Outils essentiels pour les chasseurs de MEME : Quels sont les outils privilégiés par les investisseurs intelligents ?

Original article written by Joyce , BlockBeats

Traduction originale: Jack , BlockBeats

Amid the ups and downs of the market, the meme market has produced a few more golden dogs. Several screenshots of people who have made high returns on memes have begun to circulate in the community, but behind the few lucky ones, there are many runners-up who have repeatedly fought and failed.

The meme market is a field full of opportunities and challenges. In addition to luck, traders also need to have comprehensive abilities such as market insight, the use of technical tools, psychological quality, and the flexibility to respond to changes in order to obtain satisfactory returns. Among them, the ability to use tools can be improved quickly. In this article, BlockBeats sorted out some on-chain analysis tools designed specifically for meme transactions, which are suitable for meme coins with small market capitalization and not long ago, hoping to provide some help for traders who want to participate in the meme market.

Before reading this article, it is important to note that there are a variety of meme-generating tools on the market. Some tools already have loyal communities and will focus more on maintaining the existing community and reduce their exposure on social media. Some are just getting started and have novel features but may lack stability. Still others have a large number of users and require dialectical analysis of the signals they give.

In addition, readers need to recognize the characteristics of the meme market, namely, the fast trading pace and high returns accompanied by high risks. It is not a trading field suitable for everyone to participate in. Analysis tools can only play an auxiliary role to minimize the probability of falling into traps.

Getting Started: CA Address Analysis of Holdings

The most common scenario for beginner meme traders is that after seeing a new meme coin in the community, they analyze the token from aspects such as security and chip structure to decide whether to trade. In this scenario, website tools and trading bots can provide help.

First, some basic information analysis.

The security of the token contract needs to be paid attention to, such as whether the token is a Pixiu disk, whether the contract is open source, whether the token permissions have been abandoned, whether there are risk warnings such as lock pools, etc. In addition, information such as the token market value, the number of holders, recent transactions, and the number of positions held by the top 10 holders are also important reference indicators for judging whether the token is safe in the absence of other additional signals.

In addition, the online monitoring tool GMGN provides other information about meme coins on its webpage, such as whether the dev has run away, whether the team has paid for advertisements on Dexscreener, the official Twitter account of the token and the tg community link, etc. The meaning of this information varies depending on the situation.

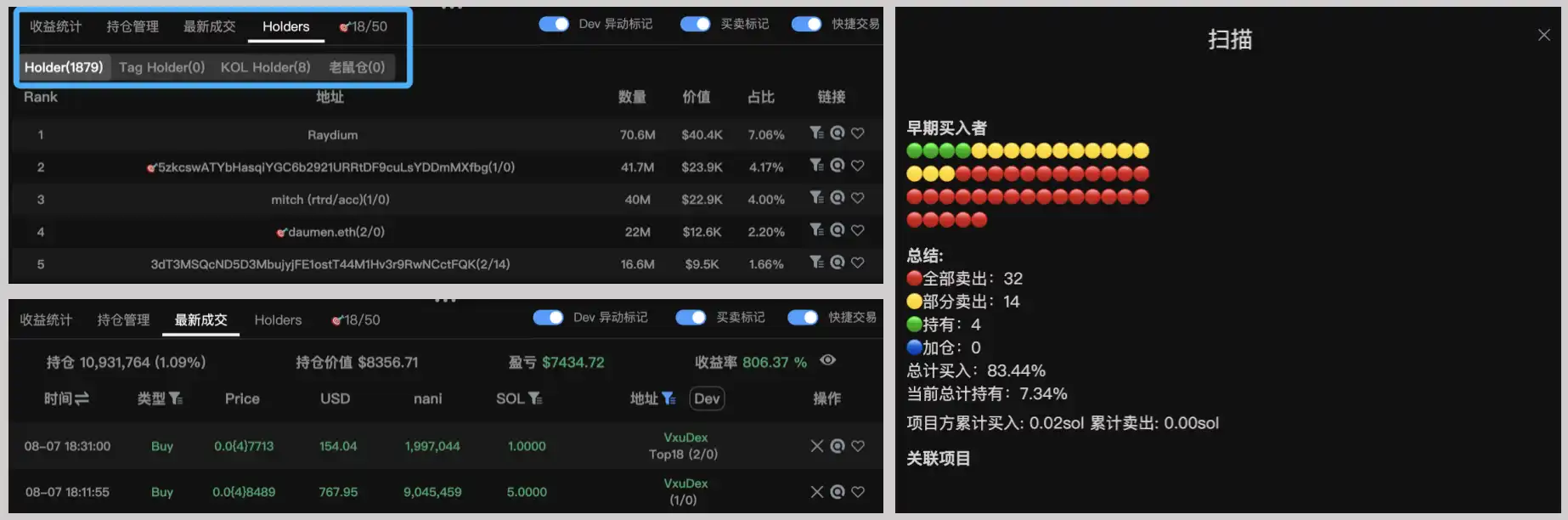

In the meme market where the PVP situation is becoming more and more intense, a deeper analysis of the token holding structure is needed. Generally speaking, the trading situation of smart money, KOLs and large coin holders can provide more effective information than other traders. For example, GMGN divides token traders into categories such as smart money, KOLs, whales, new wallets, snipers, large coin holders, and rat warehouses.

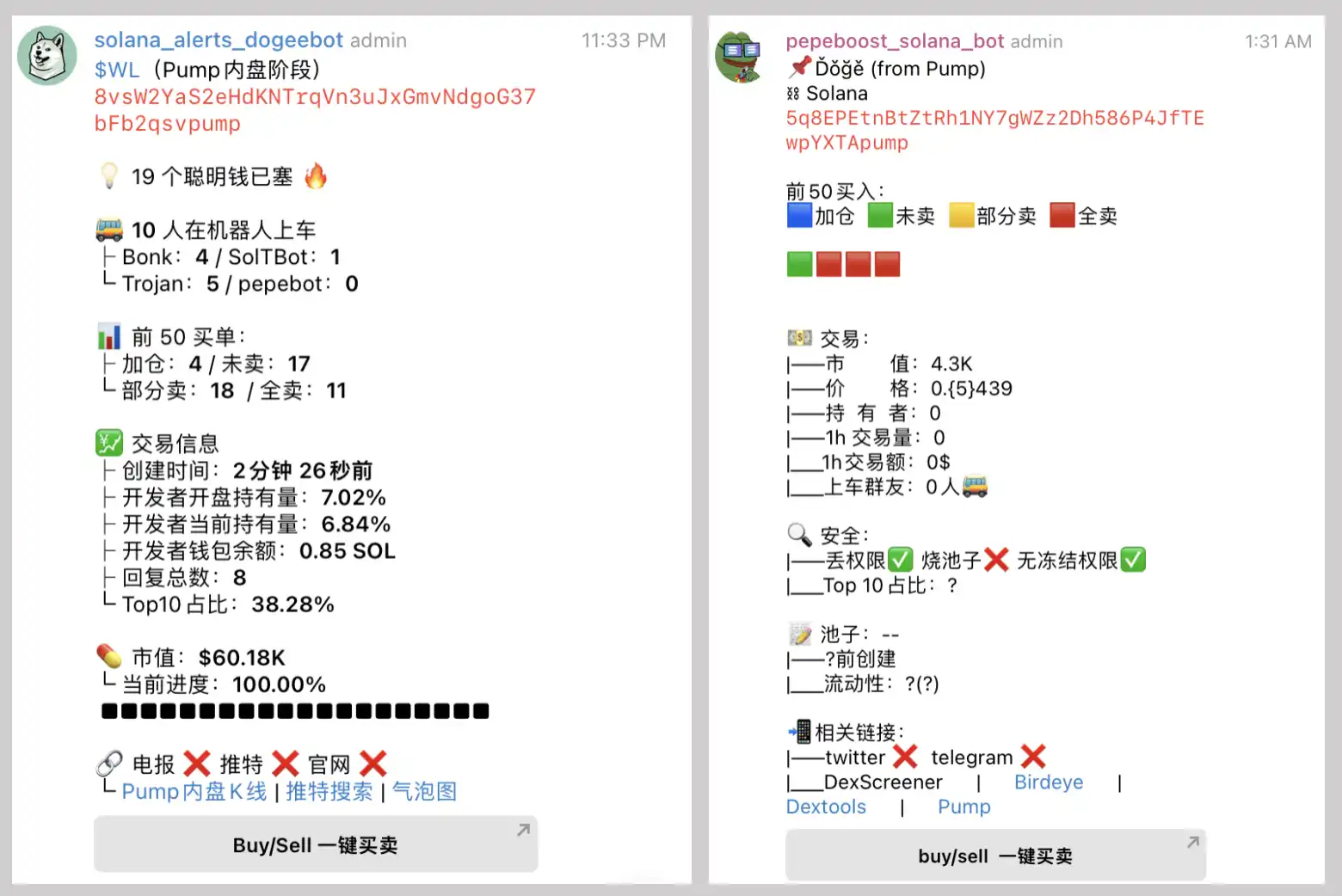

In addition, some monitoring tools based on TGBOT can also provide this function. If you pursue speed, you can first enter CA in the group with TGBOT to check the token holdings in real time.

Observing the purchase amount, entry timing and profitability of these, combined with discussions on social media, can help determine what stage this meme coin has reached. The tools currently on the market have different advantages. For example, some tools will highlight the holdings of KOLs and large investors.

Advanced gameplay: filter addresses to increase certainty

There are some public smart money addresses in the meme market, such as high-win rate addresses circulated in the community, addresses marked by institutions, and KOL addresses. GMGN has marked some smart money addresses based on statistics, but the official and public marked addresses are of little reference value, and the public KOL addresses cannot be blindly followed. Meme players need to build their own smart money attention list to better survive in the market. This demand can also be met by GMGN and other customized tools.

After seeing a meme coin with a good increase, you can look for smart money among three groups of people: early large holders, high-yield traders, and early buyers. The most important thing is to make a judgment based on the time of purchase. If this address is bought before the meme coin rises, then its reference value will be greater.

Some tools are simpler and more intuitive in viewing, and the interactive experience is more convenient. They only provide three indicators: large coin holders, KOLs, and insider trading. After clicking on the address, you can immediately view the transaction operations and profit status of this address on the current token without jumping.

After screening out a batch of wallet addresses, you need to observe the recent transactions and profits of this wallet address. Many high-yield wallet addresses are not worth tracking, and they may just be lottery tickets after casting a wide net.

In addition, some players will search their wallet addresses on solsCAn to check the initial source of funds in the wallet, so as to analyze the group the wallet is in. On meme, some smart money addresses with information asymmetry will operate with several addresses during transactions.

Lecture connexe : The Dog King becomes the Rat King: NEIROs insider trading share is as high as 130 million US dollars, and KOLs collectively promote it

Add the final selected wallet address to the watch list, and observe the transaction performance of the wallet address from time to time. When you encounter a new meme coin again, you can check whether there are any followed wallets holding meme coins through GMGNs Followed or some monitoring tools, so as to use it as a reference for transactions.

Advanced gameplay: chain scanning + copy trading, striving to be one step ahead

The transaction cycle in the meme market has been compressed into minutes, so speed is crucial to profit results. However, it should be understood that fast trading speed does not necessarily mean high profit returns, and sufficient judgment and analysis capabilities are required as support.

Usually players compete in speed in three aspects: discovering alpha new coins (chain scanning), discovering the movements of smart money (following orders), and finally buying and selling (trading).

Sweep Chain

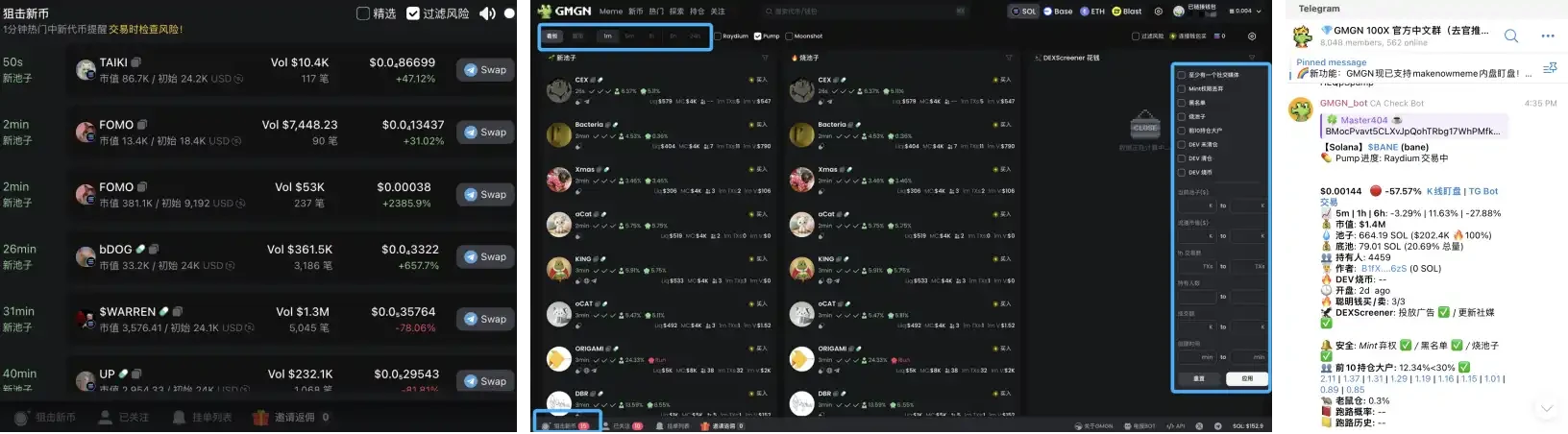

In chain sweeping, GMGN and Bullx are used more frequently.

GMGN displays a Sniper New Coin column at the bottom of the page. When a signal appears, a red prompt will appear, and users can click to view it immediately. Click New Coin on the GMGN homepage to browse the latest tokens. You can set filtering conditions on the right, including whether it is equipped with social media, DEX holdings, circulating market value and number of holders. However, some users reported that the filtering conditions sometimes do not work, and they will use TGBOT provided by GMGN.

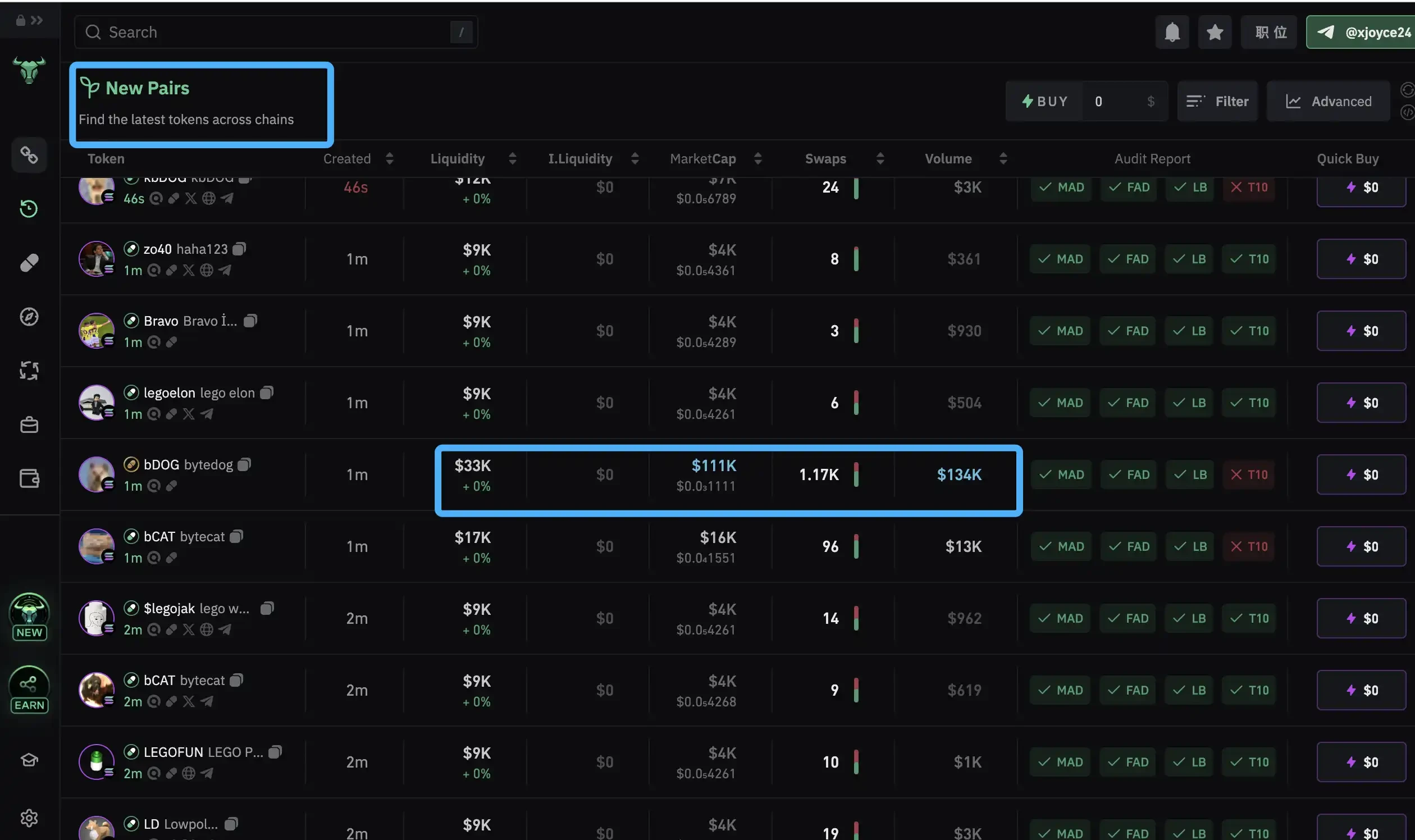

Bullx is a decentralized trading platform that covers six networks: Ethereum, Solana, BNB Chain, Arbitrum, Base, and Blast. It is unique in that it provides two trading methods: web-based and Telegram robot, with key functions such as fast trading, limit order setting, smart MEV protection, new token sorting and screening, and Pump Fun scanner.

Users can click chain to view only the new coin dynamics of Solana and Ethereum chains. Click New Pairs to display the latest 30 tokens that are monitored and launched. The earliest token on this page is usually launched 2 minutes ago. The indicators that can be viewed are token creation time, token liquidity, market value, number of transactions, transaction volume and basic contract security reports. Bullx will highlight abnormal data so that users can find alpha new coins as soon as possible.

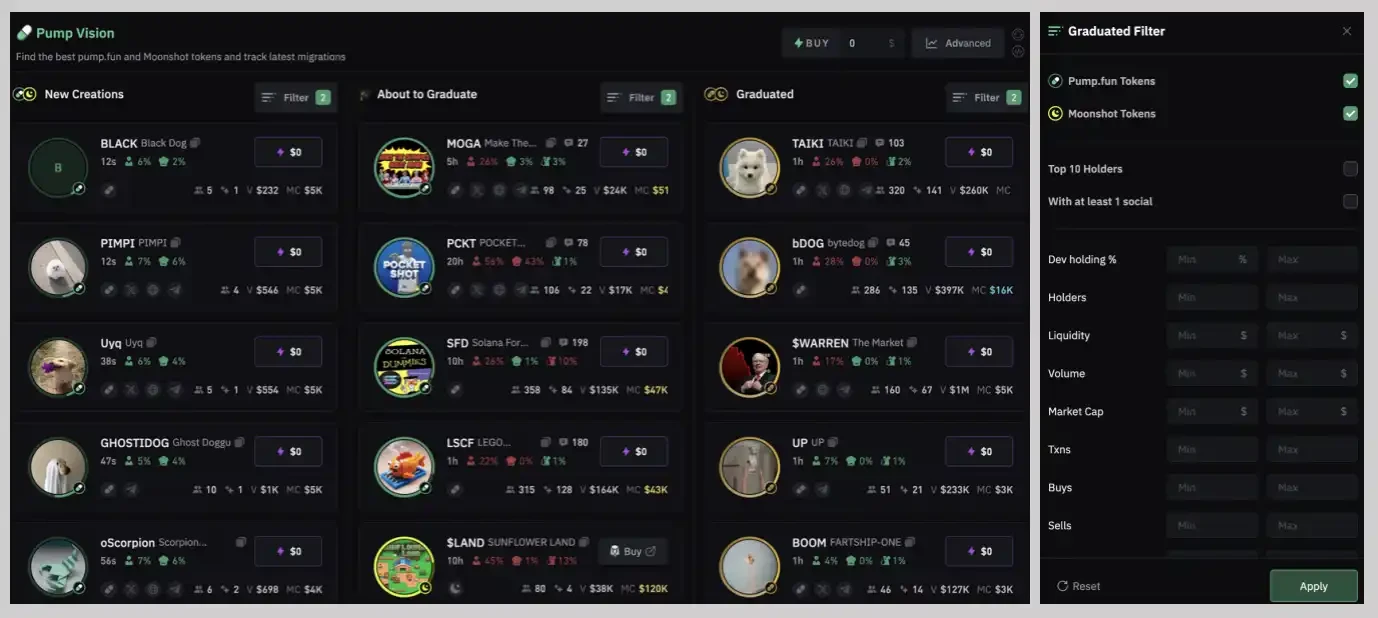

In addition, Bullx has also opened a special Pump Vision column, which is divided into three categories: new pool, internal disk is about to be full and just filled to display the dynamics of tokens on Pump.fun and Moonshot. Users can also filter tokens again in each category based on dimensions such as dev holding ratio, number of holders, liquidity, trading volume and market value.

According to the feedback from community users, Bullx has the advantages of smooth interaction, outstanding advantages in viewing new coins that appear within a few minutes, and the ability to support pending orders. However, its disadvantages are that it sometimes freezes, and there is no smart money recognition function, so it can only perform basic position structure analysis.

In terms of fees, BullX charges 1% for each transaction. If the user is recommended by other users, they can enjoy a 10% fee discount, that is, BullX deducts 0.9% of the fee. BullX also has a coin issuance plan, and the second season airdrop plan is in progress. Users can get corresponding rewards based on the accumulated early bird points. Not long ago, Whales Market announced that it launched BullX (BULLX) on its Pre-Market.

Follow orders

Copy trading is a group phenomenon that cannot be ignored in the meme market. Many meme traders want to be the first to grasp the smart money trading situation. Both GMGN and NFT Sniper can create their own follow list.

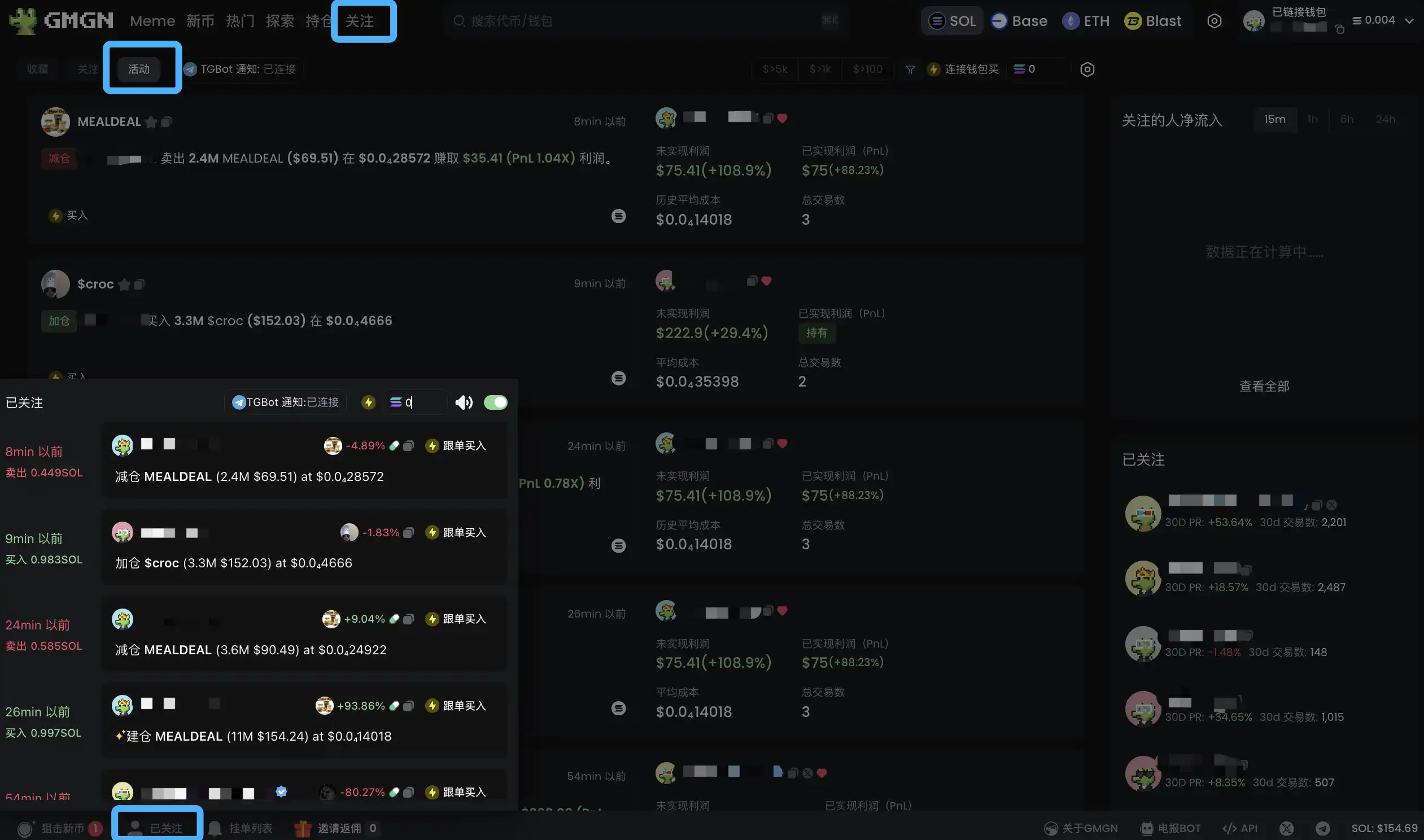

Click Follow on the GMGN page to view the list of wallets you are following. Click Activity to display the movements of the addresses you are following in chronological order. While providing address movements, GMGN also displays the purchase cost, realized profit and unrealized profit of the wallet addresses you are following.

In addition, GMGN has also set up a Followed column at the bottom left of the page to allow users to capture the movements of smart money in the first place.

Some tools provide more concise feedback on address changes, so users will have a more agile experience. Some tools have some temporary advantages, such as identifying more comprehensive KOL addresses.

commerce

The tools GMGN and Bullx mentioned above both provide trading functions. The following figures show the trading interfaces of GMGN, Bullx and a certain tool. All three have basic custom slippage, smaller fixed-amount buy, batch sell and other functions, but there are some differences in the specific experience.

GMGN displays the real-time profit situation near the trading operation button, which can help users decide the need to sell according to the profit situation. Another tool can provide functions such as multi-wallet synchronization operation and random amount trading within a set range, which is suitable for users with more customized trading needs. Bullx allows users to place trading orders, but considering that the liquidity of meme trading pairs is generally not deep enough, for some meme players, the actual use of the order function is not great.

In terms of mobile trading needs, the above tools are equipped with corresponding TGBOT services. Some meme players also use special trading bots, such as Pepeboost, Bonkbot, MaestroBots, Trojan and CAshbot. BlockBeats has introduced several mainstream trading bot tools in Solanas God-level disk continues, and trading bots have made crazy money .

Since using bot tools requires a service fee, most memes have a small market value and are more suitable for users with small amounts of capital to participate, so players also need to make some balancing considerations in terms of speed and cost.

In general, the meme market places higher demands on traders’ keen insight and quick response. Using tools can greatly increase traders’ chances of survival and profitability in the meme market. But learning to use these tools is only the first step. Real success also requires a lot of time and energy to cultivate a deep understanding of the meme market. Readers need to analyze and apply according to their own specific circumstances, and cannot blindly copy.

Finally, the crypto market is a high-risk and high-volatility market, especially the meme market. This article only provides some reference information for readers who have meme trading needs, but it cannot guarantee the trading success rate. Traders should be fully cautious and not invest beyond their risk tolerance.

This article is sourced from the internet: Essential tools for MEME hunters: What are the tools favored by smart money?

Original author: Mary Liu, BitpushNews Thursdays much-anticipated U.S. Consumer Price Index (CPI) report came in better than expected, with inflation falling to its lowest level in more than three years in June. The CPI rose 3% year-over-year, beating expectations for 3.1%, while the core CPI fell to 3.3% year-over-year, below expectations for 3.4%. The CPI data suggests that inflation is continuing to cool, which has strengthened investors confidence in betting that the Federal Reserve will cut interest rates later this year. CME Fed Watch data shows that a rate cut in September is almost a done deal, with the data showing that the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 84.6%, and the probability of a cumulative rate cut of 50 basis…