Rapport de recherche sur le sentiment du marché des crypto-monnaies (26/07/2024-08/02) : Le Bitcoin chute alors que la Fed continue de diriger

Bitcoin falls as Fed remains on hold

Since inflation has fallen less quickly than expected, the Federal Reserve has kept its interest rate target range between 5.25% and 5.5% since the end of July last year, the highest level in 23 years. After the interest rate meeting, Bitcoin fell to as low as $62,300 and then rebounded.

As the third quarter draws to a close, most market participants expect the Federal Reserve to cut interest rates. If the fight against inflation continues to make good progress, a rate cut could be announced as early as this years September meeting. This could be a positive factor for risk assets such as Bitcoin.

Historically, a lower interest rate environment is good for cryptocurrencies as investors tend to seek higher-yielding assets. Despite the uncertain economic outlook, the prospect of looser monetary policy has boosted positive sentiment toward Bitcoin. However, investors need to be mindful of the risk of price volatility in the short term.

There are about 47 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Analyse de l'environnement technique et du sentiment du marché

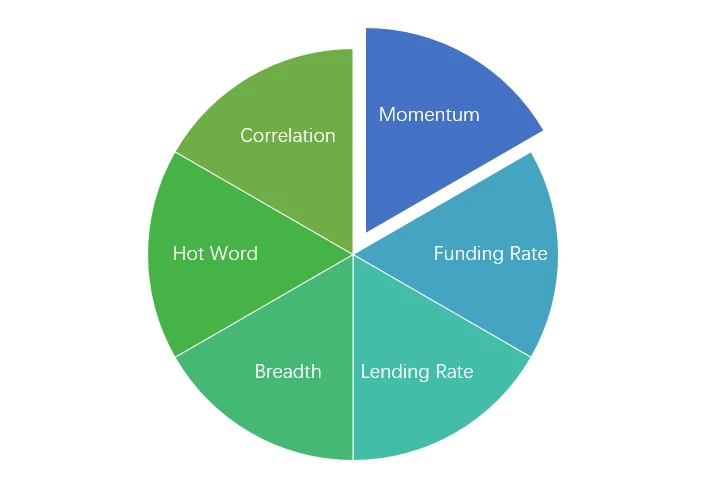

Composants d'analyse des sentiments

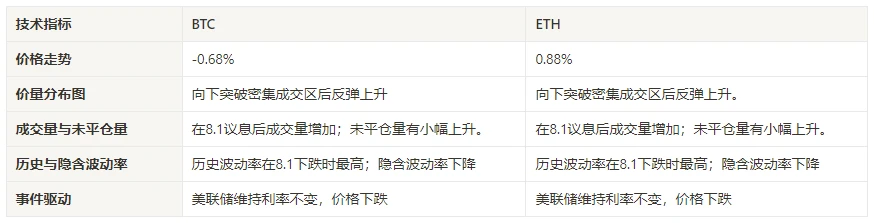

Indicateurs techniques

Tendance des prix

BTC price rose -0.68% and ETH price rose 0.88% over the past week.

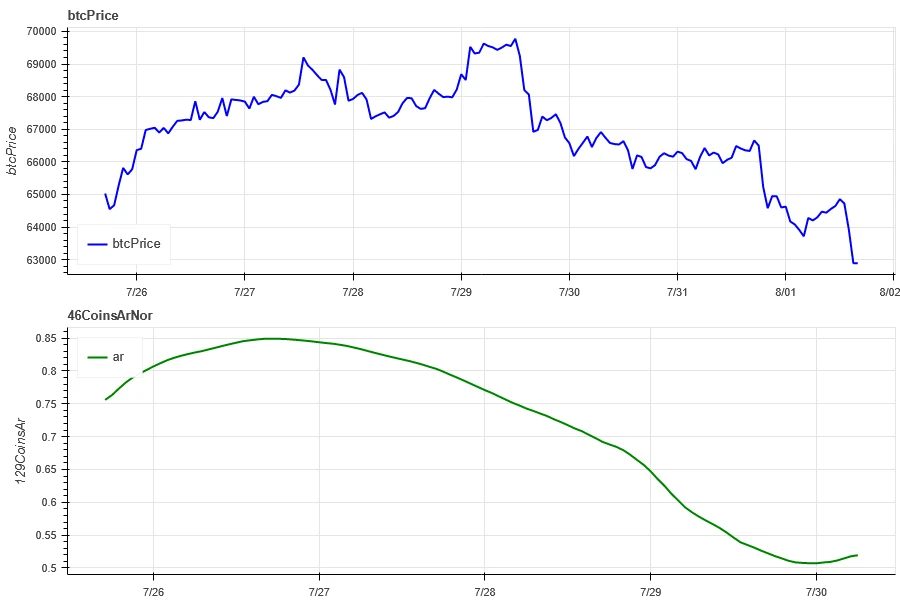

L’image ci-dessus est le graphique des prix du BTC au cours de la semaine dernière.

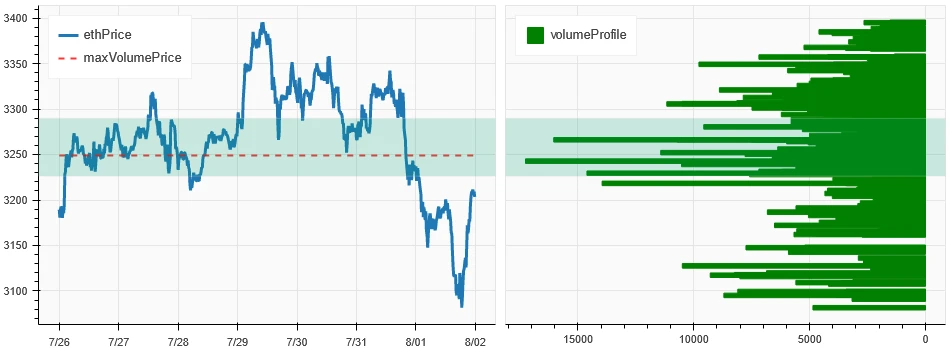

L’image ci-dessus est le graphique des prix de l’ETH au cours de la semaine dernière.

Le tableau montre le taux de variation des prix au cours de la semaine dernière.

pctChange1Day3Day5Day7Daybtc_pctChange1.12% -2.14% -3.74% -0.68% eth_pctChange-0.91% -3.44% -1.4% 0.88%

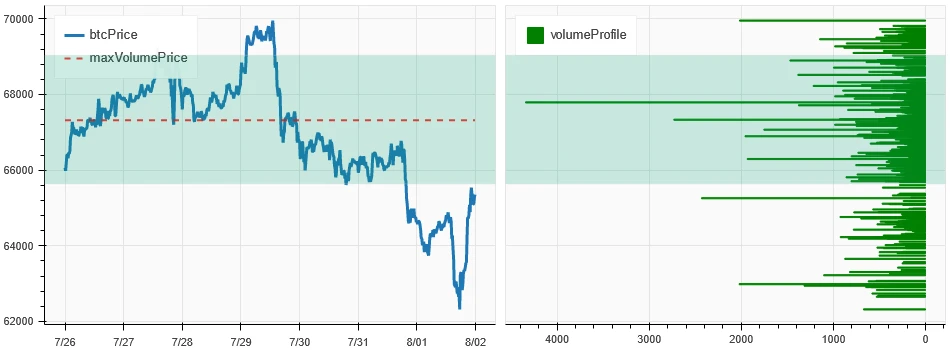

Graphique de distribution du volume des prix (support et résistance)

In the past week, BTC and ETH broke down from the concentrated trading area and then rebounded.

L'image ci-dessus montre la répartition des zones de trading denses de BTC au cours de la semaine dernière.

L’image ci-dessus montre la répartition des zones de négociation denses d’ETH au cours de la semaine dernière.

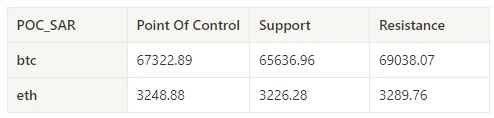

Le tableau montre la fourchette de négociation hebdomadaire intensive du BTC et de l’ETH au cours de la semaine dernière.

Volume et intérêt ouvert

In the past week, the trading volumes of both BTC and ETH increased after the August 1 interest rate meeting; the open interest of both BTC and ETH increased slightly.

Le haut de l'image ci-dessus montre la tendance des prix du BTC, le milieu montre le volume des transactions, le bas montre l'intérêt ouvert, le bleu clair est la moyenne sur 1 jour et l'orange est la moyenne sur 7 jours. La couleur de la ligne K représente l'état actuel, le vert signifie que la hausse des prix est soutenue par le volume des transactions, le rouge signifie la fermeture des positions, le jaune signifie l'accumulation lente des positions et le noir signifie un état de surpeuplement.

Le haut de l'image ci-dessus montre la tendance des prix de l'ETH, le milieu est le volume des transactions, le bas est l'intérêt ouvert, le bleu clair est la moyenne sur 1 jour et l'orange est la moyenne sur 7 jours. La couleur de la ligne K représente l'état actuel, le vert signifie que la hausse des prix est soutenue par le volume des transactions, le rouge signifie la fermeture des positions, le jaune accumule lentement les positions et le noir est encombré.

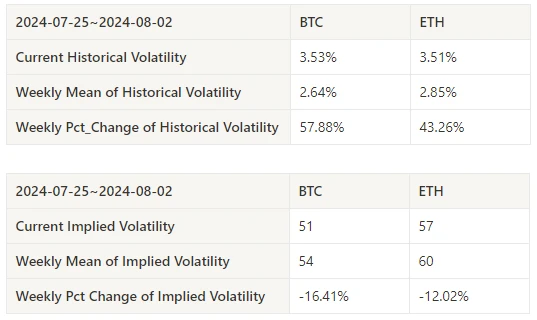

Volatilité historique vs volatilité implicite

Historical volatility for BTC and ETH was highest this past week at 8.1; implied volatility for both BTC and ETH fell.

La ligne jaune représente la volatilité historique, la ligne bleue la volatilité implicite et le point rouge la moyenne sur 7 jours.

Piloté par les événements

The Federal Reserve kept interest rates unchanged this past week, and after the interest rate meeting, Bitcoin fell to a low of 62,300.

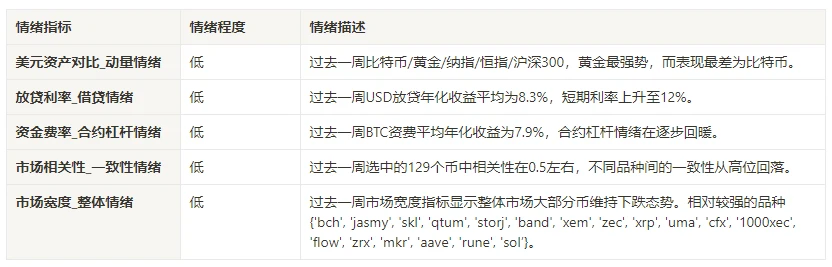

Emotional indicators

Sentiment d’élan

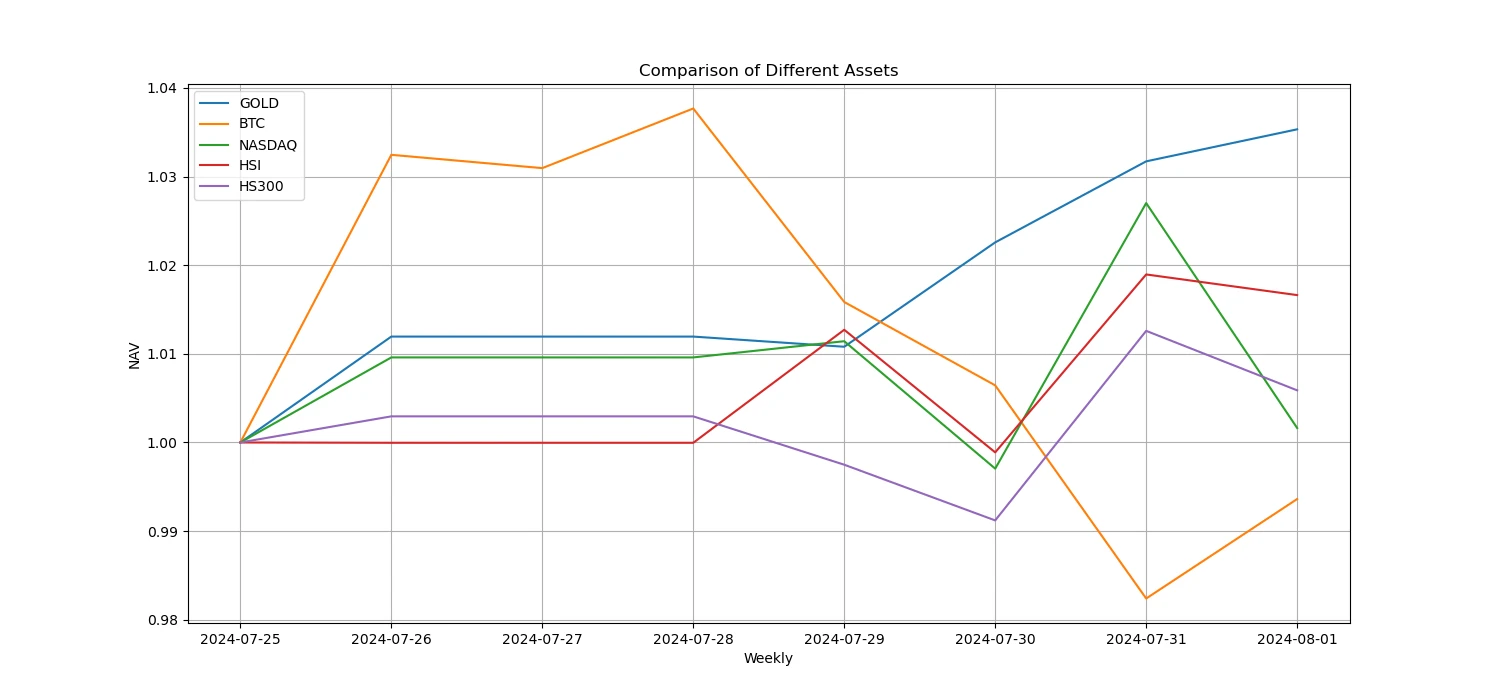

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

L'image ci-dessus montre la tendance des différents actifs au cours de la semaine dernière.

Taux de prêt_Sentiment de prêt

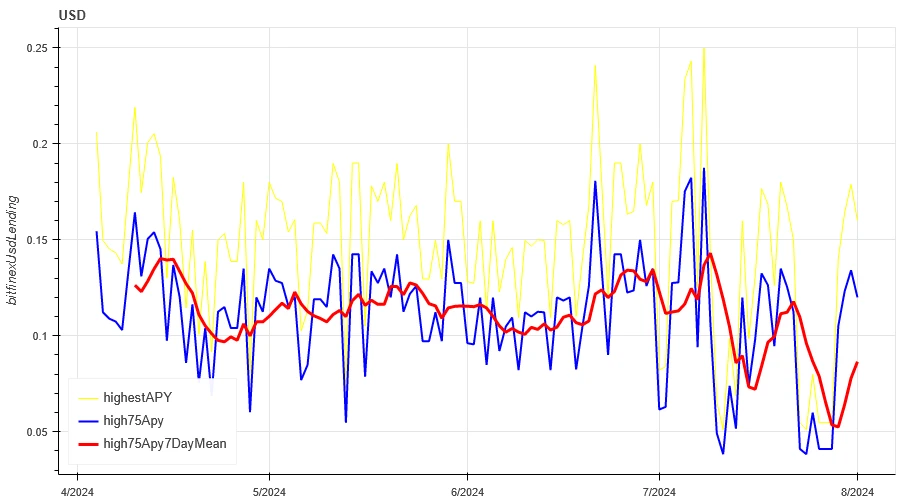

The average annualized return on USD lending over the past week was 8.3%, and short-term interest rates rose to 12%.

La ligne jaune représente le prix le plus élevé du taux d'intérêt en USD, la ligne bleue représente 75% du prix le plus élevé et la ligne rouge représente la moyenne sur 7 jours de 75% du prix le plus élevé.

Le tableau montre les rendements moyens des taux d'intérêt en USD à différents jours de détention dans le passé.

Taux de financement_Sentiment de levier du contrat

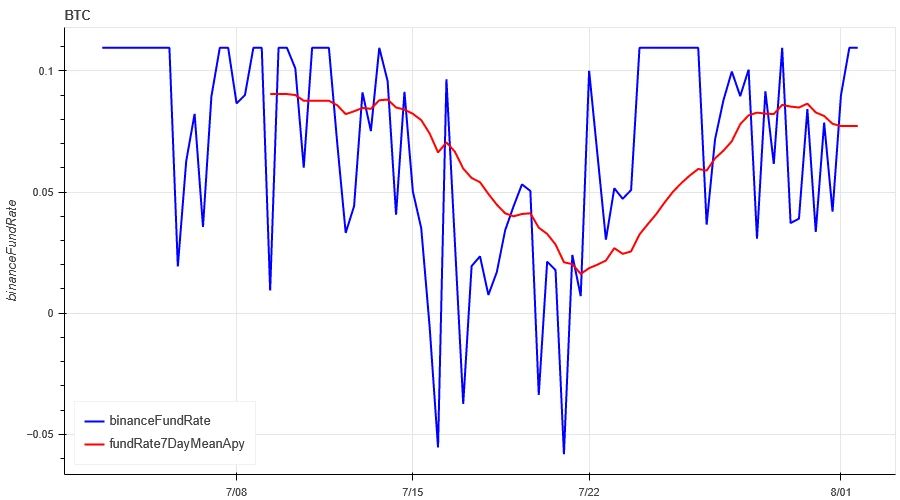

The average annualized return on BTC fees in the past week was 7.9%, and contract leverage sentiment is gradually recovering.

La ligne bleue est le taux de financement du BTC sur Binance, et la ligne rouge est sa moyenne sur 7 jours.

Le tableau montre le rendement moyen des frais BTC pour différents jours de détention dans le passé.

Corrélation du marché_Sentiment de consensus

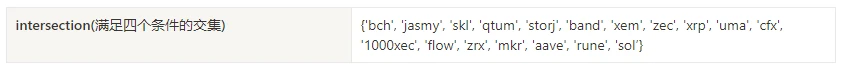

The correlation among the 129 coins selected in the past week was around 0.5, and the consistency between different varieties fell from a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Étendue du marché_Sentiment général

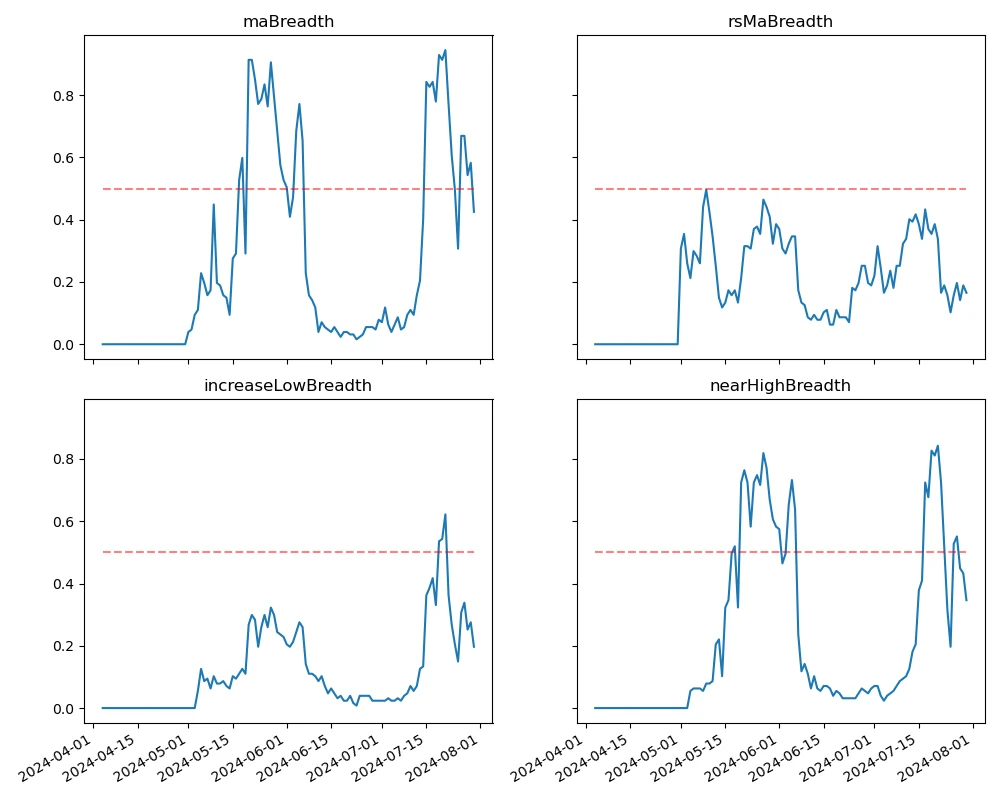

Among the 129 coins selected in the past week, 42.5% of the coins were priced above the 30-day moving average, 16.5% of the coins were priced above the 30-day moving average relative to BTC, 20% of the coins were more than 20% away from the lowest price in the past 30 days, and 35% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

Résumer

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell after the interest rate meeting, while the volatility and trading volume of these two cryptocurrencies increased after the interest rate meeting on August 1. The open interest of Bitcoin and Ethereum has increased slightly. In addition, the implied volatility of Bitcoin and Ethereum has decreased simultaneously. Bitcoins funding rate has rebounded slightly from a low level, which may reflect the gradual recovery of market participants leverage sentiment towards Bitcoin. Market breadth indicators show that most cryptocurrencies have retreated, indicating that the overall market has continued to fall in the past week.

Twitter : @ https://x.com/CTA_ChannelCmt

Site web: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.26-08.02): Bitcoin Falls as Fed Keeps Steering

Related: Hack VC: A hacker who invests in hackers, an infrastructure maniac in crypto VC

Original author: TechFlow In the crypto market of 2024, there is one crypto VC that you cannot ignore. Prefers lead investors, with 50% of the projects invested this year being lead investors, including the familiar io.net, Initia, AltLayer, imgnAI, etc. Prefer infrastructure, with one-third of the projects invested being infrastructure, including Berachain, EigenLayer, Movement, Babylon, SUI, Eclipse, etc. In addition to funds, they also have technology and developer communities that can empower the projects they invest in for the long term; The name of this VC is Hack VC . As the name suggests, they are a group of tech geeks invested in hacking. This article will give you an inside look at the story behind Hack VC and its founding partner Alexander Pack. Starting from Hong Kong, connecting the…