Financement express en une semaine | 23 projets ont reçu un investissement, avec un montant total de financement divulgué d'environ U

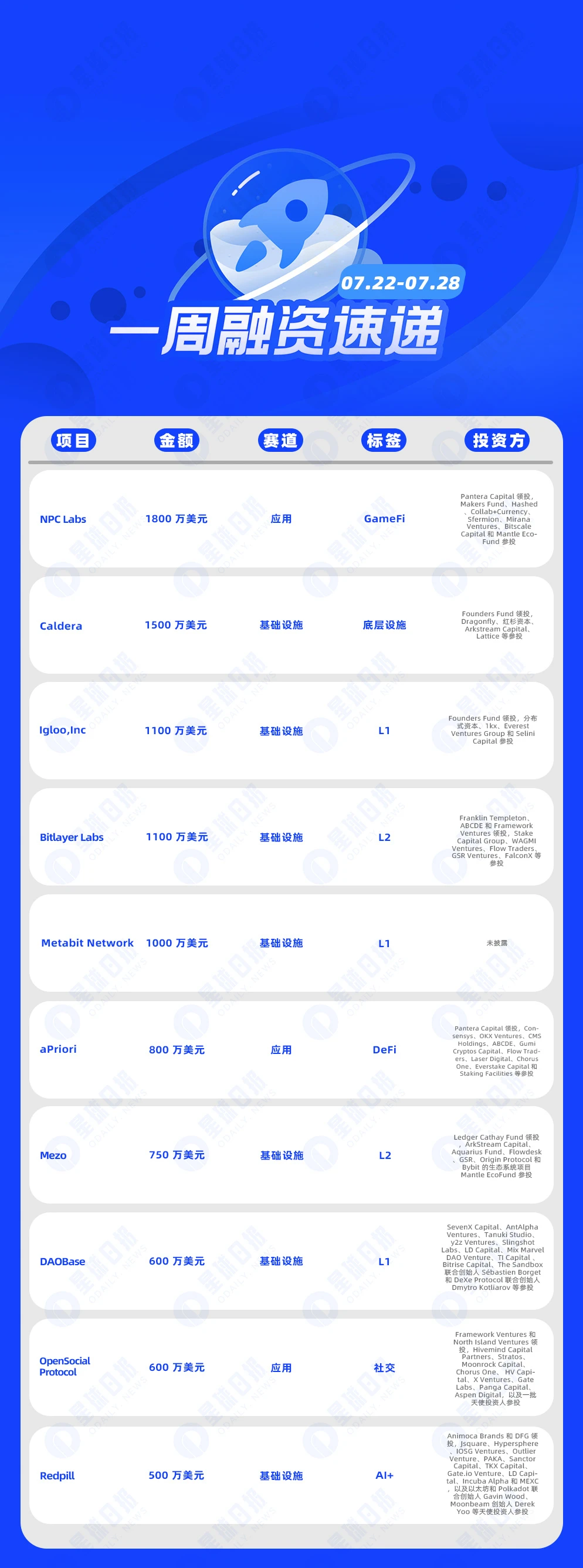

According to incomplete statistics from Odaily Planet Daily, there were 23 blockchain financing events announced at home and abroad from July 22 to July 28, an increase from last weeks data (19). The total amount of financing disclosed was approximately US$129.5 million, an increase from last weeks data (US$82.55 million).

Last week, the project that received the most investment was Web3 gaming infrastructure startup NPC Labs ($18 million); followed closely by Ethereum Rollup deployment platform Caldera ($15 million).

Voici des événements de financement spécifiques (Remarque : 1. Trier par montant d'argent annoncé ; 2. Exclut les événements de collecte de fonds et de MA ; 3. * indique une entreprise traditionnelle dont l'activité implique la blockchain) :

NPC Labs Completes $18 Million Seed Round Led by Pantera Capital

On July 22, Web3 gaming infrastructure startup NPC Labs completed an $18 million seed round of financing led by Pantera Capital, with participation from Makers Fund, Hashed, Collab+Currency, Sfermion, Mirana Ventures, Bitscale Capital and Mantle EcoFund. As of now, its total financing amount has reached $21 million.

On July 24, Ethereum Rollup deployment platform Caldera completed a US$15 million Series A financing round, led by Founders Fund, with participation from Dragonfly, Sequoia Capital, Arkstream Capital, Lattice and others.

On July 23, Pudgy Penguins parent company Igloo, Inc. announced the completion of over $11 million in financing, led by Founders Fund, with participation from Distributed Capital, 1kx, Everest Ventures Group and Selini Capital. Igloo plans to use this strategic financing to develop its new business Cube Labs, which will oversee and contribute to the development of Abstract, a new consumer-focused blockchain designed to promote the mainstreaming of encryption.

On July 23, Bitcoin L2 project Bitlayer Labs announced the completion of a US$11 million Series A financing round, led by Franklin Templeton, ABCDE and Framework Ventures, with participation from Stake Capital Group, WAGMI Ventures, Flow Traders, GSR Ventures, FalconX and others.

On July 27, Metabit Network recently announced that it had successfully completed a new round of strategic financing of US$10 million, and the investor has not yet been disclosed. Officials said that the company will use this funding to promote Metabit Networks innovation and development in the field of blockchain technology.

On July 25, aPriori, a liquidity staking platform based on the Monad blockchain, announced the completion of an $8 million seed round of financing, led by Pantera Capital, with participation from Consensys, OKX Ventures, CMS Holdings, ABCDE, Gumi Cryptos Capital, Flow Traders, Laser Digital, Chorus One, Everstake Capital and Staking Facilities.

Bitcoin scaling network Mezo completes $7.5 million in financing, led by Ledger Cathay Fund

On July 26, Bitcoin scaling network Mezo announced the completion of a $7.5 million financing round, led by Ledger Cathay Fund, with participation from ArkStream Capital, Aquarius Fund, Flowdesk, GSR, Origin Protocol, and Bybit鈥檚 ecosystem project Mantle EcoFund.

AI-driven data platform DAOBase completes $6 million in financing

On July 26, according to official news, DAOBase, an AI-driven data and infrastructure platform tailored for DAOs, announced the completion of a US$6 million financing round, with participation from SevenX Capital, AntAlpha Ventures, Tanuki Studio, y 2 z Ventures, Slingshot Labs, LD Capital, Mix Marvel DAO Venture, TI Capital, Bitrise Capital, The Sandbox co-founder S茅bastien Borget and DeXe Protocol co-founder Dmytro Kotliarov.

OpenSocial Protocol Completes $6 Million Strategic Financing, Led by Framework Ventures and Others

On July 25, Web3 community platform OpenSocial Protocol announced the completion of a $6 million strategic financing, led by Framework Ventures and North Island Ventures, with participation from Hivemind Capital Partners, Stratos, Moonrock Capital, Chorus One, HV Capital, X Ventures, Gate Labs, Panga Capital, Aspen Digital, and a group of angel investors. As of now, the total amount of financing has reached $26 million.

On July 25, the decentralized AI technology innovation platform Redpill announced on the X platform that it had completed a $5 million seed round of financing, led by Animoca Brands and DFG, with participation from Jsquare, Hypersphere, IOSG Ventures, Outlier Venture, PAKA, Sanctor Capital, TKX Capital, Gate.io Venture, LD Capital, Incuba Alpha and MEXC, as well as angel investors such as Ethereum and Polkadot co-founder Gavin Wood and Moonbeam founder Derek Yoo.

Web3 AI company Network 3 completes $5 million in financing, with E V3 and others participating

On July 23, Web3 AI company Network 3 completed $5 million in pre-seed and seed rounds, with participation from E V3, IoTeX Eco Fund, SNZ, Waterdrip Capital, and Bing Ventures. The company plans to use the funding to expand its team and continue to develop its technology stack.

On July 22, TES AI, an AI computing power protocol first launched on BNB Chain, announced that it had completed its first round of financing with a total of US$5 million at a valuation of US$100 million. The investment was led by X FORCE Foundation, with participation from OIG Investment, Group Newman Capital, CMCC Global and other institutions and angel investors such as Donahue Lawrence, Byron Hobbes, Brian Katte and Olive Colclough.

Bitcoin-denominated trading platform Roxom completes $4.3 million pre-seed round of financing

On July 28, Roxom, a Bitcoin-denominated trading platform, completed a $4.3 million pre-seed round of financing, led by Tim Drapers Draper Associate, with participation from Borderless, Cadenza Ventures, Kingsway Capital, NewtopiaVC and a group of angel investors.

Liquidity staking protocol Kintsu completes $4 million seed round led by Castle Island Ventures

On July 25, Kintsu, a liquidity staking protocol based on the Monad blockchain, completed a $4 million seed round of financing, led by Castle Island Ventures, with participation from Brevan Howard Digital, CMT Digital, Spartan Group, Breed VC, CMS Holdings, Animoca Ventures and others.

On July 24, the Metaverse blockchain gaming ecosystem Panda Titan announced that it had received a $3 million investment from Archer Capital. This round of financing will accelerate Panda Titans pace in technological innovation and market expansion, support Panda Titan in developing more games, applications, and improving game launchers, while expanding its community and partners.

Etherfuse Completes $3 Million Funding, Led by White Star Capital and North Island Ventures

On July 23, Etherfuse, a tokenized real-world asset platform, announced the completion of a $3 million financing round to bring emerging market debt onto the chain. White Star Capital and North Island Ventures co-led the investment, with participation from The Department of XYZ, The Stellar Development Foundation, Funfair and angel investors Alice Ann Schwartz and Anna Yuan. The new funds will support Etherfuse in achieving its mission of programmatically providing the next generation of blockchain developers with the debt and assets they need, making the global capital market more efficient and convenient through blockchain technology.

On July 26, DePIN network layer Multiple Network announced the completion of a $2 million seed round of financing with a valuation of $30 million. OKX Ventures, Youbi Capital, Stratified Capital, Puzzle Ventures, CatcherVC and BitriseCapital participated in the investment. The new funds will be used to continue to expand its ecosystem.

LayerPixel Completes $2 Million Seed Round Led by Kenetic Capital

On July 26, LayerPixel, a TON-based DeFi solution, announced the completion of a $2 million seed round of financing, led by Kenetic Capital, with participation from Foresight Ventures, Waterdrip Capital, VentureSouq, Web3 Port Foundation, Microcosm Research, TMM Club, and dozens of angel investors. It is reported that this funding will help LayerPixel accelerate the development and integration of its DeFi solution suite in the Telegram Mini App ecosystem, completely changing the way users interact with decentralized finance in the Telegram environment.

On-chain order book DEX Kuru completes $2 million seed round led by Electric Capital

On July 25, Kuru, a Monad-based on-chain order book DEX, announced the completion of a $2 million seed round of financing, led by Electric Capital, with participation from Brevan Howard Digital, CMS Holdings, Pivot Global, Breed and Velocity Capital, as well as angel investors such as Keone Hon, Jarry Xiao and Eugene Chen.

On July 24, Web3 AI platform Assisterr announced the completion of a $1.7 million Pre-Seed round of financing. Web3.com Ventures, Moonhill capital, Contango, Outlier Ventures, Decasonic, Zephyrus Capital, Wise 3 Ventures, Saxon, GFI Ventures, X Ventures, Koyamaki, Lucid Drakes Ventures, as well as angel investors including 0g.ai co-founder and CEO Michael Heinrich, Aethir co-founder and CEO Mark Rydon, Eigen Labs Developer Relations Director Nader Dabit, SwissBorg co-founder Anthony Lesoismier-Geniaux, and Particle Network Developer Relations Director Ethan Francis participated in the investment.

Zircuit Completes New Round of Financing, Binance Labs and Others Participate

On July 23, Zircuit, an EVM-compatible ZK rollup with AI-enhanced sorter-level security, announced the completion of a new round of financing, with participation from Binance Labs, Mirana Ventures, Amber Group, Selini, Robot Ventures, Nomad Capital, Borderless Capital, and angel investors from projects such as Renzo, Etherfi, Pendle, Parallel, LayerZero, Axelar, F 2 Pool, Nonce, KelpDAO, ETHGlobal, Maelstrom, etc.

On July 25, Web3 social aggregator Yup completed a new round of financing, with participation from Nascent, IDEO CoLab Ventures and Farcaster co-founder Dan Romero. The specific amount of financing has not been disclosed yet.

RiskLayer Completes Builders Round Financing, Antler and Momentum 6 Co-Led the Investment

On July 25, RiskLayer, a DeFi security middleware on EigenLayer, completed its Builders Round financing, led by Antler and Momentum 6, with participation from angel investors such as Wagmi Ventures, Hypotenuse Ventures and Richard Ma.

This article is sourced from the internet: One-week financing express | 23 projects received investment, with a total disclosed financing amount of approximately US$129.5 million (7.22-7.28)

Related: With big fluctuations imminent, how do institutions view the market outlook?

Original | Odaily Planet Daily Author | Nanzhi Since Bitcoin briefly hit a high of $72,000 last Friday (June 7), the market as a whole has started another round of major crash. Tonight, the CPI and the Federal Reserve鈥檚 interest rate decision will be announced, and a new round of major fluctuations is about to come. How do various institutions and research institutes view the market outlook? Odaily Planet Daily summarizes their main views since June 7 in this article. Bullish: The bull market continues 10x : If BTC breaks through $72,000, it will continue to break new highs, bullish on the BTC/ETH exchange rate 10x Research said in its latest market analysis report that tonights dual macro events CPI and FOMC seem difficult to predict after last weeks higher-than-expected…