La nouvelle ère du stockage de valeur : l'or est sorti, le Bitcoin est entré

Auteur original : Biteye contributeur principal Viee

Éditeur original : Crush, contributeur principal de Biteye

Never sell your Bitcoin, Trump said at the Bitcoin 2024 conference in Nashville this weekend, providing the strongest emotional value in the cryptocurrency world in recent times.

During Trumps speech, Bitcoin staged a V-shaped trend, first falling in the short term and falling below $67,000; at the end of the speech, when he announced that Bitcoin would be listed as a strategic reserve asset, Bitcoin rose sharply, recovering all the losses and even breaking through $69,000.

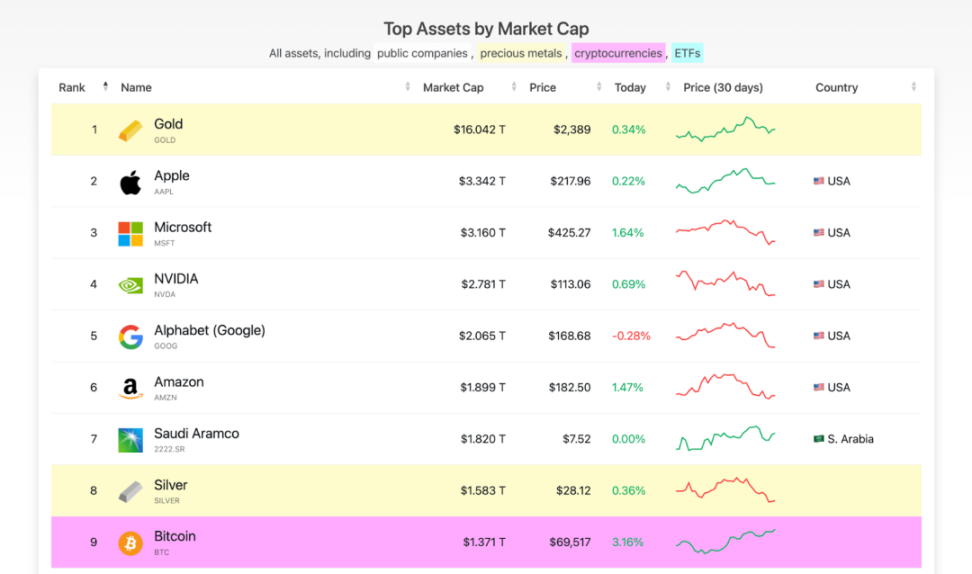

During his previous presidency, Trump had harshly criticized cryptocurrencies, calling them scams. Now, at the Bitcoin Conference, he even bluntly stated that Bitcoin has become the ninth largest asset in the world by market value, and will soon surpass silver and gold in the future.

Such a big shift shows that cryptocurrency users are beginning to become a growing political force.

From an Internet scam to a tool for politicians to lobby, ten years have passed. What is the reason for Bitcoins sudden turnaround?

01 Gold exits, Bitcoin enters: Value reserve in the new era

Not only Trump, but also Mike Novogratz, CEO of asset management company Galaxy Digital, has publicly stated that although the current market value of Bitcoin is less than one-tenth of gold, it is rising rapidly and will definitely exceed the market value of gold, and it wont be long.

MicroStrategy CEO Michael Saylor holds a similar view, believing that digital gold will replace physical gold by the end of this century.

Have you ever wondered why so many world-class experts openly believe in Bitcoin? Is it a fantasy or is there a reason?

First you need to know, why is Bitcoin similar to gold?

-

Scarcity. The total number of Bitcoins is fixed at 21 million, and it is expected that all Bitcoins will be mined by 2140. This limited supply gives Bitcoin a scarcity similar to that of gold.

-

Inflation resistance. Bitcoin, as digital gold, is considered an effective inflation hedge. Although Bitcoin has only been around for about a decade and has only experienced inflation during the COVID-19 pandemic, its unique algorithm and distributed system give it the ability to resist inflation. JPMorgan Chase research shows that institutional investors are increasingly inclined to choose Bitcoin rather than gold as a safe-haven asset.

-

Actual value. Gold鈥檚 value comes from its wide range of uses in areas such as luxury goods and electronics. Bitcoin鈥檚 value comes from its innovation in the monetary system, with its encryption technology and distributed network enabling billions of unbanked people around the world to enter the financial system.

Given that both assets are popular, what is the real reason why Bitcoin is better than gold?

The answer is return performance and supply. Bitcoin has enjoyed an annual return of nearly 120% over the past decade, while golds annual return is only 2%. Unlike gold, Bitcoins supply has a clear cap, ensuring its inherent scarcity.

Gold has always been a symbol of value storage and wealth preservation. But at the end of decades of inflation since the 1970s, golds performance began to be relatively bleak.

From 1980 to the end of 2023, golds inflation-adjusted total return is -4%. Over the past decade, gold has returned just 2% per year.

In addition, the supply of gold is difficult to control, and mining and new discoveries make its quantity uncertain. In history, the United States even confiscated gold through Executive Order No. 6102, which is a weakness of gold that is easily interfered with by the government.

However, Bitcoin is emerging with unparalleled advantages. As the worlds first cryptocurrency, Bitcoin not only has strict supply restrictions, the total amount is fixed at 21 million, and no one can change its supply, ensuring its scarcity.

Over the past decade, Bitcoin鈥檚 annual return rate has reached 120%, an astonishing figure that far exceeds gold. In addition, Bitcoin is based on the global blockchain network and is tamper-proof and unconfiscable, providing investors with an unprecedented sense of security.

As the market matures, Bitcoins volatility is gradually decreasing, bringing more stable opportunities for long-term investors.

More importantly, Bitcoin gives its holders true financial sovereignty, free from currency manipulation, and perfectly adapts to the needs of the digital age.

Thus, Bitcoin came on the scene and became the value reserve of the new era!

02 New trend in global finance: Bitcoin moves towards national strategic reserves

Going back to what was mentioned earlier, Trump mentioned at this conference that Bitcoin would be listed as a strategic reserve asset, which directly pushed the price of Bitcoin to more than $69,000.

The original words were: If I am elected, my administrations policy will be that the United States will retain 100% of all Bitcoin currently held or acquired in the future. We will retain 100%. Hopefully you will do well. This will actually serve as the core of the strategic national Bitcoin reserve.

Although the promise is relatively conservative, it undoubtedly highlights the importance of Bitcoin as a global financial asset. Trump has also been outspoken in criticizing the Biden administrations crackdown on cryptocurrencies, saying such policies have harmed the U.S. economy.

In contrast to Trumps caution, independent presidential candidate Robert Kennedy Jr. presented a more radical vision.

He promised that if elected, he would launch a grand Bitcoin reserve plan – buying 550 Bitcoins a day until the reserve reaches 4 million. This proposal is far bolder than Trumps plan and aims to make Bitcoin a national strategic asset.

In Wyoming, Senator Cynthia Loomis is also actively promoting a national reserve plan for Bitcoin. She plans to draft a bill requiring the government to establish a reserve of up to 1 million Bitcoins within five years and use it only to reduce the national debt over the next 20 years.

This plan undoubtedly further strengthens Bitcoins position as a long-term financial asset.

The above public speeches have rapidly pushed Bitcoin to the forefront of global financial and political fields. We all know that national governments may own Bitcoin as a reserve asset. For example, the US government is one of the largest holders of Bitcoin, with the federal government owning nearly 210,000 Bitcoins, accounting for 1% of the total supply.

In 2021, El Salvador declared Bitcoin as its official currency anchor, becoming the first country to use BTC as legal tender. In addition, Switzerland has also passed legislation to include Bitcoin in its national bank reserves.

So, what does this mean?

Lets look at a set of data. According to VanEcks report assumptions, Bitcoin may become an important part of the international monetary system in the coming decades as geopolitical tensions and debt repayment costs put pressure on the existing system.

The report predicts that Bitcoins status as a global reserve asset will gradually increase, and its share in international foreign exchange reserves is expected to reach 2.5%.

In this way, it can be seen that Bitcoin is gradually transforming from an emerging asset to an important component of the global financial system. Whether in the US or international markets, the status of Bitcoin is rising rapidly.

Therefore, Hong Kong is not willing to be outdone.

Fang Hongjin, co-chairman of the Hong Kong Blockchain Association, recently suggested that the Hong Kong government should take advantage of Bitcoins anti-inflation properties to diversify the asset allocation of the foreign exchange fund to reduce its dependence on the US dollar, and should continue to purchase and hold Bitcoin as part of its foreign exchange reserves.

He believes that Bitcoin not only has the potential to surpass gold, but can also significantly enhance Hong Kongs influence in the global financial market.

Hong Kong legislator Ng Kit-chung also expressed support for the trend when commenting on Trump鈥檚 speech at the US Bitcoin Summit.

He believes that Bitcoin and Web3 are key nodes in the development of globalization, and that Bitcoin can be included in official fiscal reserves in compliance with regulations in the future.

He also stressed that Hong Kong should accelerate the construction of the Web3 ecosystem to attract top global talent and investment.

Hong Kong is following suit and actively exploring the possibility of including Bitcoin in its foreign exchange reserves. All this shows us that Bitcoin may become a key pillar in the global financial system.

From the United States to Hong Kong, more and more governments and financial institutions are paying attention to the unique advantages of Bitcoin.

03 Conclusion

In this increasingly digital world and the depreciation of fiat currencies, Bitcoin is gradually replacing gold and becoming the new generation of value reserve with its scarcity, high returns and financial sovereignty.

This trend is expected to drive the further rise of Bitcoin in the international market in the coming years.

If the current drop in Bitcoin from $60,000 to $50,000 makes you lose your appetite, then here鈥檚 a horror story: if the market value of gold is reached, the price of one Bitcoin may soar from the current $69,000 to nearly $600,000.

By then, you may understand the weight of the phrase never sell your Bitcoin.

This article is sourced from the internet: The new era of value storage: gold is out, Bitcoin is in

Français:Titre original : Comprendre les mécanismes des largages aériens Auteur original : KERMAN KOHLI Traduction originale : Lucy, BlockBeats À ce stade, j'ai probablement fait plus de recherches sur les largages aériens que la plupart des gens dans ce domaine. En conséquence, j'ai commencé à formuler des observations générales sur les types de largages aériens qui sont bons et ceux qui sont mauvais. EigenLayer est un exemple récent et très médiatisé d'un largage aérien infructueux dont je pense que nous pouvons tous tirer des leçons, mais il existe d'innombrables autres exemples et nous pourrions continuer encore et encore. Intentions et attentes En prenant du recul, je pense que l'attitude de l'équipe est avant tout essentielle pour évaluer comment mener à bien un largage aérien. S'il existe des motivations sous-jacentes à la cupidité, elles seront très évidentes. Alors, aussi cliché que cela puisse paraître, gardez votre sang-froid. Votre…