Institut de recherche Bitget : les actifs de compensation de Mt.gox continuent d'être vendus et les conditions du marché à court terme sont mauvaises

Au cours des dernières 24 heures, de nombreuses nouvelles devises et sujets populaires sont apparus sur le marché, ce qui peut être la prochaine opportunité de gagner de l'argent, y compris:

-

The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO);

-

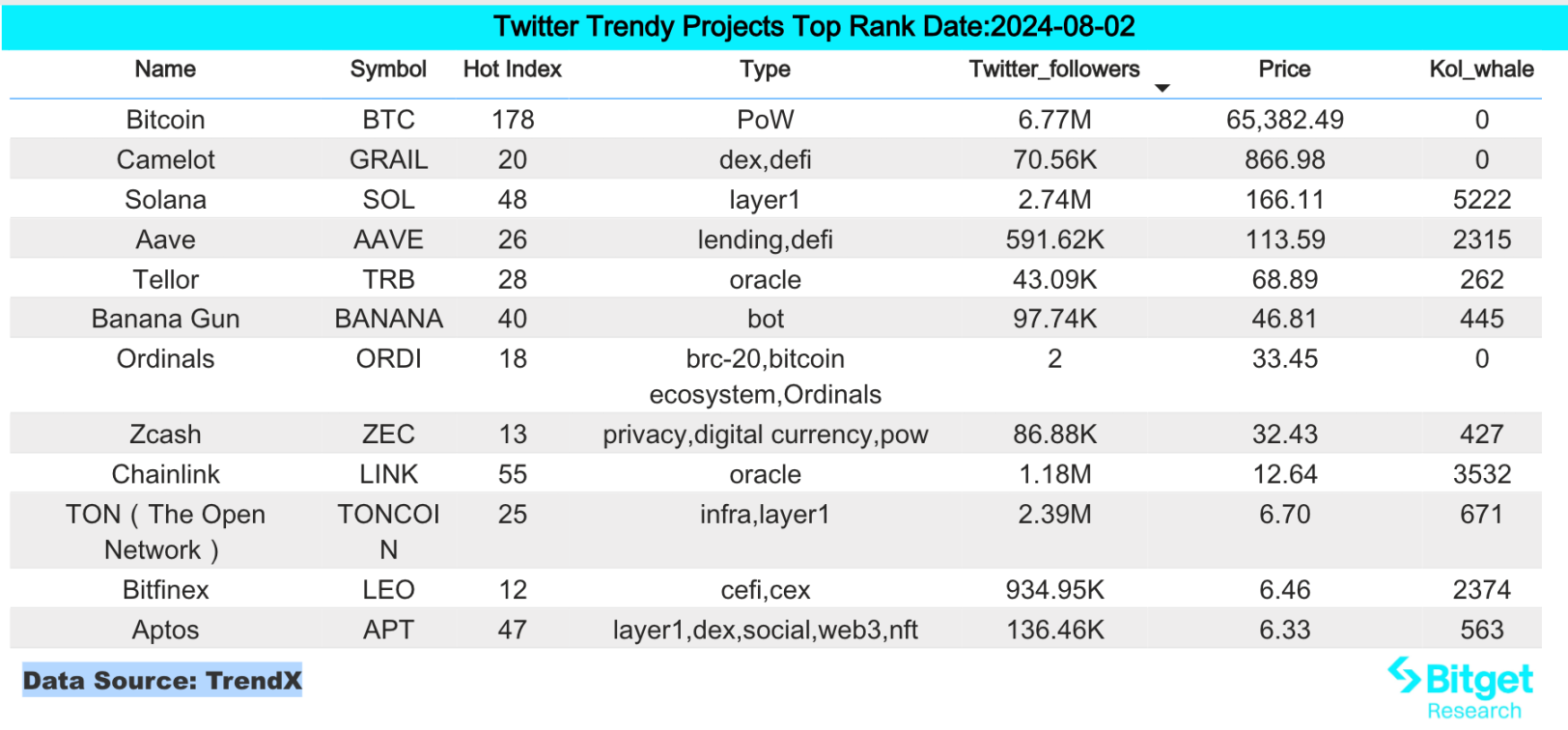

Hot search tokens and topics by users are: Morpho, Aptos;

-

Les opportunités potentielles de largage aérien incluent : Symbiotic, Mezo ;

Data statistics time: August 2, 2024 4: 00 (UTC + 0)

1. Environnement du marché

The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge of a monetary easing cycle by the Federal Reserve, which is a positive for risk markets in a sense.

Although the U.S. spot Ethereum ETF had a net inflow of $26.2 million and the spot Bitcoin ETF had a net inflow of $50.4 million yesterday, Bitcoin still maintained its downward trend and continued to fall sharply after reaching $70,000 this week. The price fell to a two-week low of $62,700 last night, and the short-term market conditions are poor.

2. Secteur créateur de richesse

1) Sector changes: Curve-related tokens (CRV, CVX)

raison principale:

-

The whale has withdrawn a total of 18 million CRV (US$4.68 million) from Binance and OKX in the past 30 hours, with an average price of US$0.26. At the same time, the whale who withdrew CRV from CEX yesterday withdrew another 5.5 million CRV (approximately US$1.51 million) from Binance.

Rising situation: CRV and CVX rose by 7.46% and 5.38% respectively in the past 24 hours;

Facteurs affectant les perspectives du marché :

-

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, the previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

2) Changes in the sector: Meme sector (NEIRO)

raison principale:

-

NEIRO has received a lot of support from KOLs, especially those in Japanese. With the help of KOLs with tens to hundreds of thousands of fans, such as @apipiro 22, @mikky_ 8080, @yukimaru_potty, @BrotherMKT, @KookCapitalLLC, and @OfficialTravlad, the price of NEIRO has also risen.

Rising situation: NEIRO rose 15% + against the trend on the day;

Facteurs affectant les perspectives du marché :

-

On-chain activity: The valuation of DeFi infrastructure depends on whether the chain can have a stable market share, that is, the number of active on-chain users and DEX trading volume, which has a huge impact on DEX, PERP, language machine, and liquidity staking projects of different public chains. Investors should pay close attention to this type of data so that they can judge the markets upward and downward revisions to their valuations;

-

Impact on funding: After the launch of the Ethereum ETF, market funds began to gradually increase the liquidity of ETH. Affected by the increase in liquidity, related meme tokens may rise further in the future due to capital transmission.

3. Recherches rapides des utilisateurs

1) Dapps populaires

-

Morpho

DeFi lending protocol Morpho has completed a $50 million financing round led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed. Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of the P2P matching engine used in the order book. Morpho-Compound improves on Compound by providing the same user experience, the same liquidity, and the same liquidation parameters, but with an increased APY due to peer-to-peer matching.

2) Twitter

-

Aptos

Yesterday, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new $10 million fund to support the growth of the Aptos ecosystem and the widespread adoption of Web3. The fund will be used to develop an accelerator program in partnership with Ankaa to drive the growth of high-quality projects and applications based on Aptos. Aptos is a scalable Layer 1 PoS blockchain that uses the Move programming language to make on-chain transactions more reliable, easy to use, and secure. The accelerator will provide selected Aptos ecosystem projects with risk support, focused guidance, marketing exposure, and a joint network of experts from OKX, Ankaa, and the Aptos Foundation.

3) Région de recherche Google

D'un point de vue global :

Why is down today fear and greed index:

Yesterday, the US July ISM Manufacturing PMI fell far more than economists expected, causing interest rates to fall to multi-month lows. The VXX index rose by 13.55%, the markets risk aversion heated up, and crypto assets followed suit.

Parmi les recherches les plus fréquentes dans chaque région :

(1) Hot topics in the CIS region include Tapswap. TapSwap is a Tap2Earn Mini App that was once liked by Telegram founder Pavel Durov. It was launched at the end of 2023 and was initially released on the Solana network. It was later transferred to the TON ecosystem. The overall popularity of the project is extremely high.

(2) There are also no obvious hot spots in Asia, but the Philippines has shown interest in US stocks such as Tesla and Nvidia.

(3) Latin America showed a higher interest in SOL and ETH, and AI project tracks appeared on the hot searches in Colombia and Argentina.

Potentiel Largage aérien Opportunités

-

Symbiotique

Symbiotic est un projet de restaking à usage général qui permet aux réseaux décentralisés de lancer des écosystèmes puissants et entièrement souverains. Il fournit une méthode pour les applications décentralisées, appelées Active Validation Services ou AVS, pour assurer collectivement la sécurité des uns et des autres.

Symbiotic a récemment clôturé son tour de financement d'amorçage, avec la participation de Paradigm et Cyber Fund, avec un montant de financement de 10T5,8 millions de dollars américains.

How to participate: Go to the project鈥檚 official website, link your wallet, and deposit ETH and ETH LSD assets.

-

Mézo

Mezo est un projet BTC Layer 2 qui se concentre sur l'écosystème BTC, aidant les détenteurs de BTC à transférer et à gérer l'argent sur la chaîne et à stimuler le développement du système BTC DeFi. Mezo a récemment annoncé l'achèvement d'un tour de financement de 10 millions de dollars, avec des institutions participantes telles que Pantera Capital, Hack VC, Multicoin Capital et d'autres institutions de premier plan du secteur.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Méthodes de participation spécifiques : 1) Visitez le site officiel du projet et trouvez le code d'invitation dans Discord ; 2) Entrez le code d'invitation et liez le portefeuille unisat ; 3) Déposez du BTC.

Plus d'informations sur Bitget Research Institute : https://www.bitget.fit/zh-CN/research

Le Bitget Research Institute se concentre sur les données en chaîne et l'exploitation d'actifs précieux. Il exploite des investissements de valeur de pointe grâce à la surveillance en temps réel des données en chaîne et aux recherches régionales à chaud, et fournit des informations au niveau institutionnel aux passionnés de cryptographie. Jusqu'à présent, il a fourni aux utilisateurs mondiaux de Bitgets des actifs précieux à un stade précoce dans plusieurs secteurs populaires tels que [Arbitrum Ecosystem], [AI Ecosystem] et [SHIB Ecosystem]. Grâce à des recherches approfondies basées sur des données, il crée un meilleur effet de richesse pour les utilisateurs mondiaux de Bitgets.

« Clause de non-responsabilité » : le marché est risqué, alors soyez prudent lorsque vous investissez. Cet article ne constitue pas un conseil en investissement et les utilisateurs doivent se demander si les opinions, points de vue ou conclusions contenus dans cet article sont adaptés à leur situation spécifique. Investir sur la base de ces informations est à vos propres risques.

This article is sourced from the internet: Bitget Research Institute: Mt.gox compensation assets continue to be sold, and the short-term market conditions are poor

Related: Viewpoint: Web3 needs Mass Admission, not Mass Adoption

Original author: Cryptoskanda (X: @thecryptoskanda ) Old investors know that every time the market is down, people will blame the market for not attracting Web2 users, so no new funds come in. This is the so-called Mass Adoption narrative, that is, Cryptos Web3 products must cater to Web2s non-profit-oriented users. This logic is like African children will starve to death because you waste food in China, which makes sense but is illogical. Mass Adoption – First understand who Mass is? Who are MASS? Don’t just generalize to traditional Web2 users — Bullshit. “Mass” is a group of different but categorizable individuals. The blind man does not drive a domestic electric car, not because he does not support domestic products, but because he does not have a drivers license (no demand).…