Niveaux de gris : des mineurs aux stakers, l'évolution de la sécurité d'Ethereum

Original author: Zach Pandl, Michael Zhao

Traduction originale : Luffy, Foresight News

-

A major feature of public blockchains is that they do not rely on any centralized authority to operate. To achieve this, blockchains use a set of algorithms and economic incentives, which we call a consensus mechanism.

-

The Bitcoin network is secured by miners through the Proof of Work (PoW) consensus mechanism, while Ethereum is secured by stakers through the Proof of Stake (PoS) consensus mechanism. Unlike PoW, where miners secure the network through computing power, PoS requires stakers to stake tokens to demonstrate their determination to “get involved.”

-

Stakers are rewarded for maintaining the blockchain. Therefore, token holders who stake their assets and verify transactions can earn income. However, staking rewards are usually insignificant compared to token price fluctuations.

Public blockchains have shaped an unprecedented new form of digital commerce, based on an open architecture platform without any centralized authority. Unlike companies that are supervised by a board of directors and governed by law, public blockchains are distributed computer networks that are protected by cryptography and economic incentives. The mechanism used to coordinate economic incentives and keep the network running can be said to be the core innovation of blockchain technology.

Proof of Stake vs. Proof of Work

The blockchain stores the same information on every node in the network. In order to agree on the information stored on the network, the nodes must reach consensus without the help of a centralized authority. Therefore, each public blockchain contains a consensus mechanism: a normative decision-making algorithm based on economic incentives that enables nodes to reach consensus.

Bitcoins consensus mechanism is called Proof of Work (PoW). Under PoW, specialized service providers called miners compete to solve computational problems, with the winning miners being rewarded with tokens and the right to update the blockchain. These puzzles are solved by brute force (i.e., repeated guessing), and therefore require significant resources, including upfront capital expenditures and ongoing electricity costs. Solving the puzzles thus proves to other network participants that the winning miners have a vested economic interest and can be trusted to update the blockchain. Miners are rewarded with tokens for their services.

Ethereum initially used the same PoW algorithm as Bitcoin, but transitioned to a new consensus mechanism, Proof of Stake (PoS), in 2022. This approach also relies on economic incentives; however, instead of solving energy-intensive computational problems, network participants represent their vested economic interests by staking ETH tokens. Stakers are responsible for validating transactions and updating the blockchain. Those who perform these duties correctly are rewarded with additional tokens, while those who go against the interests of the blockchain are punished and the staked tokens are slashed. Because stakers economic interests are aligned with the health of the blockchain, they can be trusted to validate transactions and update the network. Unlike mining, staking consumes a small amount of electricity, and some believe it is a more environmentally friendly blockchain consensus mechanism.

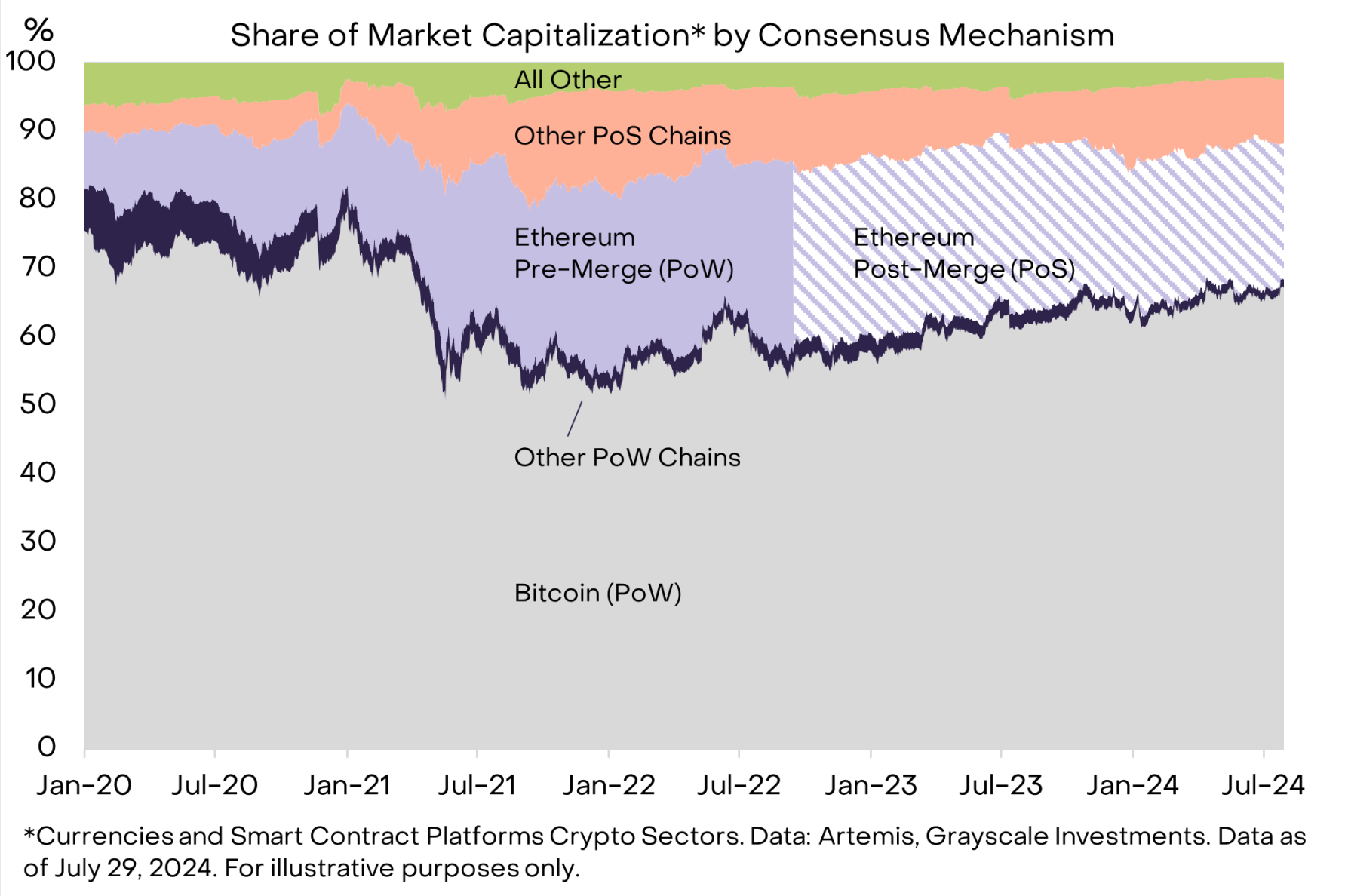

While Bitcoin remains the largest public blockchain by market cap, PoS networks have been growing in popularity. For example, more than half of the protocols in our Currency et Smart Contract Platform categories use a PoS consensus mechanism. By market cap, PoS-based blockchains account for approximately 30% of the total market cap of these crypto asset classes and 90% of the total market cap excluding Bitcoin (Exhibit 1).

Figure 1: After removing Bitcoin, PoS is the mainstream consensus mechanism

Ethereum Transactions and the Role of Stakers

On PoS blockchains such as Ethereum, stakers are responsible for verifying that all transactions comply with the network rules. Without stakers, the blockchain cannot function.

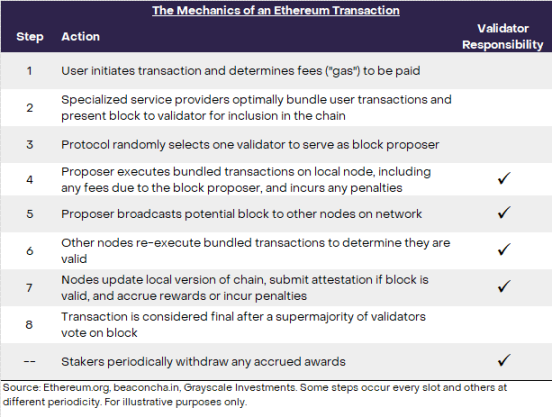

To better understand the role of stakers, it is necessary to understand the mechanism of Ethereum transactions. As shown in Figure 2, Ethereum transactions are roughly divided into eight steps (Figure 2). Although transactions are initiated by users at the beginning, and some steps may involve other professional service providers, most steps require the active participation of validator nodes. Since all Ethereum transactions (or other state changes) are carried out through the coordinated operations of validator nodes, stakers are actually responsible for running the blockchain.

Figure 2: Validator nodes are responsible for processing transactions

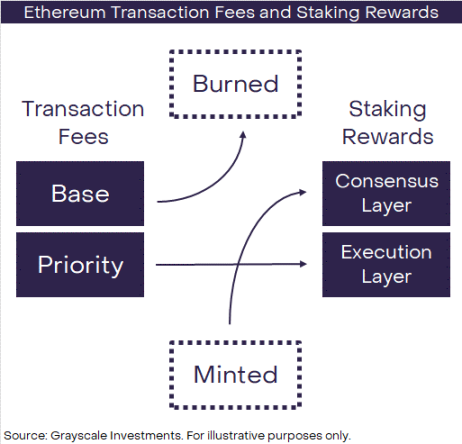

By providing these services, stakers are rewarded with tokens that come from fees paid by users and newly issued tokens. On Ethereum, fees are divided into base fees and priority fees (tips). The network automatically destroys the base fee portion, which is intended to benefit all users by reducing the token supply. In addition to newly issued ETH, stakers also receive priority fees paid by users in transactions (Figure 3).

Figure 3: Ethereum staking rewards come from priority fees and new issuance

Staking Rewards and Income

Stakers can earn potential income from their assets thanks to token rewards. In traditional markets, the best analogy might be agricultural land. The land itself has a market value and its price may rise or fall over time, but it can also be used to grow crops to earn a yield. Just like staking rewards are a reward for the service of validating the blockchain, crops can be thought of as a reward for the service of cultivating agricultural land. In both cases, the asset owner is providing a useful service and generating service income.

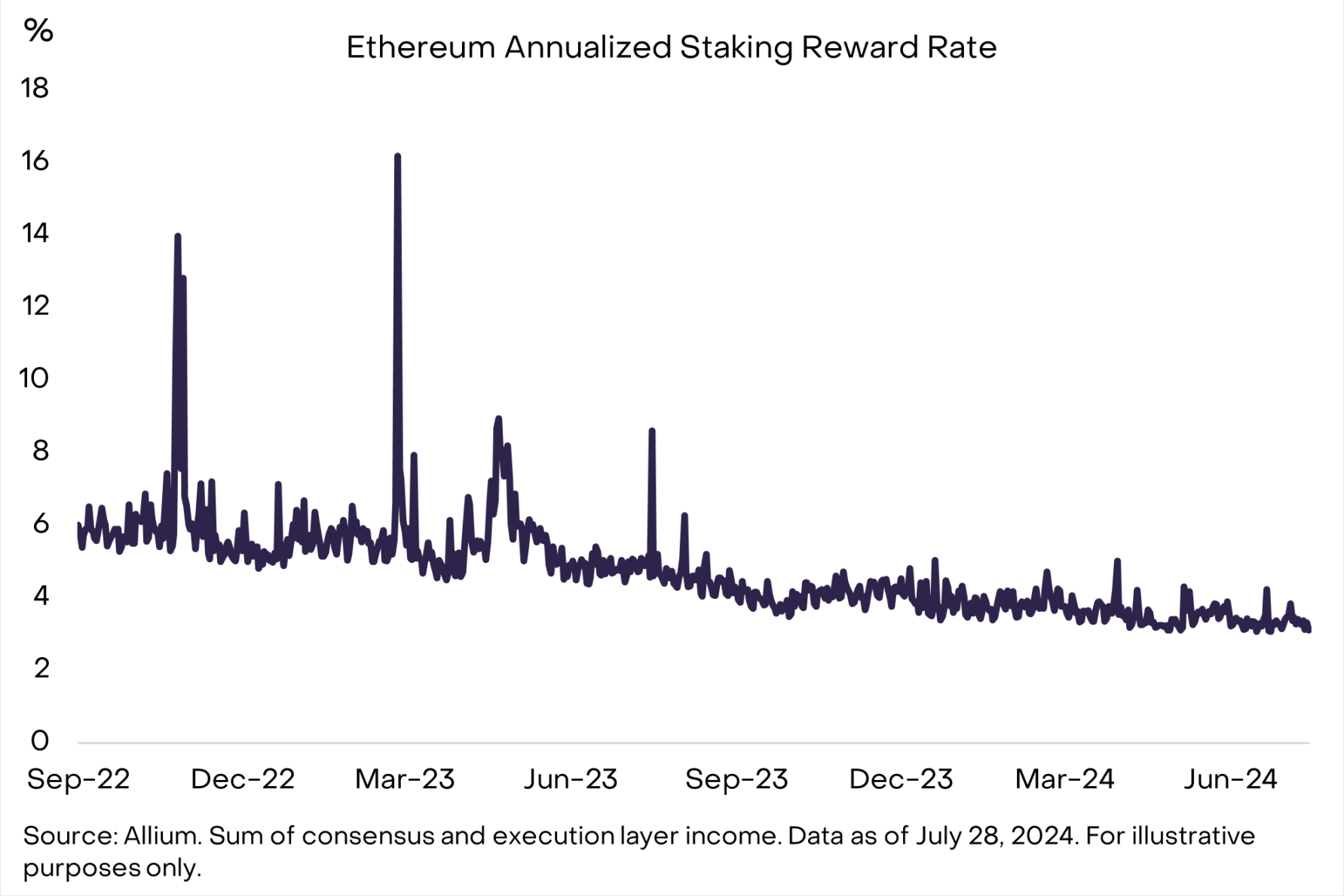

Ethereum stakers currently receive an average return of 3.1% (Chart 4). According to calculations by data provider Allium, Ethereum staking returns have been trending downward over time as the staking supply of Ethereum has increased (when the staking supply decreases, the protocol offers higher returns to incentivize staking activity). Day-to-day changes in staking rewards also reflect changes in network congestion and priority fees: when network traffic increases, users typically pay higher fees to get priority access to transactions.

Figure 4: Ethereum stakers currently have an annualized return of about 3%

For Ethereum holders who stake their tokens and provide validation services, staking rewards can be considered a source of income. For example, since the beginning of 2023, the ETH spot price has increased by 173%. During this period, we estimate that staking rewards have been approximately 4.5% annualized. Therefore, the return rate for Ethereum stakers (including price returns and staking income) will reach 192% (Figure 5). But this assumes that the staker has performed his duties correctly (i.e., received all rewards and was not fined) and did not pay any third-party fees.

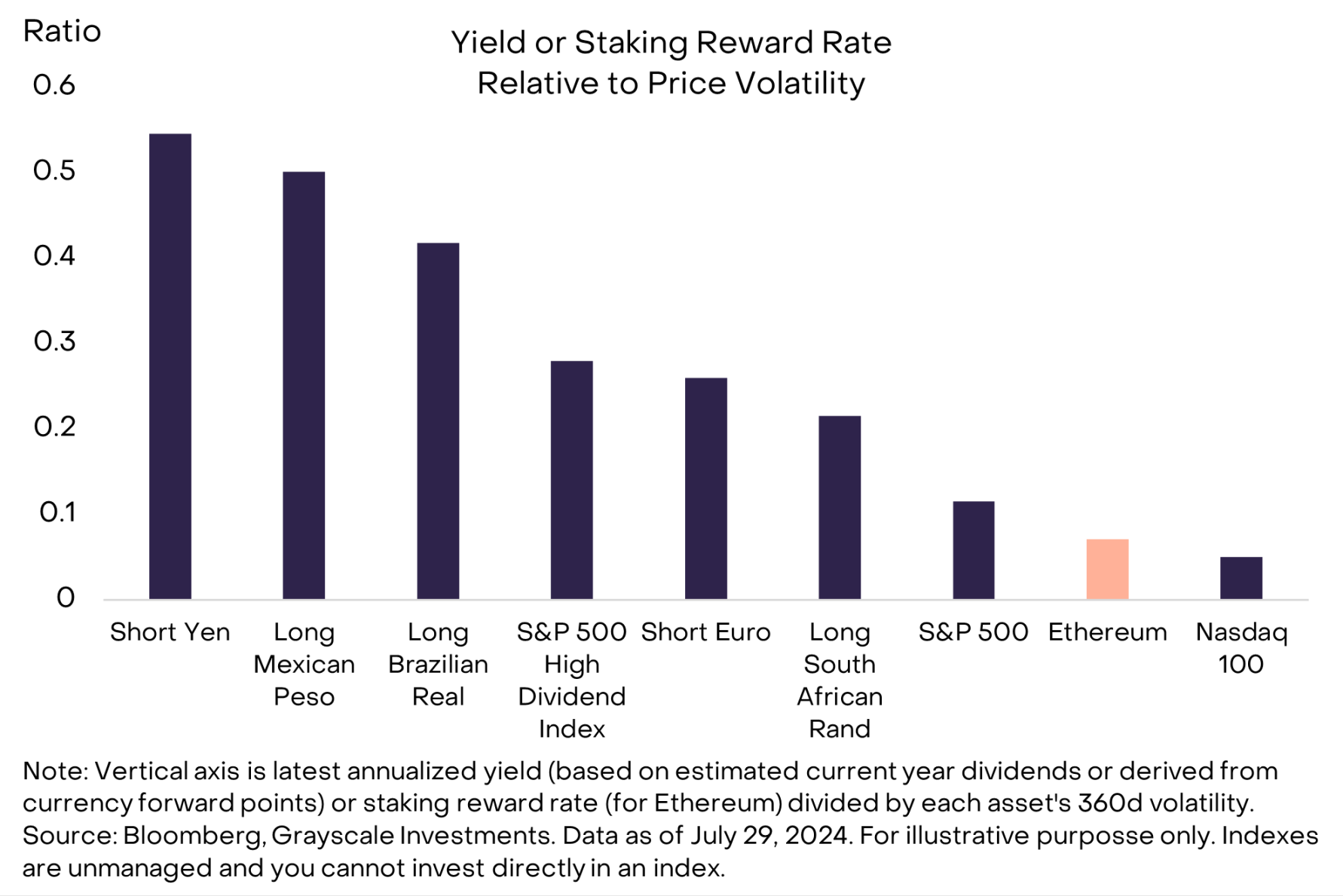

Figure 5: Staking rewards can be considered as asset income

Although staking rewards can increase returns for token holders compared to other assets, staking returns are still low relative to their volatility. In other words, investors should view the token price itself, rather than staking rewards, as the primary source of risk and potential return. For example, Figure 6 shows Ethereums staking returns relative to its volatility, compared to various currency market carry trades and the dividend yields of certain stock indices. Ethereums staking returns are relatively low relative to its price volatility, comparable to the dividend yields of US stock indices. These types of investments are typically made primarily for potential capital gains in addition to price appreciation, rather than income returns.

Figure 6: Ethereum’s staking yield is low compared to other volatile assets

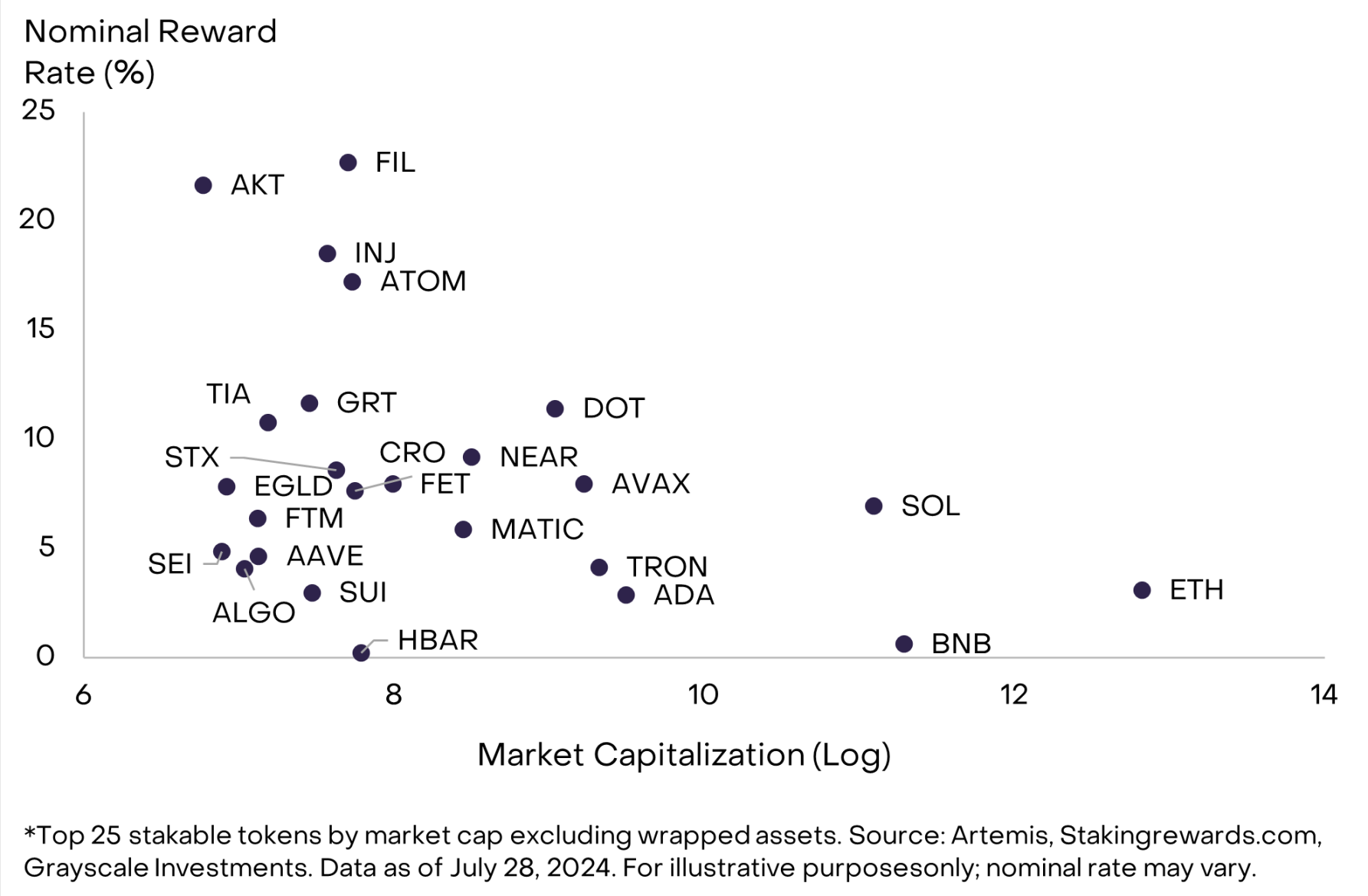

Staking returns vary widely across PoS blockchains. For example, several smaller networks (by market cap) offer nominal staking returns of 10%-20% (Figure 7). However, keep in mind that staking rewards are typically funded through a combination of transaction fees and new token issuance. In many cases, high staking returns are only possible if there is high token supply inflation, which can have an impact on price returns. Therefore, investors should also consider real (inflation-adjusted) staking returns (just as analysts typically consider real interest rates in bond or currency markets). Ethereums supply growth is close to zero, so its nominal and real staking returns are roughly the same, around 3%. In contrast, while Filecoin (FIL) offers a nominal staking return of 23%, the circulating supply is expected to increase by 20% over the next year, which means the real staking return is only 3% (Figure 7).

Figure 7: High nominal returns are often associated with high inflation

Résumer

Consensus mechanisms are to blockchain what laws and property rights are to traditional businesses. As the crypto industry develops, Grayscale Research expects PoS consensus and staking to become an increasingly important part of the ecosystem. While staking returns are generally low compared to crypto asset price fluctuations, they can be an additional source of income over time, so many token holders are willing to become validators to earn these rewards.

This article is sourced from the internet: Grayscale: From miners to stakers, the evolution of Ethereum security

La surprise apportée par la nouvelle conférence OpenAIs de cette année n’est pas encore dissipée. Après que Nvidia ait sorti une série de GPU successifs, le cours de son action a atteint un nouveau sommet. Sa valeur boursière a dépassé celle d’Apple, ce qui en fait la deuxième plus grande entreprise au monde en termes de valeur boursière, après Microsoft. Aujourd’hui, l’IA pilotée par de grands modèles est devenue l’industrie pétrolière de la nouvelle ère. Nous sommes à un stade précoce, plein d’inconnues et de possibilités. Tout comme le développement de l’industrie pétrolière a donné naissance au système industriel actuel, l’IA pilotée par de grands modèles devrait également inaugurer une nouvelle ère de technologie et d’affaires. Je pense que l’IA est le récit le plus populaire dans tous les domaines en 2024 et qu’elle entraînera une chaîne de transformations…