Les joueurs de mèmes révèlent les règles du jeu du marché : restez à la table et saisissez l'opportunité d'être un chasseur

Auteur original : Joyce , BlockBeats

Original editor: Jack , BlockBeats

Ive quit my job for a few months and have been working on memes full-time, meme player Lu Qi (pseudonym) told BlockBeats. Four months ago, the meme coin BOME on Solana attracted many crypto newbies to start playing memes with its market value rising from $0 to $1.5 billion in three days, a 100-fold increase. Lu Qi was one of them. When I was playing memes, I put about 30,000 to 40,000 yuan in my wallet. I havent added any money in the past few months. I can make 70,000 to 80,000 yuan a month.

There are many people who are in a similar situation to Lu Qi. These people only trade meme coins, live on the chain almost 24 hours a day, and wait for an entry opportunity with only 3 minutes. The time they hold meme coins is usually measured in minutes.

Most of the tokens they traded came from Pump.fun, a token issuance platform on Solana. For several months, Pump.fun has maintained an average daily revenue of over $600,000, with more than 10,000 new tokens appearing on Pump.fun every day. Many people shuttle between the fragmented liquidity, seeking stage-by-stage deterministic returns in various ways.

500K cap, only play small

Four months ago, if the market value of a coin on Ethereum was less than $1M, most people would have speculated that the consensus on the token was loose and the team was too “abandoned” to take action. But on Solana, the cost and time to reach a consensus that is just enough to make money is much smaller, so the difference between the hunter and the prey is only a few minutes.

3 minutes, hunter becomes prey

Jiawei (pseudonym), who has been in the circle for less than a year and has just started to work hard on memes, has already felt that he is falling behind. Someone in the group asked what uni is. My first reaction was uniswap, but in fact everyone was talking about unibot.

After seeing a token contract, a general trader needs to copy it to a line-reading tool for analysis before deciding whether to buy. For meme players, this process takes minutes. When more than ten minutes have passed since a tokens buy signal appeared, you need to be alert to the upcoming closing moment.

The split of meme coins IQ (left) and ZESTY (right)

The principle of fast in and fast out is very simple. Players believe that meme coins that are expected to rise must go through the order calling stage. In order to get cheap chips as soon as possible, they need to enter the market before others. Entering the market a few minutes later can result in a several-fold difference in the purchase price. If the profit is small, it is not a big deal. Most of the time, entering the market three minutes later is likely to be a high-level takeover.

For example, the meme coin CLOWN had shown signs of rising before 01:20, and then rose more than 4 times in the next ten minutes, and then fell all the way back to the initial position. The token contract sent to the group has gone through the process of the monitoring tool releasing signals, the copycat hunter capturing information and entering the market, and the group members discovering and sharing it. When it is seen by traders, it has to go through the process of selecting the contract, analyzing it on the line-reading tool, and placing an order to buy. If the entry time is only a few minutes away, doubling may turn into a loss.

Left: The second line of the meme coin CLOWN, right: Community discussion about a meme coin

Find ten times in a small plate

The strategy of quick in and quick out is based on the conservative estimation of market value by meme players, which is the rule of the game in the meme market. In some telegram communities that share meme coins, the number of group members ranges from 400 to 500, and as many as several thousand. As long as the market value of a meme coin can be raised from less than 100K to several hundredK, the profits of the big players who ambushed in the early stage will be enough.

Traders need to analyze their position in the plate. If latecomers can enter the market at 100K-200K, they can also multiply their profits. 500K is already the closing position considered by many meme players, and the market value of 600K will be considered a bit high. Going higher requires more certainty signals to let you hold on.

A traders trading records on meme coins ABDUL and MUMI, with the highest market capitalizations of 247.5K and 483.5K respectively

There is another reason why the meme market is generally low in market value, that is, the participants do not have much capital. After communicating with several meme players, BlockBeats found that many players have a capital of about 3-5 SOL, and can trade up to two tokens at a time, with each transaction amount ranging from 0.5 SOL to 2 SOL. I feel that when the market is not good, the meme market will be hotter, said Lu Qi.

More sophisticated tools

The bottom market value of tokens with certainty of pull-up expectations often depends on grabbing. For credibility considerations, the market value of meme coins posted by group members to the community is often above 100K, but the real high multiples can only be obtained by entering the market when the price is tens ofK.

You cant make money by waiting for others to output in the group. For Beibei (pseudonym), group messages are only used as auxiliary references for transactions, and active monitoring can ensure the initiative. BlockBeats found that players who often rush memes will use two or three tools at the same time, the most commonly used ones are GMGN, NFT Sniper (also known as abot) and Bullx.

Checking the trend of tokens is only the most basic function of these tools. The preparation work for the meme can be divided into finding people from coins and finding coins from people . In this demand, some tools are suitable for making dashboards and analyzing chip distribution, some tools are more sensitive in notifying address changes, and some perform better in transaction speed.

Knowing how to use it is just the first step. Finding the smart money and sniping tools that suit you is the most important thing.

GMGN and NFT Sniper have outstanding advantages in viewing the distribution of chips of relevant stakeholders. GMGN is relatively friendly to novices. You can view indicators including dev, front-row buyers, large holders, smart money, KOL, etc., and you can also create a list of wallets to follow. In the link of finding coins from people, GMGN and NFT Sniper also provide a reminder function for on-chain changes. Users add the on-chain addresses they want to monitor to the watch list. When these addresses generate transactions, users can receive reminders on the web or mobile tgbot and get information in the first place.

Left: GMGN; Right: NFT Sniper

Meme player Xu Bai (pseudonym) maintains the same smart money list with his friends. Whenever a new signal pops up, Xu Bai will check how many wallets are on the car and use GMGN to check the historical transactions of the front-row addresses of the tokens to decide whether to buy. When the signal appears frequently, Jiawei will first look at NFT Sniper. The NFT Sniper interface has few icons, and the process of obtaining information is more convenient, and there are more sophisticated automatic trading strategies.

Left: GMGN; Right: NFT Sniper

In addition to equipping with the right tools from these perspectives, traders who want to get more alpha signals will not only rely on the instructions of smart money, but will actively look for earlier new coins, such as meme coins that are still in the inner market. The inner market refers to the stage before the market value of new coins released on Pump.fun is less than 67.8K and the liquidity is transferred to raydium. Most new coins cannot meet the inner market, but there will be a few guaranteed players with signals.

In this kind of coin, meme players assume that they are competing with the dealer for chips, and will use the word plug to refer to buying in. This will lead to a faster discovery speed. Beibei prefers to use Bullx, the experience of monitoring new coins is very good, and the transaction is also very fast.

Bullx Page

GMGN, NFT Sniper and Bullx have overlapping functions, but different advantages. In the community, you can often see meme players discussing their experience of using these tools and comparing their response speeds. Only when you master the usage of the dog-rushing tools that suit you can you be considered to have entered the meme-rushing stage.

Dev must run, but dev is still needed

To win in trading, the most important thing is to understand who your counterparty is and try to predict their actions. In the meme market, the role of the counterparty has changed several times, from dev to CTO team, from conspiracy group to smart money.

CTO becomes a consensus

As early as the end of last year when the Solana ecosystem staged a meme season, the community discussed the dev rug trap of meme coins. After the token rises, the dev can withdraw the pool or sell the coins obtained at a very low cost to take away all the liquidity on board, leaving a broken head route.

At that time, the main tool for tracking the trend was Birdeye, which could only distinguish traders by three different types of trading volume, and the dev team was hidden in the dark. However, after the emergence of on-chain tracking tools such as GMGN and NFT Sniper, this situation was completely changed. Both of them can clearly show the chips of the dev and early traders.

Left: birdeye; middle: GMGN; right: NFT Sniper

It only costs 0.02 SOL to issue a coin on Pump.fun, and once the token is rushed to the foreign market, the dev can get several times the profit. Now with the brand signal, there is an extra layer of insurance. Many meme players told BlockBeats that not buying meme coins with dev still on the train is one of their trading principles. Developers are time bombs. My habit is not to buy if I see that the dev is still there, and wait for the signal of dev selling before getting on the train, Lu Qi told BlockBeats.

Therefore, most meme coins can only rise after dev sells. When Jiawei first started using GMGN, he found that many meme coins’ devs would sell at the opening, completely missing out on the subsequent rise. For example, DLORF and OOO in the figure below, they started to rise 10 minutes and 1 hour after dev sold all tokens, respectively, and the rise was dozens of times.

The red DS icon in the picture represents the operation of dev selling tokens

However, dev sell can only be regarded as a signal to eliminate the risk point. Most of the meme coins that can rise are inseparable from the CTO link.

CTO means Community Takeover, which refers to the situation where the original developers abandon the project and it is taken over by the user community. After a crypto project is taken over by CTO, it means that the risk of insider trading by developers is eliminated for retail investors, and the project development is led by the community. For example, the disappearance of Satoshi Nakamoto and the rise of Bitcoin may be regarded as the most classic CTO model.

On meme, the CTO is represented by the team buying the rugged meme coins and continuing to operate the meme coin community on Twitter and Telegram. For a while, picking up the coins that were taken over by the CTO after the dev ran away would have a good certainty of return. Xu Bai recalled, At that time, after a token was taken over by the CTO, I would enter the Telegram group organized by the team to check the community atmosphere, and judge the tokens upside potential by whether the team played music, whether everyone was having a high time chatting, and whether they would pay to update the dex.

However, not all meme coins controlled by CTO can be safely invested. In terms of understanding CTO, Xu Bais perspective has shifted from feeling the community atmosphere to analyzing the distribution of chips.

10 seconds to enter, gang becomes the banker

Now, the CTO process has been incorporated into the standard part of the meme coin life cycle, and all meme coins have learned to release this selling point. GMGN has marked the token with the CTO takeover mark, and most of the meme coins on the hot list have the CTO logo, even though the coin has been online for less than an hour.

For example, in the MARU in the figure below, dev bought it soon after the token was launched, but sold it all after only 27 seconds, earning only 0.01 SOL (about 2.08 USD) at a cost of 5 SOL. After dev sold it, MARU began to rise, increasing 20 times in 50 minutes.

The yellow icon in the picture means CTO community takeover

Are there really so many CTO teams that react quickly and shout orders with miraculous effects? Most CTOs are self-directed and self-acted. This is common sense for memes. Xu Bai said that after BlockBeats interviewed several meme players, they found that they are already familiar with the CTO routines. Some of them are in the name of God Plate Team. I have seen four or five people who say they are from the GME CTO team, Lu Qi recalled. Some are light speed CTOs. After the dev buys and sells to make a profit, the original CTO comes to make another profit.

Take MARU as an example. Less than 10 seconds after the dev sold the coin, several addresses quickly bought it and became the major coin holders. They sold it in batches after the profit rate reached 20-40 times, causing the price of MARU to fall by 52% in 7 minutes. In the communitys view, this situation is likely to be a case of the dev team acting as a CTO to engage in insider trading.

MARU’s major coin holders’ transaction records

Meme players already have a way to deal with it, and the profitability of large coin holders is also a must-see indicator for meme players. If you encounter a large holder who has just entered the market, you can try to follow him. If they make too much money, you should be cautious when you get on board, Jiawei said. Xu Bai has already changed his strategy. Now if I encounter a good opportunity and the dev is still on board, I will also follow him.

Milady cabals and the cabal

After the CTOs logic was no longer community governance but changed from individual to group, the potential rug thunder point returned to the consideration of retail investors. But in the eyes of meme experts, this process has room for profit. Milady cabals (Milady conspiracy group) was the first jargon Jiawei learned when he first started meme.

Searching for Milady cabals on Twitter will reveal a lot of discussions. The initial discussions were concentrated in late May. Lu Qi recalled, For a period of time, after a KOL with a Milady avatar called out orders on Twitter, several people with the same Milady avatar would quickly retweet him. The market value of the local dogs they called out was very high.

So turning on the Twitter bells of these people and monitoring their on-chain addresses is an important basis for meme players to go after the dog during this period. This discovery was so popular that the official Pump.fun also made a joke, Im already in the 13 Milady conspiracy groups, Im serious).

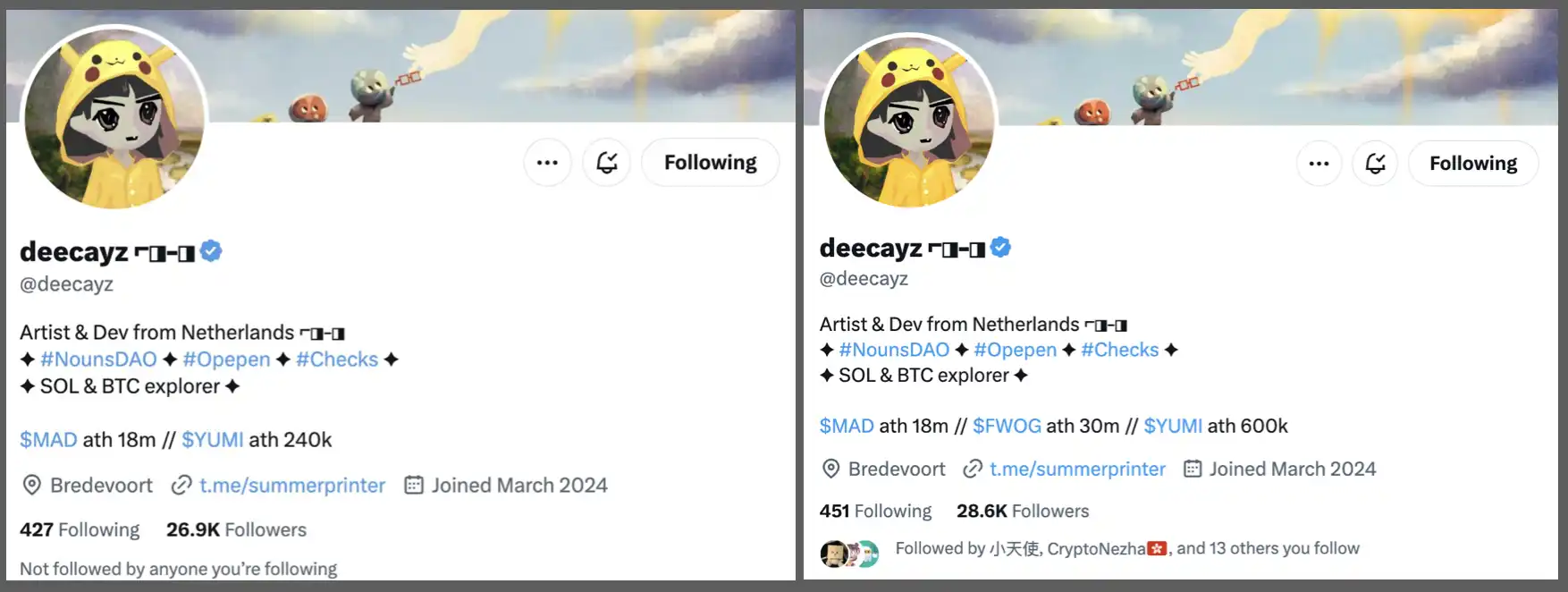

Yesterday, FWOG, which was originally not favored due to its imitations, achieved a 50-fold increase in 7 hours and a trading volume of over 60 million US dollars. The Twitter account avatar of its CTO team caller @deecayz is Milady, who showed two successful meme coins that he had once successfully created in his bio.

When FWOG reached a high point, the top three major investors of FWOG liquidated their positions to take profits. The on-chain monitor ai_9684xtpa analyzed that this operation caused the token to plummet by 73% in a short period of time. However, this did not affect deecayzs performance, and FWOG became his third successful work.

deecayzs Twitter bio

But Milady is not the only criterion for judging a conspiracy group. For meme players, any team that ambushes a large number of low-priced chips in advance, pushes up a meme coin through shouting orders, and then pulls up shipments is considered a conspiracy group. Meme players need to constantly look for new rival organizations. Now I only occasionally look at those Miladys, and my watchlist has been cleared out, Beibei said.

Stay at the table

Even though he has had many successful experiences, Lu Qi still spends up to 10 hours a day watching the market. Most of the time its boring, but the more boring it is, the more you should wait, waiting for that seemingly inexplicable opportunity.

The people following the orders may be fake smart money

Players who can continue to make money on memes believe that trading signals are actively squeezed out from a large number of information flows, and they will not wait for the code to wealth to appear in front of them.

As more and more people learn to track KOL addresses and smart money addresses that have been marked by public tools, players need to have stronger information analysis capabilities if they want to make money. Its getting harder and harder to follow orders now, said Lu Qi. The real code for wealth is always in a Schrodinger state.

There are many obstacles between players and real smart money. The first is the on-chain noise. Many people will look for smart money addresses among those with a high single-coin winning rate. However, from the perspective of smart money, it is not necessary to earn a tenfold or even a hundredfold profit rate in every investment. As long as there are enough plates and the principal is large enough, even if only a 20% increase in profit is obtained, considerable profits can be accumulated. Not all those who buy at low points are smart money, and those who pursue long-term returns do not want to be discovered by the market, said Xu Bai.

The second is the information gap. If the copy order is small, the price will be raised several times immediately after the smart money buys it. Blindly copying orders will only make you the exit liquidity of smart money. Crypto KOL 0x Sun mentioned this issue in a sharing article from the perspective of being copied a few days ago.

In addition, information asymmetry can only be applied in a small range. Retail investors want to track insider trading, but traders will squeeze the space for retail investors to grab low-priced chips through various means such as washing the market, killing copycats, and making matrix addresses. A few days ago, the KOL Wang Xiaoer, who vowed to be a diamond hand who made a lot of money on meme coins called on followers on Twitter not to follow his orders. He explained that he preferred to pick up meme coins with extremely low market value and have been launched for many days, but this strategy is meaningless after being copied. This can be seen as an example of the information asymmetry dividend of smart money becoming less and less in the copycat trend.

Many players that BlockBeats has communicated with have also realized this. Addresses followed by many people are not valuable, and you need to keep looking for new wallets to survive. Lu Qi, Bei Bei, and Xu Bai all spend a lot of energy on maintaining their own lists of followed addresses.

Strategies that fail at random times

If we were to summarize a universal meme-creating strategy, it would be respect experience, but experience will quickly become ineffective.

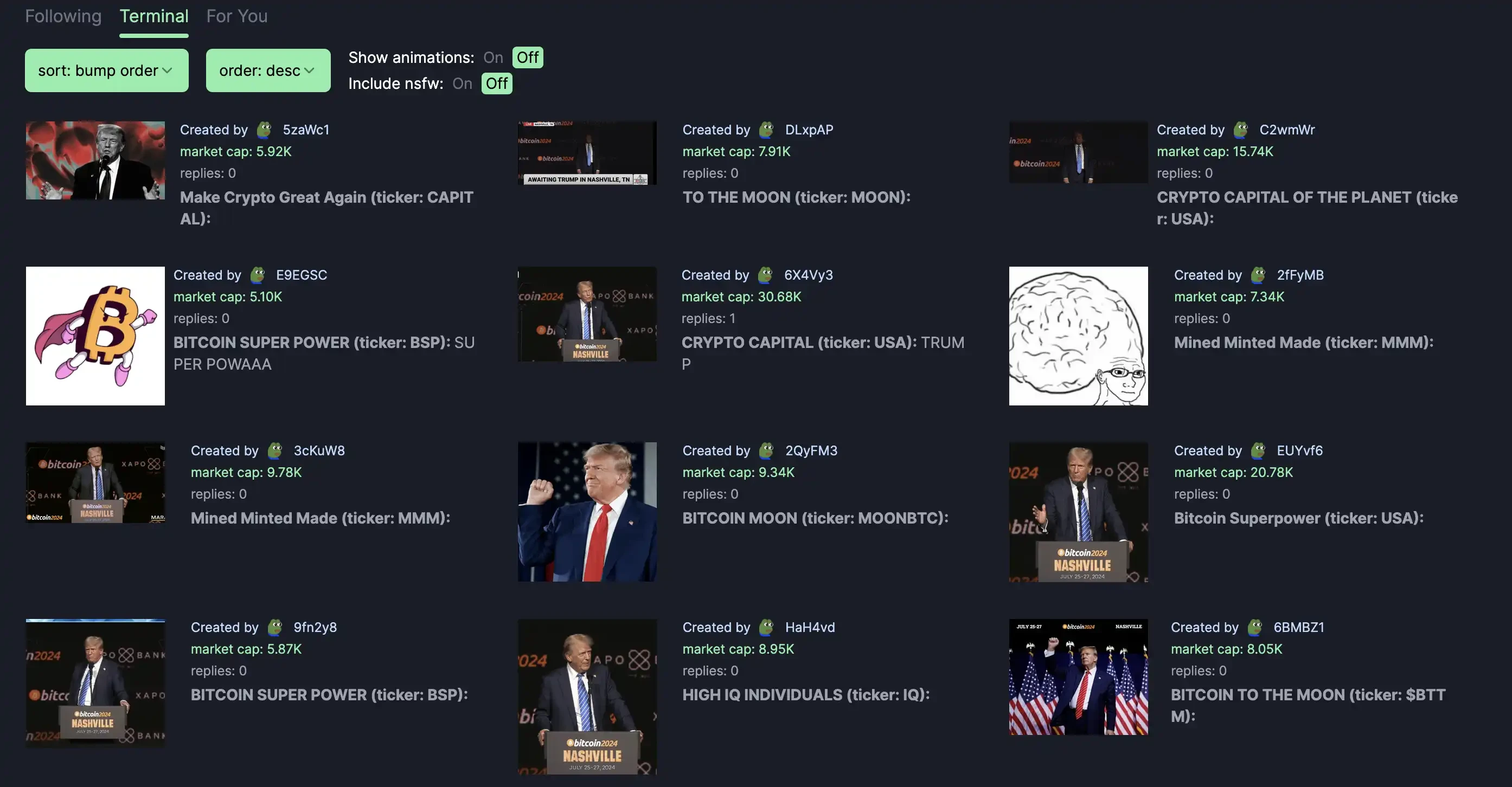

For example, memes surrounding Trump news were once a high-winning secret to wealth, but now they have been consumed a lot.

On the day Trump was assassinated, Lu Qi was serving as a best man for his friend. I woke up very early that day, and my first reaction after seeing the news about Trumps assassination was to look for related meme coins. I didnt have time to check the market, so I bought a lot of coins at once. Among the coins Lu Qi bought, EAR rose 80 times within 7 hours of its launch. I sold them all the way, but I also made a good profit.

Attention is the most important thing. When Trump is in the news, there must be coins that come out. Lu Qi has since made this judgment. A few days ago, when Trump, as the first former US president, gave a speech at the Bitcoin 2024 conference in Nashville, meme players postponed their attendance and waited for the entire speech, looking for bet targets in various keyword tokens that popped up in real time on Pump.fun. Among the dozens of related meme coins, none of them has a market value of more than 500K.

The Pump.fun homepage during Trumps speech

That day, the owner of the Shiba Inu Kabosu, the prototype of the meme coin DOGE, showed off his new pet on Twitter, which is translated into English as NEIRO. Trumps speech had just ended, and the meme coin Neiro had attracted $50 million in trading volume. What a mistake, I didnt expect the dog couldnt outrun Trump, the meme players who missed the opportunity complained in the group.

If the KOL address movement is taken as the dominant signal, the battle between the meme coins Neiro and NEIRO on that day would be completely messed up. NFT Sniper shows that 31 KOL addresses participated in the transaction of Neiro, and 28 addresses participated in NEIRO. Looking back, many KOLs also made mistakes.

The KOL deecayz, who used the Milady avatar to shout orders mentioned above, offered three meme coins to the community CTO the day before offering 50 times FWOG. Among them, the market value of the meme coin BEIRO, which clearly released ca, failed to exceed 30K.

meme nothing new

In the view of Zhang Ran (pseudonym), who entered the crypto industry a few years ago, the evolution of the meme market is the same as that of ICO a few years ago. There is nothing new.

After experiencing the crazy bubble of ICO, the crypto industry spent several years exploring new narratives such as NFT and DeFi, and formed subdivided directions such as cross-chain interoperability, L2 expansion, and RWA from the perspective of reinvestment. But now, mainstream crypto investors use the words value investment is nothing, all in MEME lives in the palace to mock themselves.

Even after spending a lot of time, most meme players still have a low win rate. Small losses and big profits is the ideal settlement result for meme players. On the one hand, you need to stay cautious at the table, and on the other hand, you need to seize the opportunity to be a hunter.

BlockBeats found that many players in the meme community only entered the market to learn about cryptocurrencies during the hot period of Bitcoin inscriptions at the end of last year, and BOME and SLERF three months ago confirmed their choice of the meme market. When asked whether he would understand and participate in other crypto fields besides meme, Lu Qi replied, I am not a newbie or a leek who just came in. The purpose of making an investment portfolio is to hedge risks. I will try to avoid blind gambling, so I will not participate if my energy is limited, Xu Bai said.

This article thanks the interviewees: Lu Qi, Xu Bai, Bei Bei, Jia Wei, Zhang Ran

This article is sourced from the internet: Meme players reveal the rules of the market game: stay at the table and seize the opportunity to be a hunter

Related: WazirX hackers continue to process tokens, 3 addresses have accumulated 61,750 ETH

On July 22, 2024, hackers who attacked the Indian exchange WazirX continued to process the tokens obtained in the previous attack. According to iChainfo ( search.ichainfo.com ), nearly two-thirds of the tokens on its address have been transferred and processed, and the remaining token amount is less than 5 million US dollars. On-chain data shows that the hacker attack address 0x04b21735e93fa3f8df70e2da89e6922616891a88 transferred 15,290 bitcoins obtained from the attack to the 0x58d3b2fd2ce20a7149244d7e34d18b9b55448e7a address, and continued to use four addresses to process the large amount of tokens it obtained. As of July 22, 124 of the 200 tokens obtained from the attack have been processed, mainly through decentralized exchanges such as Uniswap. After exchanging the tokens for ETH, the hacker transferred all the ETH to two new addresses 0x668399a6604c41d46c81430e4dff71443d44efe6 and 0x361384e2761150170d349924a28d965f0dd3f092. Currently,…