Can you make money using the dumbbell strategy in this bull market?

Auteur original : Biteye contributeur principal Viee

Éditeur original : Crush, contributeur principal de Biteye

Can you make money using the dumbbell strategy in this bull market?

Today I鈥檓 going to share with you a strategy that can make a lot of money while avoiding losing everything: the dumbbell strategy.

The performance of the following crypto assets was analyzed by the indicator:

-

BTC is the eternal king: BTC.D Index

-

ETH lags behind BTC at this stage: ETH/BTC exchange rate

-

Altcoins are generally sluggish: (1) Altseason Index (2) Altcoin market capitalization

-

Memecoin has high risk and high return, outperforming BTC and ETH: Memecoin Index

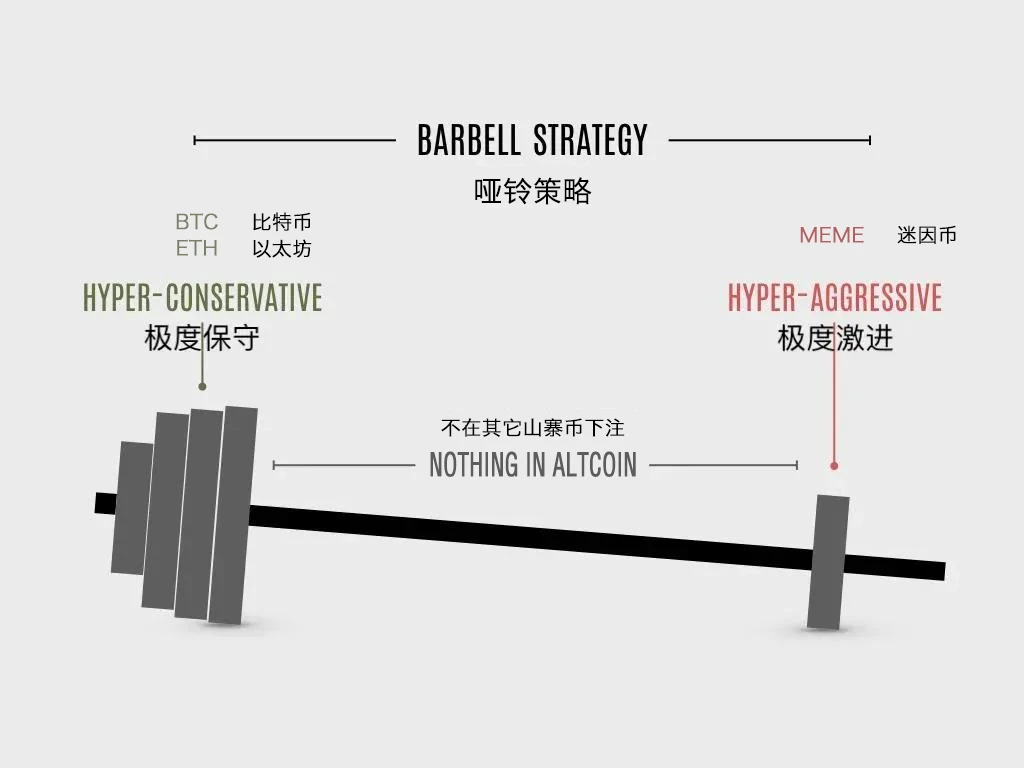

1. What is the dumbbell strategy?

The dumbbell strategy is what Taleb mentioned in Antifragile. It is to adopt a conservative strategy in one field and an open strategy in another field, giving up the middle road. Simply put, it is mostly conservative and a small part radical.

When applied to the cryptocurrency world, you can invest most of your assets in relatively secure assets such as BTC and ETH, a small portion of your funds in high-risk assets such as Meme coins, and try to avoid participating in most of the altcoins in between.

This way, you can preserve your capital and maintain stability amid the high volatility of the cryptocurrency world, while also having the opportunity to earn high returns through high-risk assets (such as Meme coins).

Next, let鈥檚 take an objective look at the performance of BTC, ETH, most altcoins, and Meme coins through some indicators.

2. BTC is the eternal king: refer to the BTC.D index (Bitcoin Dominance)

The Bitcoin Dominance Index is used to reflect the market share of Bitcoin and is often used to determine whether the altcoin season has begun. From the figure, it can be seen that during the altcoin season in 2021, the last bull market, the BTC.D index fell significantly.

The logic that can be explained is: BTC.D index falls 鉃★笍 BTC dominance decreases 鉃★笍 Risk increases 鉃★笍 Altcoins regain market position 鉃★笍 Altcoins begin to surge. (And vice versa)

We are still in Bitcoin season. The index has been rising since the beginning of the year, reaching 56% as of July 26. Altcoins still perform worse than Bitcoin, so Bitcoin is dominant.

3. ETH lags behind BTC at this stage: refer to the ETH/BTC exchange rate

Generally speaking, the larger the ETH/BTC exchange rate, the smaller the price gap between the two, and the stronger the performance of ETH. On the contrary, the smaller the ratio, the larger the price gap, and the weaker the performance of ETH.

In addition, this indicator is also used to judge the markets interest in altcoins. If the ratio starts to outperform BTC, it may be a sign that funds are flowing into altcoins.

At present, the ETH/BTC exchange rate is still at a relatively low level, and ETH is performing relatively weakly. Even the approval of the ETF has not allowed Ethereum to reverse the trend. However, since it is at a low level, if you have enough confidence in ETH, you can also consider building a position in batches and wait for subsequent increases.

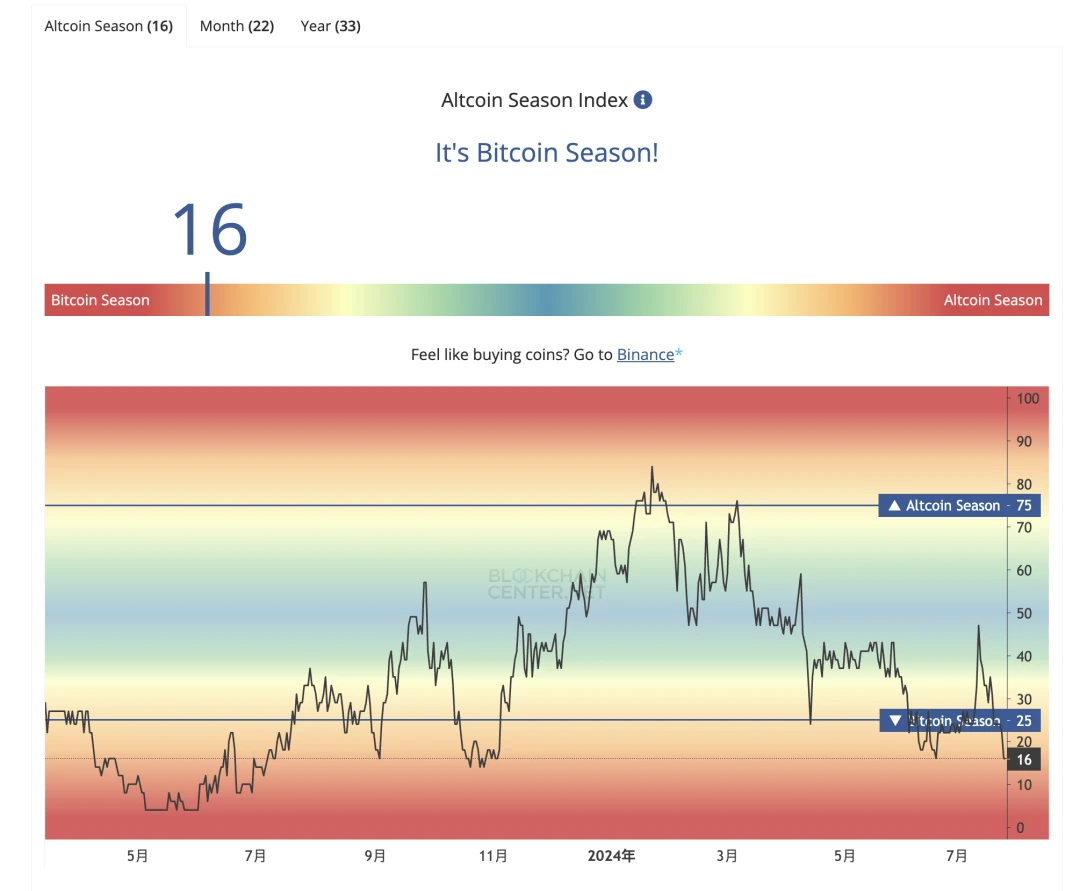

IV. Overall decline of Shanzhai: Reference (1) Altseason Index

The Altseason Index tracks the sentiment of the altcoin market, counting the percentage of the top 50 altcoins that outperformed Bitcoin over a period of time. The indicator shows that a value greater than 75 is an altseason and a value less than 25 is a Bitcoinseason.

It is obvious that we are in the Bitcoin season, with the index at 16, and the momentum of the altcoin is relatively weak. This year, the index was only greater than 75 at the end of January, which only lasted for half a month. Compared with the three-month period from the end of March to the end of June in 2021 when the index exceeded 75, it is not a true altcoin season.

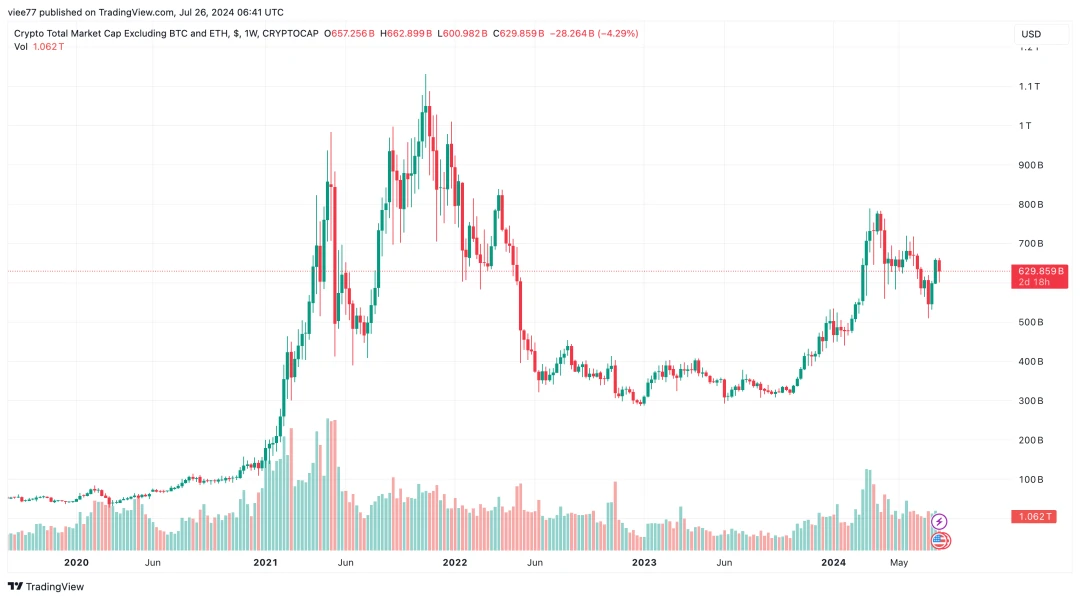

5. Overall decline of altcoins: Reference (2) Total market value of altcoins

The full name of this indicator is Crypto Total Market Cap Excluding BTC ETH. In addition to BTC and ETH, the total market value of other tokens in the crypto market reflects the overall situation of funds flowing into the altcoin market.

After the total market value of Shanzhai rose significantly at the beginning of the year, it did not continue the trend. It has fluctuated repeatedly in the volatile market in the past few months. There is no obvious breakthrough signal at present, and Shanzhai is still relatively weak as a whole.

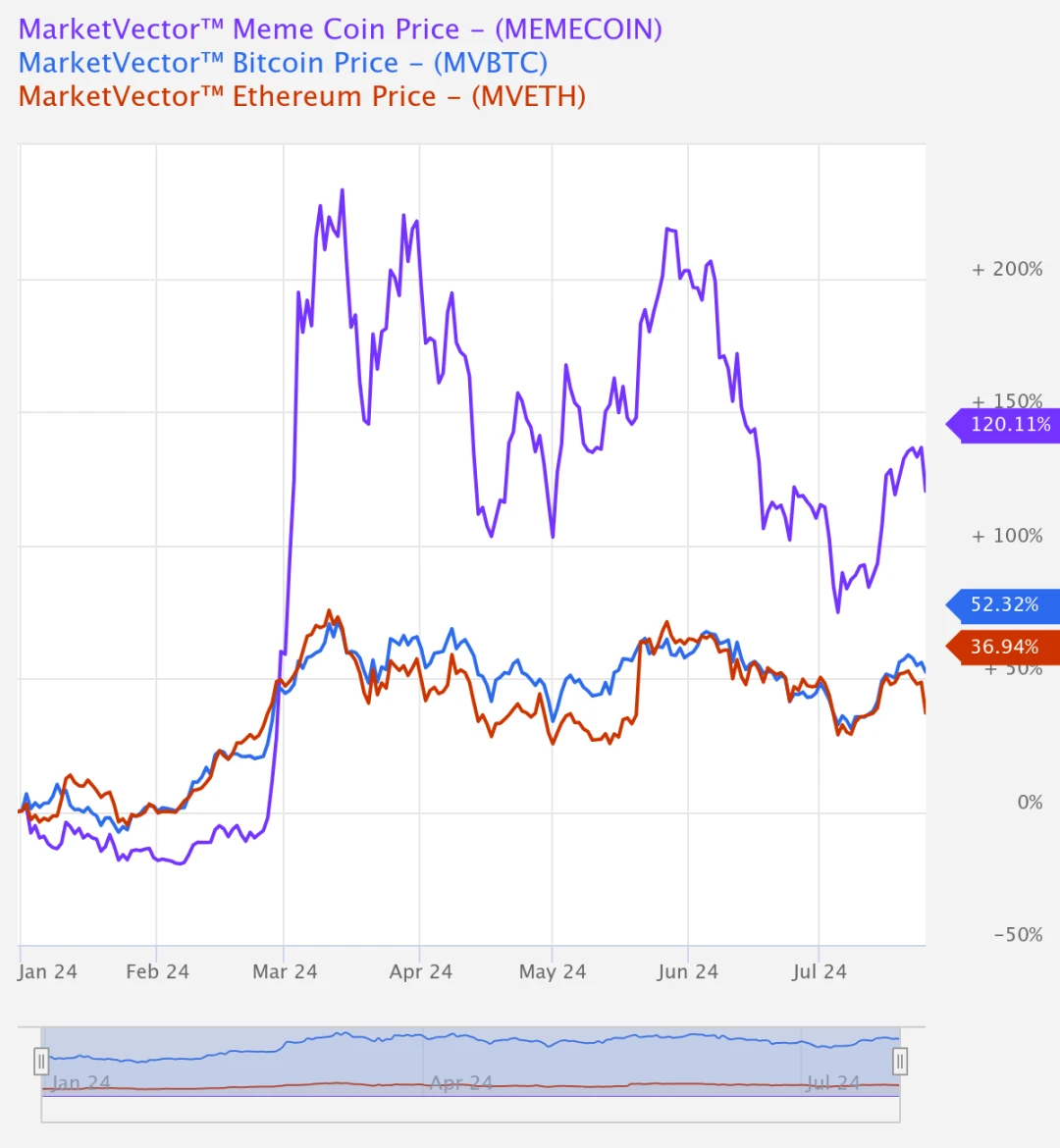

6. Memecoin has high risk and high return, outperforming BTC and ETH: refer to Memecoin Index

The Meme Coin Index launched by MarketVector tracks the return performance of the six largest Meme tokens by market capitalization.

The main components include $DOGE, $SHIB, $PEPE, $FLOKI, $WIF and $BONK, which best represent the overall performance of Meme coins.

By comparison, it can be seen that the performance of Meme coin from the beginning of the year to date is really eye-catching, with an increase of 120%, exceeding BTC (52%) and ETH (37%).

VII. Summary Risk Warning

Combined with the dumbbell strategy, it can be seen from the above indicators that under the current market conditions, BTC and ETH are indeed well-deserved safe assets with a high market share.

Especially BTC, which is even stronger than ETH. From the comparison of return rates, we can see that Meme coin is still a representative of high-risk and high-return assets. On the other hand, most altcoins are still relatively sluggish overall, and there are not many opportunities, so it doesn鈥檛 matter if you put less chips.

We should also point out the risks here. Crypto asset allocation is a very difficult task and it is not something that can be accomplished simply by using a few indicators.

But in any case, please remember that taking risks only makes sense when most of the funds are very safe. People who have experienced multiple rounds of bull and bear markets must have a deep understanding of this! As the old saying goes, if you have green mountains, you will never be short of firewood.

This article is sourced from the internet: Can you make money using the dumbbell strategy in this bull market?

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with mainstream data platforms such as CoinGlass and AICoin, starting from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. The following is the second issue, in which the OKX Strategy Team and CoinGlass Research Institute jointly discussed the data dimensions that need to be referenced in different trading scenarios. It involves topics such as capturing trading opportunities and how to cultivate scientific trading thinking. We…