view on the probability of the event.

The goal of the prediction market is to play the role of collective wisdom through the trading behavior of many users, and then reflect the accurate assessment of the probability of an event. For example, if the contract price of the event “Trump was elected as the President of the United States” is 60 yuan, it means that the market believes that there is a 60% probability of this happening.

Disassembling the most popular prediction market Polymarket

Polymarket is a prediction market built on Polygon, allowing users to directly purchase USDC through Moonpay using traditional payment methods for betting, without the need for complex operations such as binding wallets, and does not involve concepts such as Gas and signatures when using it, which is friendly to non-Web3 users.

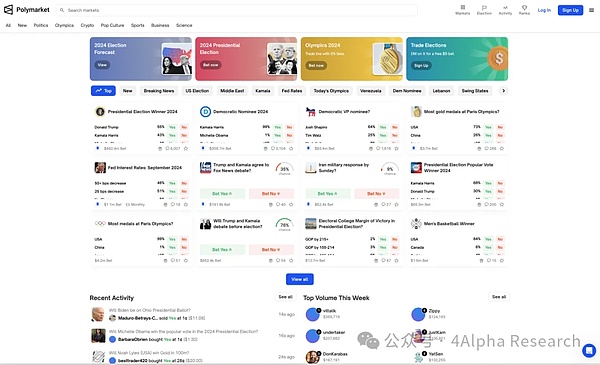

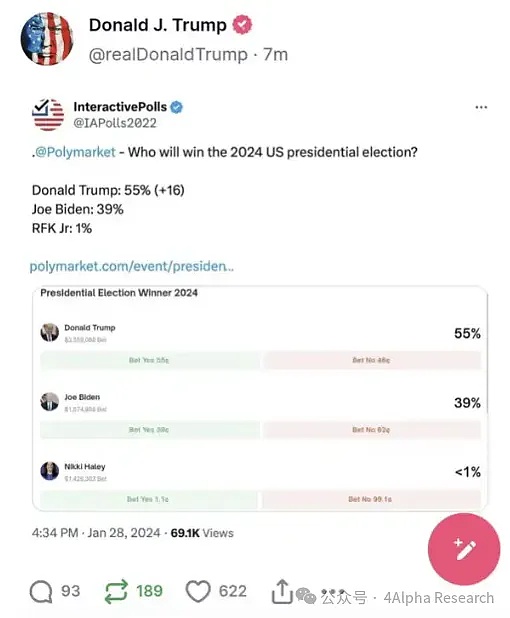

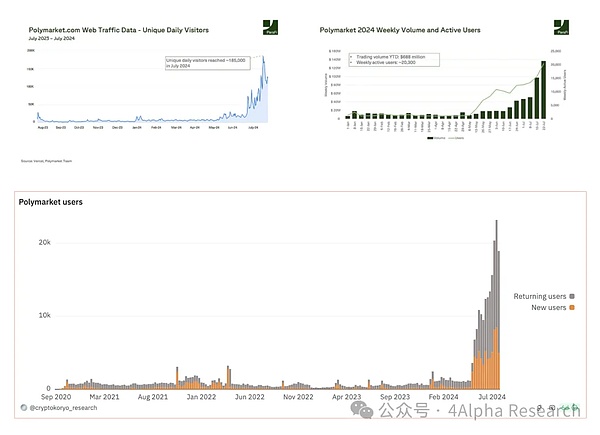

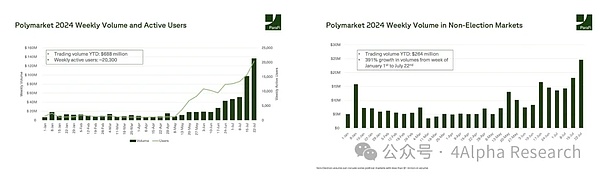

Currently, Polymarket’s data performance is good, with bets reaching 387 million US dollars in July and daily trading volume reaching millions of US dollars. There are more than 550 million US dollars in unsettled contracts for the event of the US presidential candidate alone. At the same time, according to the data on Dune, the number of active users of Polymarket has continued to grow this year, with the highest weekly active users exceeding 23,000. At present, Polymarket has become an important reference for public opinion in the presidential election, and even Trump himself has repeatedly forwarded his data on the leading winning rate on Polymarket.

The rise of Polymarket is inseparable from some favorable conditions, such as:

1) Enough high-quality events: There will always be topics in 2024, from Bitcoin and Ethereum ETFs to the US election and the Olympics

2) The crypto market is more closely related to policies, regulations, and the economy: In the past one or two years, the factor that caused the biggest price fluctuations in the crypto market is often not the development of the crypto itself, but the changes in external macro factors. This also guides more Crypto Native users and funds to pay attention to macro changes and prediction markets, because prediction markets provide simple “conclusions” for many macro factor topics.

3) Better infrastructure: When the concept of prediction markets became popular in 2019, custodial wallets, deposit and withdrawal services, and public chains were not perfect, which restricted user access. At that time, many prediction markets were built on Ethereum, and problems such as difficulty in recharging and inability to place bets often occurred.

In addition to the right time and place, Polymarket has also made many optimizations at the product level compared to the prediction markets in previous cycles

Prediction markets in the past usually have the following pain points:

- The entry threshold is too high, the infrastructure is imperfect, and you need to understand the concepts of wallet use

- The product is complex and difficult to understand. The prediction market is a collection of casinos, options and other models, which is easy to be designed too complicated

- Insufficient liquidity and counterparty

- It is difficult to balance the freedom of event creation and clear standards

- Regulatory risks. The prediction market has existed since ancient times, but it has always been restricted by centralized power

- …

Although Polymarket has not been able to completely solve the above problems, it has still made some innovations or optimizations to these pain points

1) Try to make the product UIUX Optimization, lowering the threshold for use

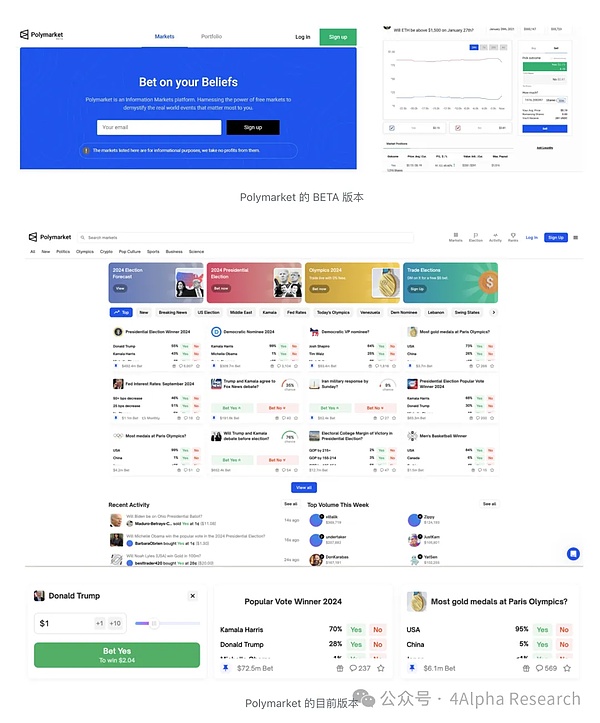

We can collect some data pictures to compare the user experience of Polymarket a few years ago with the user experience today.

Comparing the Beta version of Polymarket with the current version, you will find that the current Polymarket is simpler to use and the path is smoother. For example, the current homepage directly includes all the most popular “events” in the platform, and users can place orders directly without entering the secondary page; at the same time, the user’s participation logic revolves around “how much to invest & expected return”, rather than the “cost” of each bet; the probability of winning each bet, the expected return, the size of the pool, and other data that may need to be referenced before placing an order are also fully displayed. The platform also supports the use of Web2 registration and payment methods to create wallets and deposit funds, and there is no need to understand the concepts of blockchain and Gas when using it.

2) Abandon mechanism innovation and provide liquidity through incentives

In some sense, prediction trading and NFT markets are very similar. Any event can be traded on any prediction platform. It can be said that liquidity is one of the decisive factors affecting user choices, because sufficient liquidity can not only allow users to profit from the results of correctly predicting events, but also from the fluctuations in market judgments on events.

Polymarket uses the order book as the mainstream settlement method. Market makers can provide liquidity by placing limit orders to obtain rewards. The closer the order price is to the market price, the more rewards they will receive. Does this model sound very similar to Blur? In fact, all positions held by Polymarket users are in the form of ERC1155, but the inspiration for this liquidity incentive actually comes from dYdX.

3) Improve content supply and decentralized settlement as much as possible

There is a set of special channels in the Polymarket community for community members to provide event suggestions, so that the team can always keep an eye on various events around the world to ensure the continuity of platform content supply. At the same time, UMA’s oracle is used to decentralizedly solve the settlement problem of events. A rich supply of events is the basis for ensuring the long-term survival of the platform, because popular events such as the US election and the Olympics are not common, and “events” themselves are “content” rather than “gameplay”, and cannot exist for a long time like “slot machines” and “baccarat”. Therefore, whether it can continuously and quickly provide consumable content will directly affect user retention.

From these aspects, Polymarket has solved some of the problems faced by the past Crypto trading market to a certain extent, laying the foundation for its outbreak; in addition to products, Polymarket has also invested a lot of money in user marketing, including Reddit channels and WallStreetBets.

Even though Polymarket has done so much, it still has some imperfections. Future innovations in the prediction market may also start from these aspects:

1) Insufficient liquidity will be a long-term problem

Events will eventually have clear results and are not completely manipulable. Market making for events depends on the understanding of the event itself. If it is just for incentives, blind market making is likely to lead to losses. The requirements of the prediction market for liquidity providers are different from other markets.

2) Token Utility is difficult to design

Because stablecoins must be used for betting, otherwise the value of the bill will fluctuate, affecting the prediction results. Therefore, when designing tokens, it will be more difficult to empower the tokens and integrate them into the core gameplay of the platform. If the platform tokens are only used as governance tokens or liquidity incentives, they may face a situation where the token price continues to fall and in turn affects the platform traffic.

3) Low conversion rate, difficult to acquire customers

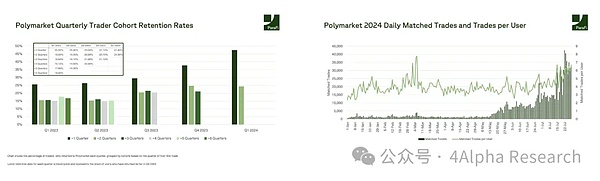

The prediction market category currently seems to have a low conversion rate. The left side of the figure below shows the traffic changes of the Polymarket website. The highest number of independent visitors in July was close to 200,000, but the highest number of weekly active users in July was only 20,000; in addition to the low conversion rate from visits to new users, the conversion rate from new users to transactions is also low. The number of active users in May doubled, but the transaction volume did not increase accordingly, which illustrates this point from the side. We speculate that the high threshold for participation in the prediction market and the gameplay close to gambling may be potential reasons.

4) Still far from decentralization and fairness

At present, Polymarket has adopted a settlement mechanism based on the decentralized oracle UMA for fairness. UMA resolves disputes based on token voting and confirms the results of events. This has certain centralization risks and can only achieve relative fairness. A famous controversial event was about whether the ETH ETF could be passed. In the end, the community did not foresee in advance that only the 19b-4 form was approved at that time, but not the S-1. In the end, it was unanimously agreed that 19b-4 was also considered passed under the UMA mechanism. Since events are usually off-chain and sometimes do not have a clear settlement point, similar events will occur repeatedly.

5) Event Gaming is not pure Gambling, and it is difficult to increase participation in non-election related events

Data shows that as of the end of July, election-related event transactions on Polymarket accounted for 61.63% of the platform’s transaction volume, and this proportion has been rising recently with the influx of new users, reaching a maximum of about 82%. Before May, the platform’s election-related event transaction volume was around 50%, which may mean that a large number of new users are focused on election-related events.

We believe that the core reason behind this is that event prediction is difficult, resulting in a high threshold for participation. Participating in event gaming may even be more difficult than MEME hype, because event gaming is not pure Gambling. On the one hand, stable and mature fields such as sports and e-sports already have too many competitors and fixed audiences, and the prediction market has no advantage in competing for these users; on the other hand, events outside of sports and elections are often “different fields are different”, which increases the difficulty of user participation.

It is inevitable that the popularity will decline after the US election, but the platform has long-term stickiness, and this round of explosion has left accumulation

Considering the recent election-related event trading volume, which can account for up to 80% of all event trading volume on the entire platform, it is almost inevitable that the prediction market will decline in popularity after the US election. However, even so, the prediction market is by no means a flash in the pan. This category will continue to develop in the process of constantly solving the above problems. The reasons are as follows:

1) The prediction market has a solid user base history. Prediction markets are not new. The earliest modern form originated from the Iowa Electronic Market in the 1980s, which was used to predict the US presidential election. Subsequently, prediction markets gradually attracted the interest of academia and the business community, and were applied to finance, business decision-making, and public policy. With the development of the Internet, online prediction markets such as Intrade and PredictIt have become more and more popular. There are similar platforms all over the world. However, due to regulatory issues, these platforms are generally either shut down or can only use worthless points for betting, which cannot realize their maximum potential. As the Crypto version of the prediction market gradually improves, the golden age of the prediction market is bound to come.

2) The election will end, but political topics will not end. Therefore, although the attention of the event will decrease, the supply of events will never be a problem, and prediction markets such as Polymarket have come in cycles. On the other hand, the world is moving forward in instability, geopolitical conflicts, economic crises, etc. are all affecting people’s nerves. In the turbulent and information-exploding era, people’s demand for “conclusions” will always keep a certain amount of traffic in the prediction market.

3) User stickiness is getting stronger, and 15% – 25% of users are converted into long-term users. Since Q3 of 2023, the long-term retention rate of new users has increased significantly, indicating that the product logic has been verified before the explosion; in addition, with the influx of a large number of new users, the average number of transactions completed by users has not decreased, and even showed an upward trend in July. This also indirectly shows that the platform has a high retention rate and participation rate of new users, and the increase in the proportion of new users has not lowered the average number of transactions for overall users.

The prediction market deserves long-term attention. In our opinion, the prediction market based on Crypto still has three potentials that have not been fully explored:

1) Everyone can create events and have ample liquidity: Dragonfly’s Schmidt once said, “Polymarket’s ultimate secret weapon is that the platform will allow ecosystem participants to create new bets independently, and it is difficult for competitors in the traditional financial field to replicate this model. It’s like YouTube to TV.” As of now, this has not been fully implemented on Polymarket. I look forward to a platform that can combine the contradictions of event creation and liquidity provision. Perhaps, we have to wait until AI intervenes.

2) Media where everything can be predicted. The prediction market is still restricted by ethics and policies. In June 2023, a tweet about the disappearance of the Titan submersible went viral, and users on Polymarket bet more than $300,000 on whether the missing submarine would be “found before June 23.” This triggered ethical criticism of the profit-making nature of the prediction market, and the attack of “making money from death” forced Polymarket to respond and clarify. This invisible ethical pressure will limit the creation of events, but if you think from another perspective, and regard “profit-making” as the cost of calling on collective wisdom, you will be more tolerant of the range of topics that the prediction market can accommodate. The prediction market has the potential to become the provider of the richest thematic content, and even evolve into a new social media, allowing discussions and predictions to take place in one place.

3) As a supplement to search engines, prediction markets provide the “conclusions” most needed in the era of information explosion. Many advocates of prediction markets will say that prediction markets will provide the “truth” that people need, but this statement is a bit exaggerated, because collective wisdom is still far from the “truth.” But prediction markets can still provide something important, namely “conclusions.” In our opinion, “win rate” is something similar to “K-line”. It only provides numbers, but contains all the analysis. It is the crystallization of collective wisdom. In many cases, such a clear conclusion with probability is enough to assist people in making judgments.

Other revelations from the popularity of Polymarket

The end of the prediction market has not yet come, and it is still unknown whether Polymarket can become the final winner, but its development history can still give market participants a lot of inspiration, such as:

- Focus on applications. The imperfection of infrastructure is increasingly not an excuse for the lack of excellent crypto applications: In the past, prediction markets were indeed limited by the price and performance of Ethereum, but now there are enough alternatives. Polymarket is even built on the previous generation of expansion solutions such as Polygon. Therefore, even if the current infrastructure may still not meet the needs of tens of millions of daily active users, it is enough to create excellent consumer products that can verify the needs of a small range of users.

- The infrastructure that lowers the threshold is basically sufficient, whether it is fiat currency exchange, email registration or gas-free interaction, it is time to look beyond Crypto

- Perhaps there is no need to rush to look at the global market, perhaps you can focus on verifying product demand in a certain market first: Before Polymarket was banned in the United States, more than 80% of its users and traffic came from the United States, Crypto The openness of the platform makes it easy for entrepreneurs to start with “global users”, but in the end, the human resource limitations of startups make it easy for the promotion target to become “global on-chain users”. This user scale has not increased for many years, and the demand is relatively single. It is a profit-oriented group, thus entering an extremely fierce stock competition.

- For startups, it is necessary to decide the timing of the disclosure of financing news. The opportunity to gain attention is limited, and it is necessary to develop low-key before the product is ready.

The content of this article is only for information sharing, and does not promote or endorse any business or investment behavior. Readers are requested to strictly abide by the laws and regulations of the region and not participate in any illegal financial behavior. It does not provide transaction entry, guidance, distribution channel guidance, etc. for the issuance, trading and financing of any virtual currency or digital collections.

4Alpha Research content is prohibited from being reproduced or copied without permission, and violators will be held legally responsible.

Related: Solana DEX Raydium Flips Uniswap in Weekly Fees

Home / News / DeFi Home /This article is sourced from the internet: Solana DEX Raydium Flips Uniswap in Weekly FeesRelated: Five Key Challenges with DeFi Solved with the Stellar Smart Contract PlatformHome / News / DeFi Home /This article is sourced from the internet: Five Key Challenges with DeFi Solved with the Stellar Smart Contract PlatformRelated: GameCene, a Pioneer in Building the Web3 Gaming Ecosystem, Secures $1.4 Million in Seed FundingGameCene, a Web3 game publishing platform, has announced the successful completion of its seed funding round, raising $1.4 million. This funding will fuel GameCene’s growth, accelerate the development of its platform, expand its diverse game library, and further streamline the management and monetization of user assets. GameCene: A Catalyst for the Web3 Gaming Revolution GameCene’s mission is to bridge…