Pourquoi JLP, le meilleur investissement à prix fixe dans le cercle des crypto-monnaies, est-il si résistant aux baisses ?

There are no gamblers who always make money, but there are casinos that always make money. So, on the chain, can we also make money by investing in casinos? After launching JLP, Jupiter seems to have given an answer.

Since the beginning of this year, Jupiters perpetual contract platform JLP (Jupiter liquidity provider) has become one of the best performing and most profitable casinos. According to Données sur les dunes , the opening fee on August 5 alone reached 2.475 million US dollars, and each opening fee was only 0.0006 US dollars. But according to flyingfish data , from the beginning of this year to date, players who played contracts on Jupiter have only earned a total of 3.7 million US dollars, and they have contributed 136.8 million US dollars in fees to JLP.

On August 5, the market plummeted, crypto assets collapsed across the board, Ethereum wiped out its year-to-date gains, and SOL also fell all the way to $110. However, when the underlying assets are all Bitcoin, Ethereum, and SOL, JLPs decline is smaller than that of the underlying assets. Many people began to wonder why JLP is so resistant to declines?

Contract players: You are in debt from the moment you open a position

On JLP, the users counterparty is the platform itself. When traders seek to open a leveraged position, they borrow tokens from the pool and are fed prices directly by the oracle. This model is also known as jointly opening a casino, that is, users make money and the platform loses money.

The JLP pool supports five assets: SOL, ETH, WBTC, USDC, and USDT. The contract supports a leverage multiple of 1.1x-10 0x. The relevant liquidity is borrowed from the JLP pool. After closing the position, the trader obtains profits or settles losses, and returns the remaining tokens to the JLP pool.

Take long SOL as an example. Assuming the price of SOL is $150, a 5x leverage is set, which means 5 SOLs are borrowed from the pool, worth $750. If the price of SOL rises to $160, the position rises to $800, and the trader closes the position with profit. After closing the position, the trader needs to return the initial $750 principal, with a total profit of $50. However, for the platform, since SOL has risen at this time, the principal price is less than 5 SOLs, so the platforms U-based funds remain unchanged, while the currency-based funds are in a loss state.

If the price of SOL drops to $140, the position is only $700, and the trader stops the loss and closes the position, so the trader needs to return the remaining $700 assets to the platform and pay an additional $50. As SOL falls, the amount of SOL corresponding to $50 increases, the platform currency standard is in a profitable state, and the U standard funds remain unchanged. Similarly, shorting SOL requires borrowing stablecoins.

The biggest difference between JLP and general perpetual contracts may be that the latter may have negative rates. In order to make the price of perpetual contracts close to the spot price, the platform will subsidize the interest rate, but in the case of JLP, there is no platform subsidy.

Regardless of whether it is a profit or a loss, the opening capital comes from the JLP platform. Therefore, whether it is long or short, from the moment the position is opened, the trader is in debt to the platform. According to the JLP Pool page, the current APR of JLP is 72.47%, but this data is updated once a week and is different from the actual income.

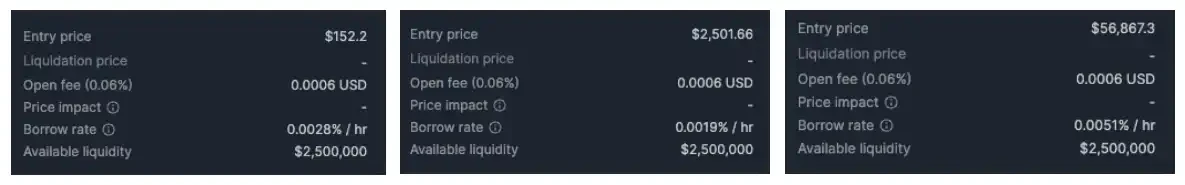

You can manually calculate directly on the contract trading page. The interest rates of different pools are different, which is the borrowing rate in the figure below. If calculated based on the SOL interest rate, 0.0028% per hour (x24 hours x365 days), the annualized rate is 24.53%. Similarly, Ethereums annualized rate is 16.64%, and Bitcoins annualized rate is 44.68%, that is, the total annualized rate is 85.58%.

From left to right are the contract-related fees of SOL, ETH, and wBTC

JLP Investors: Gains and losses are smaller than the underlying assets

The fees generated by the transaction will be reflected in the platform token JLP. According to the official introduction, the value of JLP comes from three aspects.

The first is 75% of the fees for opening, closing, borrowing and fund pool transactions. Since the platform fee can be shared, the net value of this part of JLP is basically in an upward state.

The second is from 5 underlying assets. Theoretically (Target Welghtage in the figure below), the price of one JLP is composed of 44% SOL, 10% ETH, 11% WBTC, 26% USDC and 9% USDT. The net value of JLP is also calculated based on these factors on the official platform page, which is currently $3.18.

The rise and fall of SOL, Ethereum and Bitcoin will also cause JLP to change accordingly. Therefore, some community members believe that buying JLP at a low point is a good choice, which can not only benefit from the increase in the underlying assets, but also get the platform fee.

However, a careful comparison of the rise and fall of JLP and other assets shows that JLPs volatility is smaller. The main reason is that 35% of JLPs value comes from stablecoins (USDT and USDC), and the price of stablecoins does not fluctuate violently.

In order to compare the increase of JLP more specifically, DeFi researcher @22333D calculated the price changes of JLP and equal shares of SOL, Ethereum and Bitcoin from May 7 to May 19, and found that JLP had the smallest increase, with JLP increasing by 5.3%, while the corresponding SOL, Ethereum and Bitcoin increased by a total of 6.8%.

@2233 3D explained that the shortfall may come from the currency standard loss of the JLP platform. This is also the third source of JLP value, namely the traders profit and loss, which is negatively correlated with the JLP price. If a trader makes a lot of money, the net value of JLP will decrease, which is equivalent to the asset composition of JLP being earned by the contract player, and vice versa.

Although the platform will also be in a loss-making state in the short term, according to flyingfish data , JLPs profits have generally been greater than its losses since the beginning of this year.

Treat JLP as financial management?

Currently, you can purchase JLP directly on the JLP official website through the Jupiter current price order, with 0 handling fees. Part of the purchased JLP comes from LP, and part is newly minted JLP. When JLP reaches the TVL limit (US$700 million), minting will stop. The current TVL is US$591 million.

@2233 3D pointed out that if you use SOL to buy JLP, it is equivalent to exchanging 56% of SOL for stablecoins, Ethereum and Bitcoin. Then, by using 35% of the total JLP position to buy SOL, you can use hedging to achieve SOL financial management.

If you use USDT or USDC to buy JLP, you can use 44% of JLPs total position to short SOL, 10% to short Ethereum, and 11% to short Bitcoin. This actually turns JLP into a financial product based on stablecoins.

In addition, JLP also has other arbitrage methods, such as depositing JLP on Solanas lending platform Kamino, borrowing stablecoins and then buying JLP to achieve leveraged mining. However, because of the casino factor of JLP, its price has uncontrollable risks. Whether as a contract player or a token investor, you need to be cautious, DYOR.

This article is sourced from the internet: Why is JLP, the best fixed-price investment in the cryptocurrency circle, so resistant to declines?

Related: Bloomberg reporters perspective: 48 hours of Bitcoin 2024 conference

Original article by Zeke Faux, Bloomberg Original translation: Luffy, Foresight News On July 17, about a week before Donald Trump took the stage in front of 8,000 Bitcoin fans in Nashville, Bitcoin Magazine CEO David Bailey gleefully explained how he and his friends had gotten the presidential candidate to attend the convention. Bailey, a 33-year-old with a baby face and a thick beard, appeared on a podcast called Galaxy Brains and told the host that the event was so crazy that he was keeping a journal to record what was going on. “I’m not going to publish this because no one is going to believe it,” Bailey said. Why is Bailey so excited? It’s easy to understand why. Trump will attend the Bailey Company conference, a convention for Bitcoin’s true…